Nicholas Hall

@nicholashall

Followers

4K

Following

2K

Media

160

Statuses

1K

Attorney | InstaLaw founder | AI-powered, lawyer-backed free legal help

Texas

Joined April 2008

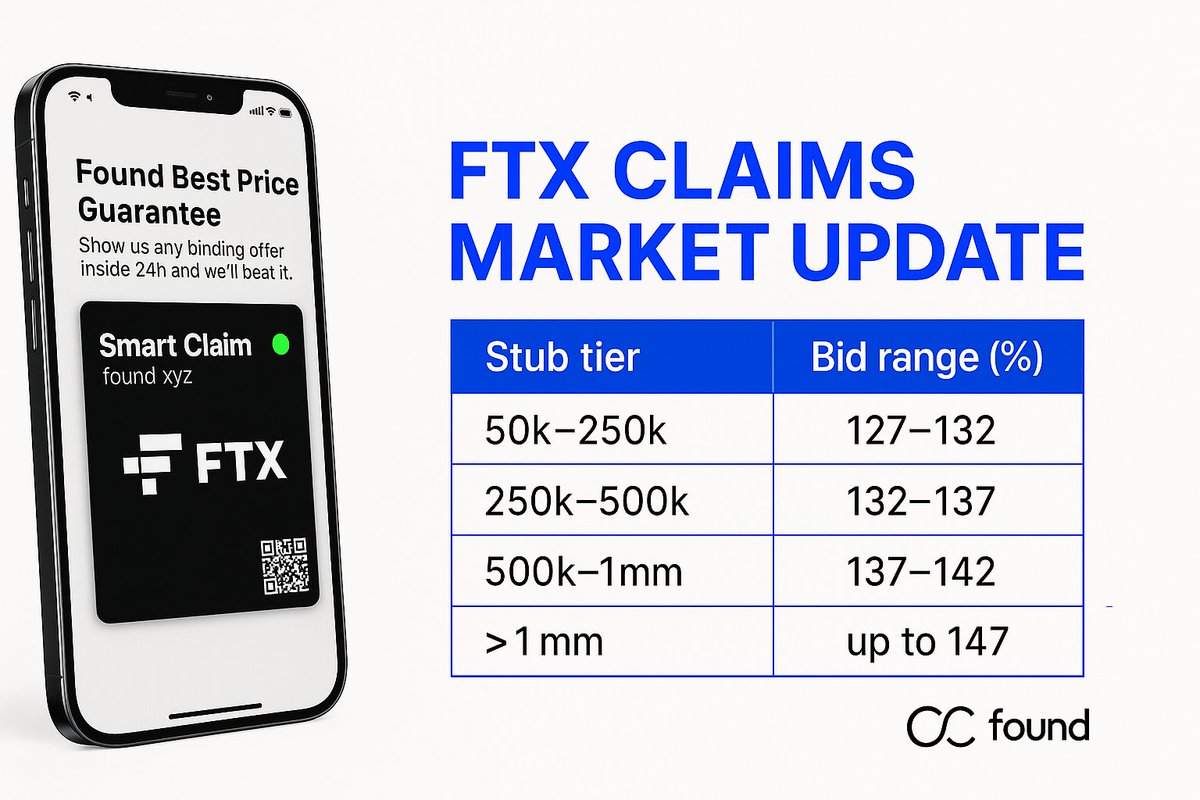

We make it easy to find out what your FTX claim is worth. Go to Found, enter your UCC, and get bids from the largest buyers today. Zero commitment. We don’t make you sign anything. It’s free and the most secure way to test the market.

🔥 FTX CLAIMS UPDATE 🔥. Bids now reaching up to 147%. We advertise actual bids. No deceptive bid-ask spreads. Best Price Guarantee means:.✅ We’ll beat legit binding offers.✅ You sign nothing until you get paid. This is how smart claims trade. 🧠

0

0

7