mono †

@monosarin

Followers

12K

Following

53K

Media

3K

Statuses

15K

Here to help you make it with/in DeFi. Will use: 🧠 threads 🧠 alpha

on your screen

Joined May 2021

RT @AltitudeFi_: The crypto collateral economy is maturing. Here’s why that matters and where we fit in:. Traditionally, tapping into your….

0

18

0

Something I'd love to see, are expansions to other chains (L2s with fat TVL) and the integration of other DeFi protocols (you know, more rewards/yield). What's your opinion?. If you don't know what I'm writing about, start here ⬇️.

Summer is here, you're too lazy to do the DeFi clickity clicks, but you'd like to max out your BTC and ETH bags, and have no clue where to put them to work. Don't stress, enjoy your cocktail. 👇. Here's how to have your (cb)BTC and (wst)ETH farm while you're maxing Cuba Libre.

0

0

8

If you need a TL;DR, no one does it better than @eli5_defi . So I suggest you read his piece first, and in the next post, my article on Altitude I recently wrote.

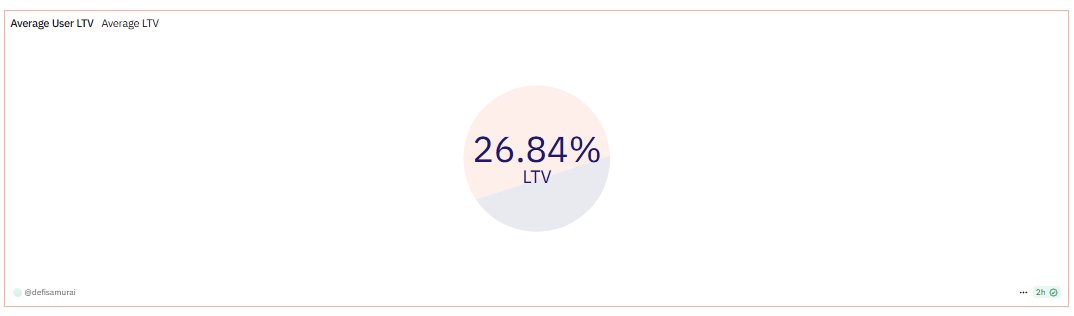

➥ Unlocking DeFi Capital Efficiency. DeFi lending is stuck in a loop of inefficiencies, tying up user capital and capping returns with overcollateralization. On the other hand, @AltitudeFi_ transforming DeFi lending by turning cumbersome manual management into an automated

1

0

5

AMAs are oftentimes where the real alpha is. If not alpha, then the details you've been looking for. Treehouse co-founders will provide answers to all the (good) questions. Twitter (I refuse to call it X) Space info below:.

🌳 Upcoming Space: The Tree Talks. You’ve asked the questions. We’ll bring the answers. Join our Co-Founders @mytwogweis & @bgohroo as we chat TGE, tAssets, and what's next for Treehouse. 🗓️ 4 Jul (Fri).⏰ 10 AM UTC. We're giving away $tETH (worth $300)!. See you, Squirrels. 🐿️

1

0

5

Wait, if you're still not familiar with what Treehouse does, I wrote a thread (it's not that long) ~3 months ago. Of course I recommend having a read (no, it's definitely not a biased take):.

When was the last time a team shipped something that had the DefiLlama add a new category to its platform (we all love)?. @TreehouseFi did exactly that with the introduction of DOR. Quick intro and overview [also, see embedded post] ⬇️

1

0

3

So, @mytwogweis laid out some fantastic points and was very accurate in his post, connecting as many Dots as possible. If you didn't read his post (y tho?), here's a TL;DR:

1

0

1