PSLAI Association of India

@pslassociation

Followers

14

Following

6

Media

10

Statuses

18

PSLAI | Driving Financial Inclusion through Priority Lending | Empowering MSMEs with credit solutions | Building partnerships for a 2x growth vision

Joined September 2024

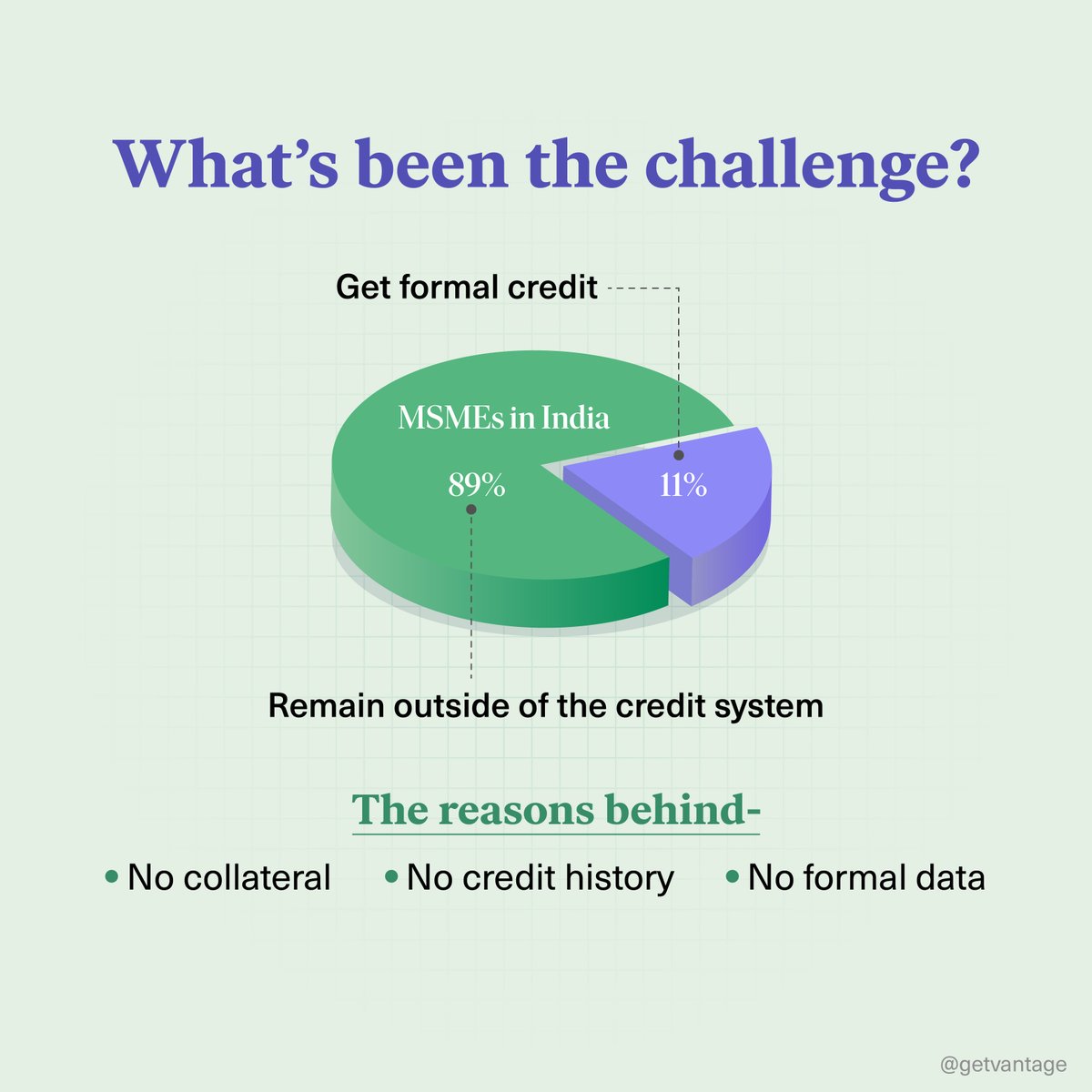

We cannot support msme industry without capital. At PSL we want to reverse the 89% of MSMEs don't have access to capital to 89% have access to capital. And Getvantage is helping us in that vision along with others.

What if MSMEs didn’t have to chase capital or clarity, but got both when they needed it most?. That’s the future PSL Association of India is building. @pslassociation @priyashmita @Product_nation @parikh_sagar @sharads @bhavikvasa @apsrivast @Roethz @akash_atul

0

1

1

India’s $1.47T MSME lending opportunity is still waiting. Our CEO talks to @IBSIntelligence on how #PSLAI is building a robust credit ecosystem through collaboration, policy reform & digital enablement. 🔗 #MSME #CreditAccess #PSLAI.

lnkd.in

This link will take you to a page that’s not on LinkedIn

𝗜𝗕𝗦𝗶 𝗙𝗶𝗻𝗧𝗲𝗰𝗵 𝗝𝗼𝘂𝗿𝗻𝗮𝗹 – 𝗜𝗻𝗱𝗶𝗮 𝗘𝗱𝗶𝘁𝗶𝗼𝗻 | 𝗠𝗮𝘆 𝟮𝟬𝟮𝟱 𝗶𝘀 𝗼𝘂𝘁 𝗻𝗼𝘄! 📘.Explore the leadership perspectives, cutting-edge features, and strategic deals shaping India’s financial ecosystem today. 💡 𝘏𝘪𝘨𝘩𝘭𝘪𝘨𝘩𝘵𝘴 𝘰𝘧 𝘵𝘩𝘪𝘴

0

2

2

As DSAs become vital in rural MSME credit, guardrails are essential. At @PSL_Association, we recommend an SRO-led framework to ensure transparency & protect borrowers. We're also watching the rise of Borrower’s Agents. Read our full take via @ETBFSI:

0

0

0

DSAs are key to last-mile MSME credit in rural India—but accountability matters. At @PSL_Association, we propose an SRO-led approach to ensure transparency & borrower-first practices. Read our views in @ETBFSI :

bfsi-economictimes-indiatimes-com.cdn.ampproject.org

As we work towards a 7 trillion-dollar economy, it's increasingly clear that innovation and ethical practices should go hand in hand to make credit delivery efficient, equitable, and inclusive....

0

0

0

Cyber threats are increasingly sophisticated and costly. Is the BFSI sector prepared to effectively quantify and mitigate these risks?.Join expert Sanket Sarkar, CEO, @securezeron , for actionable insights on cyber risk strategies for BFSI. 🔗 Register:

0

0

1

It's wonderful to see the progress OCEN is making. We at PSL believe that to grow the market, OCEN would be one of the biggest driving forces. Join us in this journey to learn more.

We are now starting to publish monthly numbers of the OCEN ecosystem to build a trendline of progress. As of January 2025, here’s a quick look at the latest numbers on the OCEN ecosystem: . @aaRBee16 @parikh_sagar @priyashmita @sharads.

0

0

1

RT @pslassociation: Join the PSL Pulse Webinar: Unlocking Data for India’s Growth! 🚀.📅 Date: February 11, 2025.⏰ Time: 3:00 PM.📍 RSVP Here:….

0

1

0

Our Co-Chair Sharad Sharma was featured on @Money9Live. He discussed how OCEN is revolutionizing MSME lending with cash flow lending,reducing loan tenure,cutting costs,& staying compliant. This will empowers MSMEs,boosting growth & build a Viksit Bharat.

0

0

0

Proud to share that @Money9Live featured the launch of PSLAI and an interview with our Chairman, Mr. Shachindranath!.He shared how PSLAI is adopting cash flow-based lending to empower MSMEs and turn PSL loans into opportunities. Watch here: #PSLAI.

0

0

0

RT @Product_nation: What's the Priority Sector Lenders Association of India? Find out below 👇🏽. - with @pslassocia….

0

3

0

Excited to share that Money9 has featured the launch of PSLAI!.They highlighted our mission to double the MSME lending market and interviewed us on how we aim to revolutionize it.Thank you, @Money9 & Satyam Singh, for showcasing our vision!.Watch here:

0

0

0

Thrilled to announce the launch of PSLAI! 🚀 Our mission: bridge India’s ₹22.5T MSME credit gap, drive reforms, and empower small businesses. A big thank you to @livemint @GopikaGopa for featuring this milestone. Together, let’s transform MSME lending!

0

0

0

🚨 Join Our Exclusive Webinar! 🚨. Topic: Latest RBI Guidelines for Compliance & Digital Execution. 📅 Date: 30th September 2024. 🕓 Time: 4:00 PM. 🎤 Speaker: Mr. Aditya Patel, Head of Sales at Leegality. 👉RSVP #Webinar #Fintech #Compliance #RBI #KFS

0

1

1