Sandeep Kulkarni

@moneyworks4u_fa

Followers

23,571

Following

85

Media

5,038

Statuses

27,652

CEO, Aksha Moneyworks4u Pvt Ltd | Chartist | Howard Marks disciple | Fitness enthusiast

Pune, India

Joined November 2014

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Macklemore

• 356156 Tweets

WIN Premiere Night TH

• 291327 Tweets

#आँखों_देखा_भगवान_को

• 280530 Tweets

GW明け

• 189026 Tweets

#CantBuyMeLoveFinale

• 76058 Tweets

Switch後継機

• 75078 Tweets

BINGLING ENDGAME

• 70253 Tweets

#Victor_เริ่มก่อน

• 55204 Tweets

#AppleEvent

• 53053 Tweets

Tango

• 45492 Tweets

Switch 2

• 44076 Tweets

SB19 GOES INTERNATIONAL

• 44028 Tweets

iPad Pro

• 40340 Tweets

#家庭教師ヒットマンREBORN

• 30840 Tweets

2ND LOREAL LIVE X BOOK

• 25602 Tweets

Hi-Fi Rush

• 24999 Tweets

#สงครามสมรสep14

• 21485 Tweets

生田斗真

• 19622 Tweets

Arkane Austin

• 19111 Tweets

Rebeca García

• 18944 Tweets

Prey

• 16259 Tweets

桃源暗鬼アニメ化

• 15968 Tweets

Redfall

• 14800 Tweets

無痛おねだり

• 14305 Tweets

退職代行

• 13637 Tweets

無痛分娩

• 12128 Tweets

#ヒゲダンラジオライブ

• 10972 Tweets

スマブラ新作

• 10963 Tweets

Apple Pencil Pro

• 10936 Tweets

Last Seen Profiles

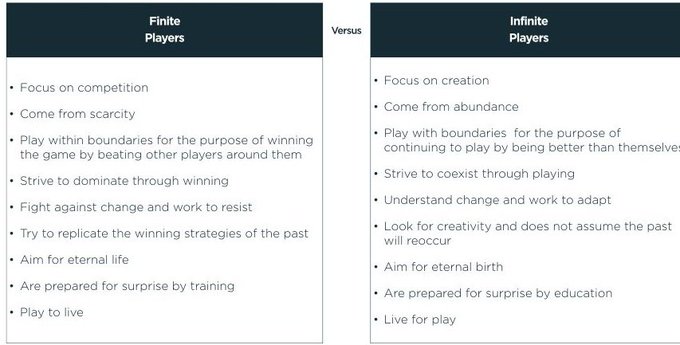

So many Gujaratis are so successful in life not because they are the most hard working or most talented. But because they have an Infinite mindset. They think in terms decades and generations not next month or next year, in their community business failure is not considered…

104

226

1K

Indiamart is down 40% from April when this good lady covered it as moated midcap stocks for long term.

It is very well intentioned video I don't doubt that & 9mths is not long term, but how are you going beat the fund manager if you keep buying random stocks on random advise?

215

116

1K

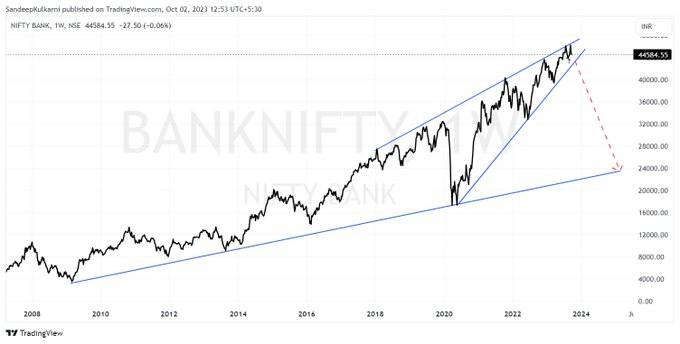

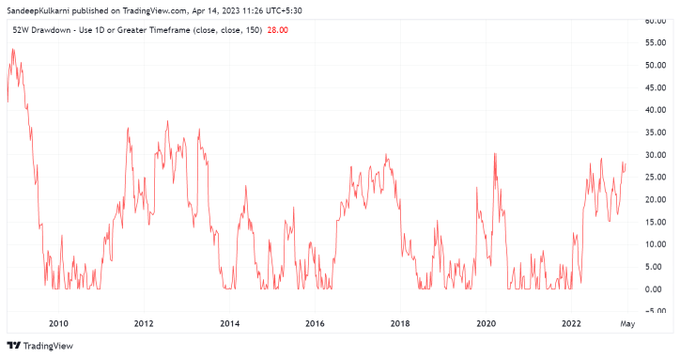

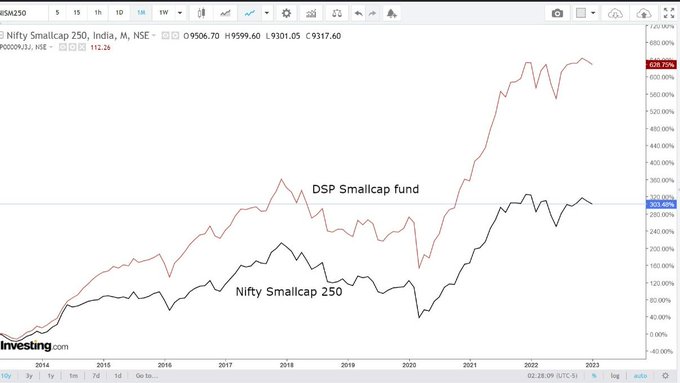

Climax move in Smallcap about to end imho.

Although I have been cautioning for a while today could be the day Smallcaps start to top out.

I don't think this is 2017 but investing fresh money in smallcaps is not a good idea at this time.

Last time I had called out the market top…

16

34

319

Traveling abroad - TCS cut karenge

Investing abroad - Put limits

Investing in MFs - we wanted officially validated document for KYC.

But dont ask us anything about electoral bonds and Adani proxies in tax havens. Sara corruption ka paisa log stock market mein invest karte hai ya…

23

56

258

Shankar Sharma tried to portray MF managers in poor light in Mar 2020 as well as in Oct 2008.

Nilesh Shah told us a story of how he tried to pull down MF managers on a live show in Oct 2008(Sensex about 8k). He was bearish even then and told audience not to listen to MF guys as…

53

29

257

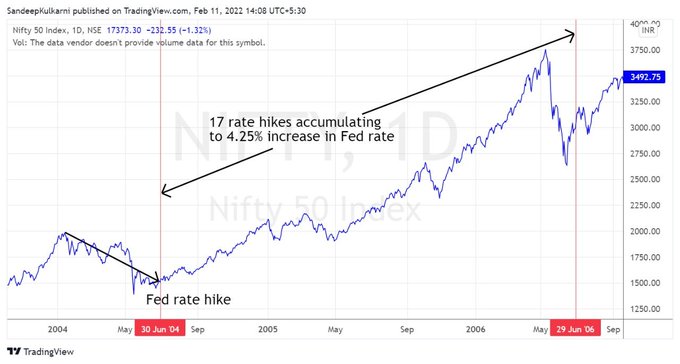

This is Nifty's chart from 2004 to 2006. Back then also US interest rates had gone up. Markets had corrected well before Fed had hiked rates for first time in 2004, from then it hiked rates 17 times by 4.25% over next 2 yrs and yet market kept making new highs.

@shivaji_1983

21

41

243

You have photographic memory

@suru27

..

Last 4 yrs smallcap index has seen very sharp 4-5% drawdowns around these dates of 20/21st Dec.

10

13

239

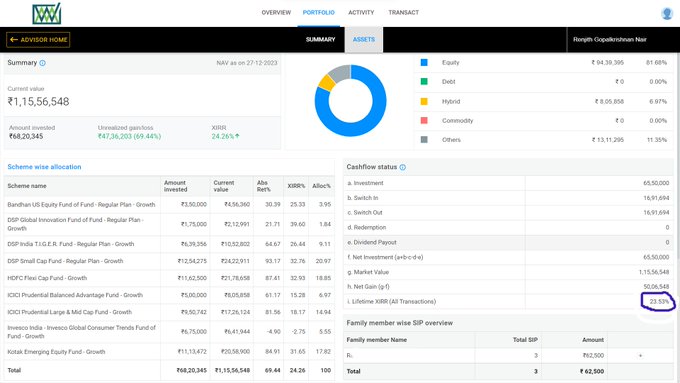

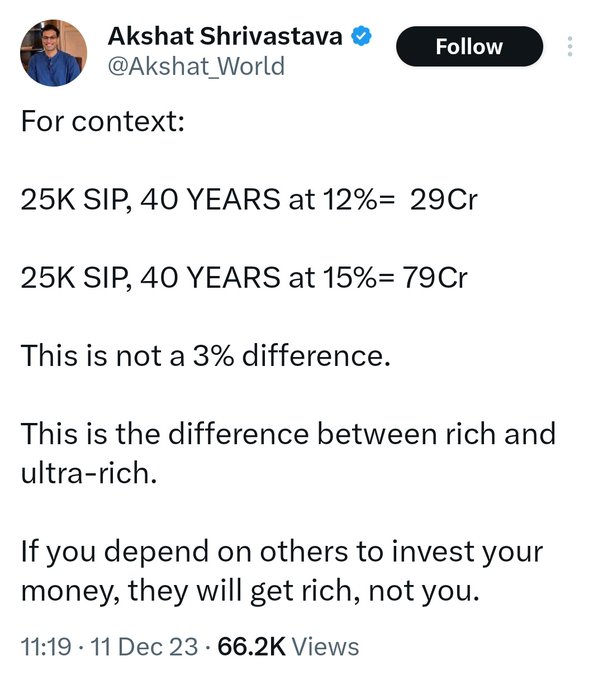

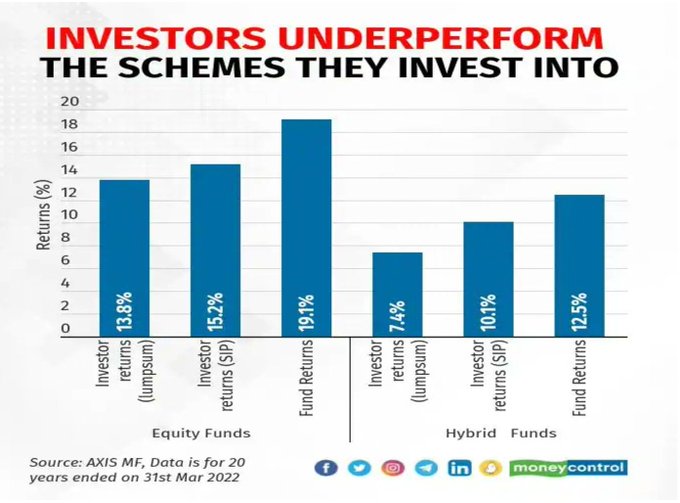

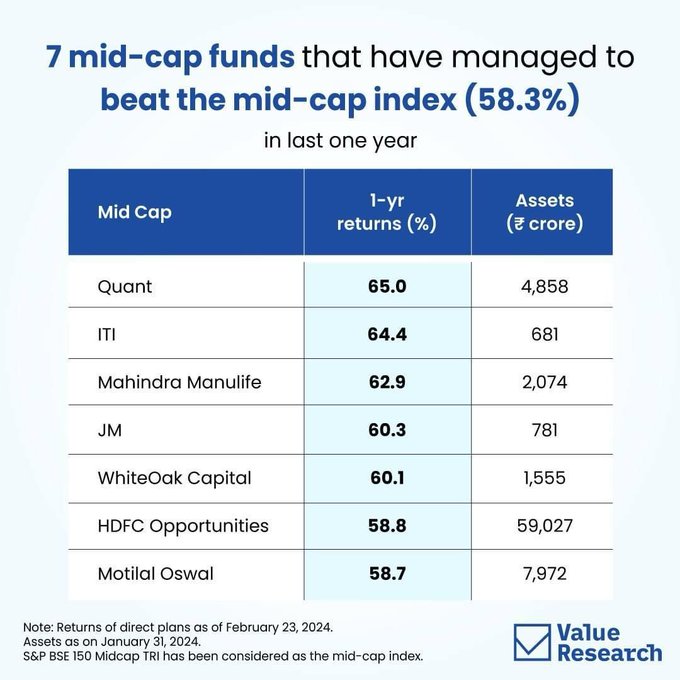

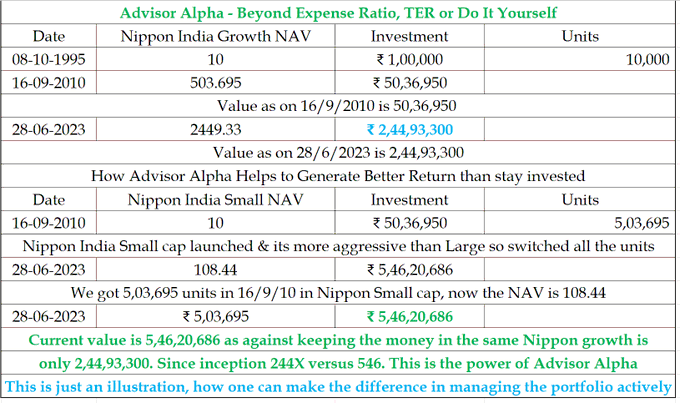

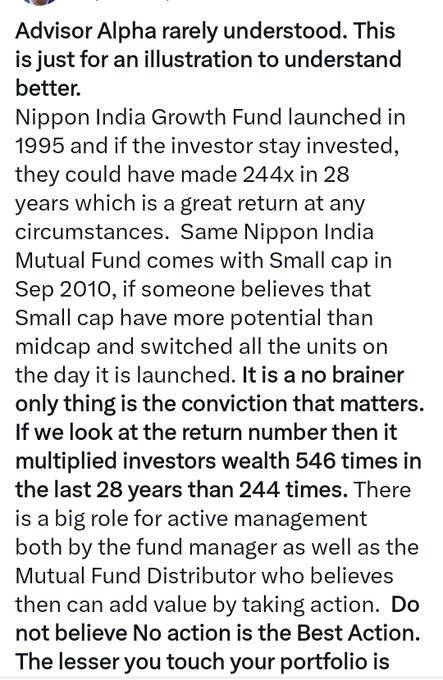

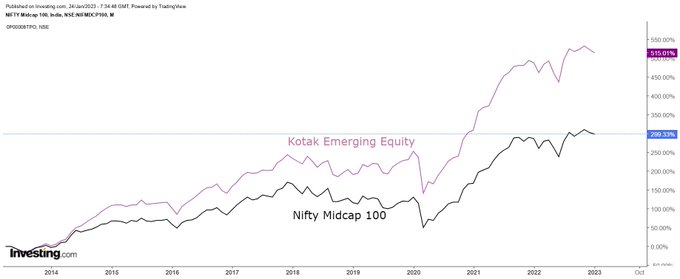

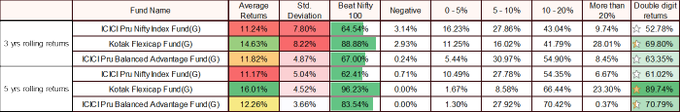

This is not an ad for 23% XIRR. Making 20% from current level looks highly unlikely. Even 15%+ XIRR over next 5 yrs from current level is going to be challenging ask. I want you to look at this message at 3 levels.

1) People say active MFs don't make money. Show them this.

2)…

16

8

209

@RajanSi65889814

No no it's not about laurus lab nor is it about shilpa ... Its about how difficult it is to foresee or forecast the future. Extrapolating past trends can prove to be costly mistake.

1

3

188

I see this craze for early retirement on social media. I have worked in wealth mgmt for past 15 yrs have seen innumerable people retire.

I think it's one of the toughest transition one makes in our lives. From being tremendously busy to having a lot of idle time many...🧵

1/

13

30

189

You know why icici bank is never in the race of credit cards?

Because it burnt it's hands badly in 2008. They used to issue credit cards to anyone and everyone.

It took them almost 2 yrs to clean up that mess after 2008.

Do you know who was the retail banking head of icici bank…

23

16

183

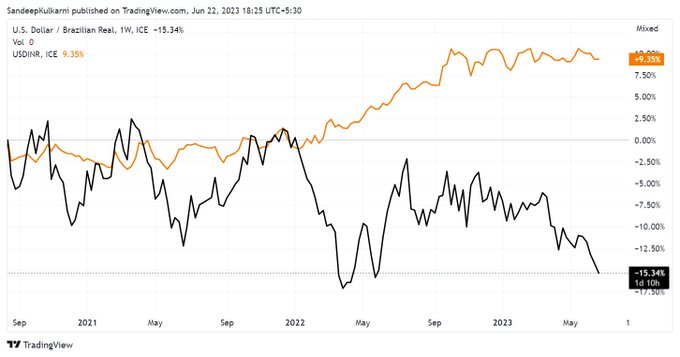

Who would have thought India can become current account surplus with $80 oil? Do remember the precarious scenario just 5 yrs back when oil briefly went to ₹85. This is the kind of ache din I want to see.

Salute to the IT/ITeS sector for becoming the pillar of our economy 🫡

Surging services exports have made India a current account surplus country this quarter. Is this likely to continue? What does this mean for currency, monetary policy, and growth?

@latha_venkatesh

analyses

#Exports

#MonetaryPolicy

#Deficit

#Currency

16

97

276

7

19

159

Very few people would have influenced entire generations thought process the way he did.

Sharing some of my favorite Charlie Munger quotes.

#RIPLegend

2

35

154

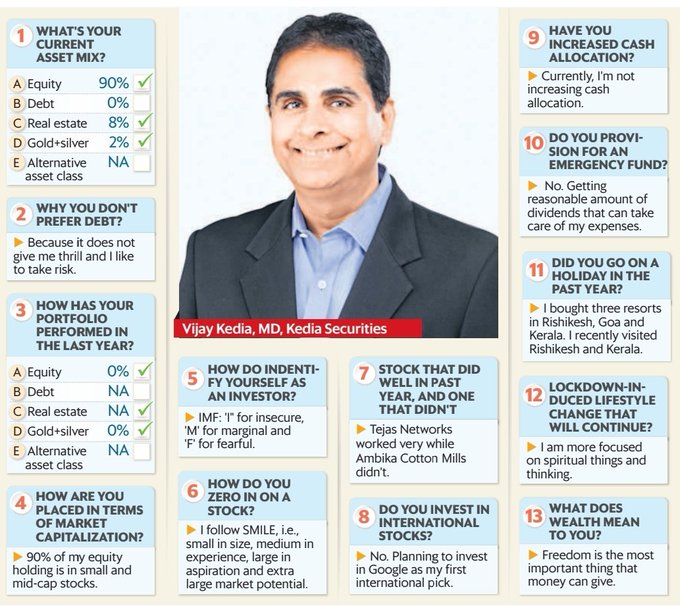

Kids go to Rishikesh

Men go to Kerala

Legends go to Goa

Ultra Legends - "I bought 3 resorts in Rishikesh, Goa & Kerala"

5

18

153

Force motors 3x in 3 months 😎

Force motors: Another of those falling knife coming out of a prolonged bear market

@Tradewithsandy

2

2

58

7

2

149

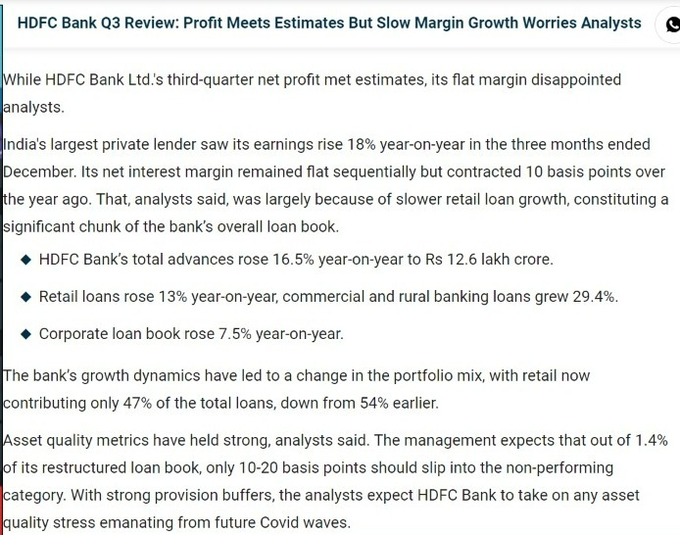

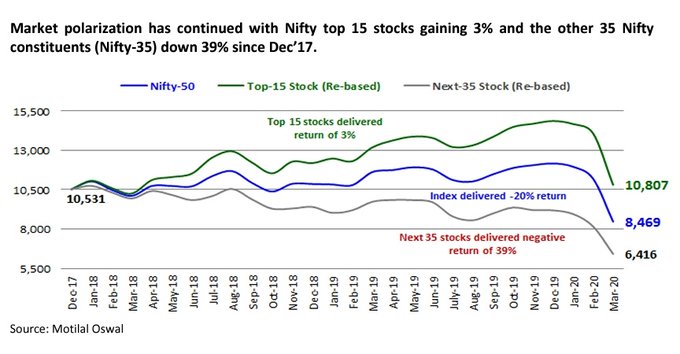

Today everyone knows why HDFC bank is underperforming.

But we wrote this 4 yrs back when HDFC name was ruling the roost on Dalal street. Just having HDFC prefix was enough to command premium valuations.

I think after 4 yrs of under-performance its too late to be bearish on HDFC…

13

9

145

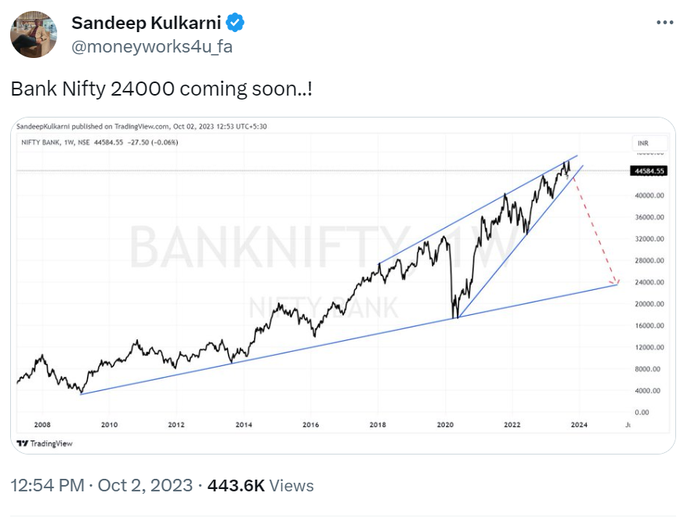

Bola toh Bola 😎

19

1

128