Natan

@nataninvesting

Followers

6,615

Following

305

Media

1,046

Statuses

4,602

22y old finance student 👨🏼🎓 | Diving into the stock market and sharing my insights along the way

My portfolio (free) & Tips ⬇️

Joined January 2021

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

オーロラ

• 341828 Tweets

Joost

• 296472 Tweets

CHAWARIN ON STAGE

• 179982 Tweets

FOURTH SINGING TIME

• 119373 Tweets

#withMUSIC

• 97434 Tweets

自分これ

• 59310 Tweets

Fulham

• 58418 Tweets

#不破湊3Dライブ

• 49014 Tweets

#العين_يوكوهاما

• 33172 Tweets

太陽フレアのせい

• 30241 Tweets

カクレンジャー

• 27304 Tweets

PERTHCHIMON LIVE x TARO

• 27040 Tweets

Gvardiol

• 26712 Tweets

マリノス

• 24951 Tweets

Buju

• 20838 Tweets

#FULMCI

• 16235 Tweets

自分の魚

• 15328 Tweets

HeavenlyVoice WithMrC

• 15150 Tweets

わたしの誕生魚

• 14385 Tweets

Dremo

• 13867 Tweets

ホールツアー

• 10079 Tweets

Last Seen Profiles

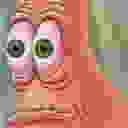

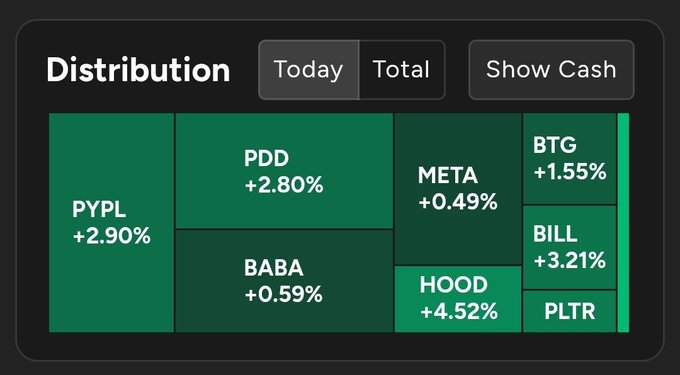

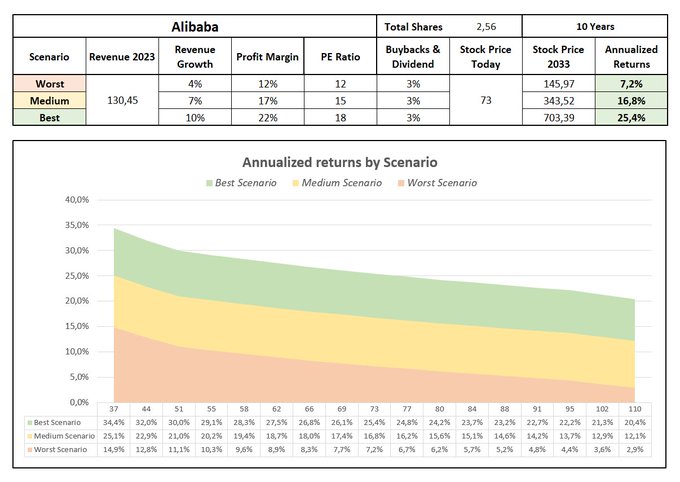

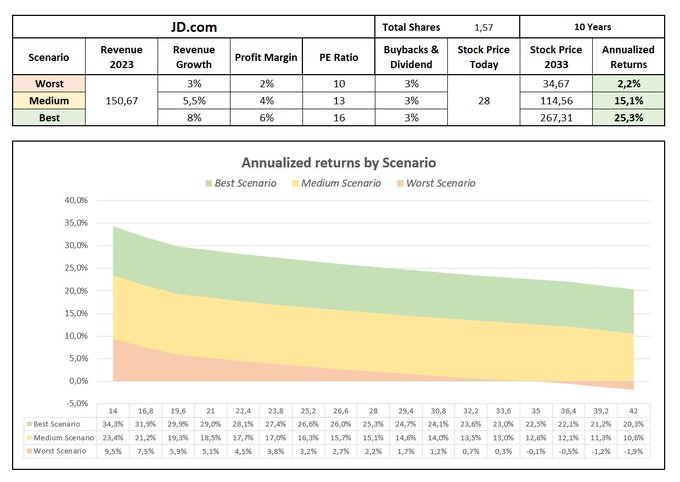

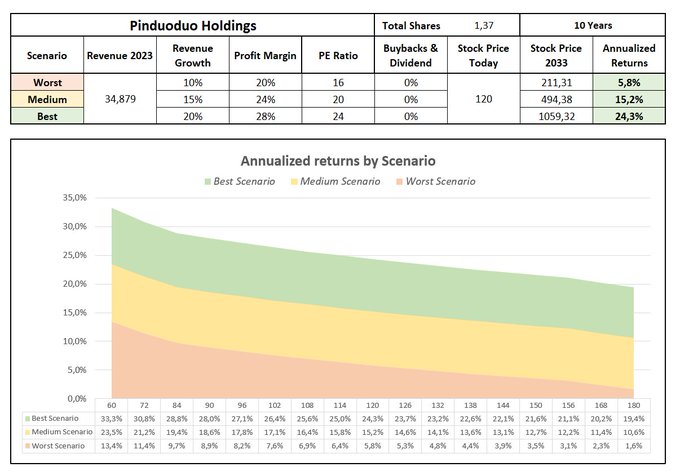

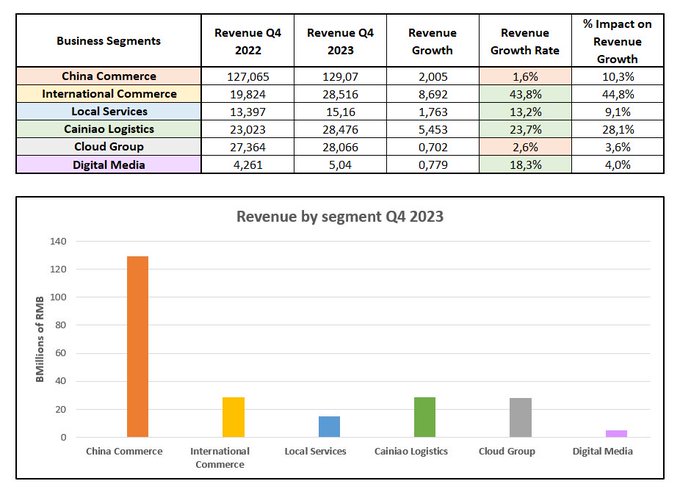

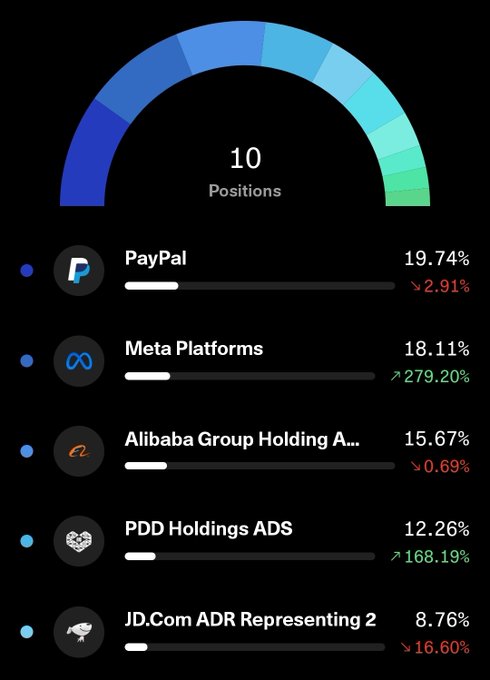

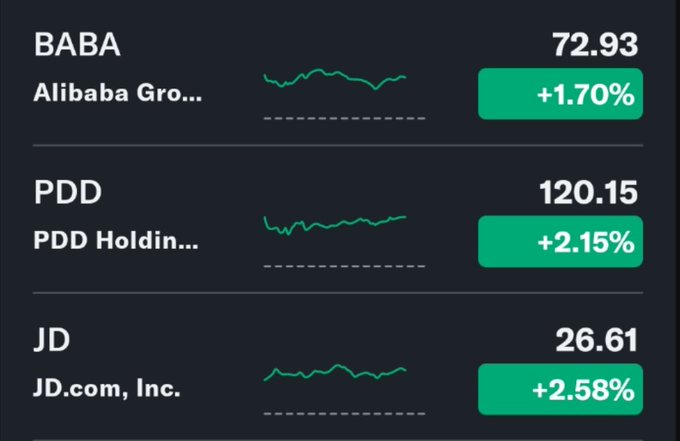

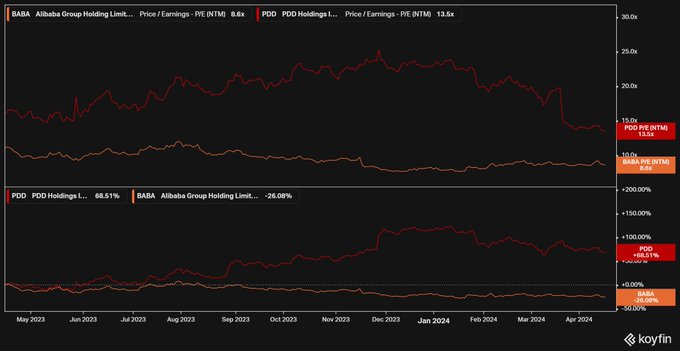

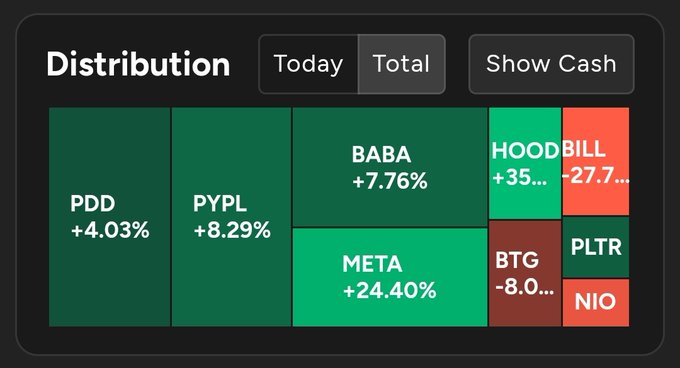

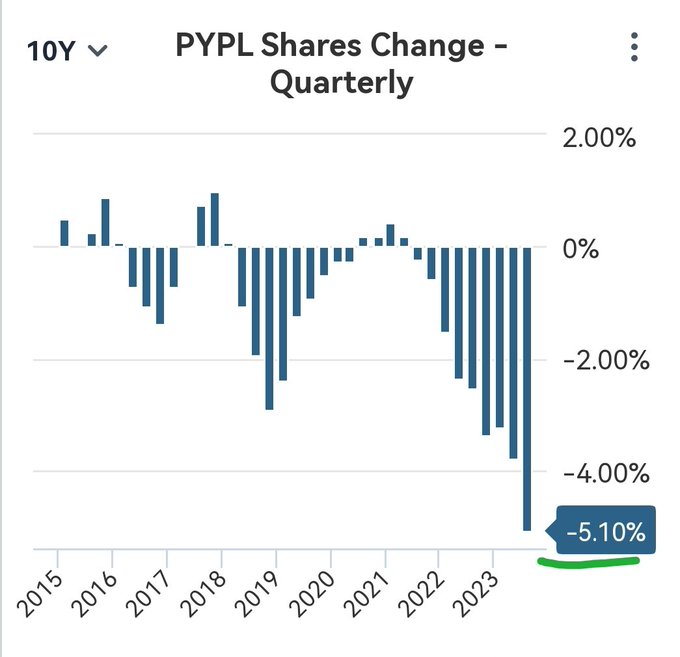

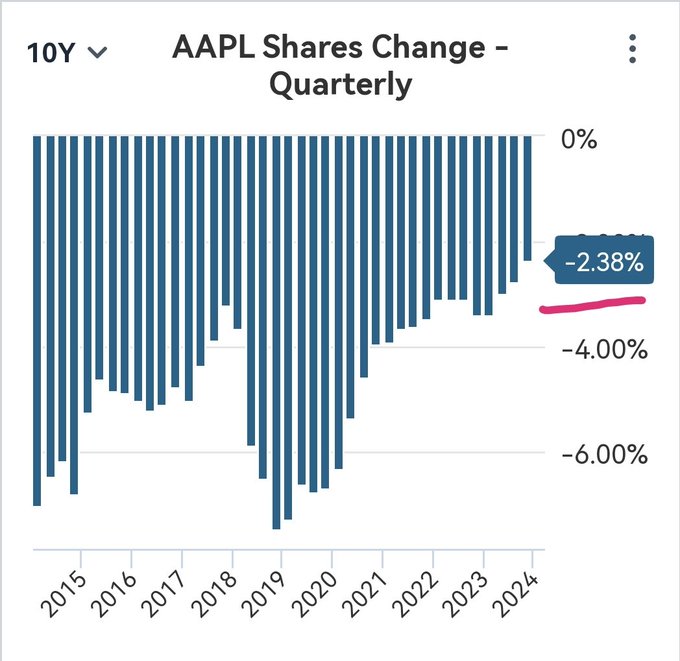

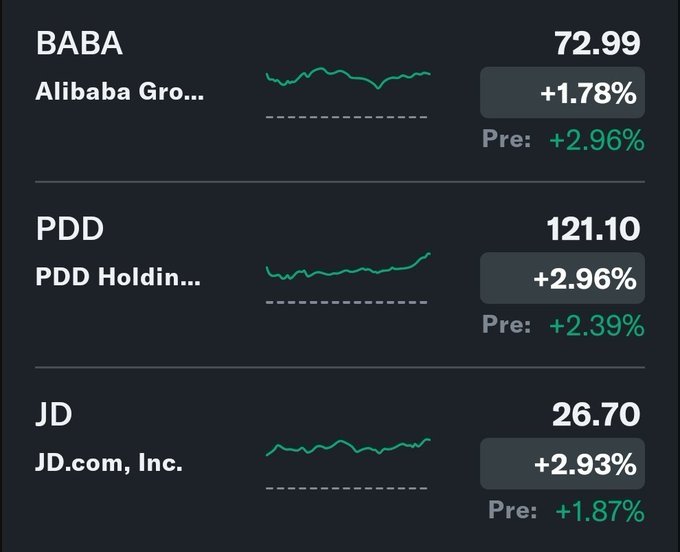

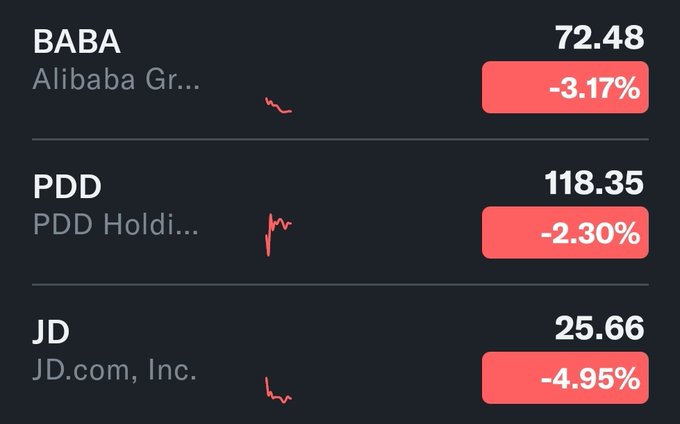

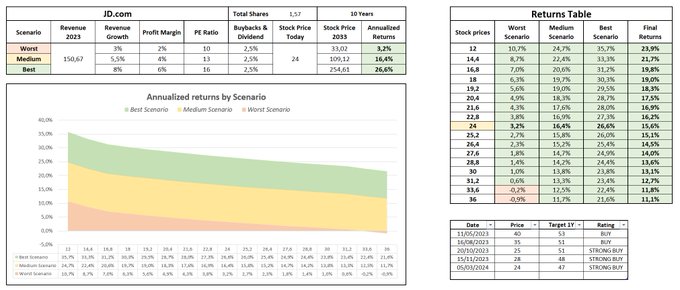

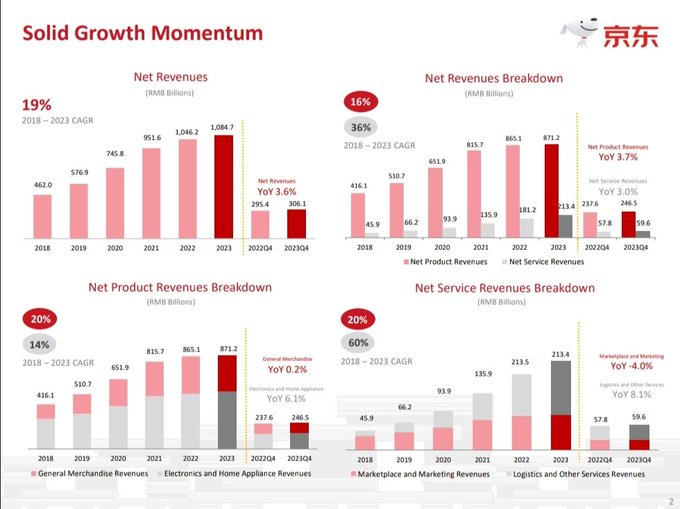

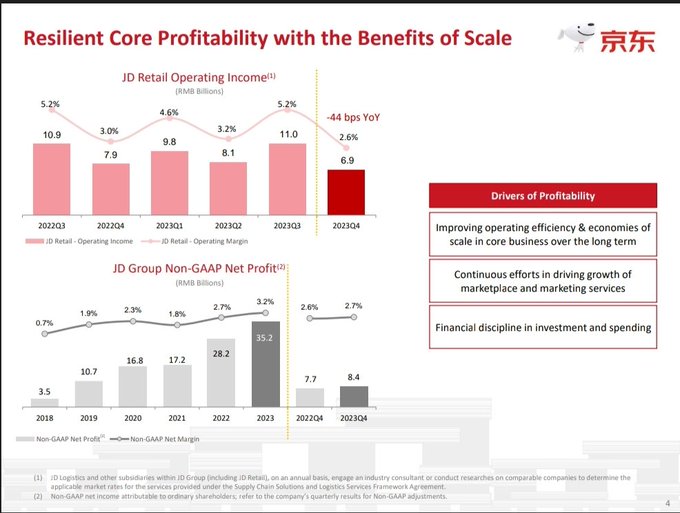

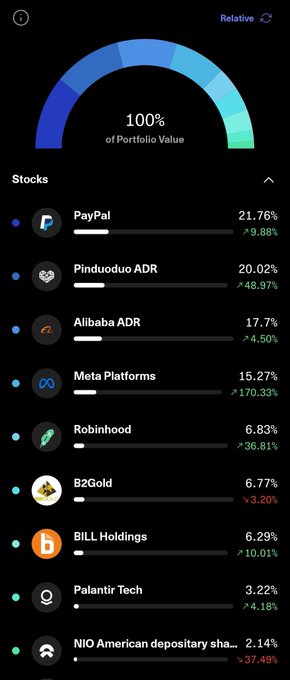

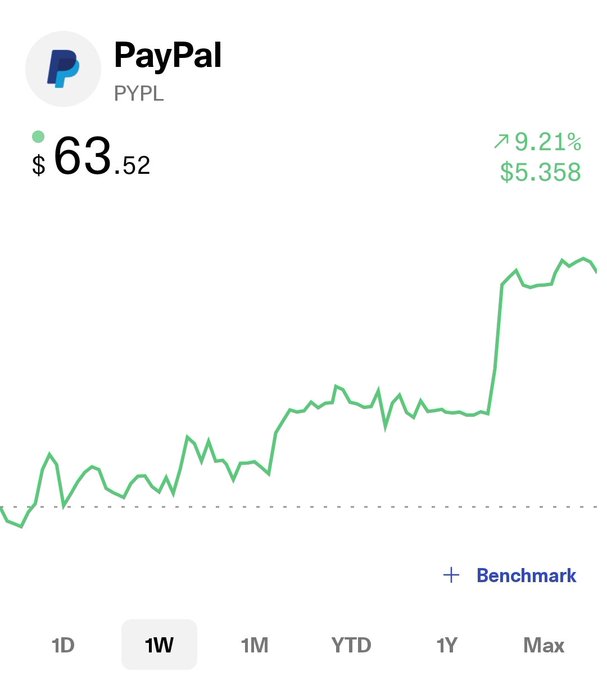

Top 5 positions in my portfolio and (total returns):

1) 19.7% $PYPL (-3%)

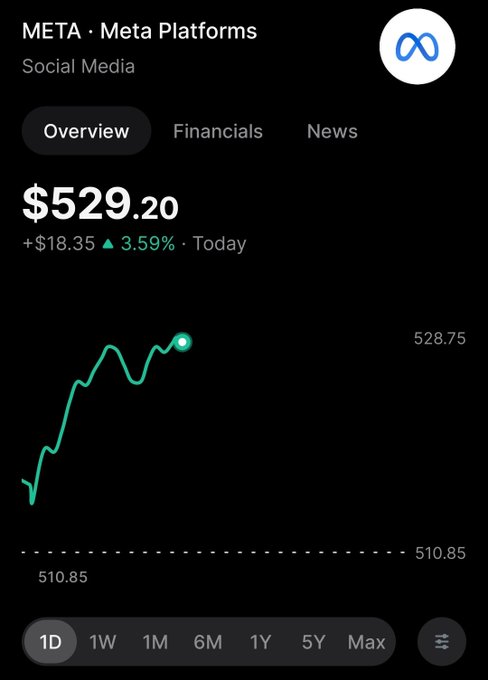

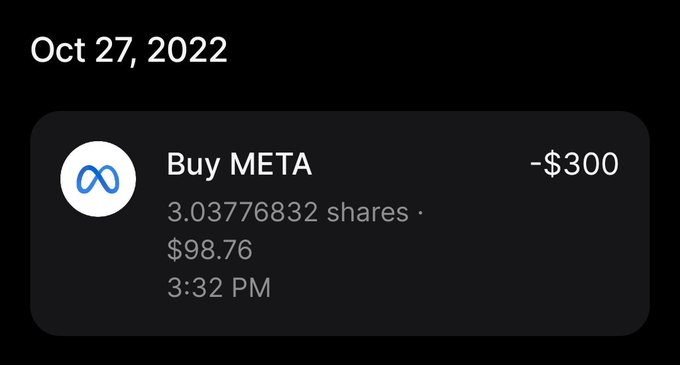

2) 18.1% $META (+202%)

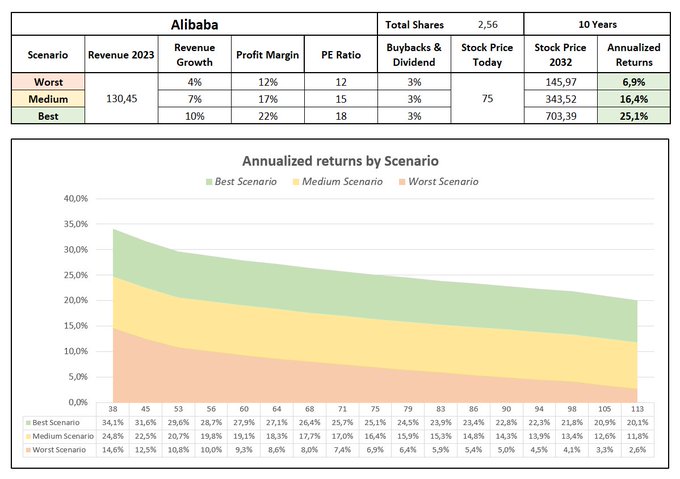

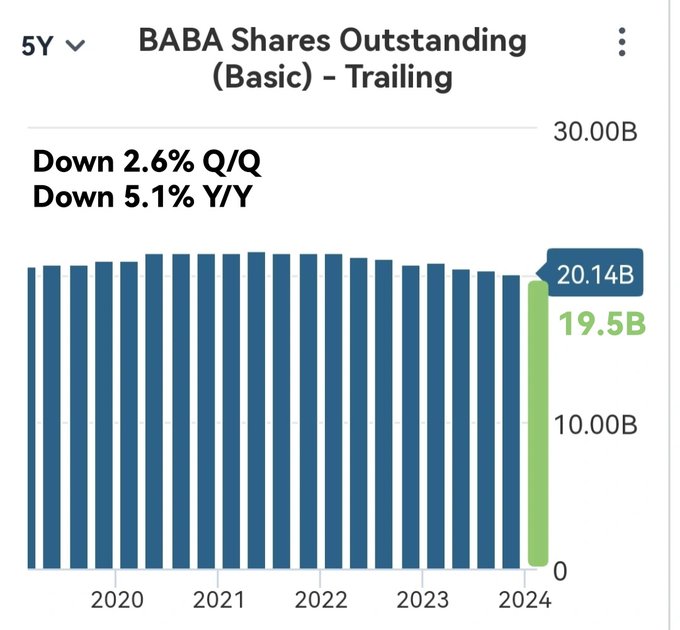

3) 15.7% $BABA (-29%)

4) 12.3% $PDD (+179%)

5) 8.8% $JD (-29%)

Follow me:

@Elkingnatinho

22

10

144

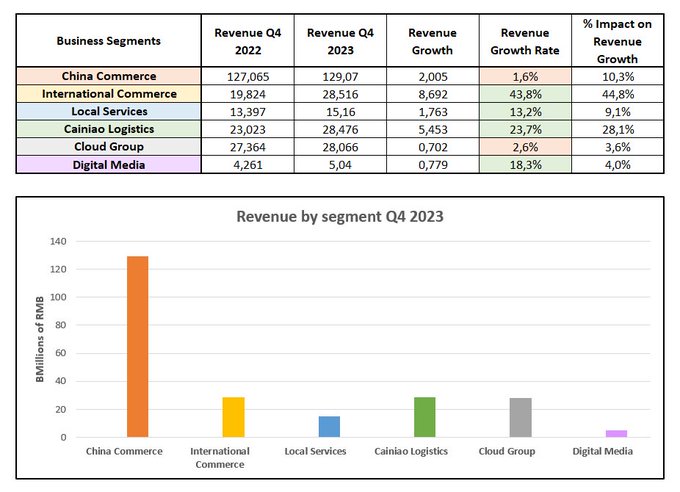

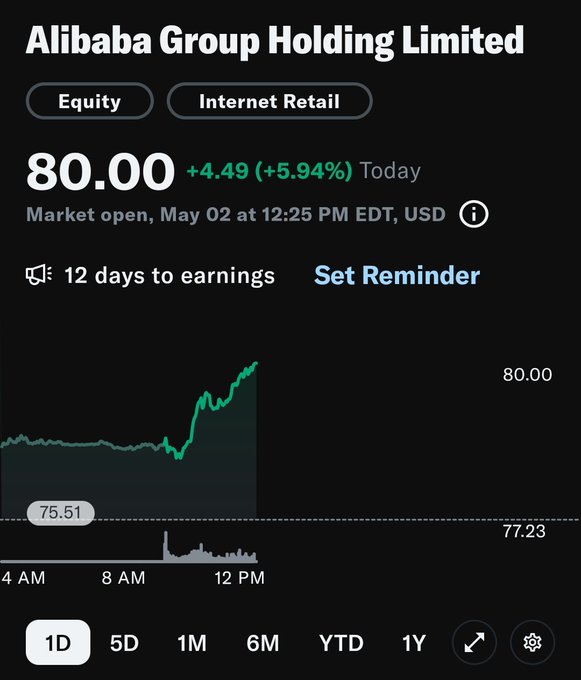

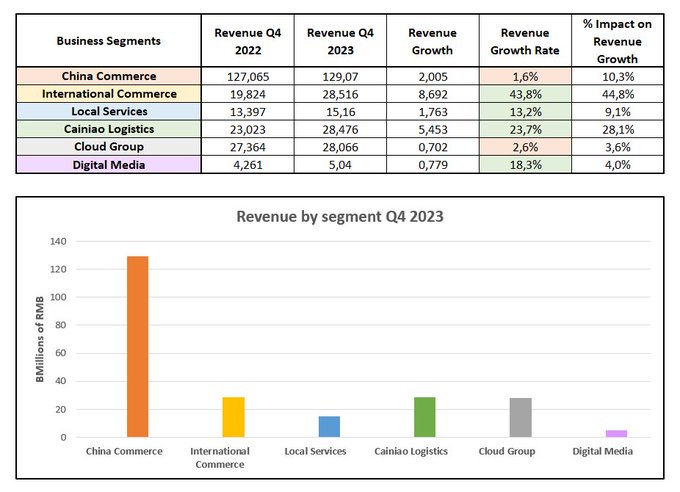

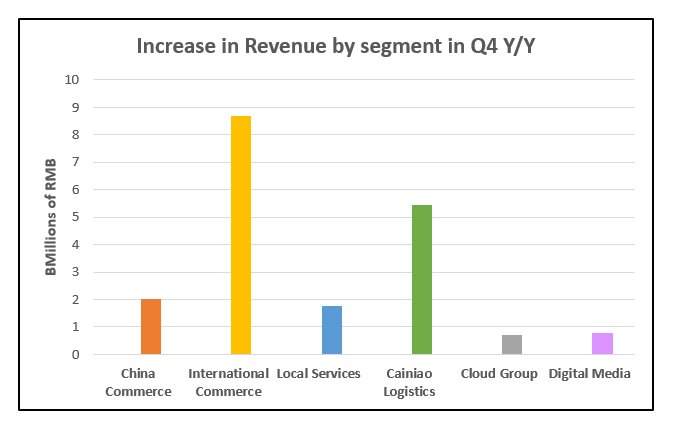

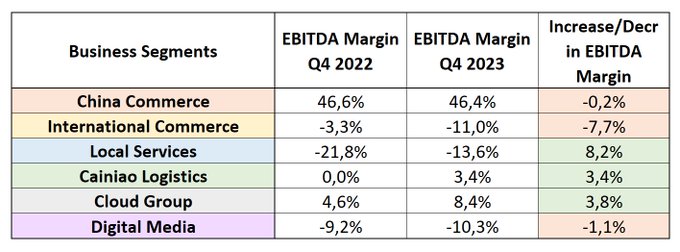

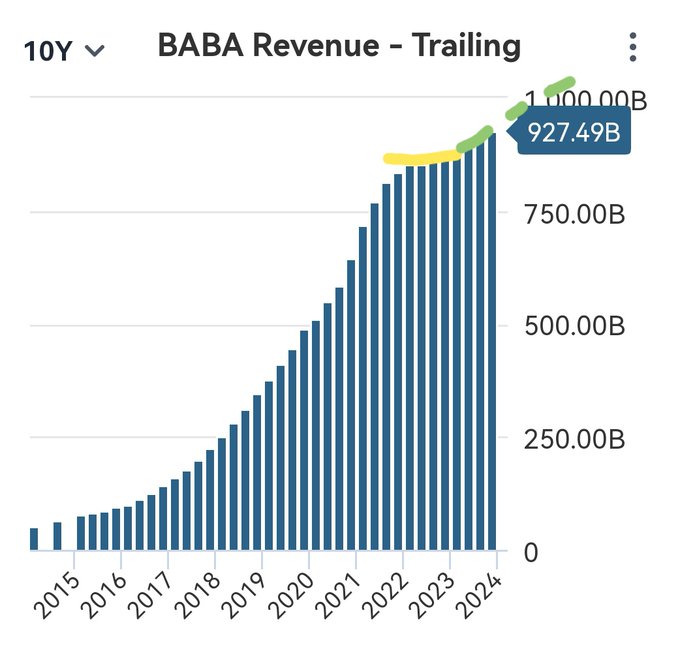

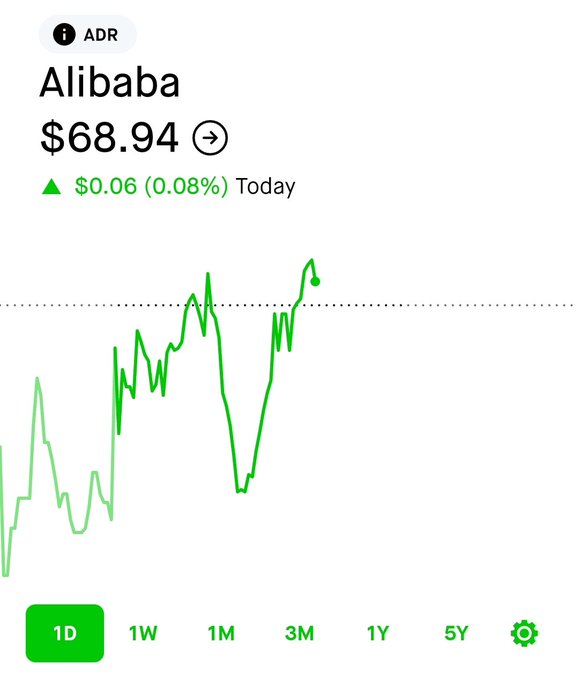

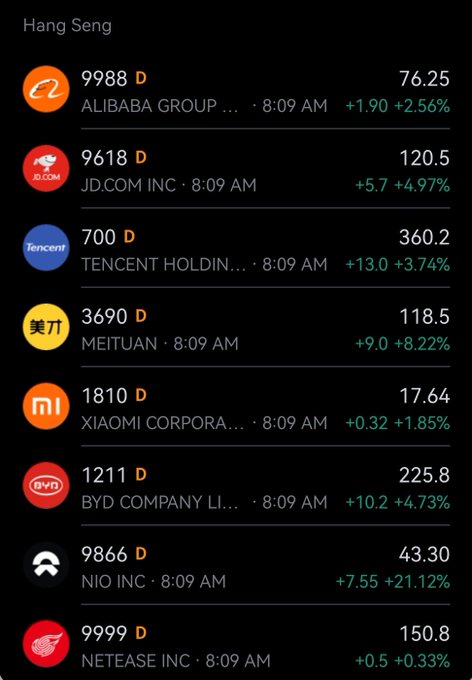

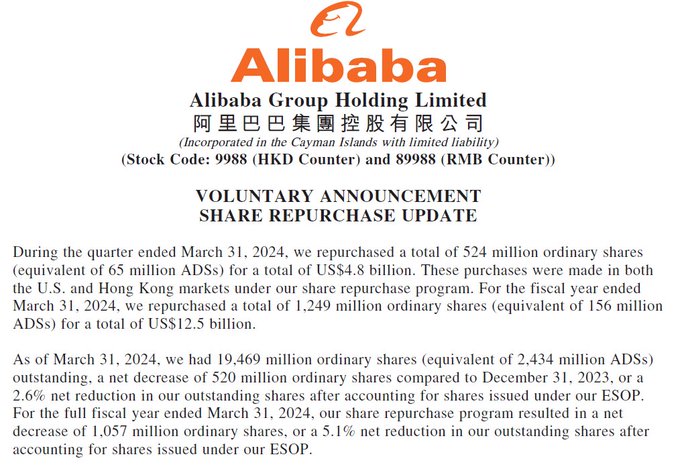

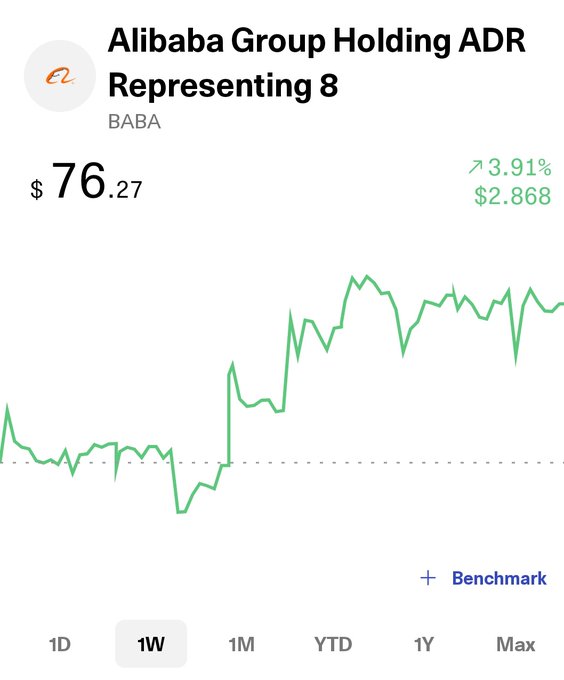

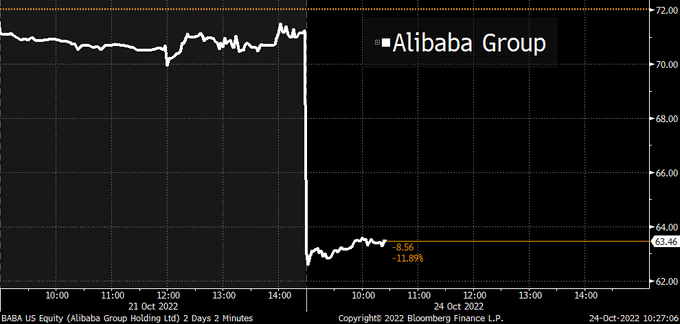

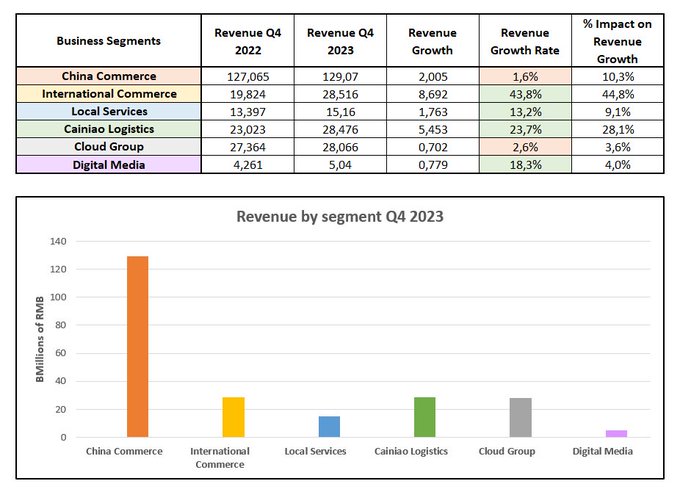

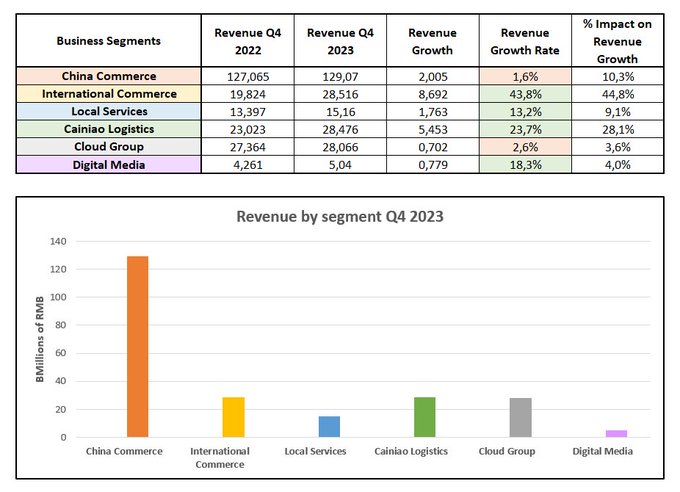

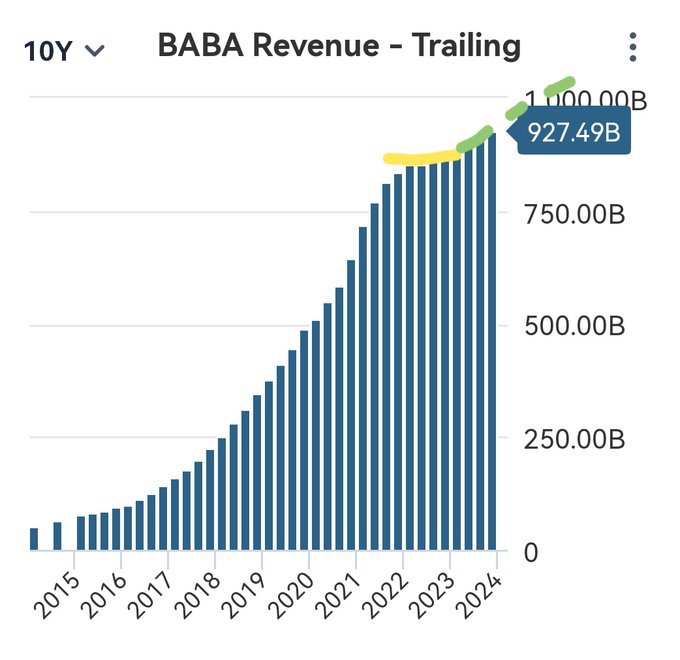

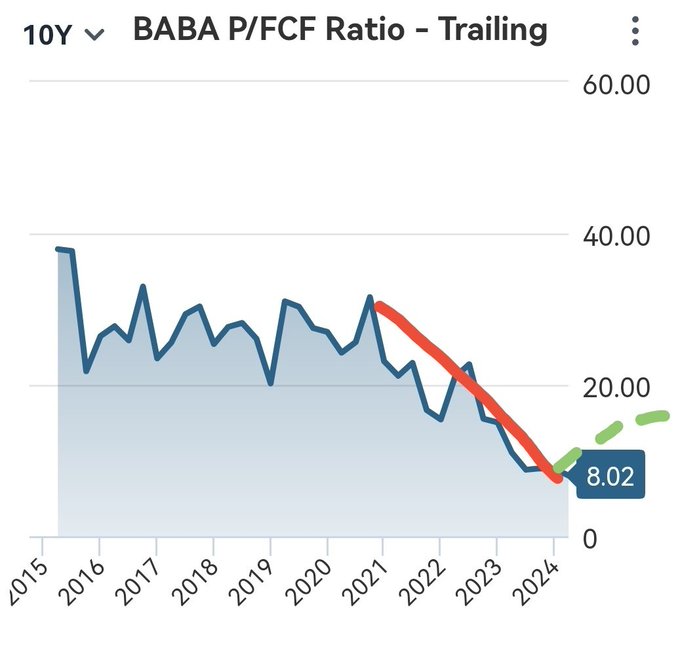

🟠 Alibaba $BABA is up 4% during this trading week.

✅ Company is trading below my 145$ fair value, that implies a potential upside of 91%.

Calculation: (145-76)/76

Follow me:

@Elkingnatinho

$PDD $JD $NIO $TCEHY $YUMC $HSI $KWEB

9

9

71

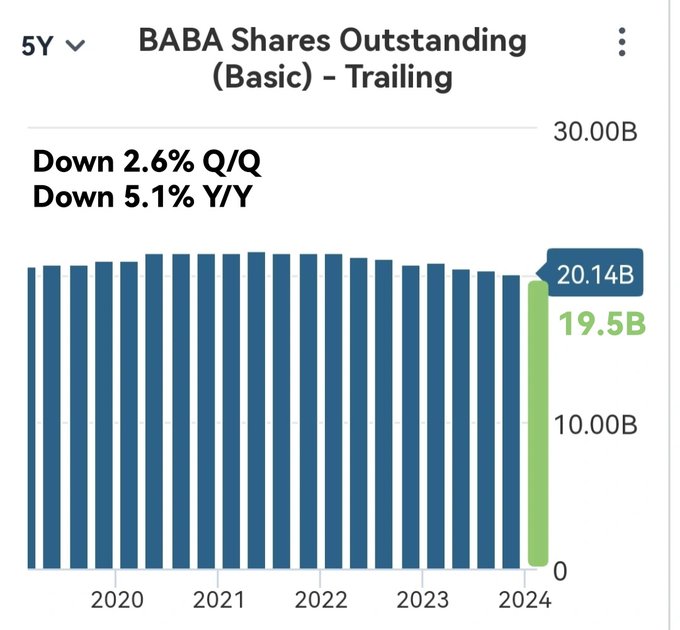

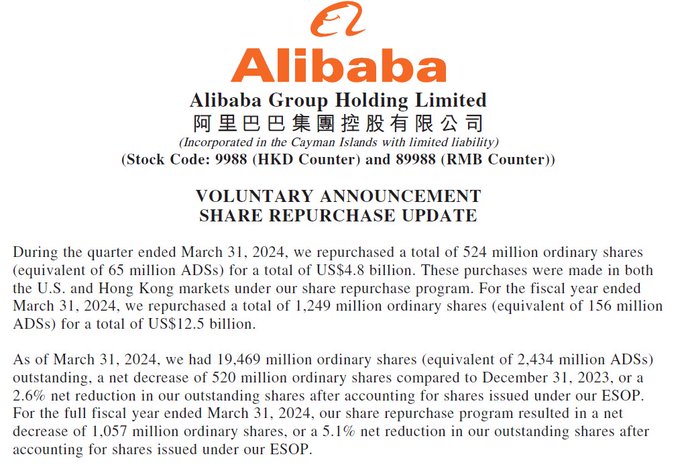

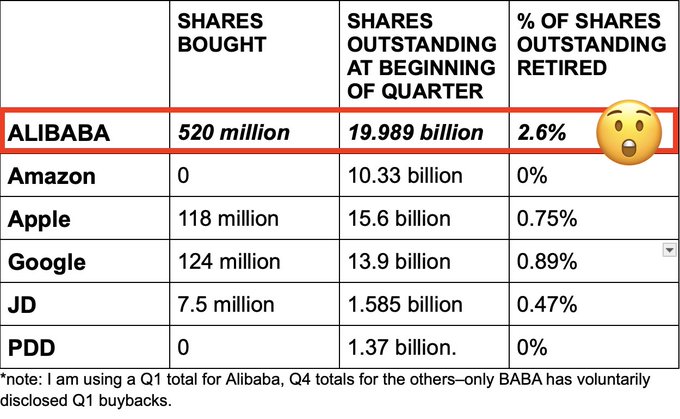

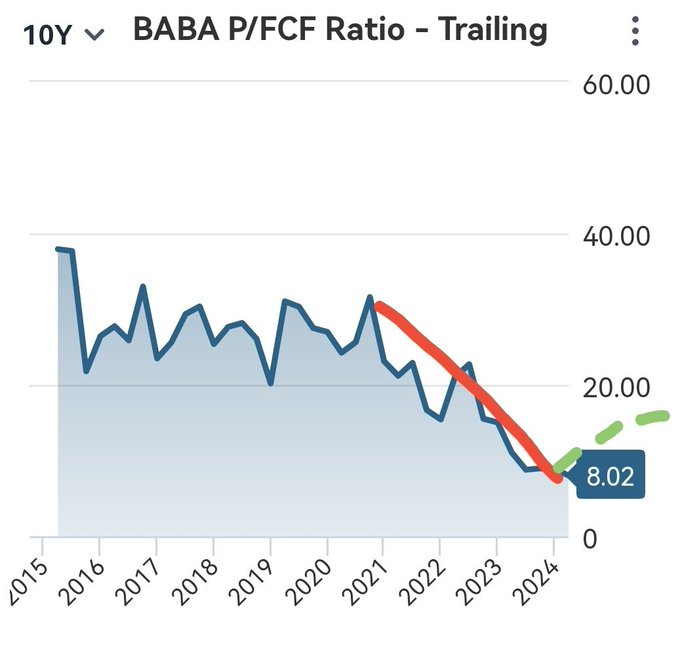

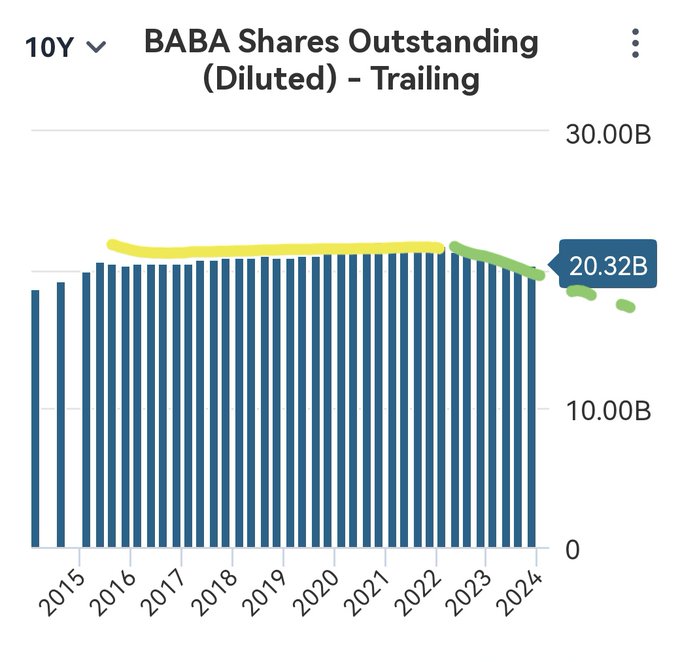

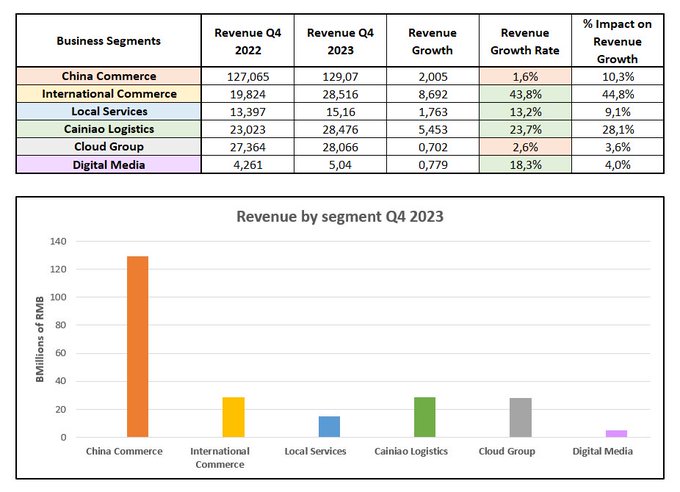

Lot of hedge funds and big investors increased their position in $BABA during Q4.

Is the trend inversion coming? 👀

EXCLUSIVE: KEN GRIFFIN'S HEDGE FUND CITADEL ADVISORS HAVE INCREASED THEIR $BABA POSITION 835%

THEY NOW OWN MORE THAN $230M IN THE STOCK

FOLLOW

@DAILYCOMPOUNDNG

FOR MORE EXCLUSIVE NEWS TO DROP TODAY

31

105

579

8

9

61

@DividendTalks

After the drop $META is at 21X considering a 20.4 estimated EPS.

So it's the cheapest in the big 7 basket

5

0

55

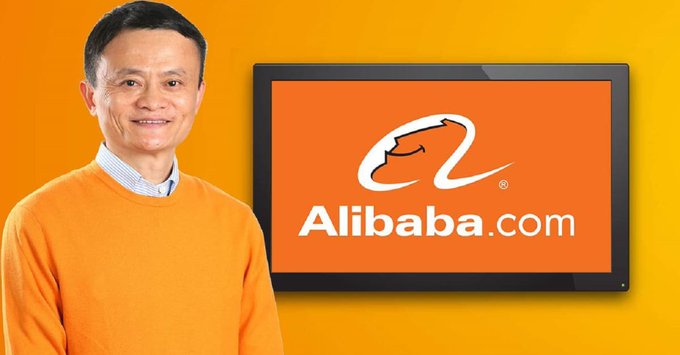

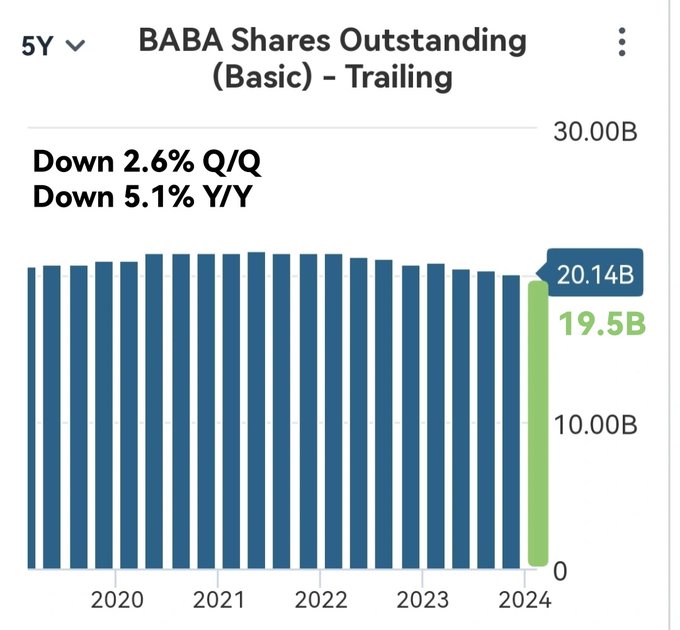

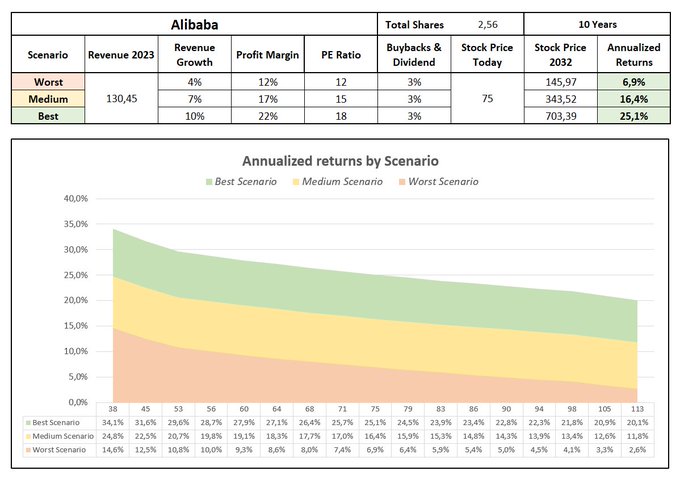

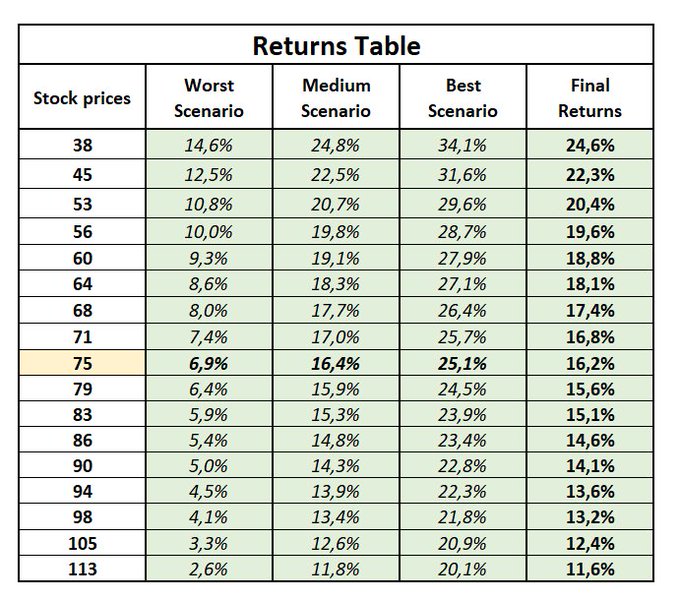

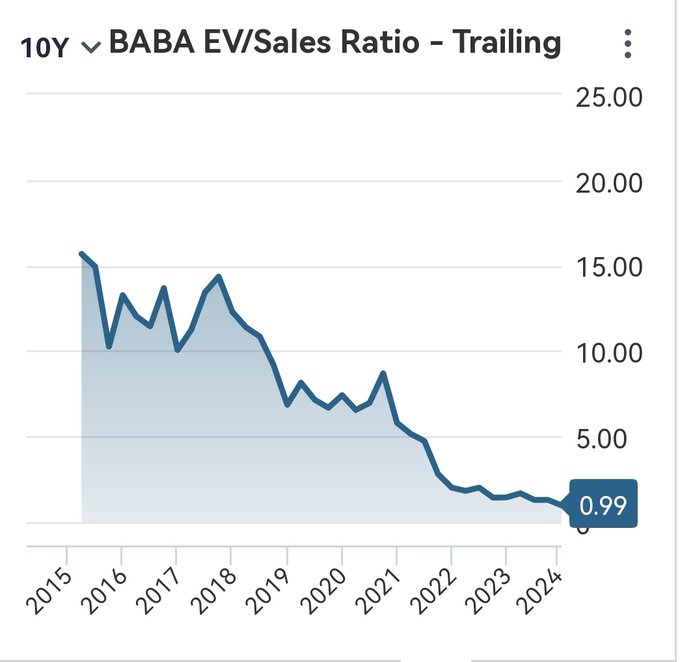

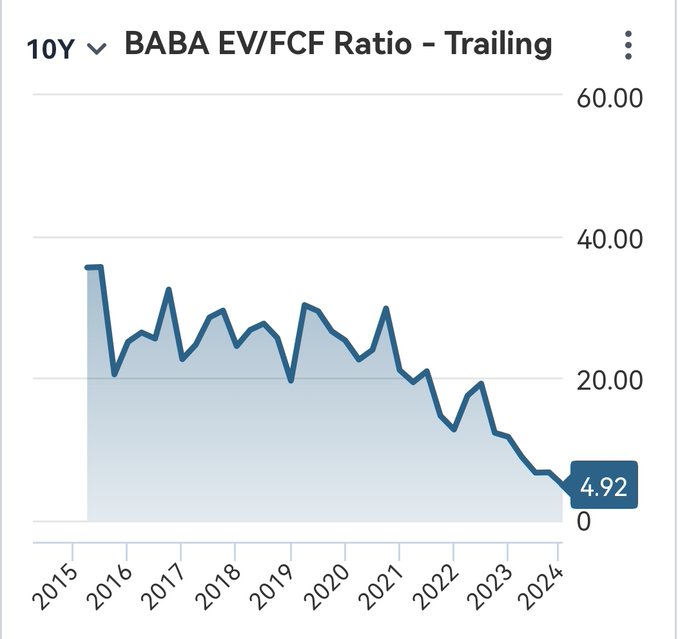

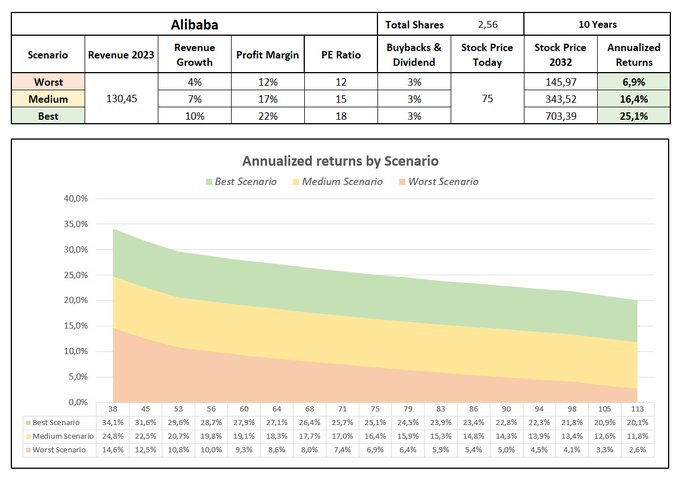

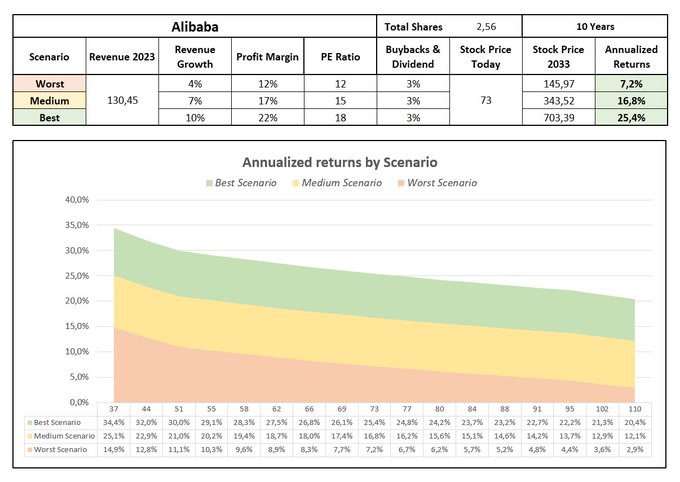

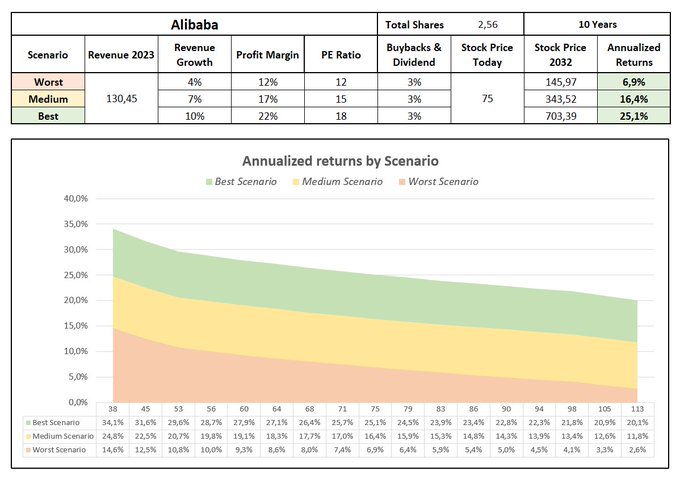

$BABA

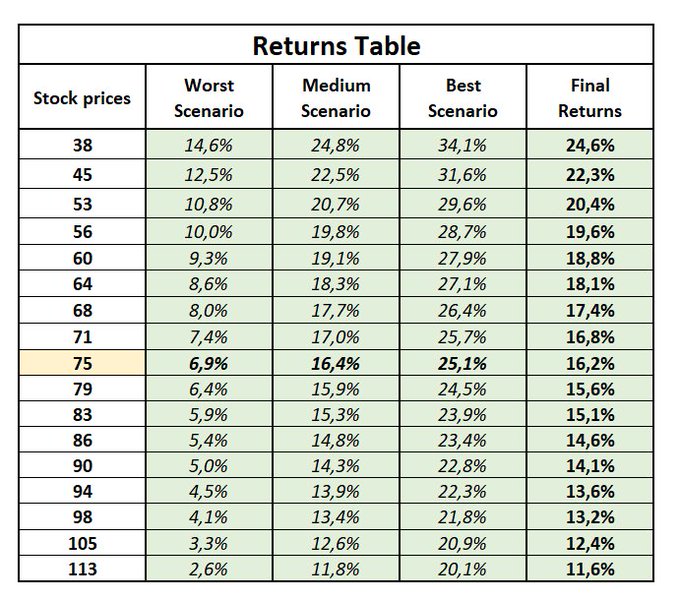

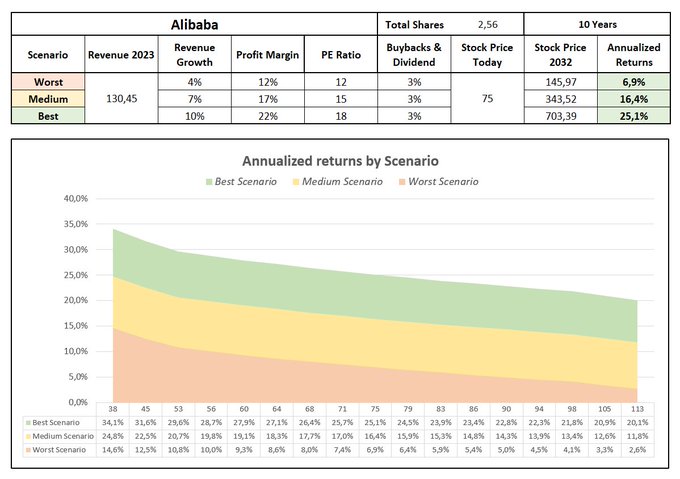

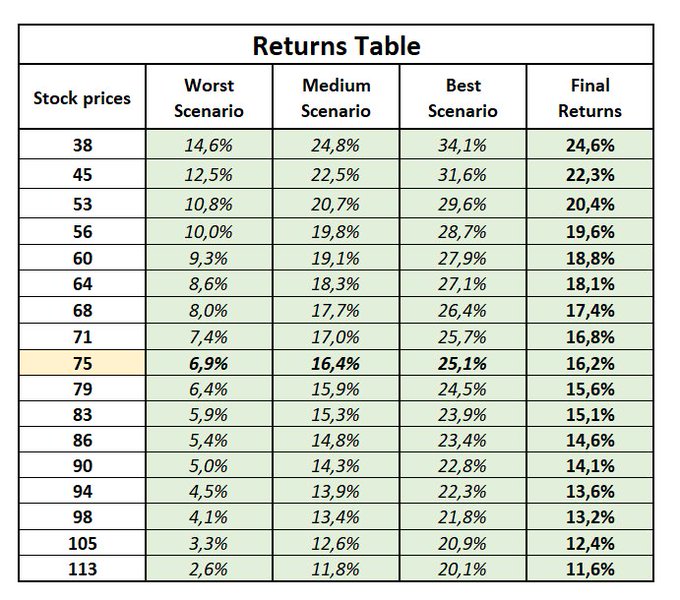

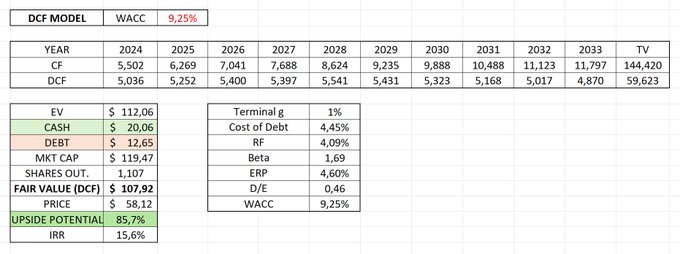

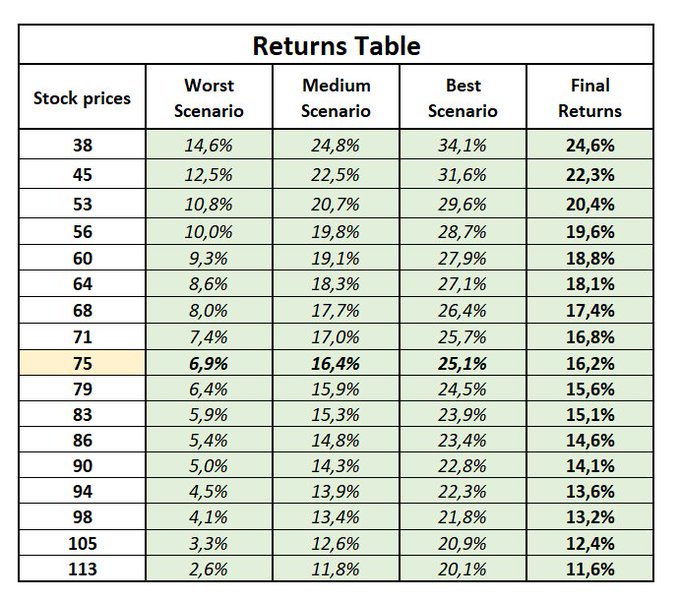

Based on my model, if you buy Alibaba stock at 75$ in next 10Y you'll get:

🔴 6.9%/year (worst s.)

🟡 16.4%/year (average scenario)

🟢 25.1%/year (best s.)

My rating: STRONG BUY ✅

Price target 1Y: 155$

$JD $PDD $NIO $KWEB $HSI $ENPH $PYPL

Follow me:

@Elkingnatinho

4

6

44

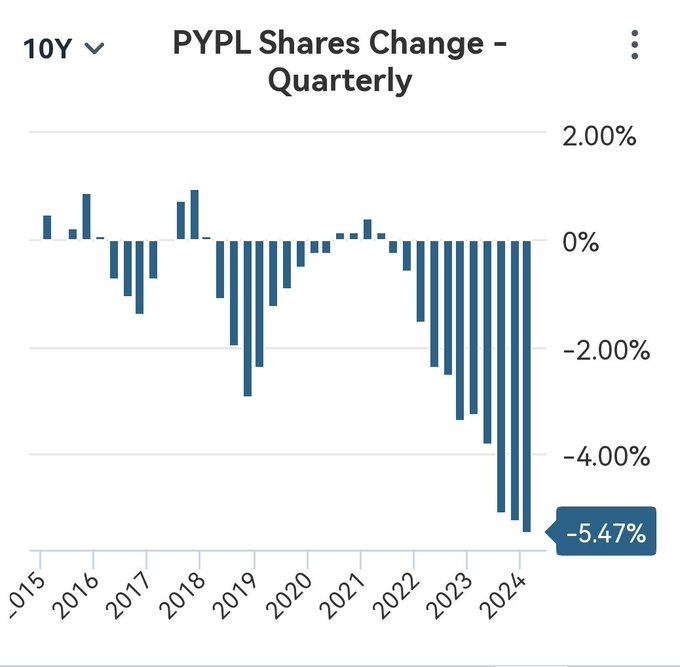

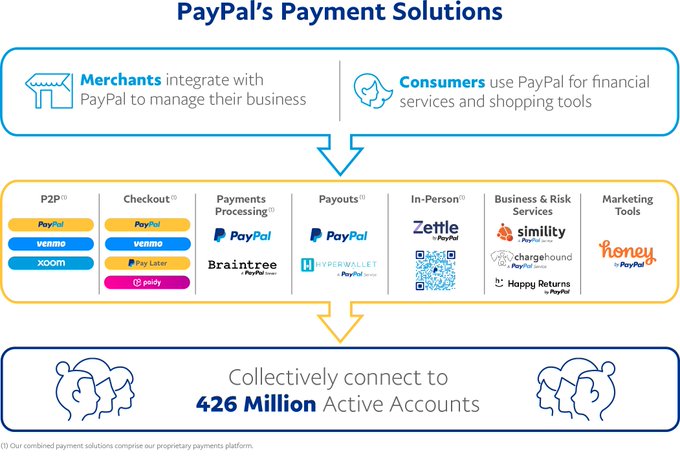

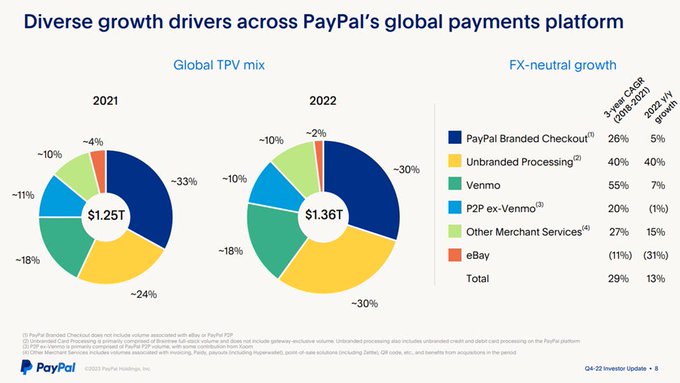

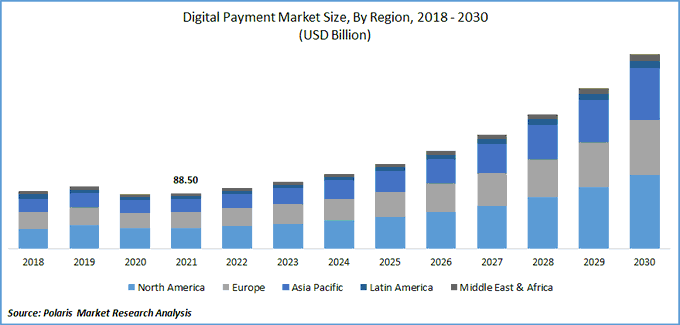

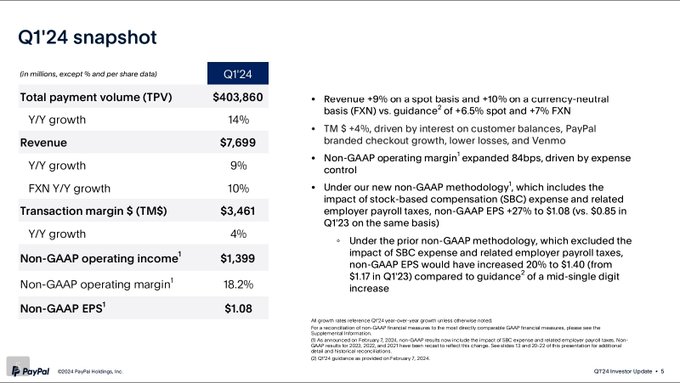

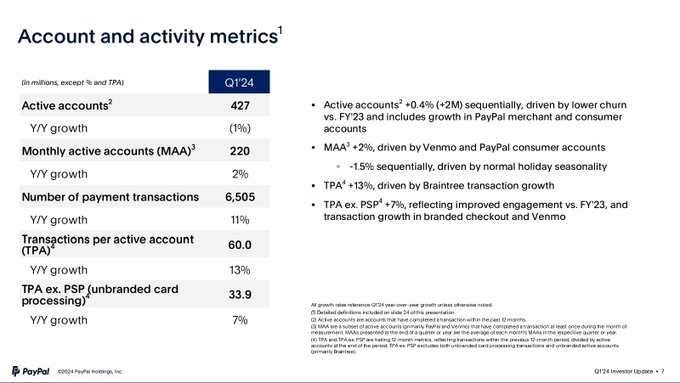

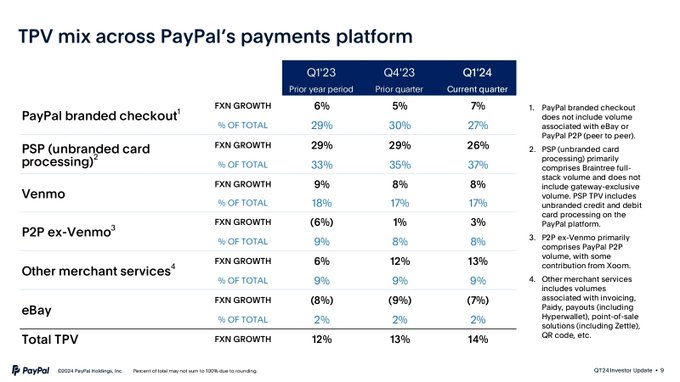

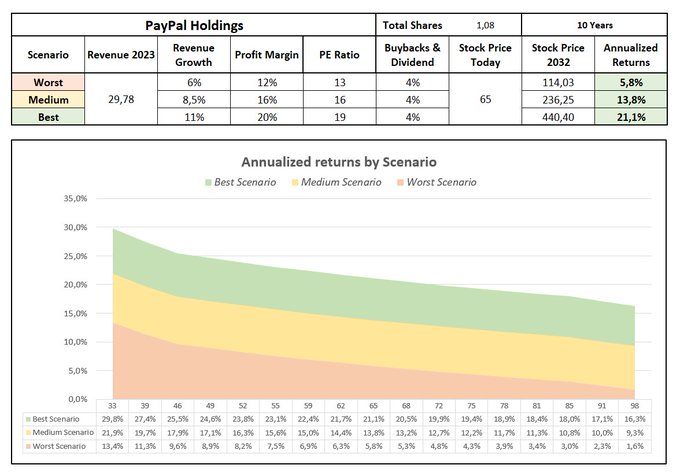

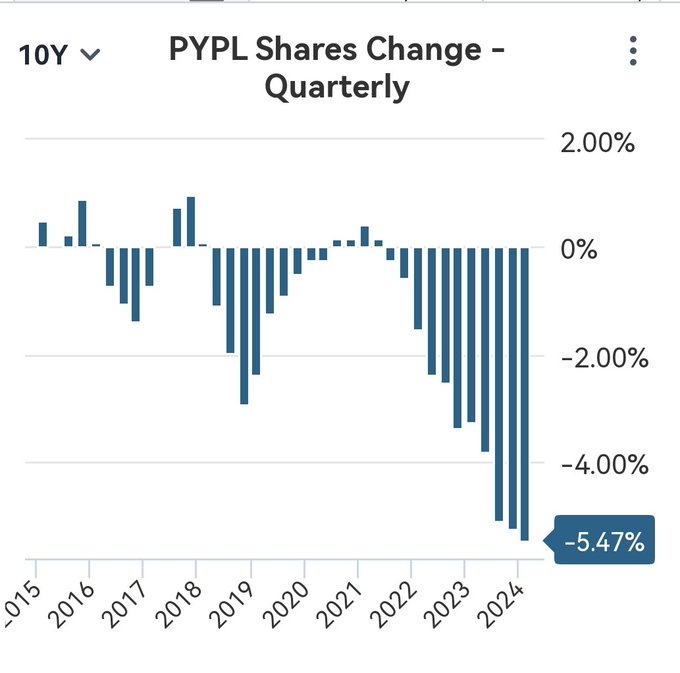

$PYPL

Based on my model, if you buy PayPal stock at 65$ in next 10Y you'll get:

🔴 5.8%/year (worst s.)

🟡 13.8%/year (average scenario)

🟢 21.1%/year (best s.)

My rating: STRONG BUY ✅

Price target 1Y: 107$

$SQ $SOFI $COIN $UPST $GOOG $DIS $BABA

Follow me:

@Elkingnatinho

6

7

41