Michael Kahn, CMT

@mnkahn

Followers

9,368

Following

377

Media

1,263

Statuses

11,311

Senior Market Analyst, @LowryResearch / @CFRAResearch . Barron's alum. Jargon buster.

New York

Joined November 2008

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

어린이날

• 536406 Tweets

こどもの日

• 501971 Tweets

#EğitimHaykırıyorTekinistifa

• 158199 Tweets

子供の日

• 136599 Tweets

#光る君へ

• 106150 Tweets

Mülakatsız68binAtamaistiyoruz

• 85104 Tweets

#ขวัญฤทัยEP12

• 79520 Tweets

GW最終日

• 72762 Tweets

予選突破

• 47466 Tweets

Al Jazeera

• 35248 Tweets

#CHEWHU

• 31796 Tweets

Happy Easter

• 29874 Tweets

Cole Palmer

• 28978 Tweets

Noni

• 28043 Tweets

Gallagher

• 20816 Tweets

柱稽古編

• 19825 Tweets

BINGLING THROUGH IT

• 19188 Tweets

سعد اللذيذ

• 16561 Tweets

Santner

• 15731 Tweets

四塩化一黄酸

• 15681 Tweets

GW終わり

• 15044 Tweets

Kerem Shalom

• 12131 Tweets

#فيصل_ابورميه_المطيري_58

• 11760 Tweets

Madueke

• 11515 Tweets

Happy Cinco de Mayo

• 10711 Tweets

蜜璃ちゃん

• 10065 Tweets

Last Seen Profiles

@WalterDeemer

Just a warning to the minions that a 90% downside day (with points) is not a guarantee of capitulation.

17

7

142

@AntithetosCptl

@WalterDeemer

We have no studies showing that back-to-back 80% upside days mean anything more than a temporary surge in buying. As you point out, a major selling day (90% downside) just before these upside days is a different story as it shows the exhaustion of Supply and return of Demand.

8

19

117

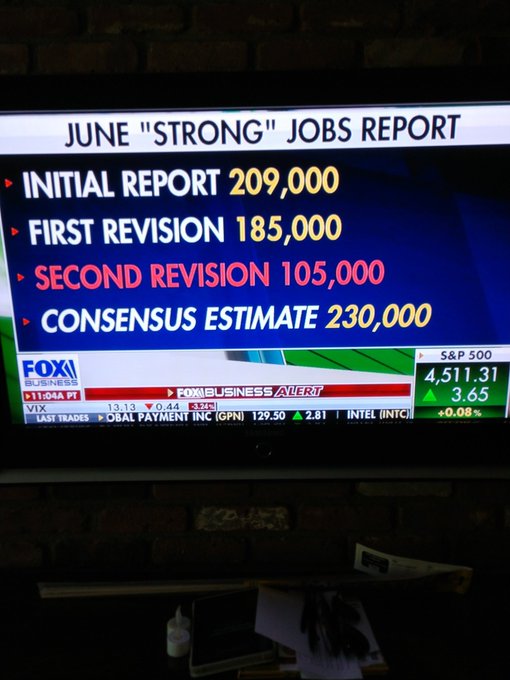

If this is not the best reason to use technical analysis, I don't know what is. No data revisions, no data guesses.

@CMTAssociation

3

26

108

@WalterDeemer

Obviously, I cannot give away the store but this is the first 90% Downside Day since November. An isolated 90% Down doesn't tell us much more than volatility in a downtrend at this point.

6

12

110

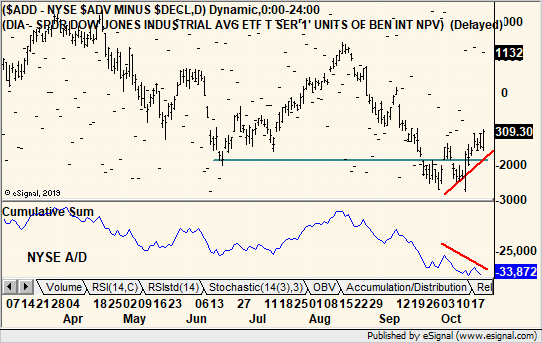

Something we find troubling. $DIA on top, NYSE Adv-Dec on bottom.

@LowryResearch

@cfraresearch

6

26

104

@WalterDeemer

Or as Paul Desmond wrote, multiple 90% down days spark additional 90% down days.

5

9

61

@WalterDeemer

Officially an 80% Upside Day. We got the 90+% points but our official volume was 89.84%. The end of day WSJ data did beat 90% at the close but they keep updating for hours. The closing diaries page today also shows sub-90%.

7

5

51

@WalterDeemer

We show that this was the first back-to-back 80% Up in 2023. The last 90% Down was March 9. Keep in mind that an 80-80 Up is not meaningful unless following a 90% Down and in a downtrend.

6

8

52

Before you all disappear for the long weekend of drink and debauchery, I would like to say thank you for reading my charts and various other brain dumps.

#GoodHealth

and

#HappyNewYear

#dontdrinkanddrive

4

1

46

@WalterDeemer

Friday's official Lowry numbers - 92.00% Volume 96.50% Points. (Sorry, but implications must be reserved for clients.)

2

3

35

@billmonness

@WalterDeemer

1- very early into a decline, like near the highs, it says to watch out.

2 - after the decline, a 90% Up (plus a few other Lowry things) says Supply is exhausted and Demand is roaring back.

2

3

31

If only they understood what there were writing about.

Headline - Boeing, Nike and 3M pacing Dow gain. The top gainers on the Dow by points, not percentages, are UNH, BA and HD. The Dow is price weighted, not equal weighted (or cap weighted).

#stupidmedia

2

5

30

@WalterDeemer

Heavy selling begets heavy selling. I would be surprised to see an upside day anytime soon. Of course, 2020 did not follow that rule.

5

1

26