Sonja Gibbs

@onegoodchart

Followers

899

Following

44

Media

122

Statuses

898

Managing Director, Head of Sustainable Finance @IIF. We look at financial stability risks and long-term investment themes--ESG investment, global debt...

Washington, DC

Joined December 2011

Backstage with the wonderful @hiromichimizuno - we talked transition finance, @Tesla and @COP28_Dubai at our @IIF Sustainable Finance Summit. #IIFinTokyo #Sustainability

1

2

9

RT @IIF: Sustainable finance is on the agenda at the IIF European Summit today — our @onegoodchart is leading back-to-back sessions on #sus….

0

1

0

RT @IIF: IIF Head of Sustainable Finance @onegoodchart highlights the big role for #emergingmarkets in #sustainablefinance in 2022. https:/….

0

3

0

RT @IIF: At #IIFLive, @BNPParibas Chairman Jean Lemierre says "the economic recovery is strong in Europe," fueled by consumption, central b….

0

4

0

RT @IIF: Global sustainable debt issuance was over $620 billion in 2020 (vs. $500bn), largely driven by green and social bonds. Read more….

0

7

0

RT @IIF: Sonja Gibbs (@onegoodchart) looks back on a year of dialogue and debate with #G20, #ParisClub, #IMF, #WorldBank, #UNECA and privat….

0

2

0

RT @RichMattison: Very much looking forward to joining Audrey Choi, Morgan Stanley, Daniel Klier, HSBC and Sonja Gibbs, CFA at the Institu….

0

2

0

RT @IIF: Weekly Insight: Debt Burdens Weigh On Recovery Prospects . State-owned enterprises, particularly in EMs, are likely to play a majo….

0

4

0

RT @NewClimateCap: The COVID-19 crisis has been good for #ESG invesments in the short-term, but what about the long game for decarbonizatio….

0

5

0

Social bonds should see a solid pickup in issuance in H220. #sustainablefinance #Sustainability.

Sustainable Debt Monitor: Social Bonds to the Rescue. The #COVID19 pandemic is prompting a surge in interest in #ESG investment across both equities and fixed-income markets; social bonds are in high demand. 🔗

0

0

2

Tough subject, thoughtful panel: kudos to @Jonthn_Wheatley for excellent moderation and @ftlive for smooth logistics. Great insights from fellow panelists @NOIweala, Richard Kozul-Wright of @UNCTAD and Ferdinand Ngon Kemoum of Oragroup. @IIF #debt #COVID19 @onegoodchart.

‘The hunger virus will kill us before the coronavirus. That is the worry.’ @NOIweala. The stresses of lockdown are magnified in emerging economies. Weaker healthcare systems and debt burdens have put emerging markets in a perilous position. #FTGlobalBoardroom

1

2

6

Great conversation: how to make sense of #stock valuations with no clarity on the outlook for #earnings or post-#COVIDー19 demand?.

As markets grapple with the impacts of #COVID19, emerging market equities are facing a record valuation discount to US equities, IIF MD Sonja Gibbs (@onegoodchart) tells the @FT's @SteveJohnson000

0

0

3

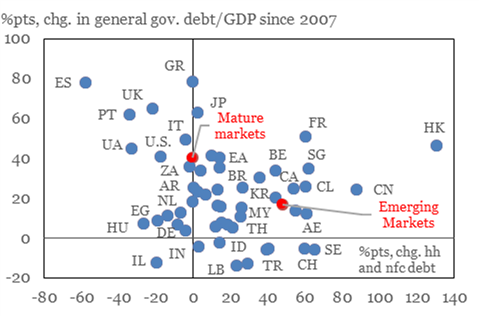

Be afraid. Even pre #COVIDー19, government #debt in mature markets was >110% of GDP. For mature markets, that's 40pp higher than before the last crisis. #EmergingMarkets lower at 53% of GDP but still up 20pp since 2007. Fiscal response + #Recession2020 = big jump in debt/GDP.

0

0

1