Moondrops AI Crypto Screener

@moondropsapp

Followers

1K

Following

9K

Media

1K

Statuses

2K

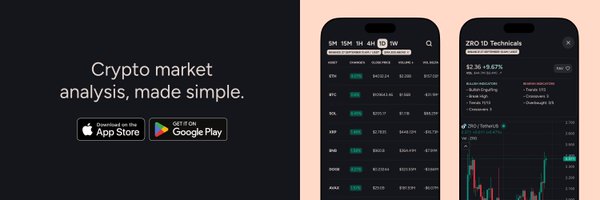

Moondrops V2 is here! Track price, volume, and indicators across multiple timeframes with advanced filtering, real-time strategy alerts, and AI-powered insights

Joined June 2018

Moondrops V2 is here. Crypto market analysis, made simple. Track price, volume, and indicators across multiple timeframes with advanced filtering, real-time strategy alerts, and AI-powered insights. Now available on iOS + Android.

28

43

910

Market Regime Classification with @moondropsapp 1W and 1D: Weak Downtrend Look for Bearish Trend Continuation trade setups: Ichimoku Kumo Breakdowns (47), Bearish Candlestick patterns (179). 4H and 1H: Strong Downtrend Look for Counter-Trend Mean Reversion (Long) trade setups:

0

0

1

Bugfix update 21/1: a critical bug was patched today in the iOS/Android Moondrops app that affected new users who were not receiving alerts/push notifications. If you were affected, a quick log out and log back in after updating will resolve the issue. iOS:

0

0

1

Yesterdays AI Market Insights report stated we were in a deeply oversold market regime - with bearish capitulation being the most probable trade setup. Today, the trade setup has switched to aggressive mean reversion with RSI Bullish Divergence, Bullish Candlestick patterns and

0

0

2

Technical analysis dunks hit different @intocryptoverse

@martypartymusic The 200d moving average is at $109k When you change to the 4 hour timeframe and look at the 200 period moving average, you are actually showing the 33.33 day moving average. Calling it to the 200 day moving average is completely nonsensical. I suggest you understand some

0

0

1

AI Market Insights across different timeframes from @moondropsapp: Weekly: weak downtrend regime, 7.5/10 conviction score, sell rallies. Daily: strong downtrend regime, 3/10, bullish counter trend bounces. 4H: range bound regime, 6.5/10, fade edges / range rotation. 1H:

0

0

0

Getting a Binance liquidation notification while playing Roblox https://t.co/FCEhy6CXBv

Introducing Binance Junior, a parent-controlled app and sub-account for kids and teens. Build family-focused crypto savings and prepare your child for a future empowered by crypto. Try it now 👉 https://t.co/q4Y50PvApy

0

0

0

Phase 2 of our AI Market Insights now live in the Moondrops app: key trade setups, market regime classification, & conviction score. AI reports are generated in real-time at the close of the 1W, 1D, 4H, & 1H timeframes. Find crypto setups in seconds!

4

2

20

Phase 2 is live right now in the Moondrops app. Stop guessing the market's direction. Let the data tell you the story. Read the full breakdown of the new logic here:

moondropsapp.com

Introducing Phase 2 of Moondrops AI. We've upgraded from simple summaries to a skeptical Quantitative Logic Engine. Discover Market Regimes, actionable Key Trade Setups, and Conviction Scores that...

1

0

0

We designed the AI to be risk-averse. It looks for conflict. If it sees a bullish breakout on low volume in a bear market, it won't call it a "Moon Mission"—it calls it a "Low-Conviction Trap." No fluff. No hype. Just math. 📉

1

0

0

The new Executive Summary is a 30-second "C-Suite" dashboard: Key Trade Setups: The specific "needle" events to trade right now (with reasoning). Market Regime: The dominant state (Trend vs. Chop). Conviction Score: A 0-10 risk gauge measuring signal alignment.

1

0

0

We just rebuilt our AI from the ground up. 🤖🏗️ Most tools confuse the Regime (The Weather 🌧️) with the Event (The Lightning ⚡️). Introducing Moondrops AI Phase 2: It doesn’t just summarize data anymore; it acts as a skeptical Quantitative Analyst to synthesize a strategy.

1

0

1

📊 Data Deep Dive (3/3) Momentum: Heavily bearish (389 assets with RSI < 50), BUT a critical cluster of 108 Bullish RSI Divergences warns of a potential snap-back rally. Volume: Institutional participation is weak. 319 assets are on Low Relative Volume. Order Flow: Despite low

0

0

0

⚡ Key Trade Setups (2/3) 1️⃣ Bullish Mean Reversion (High-Risk):A "falling knife" setup. Assets are hitting floor structures while showing divergence. Action: Watch for the 152 assets at Support Levels showing Bullish RSI Divergences (108) and Liquidity Sweeps (58). 2️⃣ Bearish

1

0

1

📉 Market Report Summary (1/3) Overall Read: Low Conviction (3/10) & Trend Exhaustion. The market remains in a Strong Downtrend (283 assets), with most assets trading below the SMA 200. However, caution is advised. The combination of Low Relative Volume (319) and massive

1

0

0

📊 Data Deep Dive (3/3) Trend: Overwhelmingly bearish. 79% of assets are making new Lower Lows & 338+ are below all major MAs. Momentum: 93% of assets have RSI < 50, but the market is clearly in an Oversold extreme condition. Volume: Market is quiet (62% on Low RelVol). Selling

0

0

0

💡 Key Trade Setups (2/3) 1️⃣ Bearish Trend-Following (High-Confluence):The dominant setup. Aligns with the Strong Downtrend regime. Action: Look for Bearish Candlestick Patterns (69) on assets that also show Negative Rate of Change (392) and a Bearish RSI (393). 2️⃣ Bullish

1

0

0

📈 Crypto Market Report Summary (1/3) Overall Read: High Bearish Conviction (7/10) but with significant conflict. The market is in a Strong Downtrend (71% of assets), confirmed by a Strong ADX (70%). However, this is in direct Conflict with a large cluster of Bullish RSI

3

0

0

Crypto market is down bad at the moment. Let’s take a look at the @moondropsapp 1W AI Market Insights which was pushed on Sunday night at the weekly close… Price action: bearish Trend: bearish Momentum: bearish Volume: bearish Overall: bearish

0

0

1

Ran @cobie as an ad strategy. 5M impressions - literally up only. Still no clue how to convert parasocial influence into downloads. marketing’s hard lol.

0

0

1