Martin Castellano

@mcastellano44

Followers

8,779

Following

1,023

Media

417

Statuses

725

Head of Latam Research @IIF . Opinions are my own.

Washington, DC

Joined September 2010

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

México

• 631713 Tweets

Uruguay

• 64463 Tweets

Yuta

• 57724 Tweets

#jjk262

• 49802 Tweets

#ช้อปถูกที่Lazada66xZNN

• 47499 Tweets

JULIANA AL 9009

• 34292 Tweets

Asian Value

• 33233 Tweets

VIRGINIA AL 9009

• 28447 Tweets

Gege

• 28350 Tweets

悪魔の日

• 25116 Tweets

Hannity

• 23365 Tweets

Yinlin

• 22891 Tweets

Jiaoqiu

• 21750 Tweets

Rika

• 20314 Tweets

ショウキュウ

• 18660 Tweets

Bielsa

• 15677 Tweets

インリン

• 15630 Tweets

chivas

• 14757 Tweets

悪魔の数字

• 12479 Tweets

Ben Carson

• 10471 Tweets

Last Seen Profiles

#ElSalvador

: Will President-elect

@nayibbukele

be able to deliver policy improvements, despite limited legislative support? Early signals in the transition, which include the will to make the relationship with the US a key priority, suggest reliance on pragmatism to work it out.

12

56

228

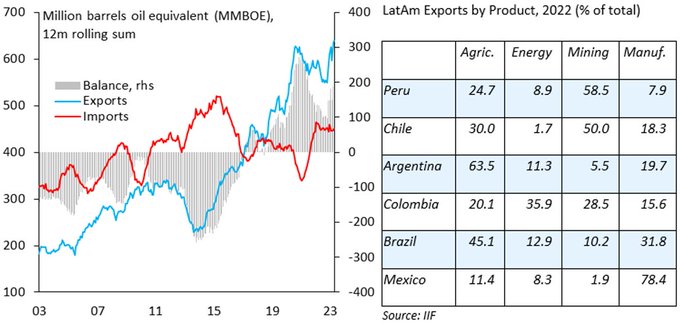

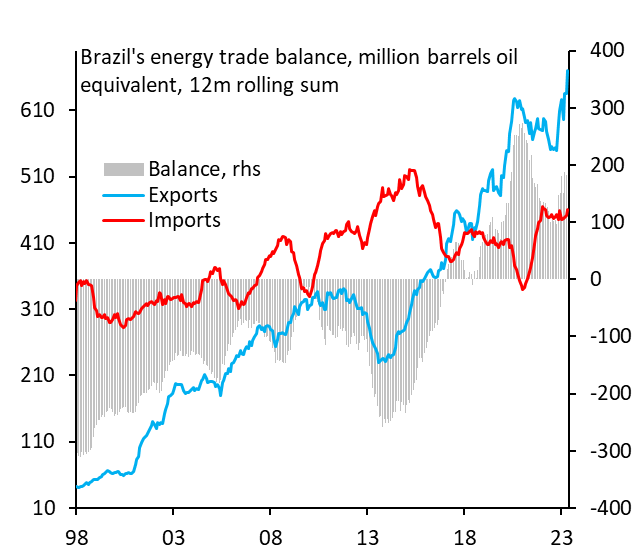

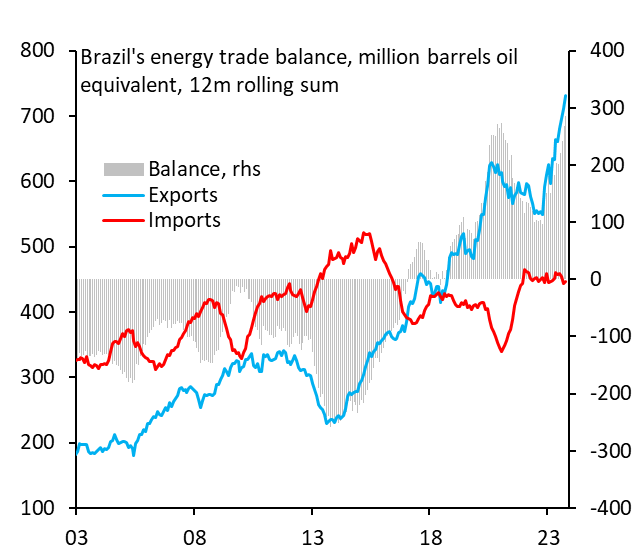

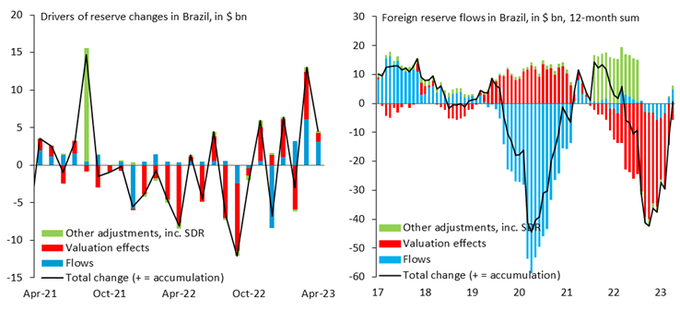

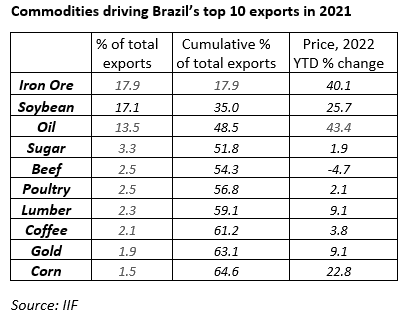

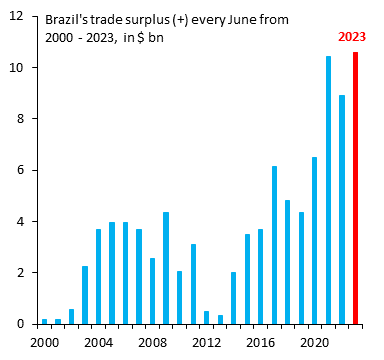

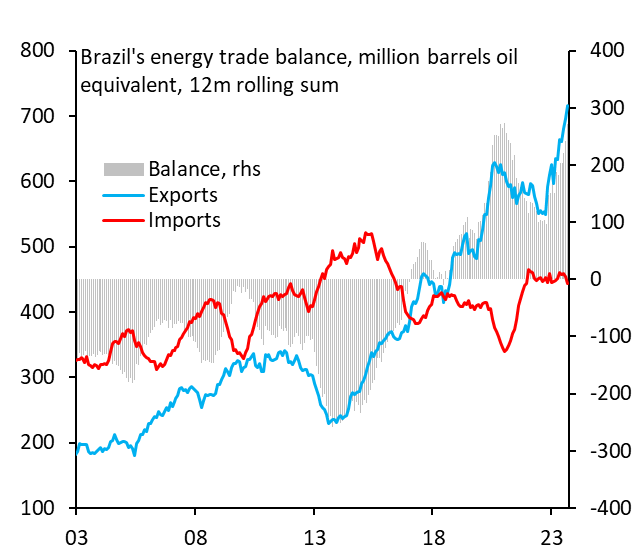

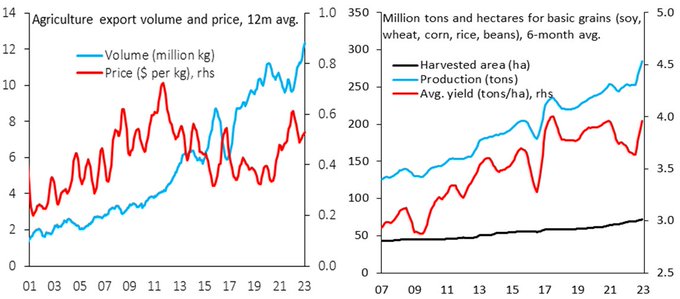

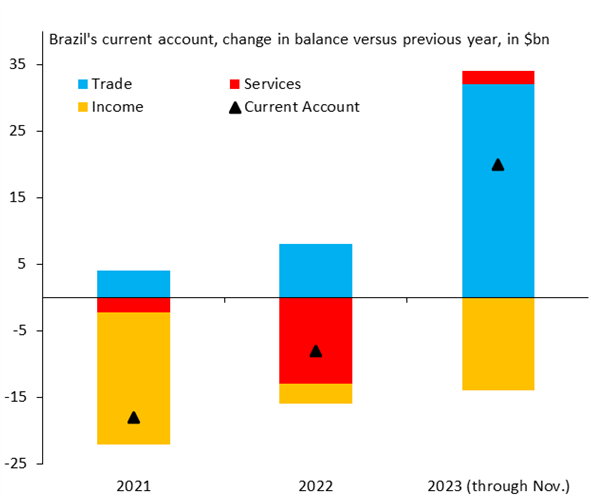

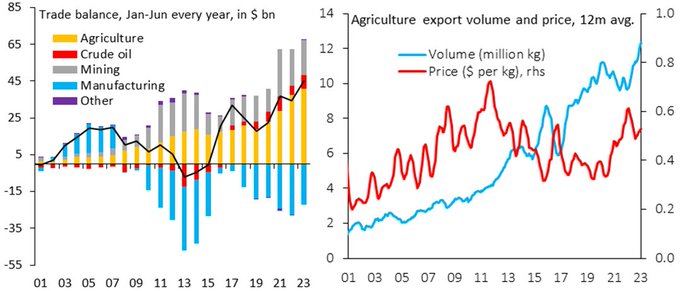

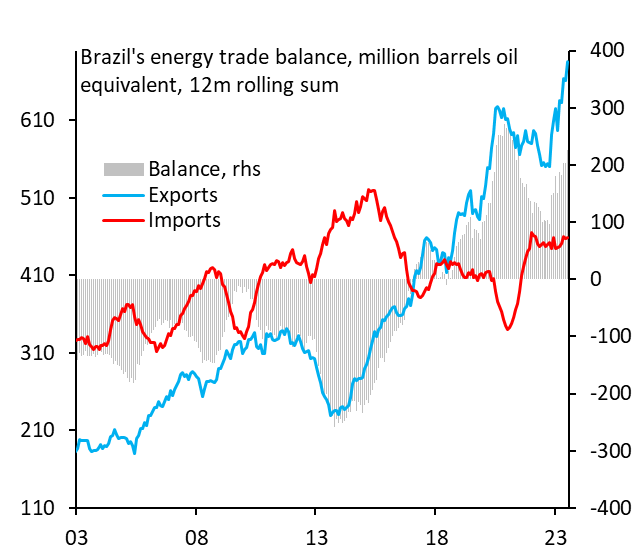

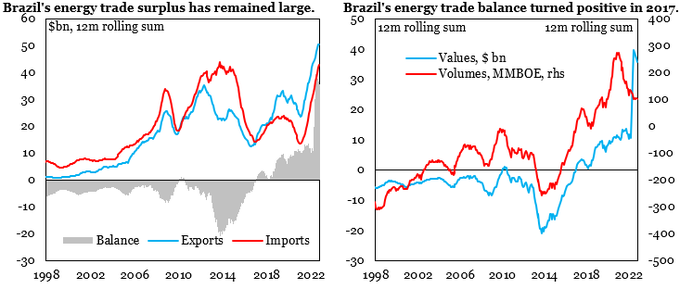

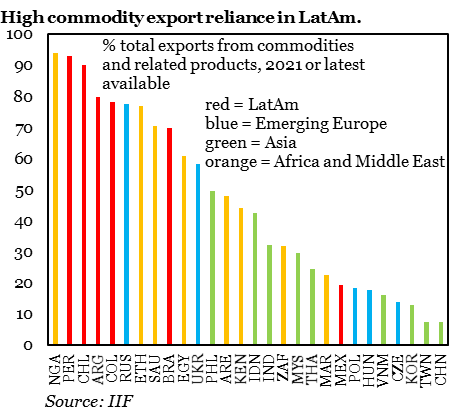

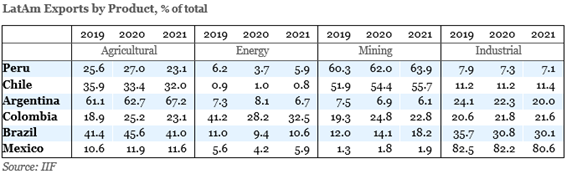

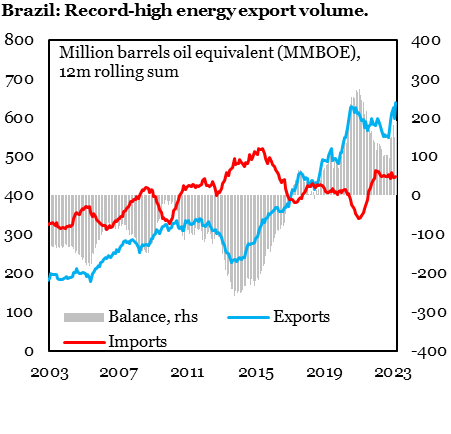

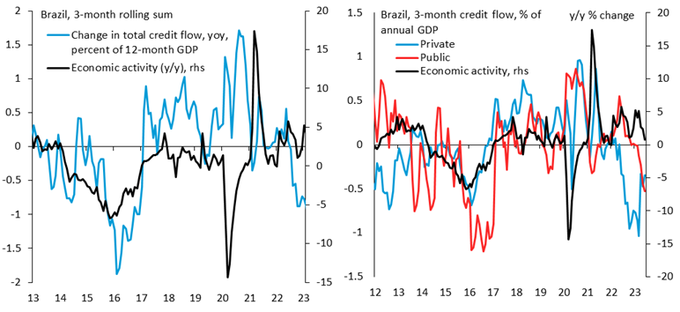

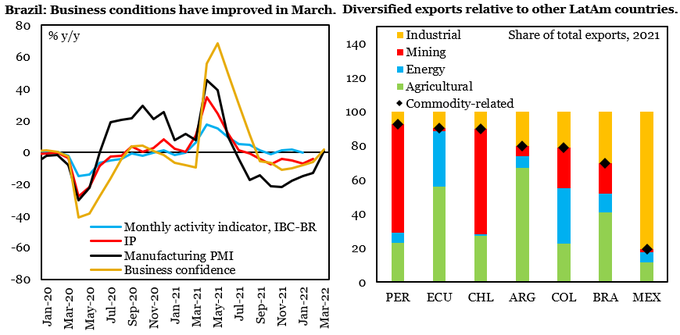

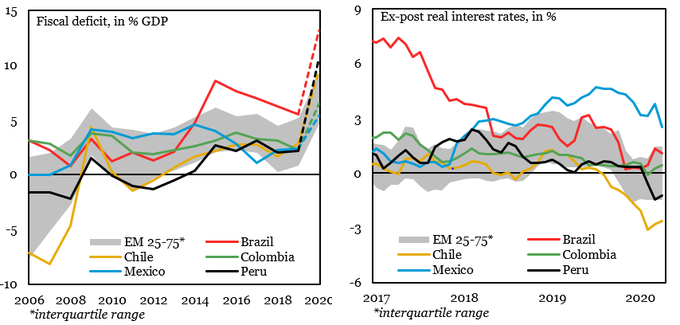

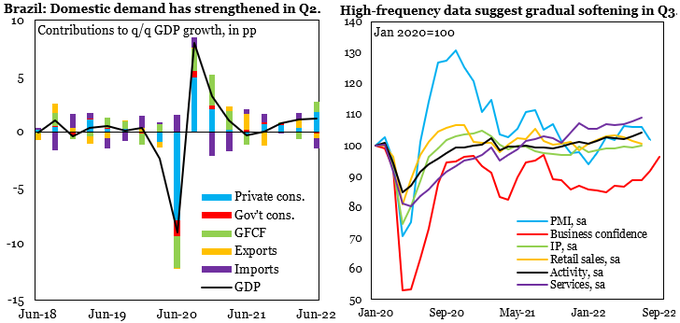

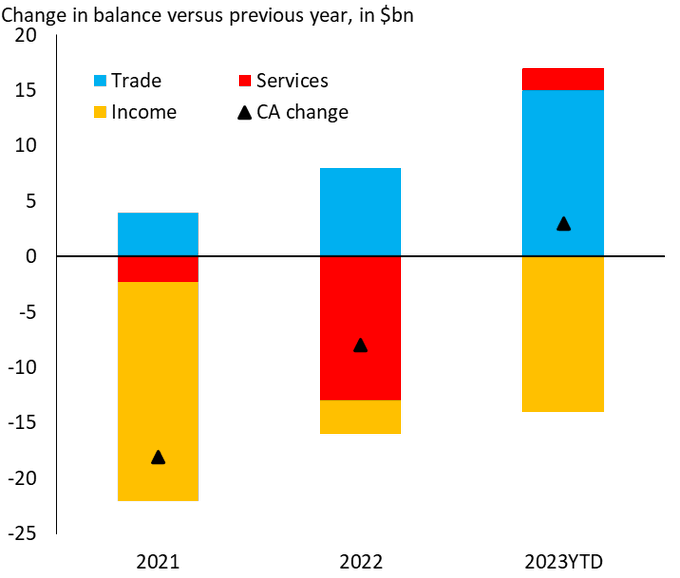

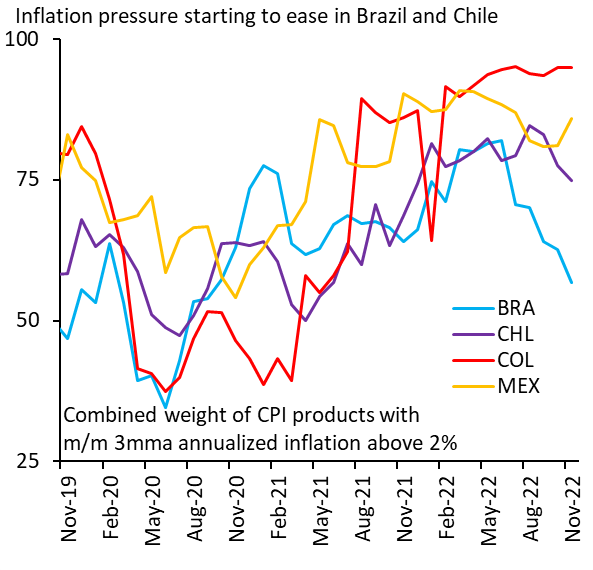

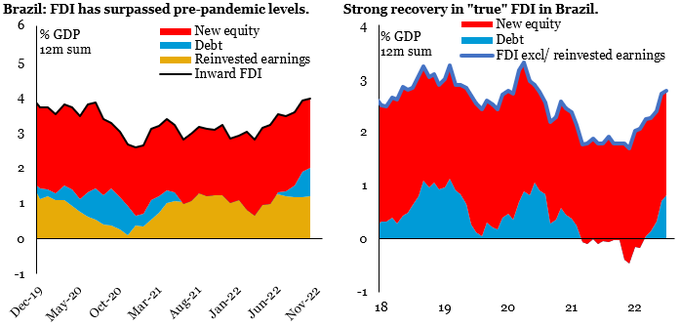

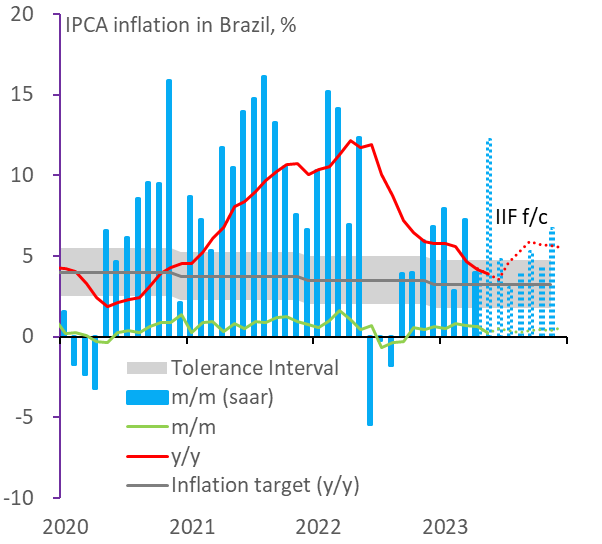

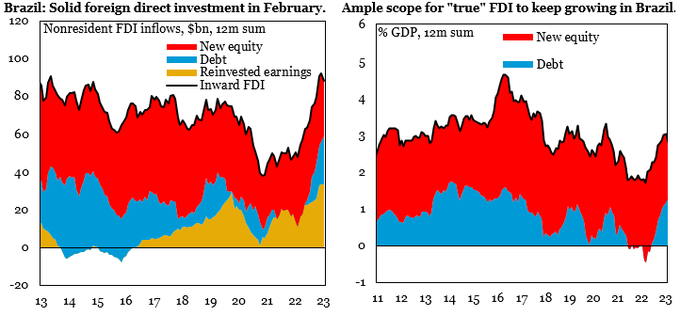

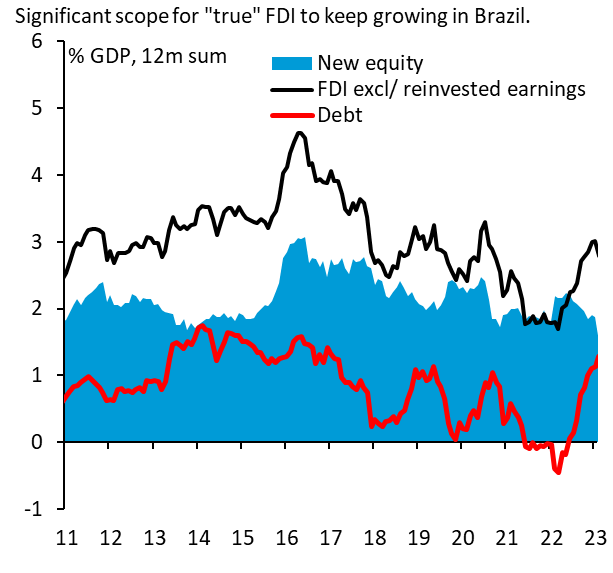

Subdued export prices have not prevented Brazil from posting a double-digit trade surplus in June. A trade surplus of over 3% of GDP in 2023 will be the largest since 2006. While soybean contributes the most, a diversified export base makes Brazil a key global commodity supplier.

7

57

221

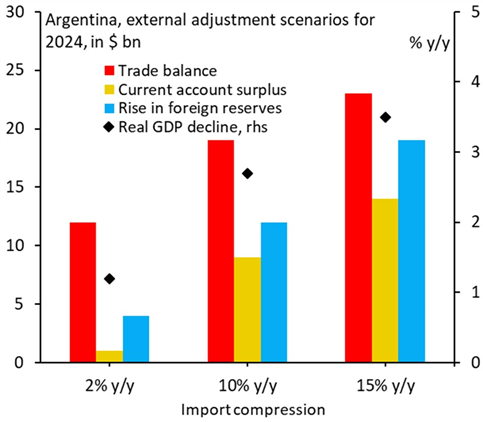

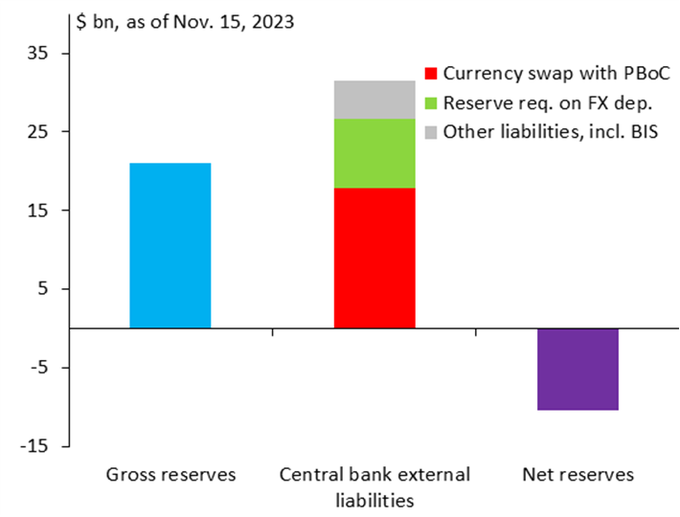

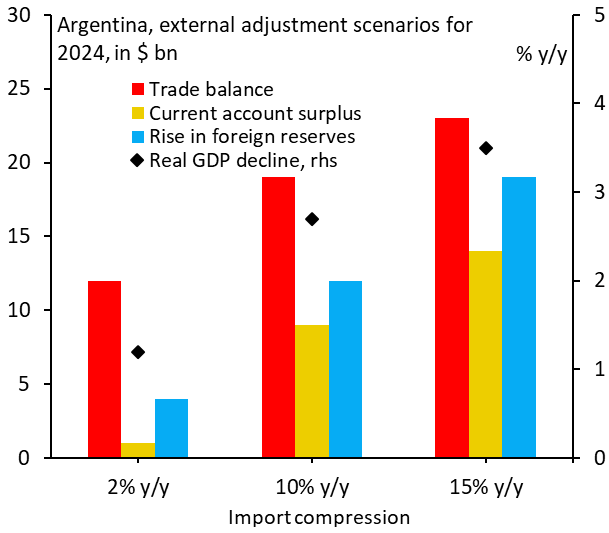

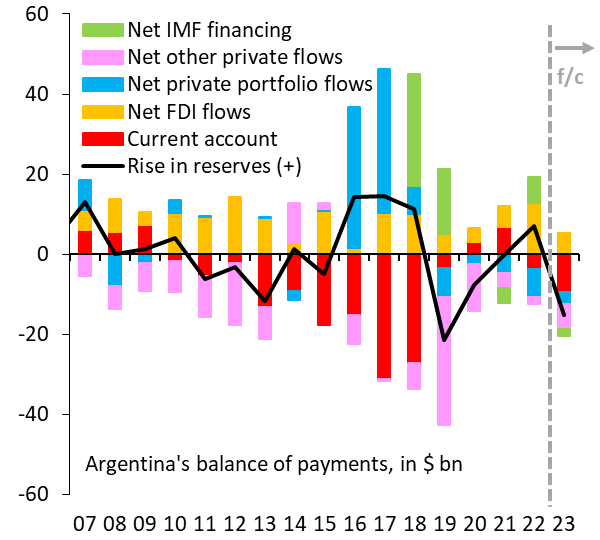

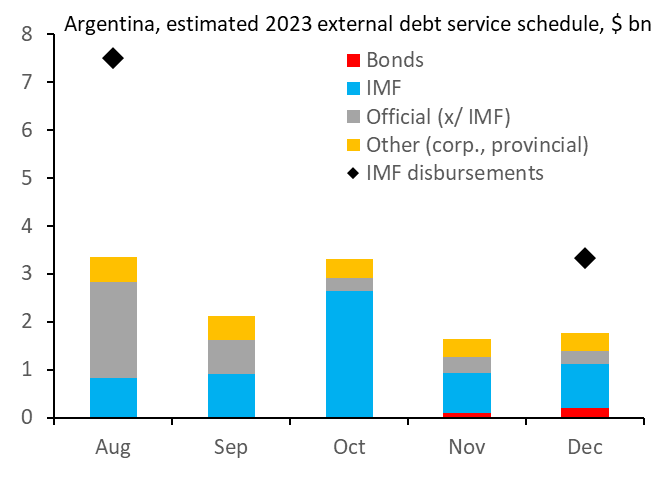

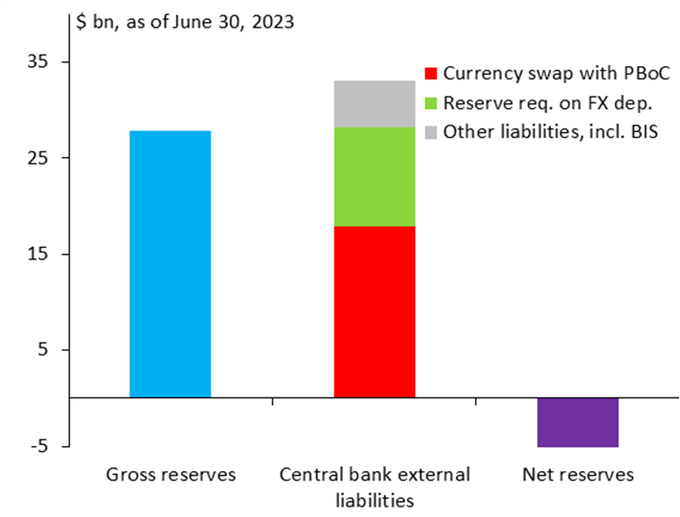

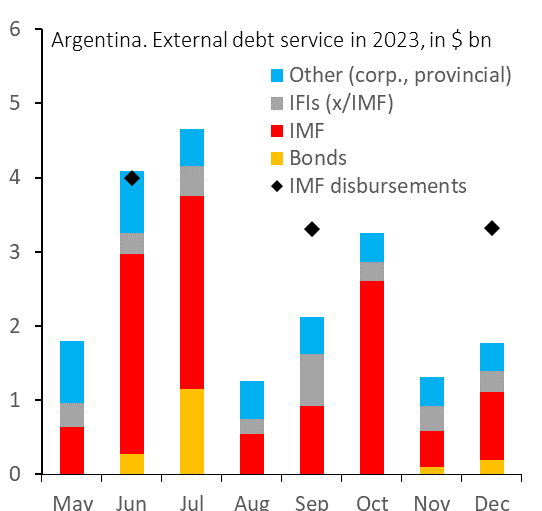

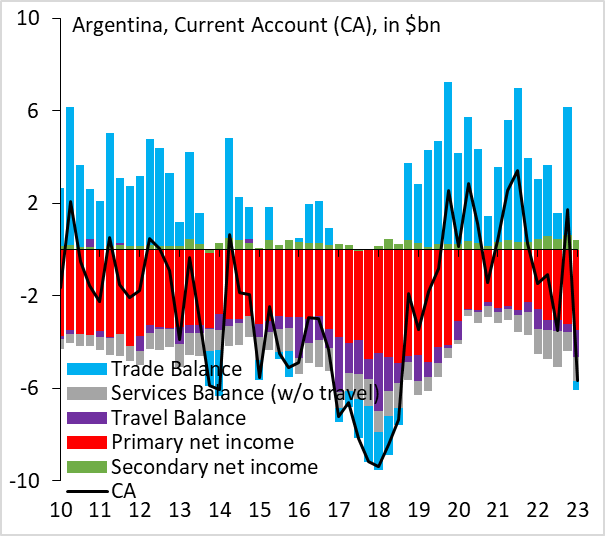

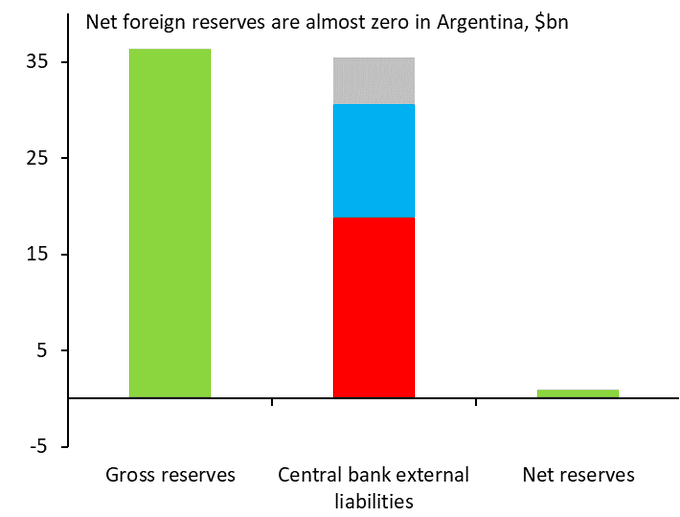

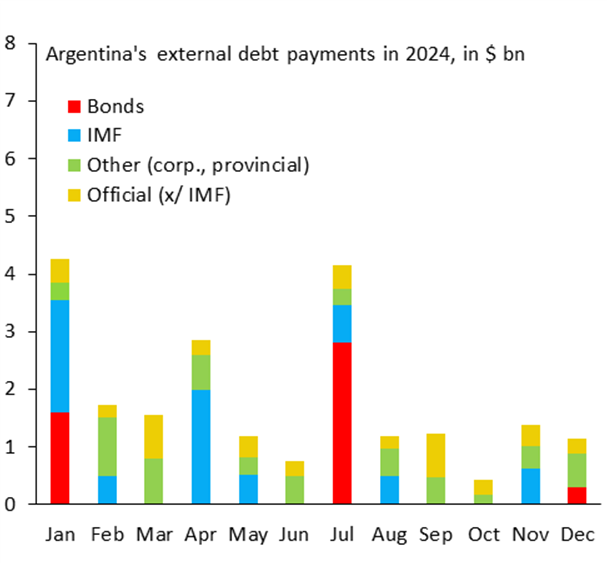

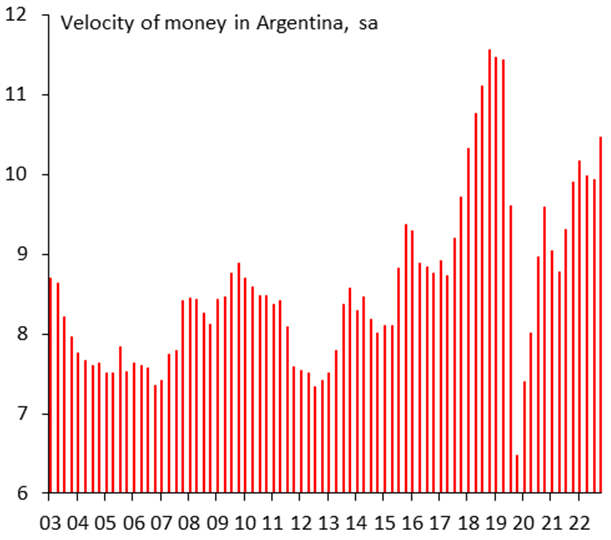

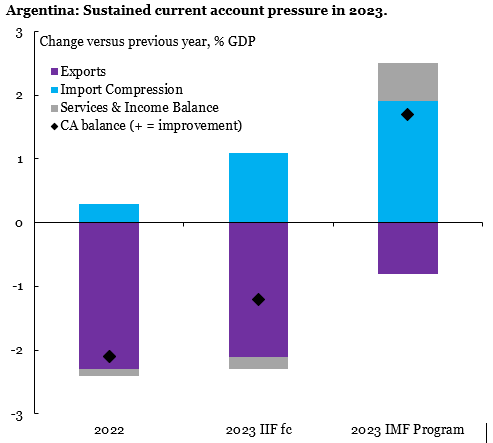

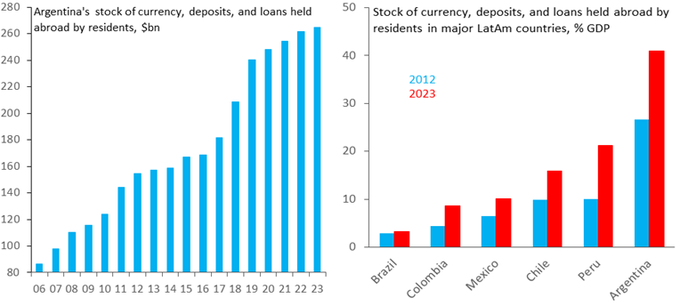

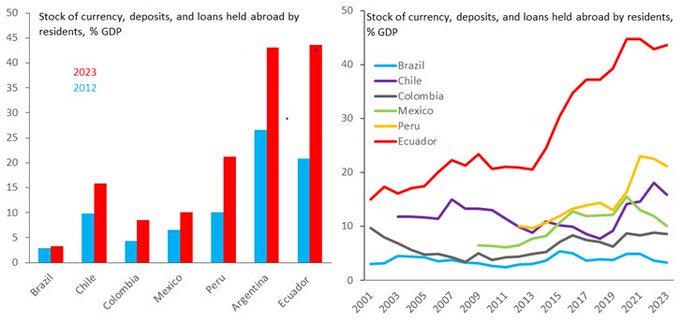

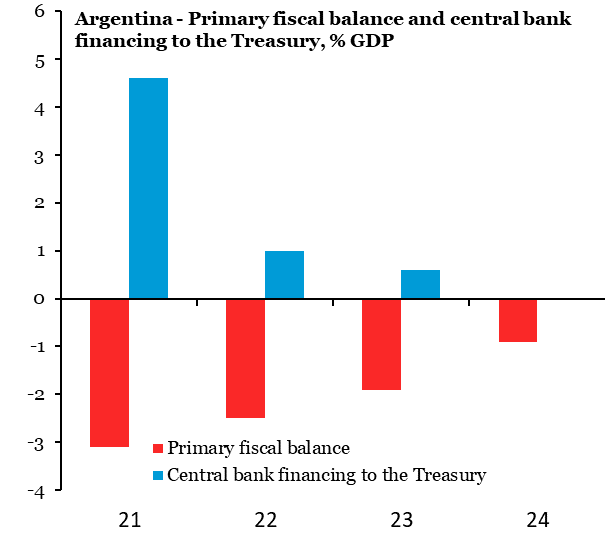

In Argentina, the latest incoming govt statements seem to acknowledge dollarization is not viable (no reserves, debt appetite, big new IMF money, resident external financing). With dollarization off the table, the focus should be fiscal and central bank/FX market normalization...

3

34

106

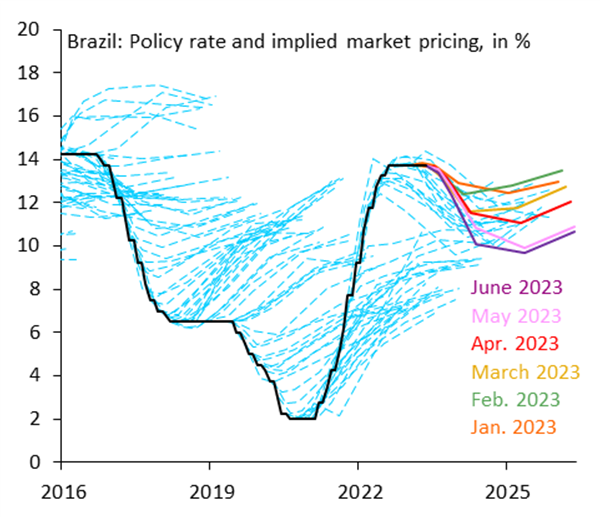

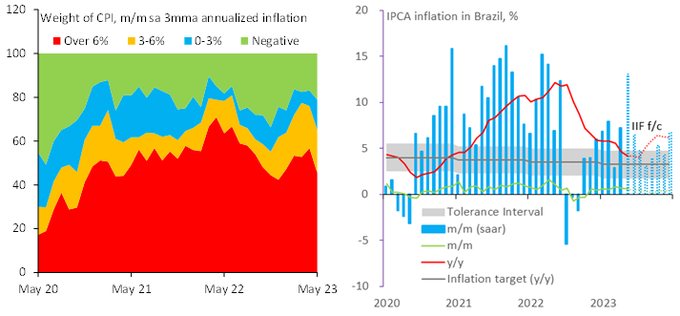

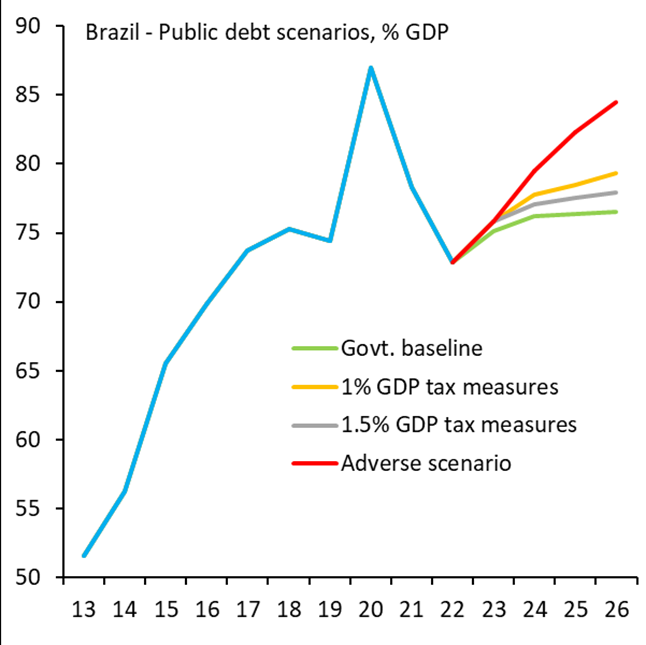

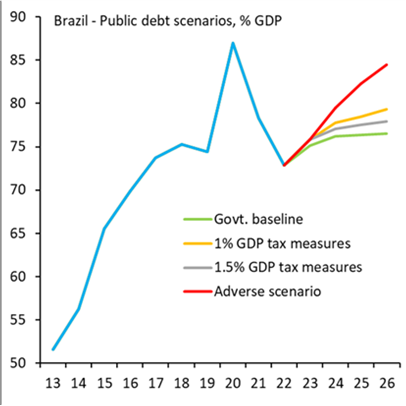

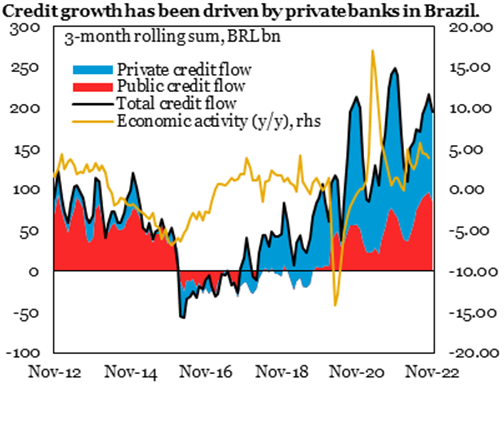

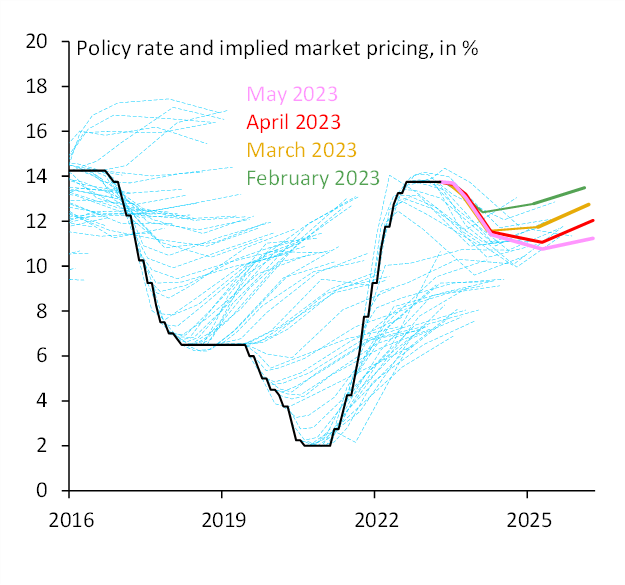

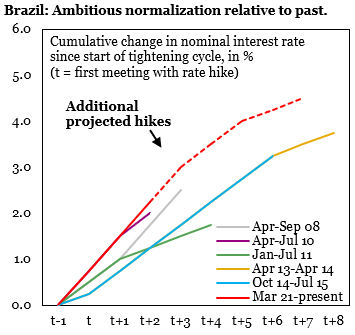

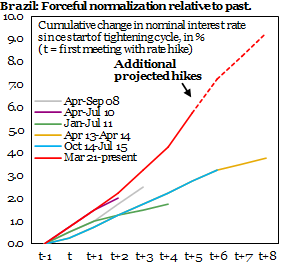

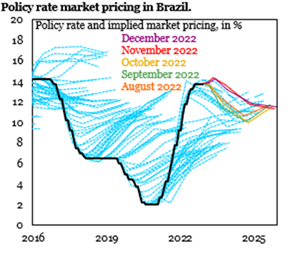

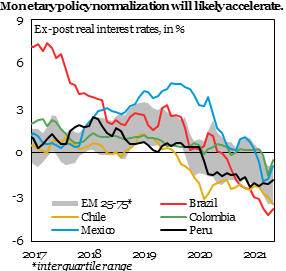

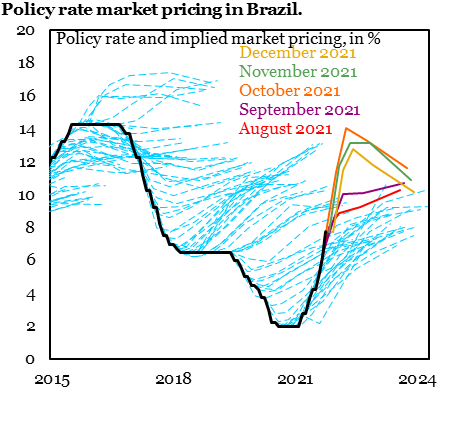

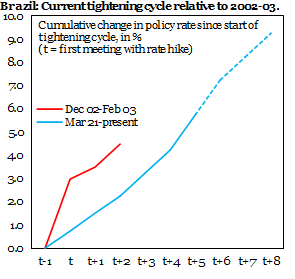

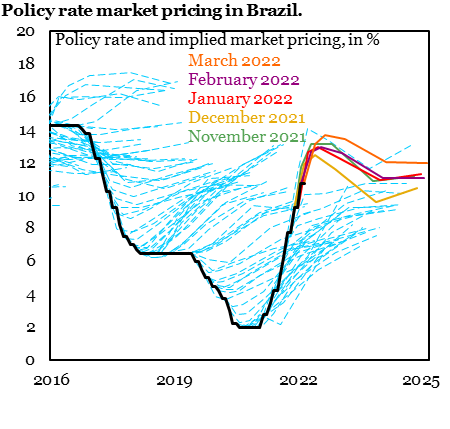

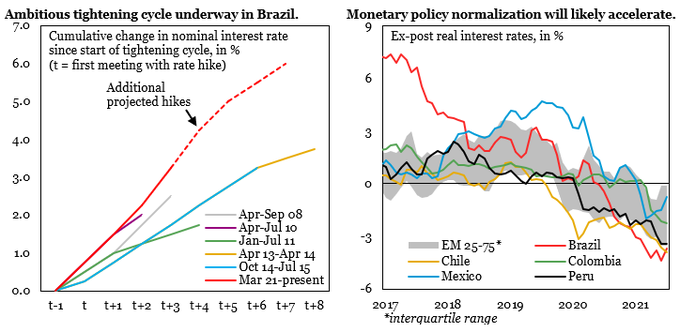

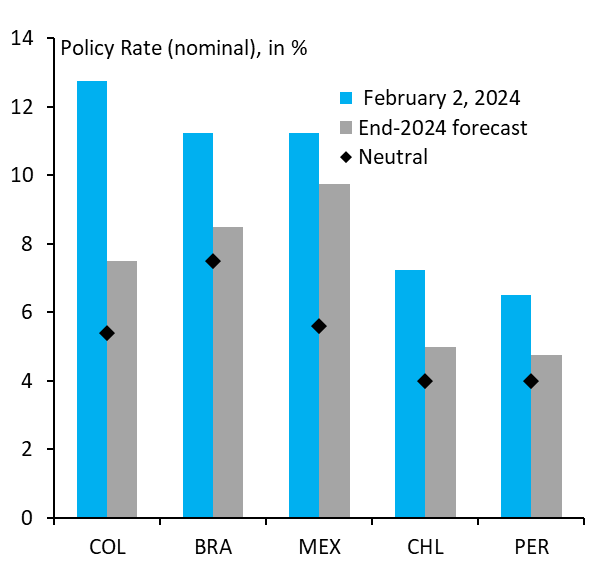

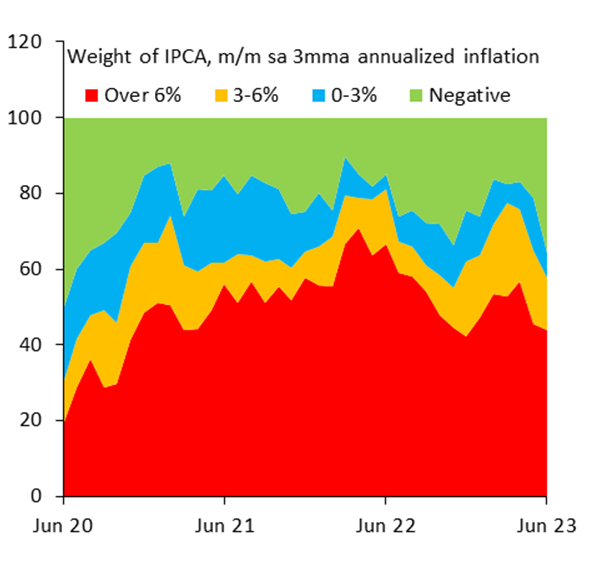

Brazil’s central bank cut the policy rate by 50bps to 12.25%. The slightly more hawkish press release 1) anticipates cuts of the same magnitude in upcoming meetings (until Jan. 2024, at least) and 2) reiterates the need to meet the fiscal targets (relevant given current talks).

4

16

76

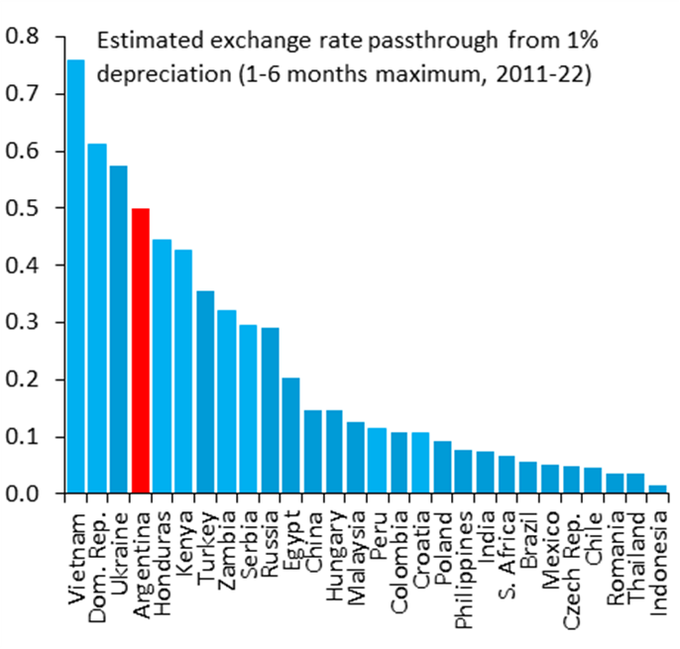

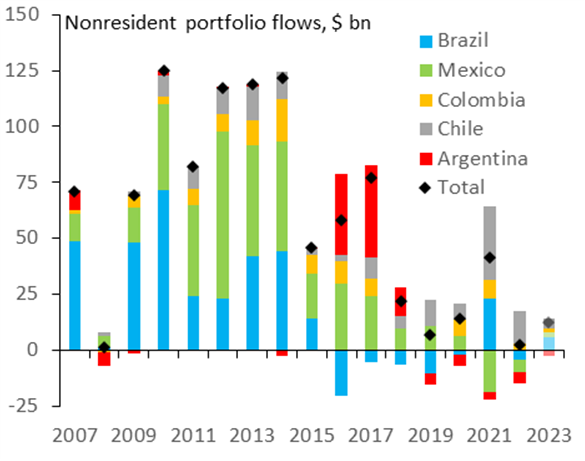

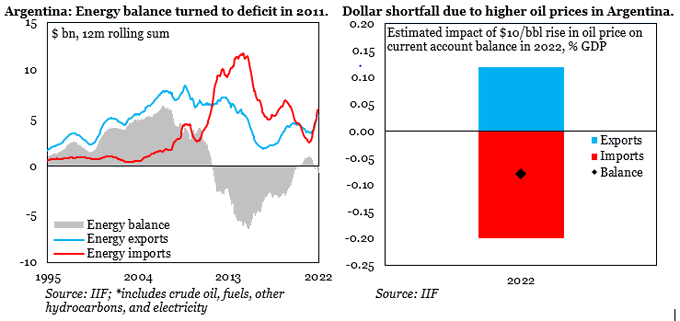

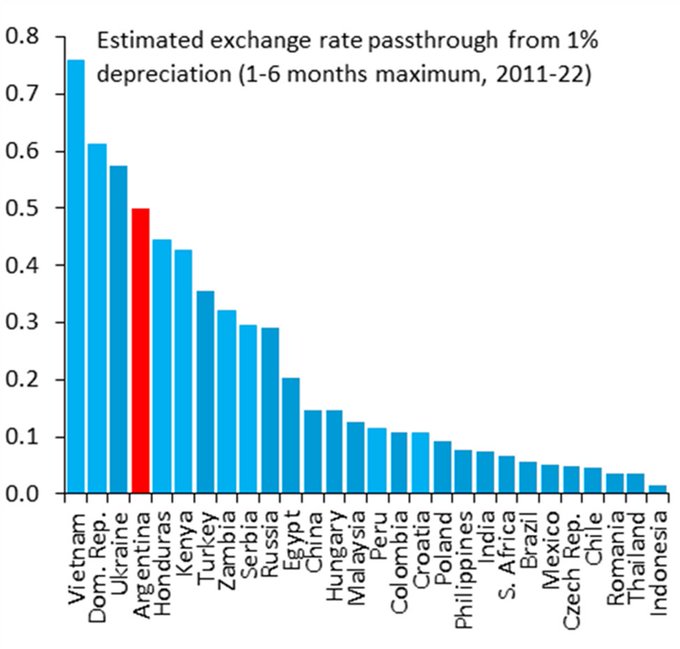

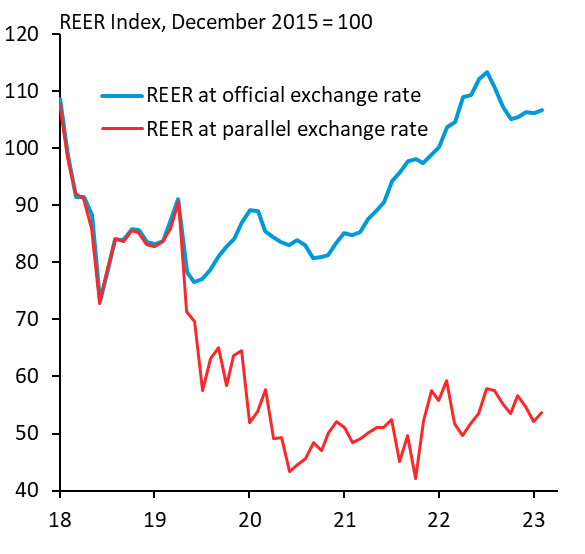

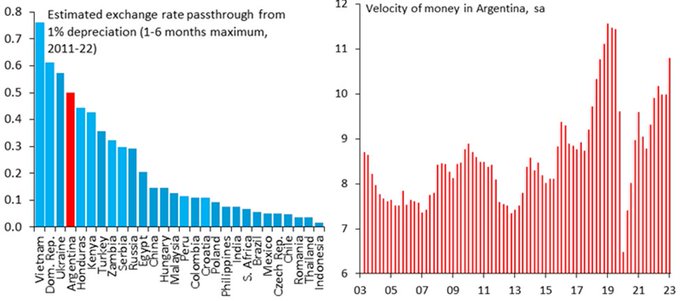

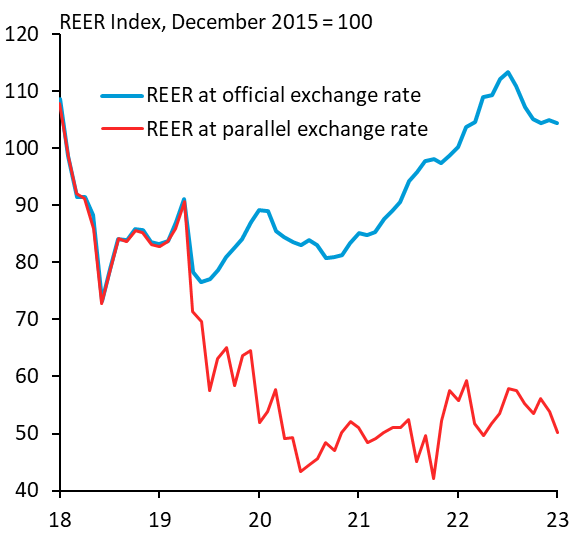

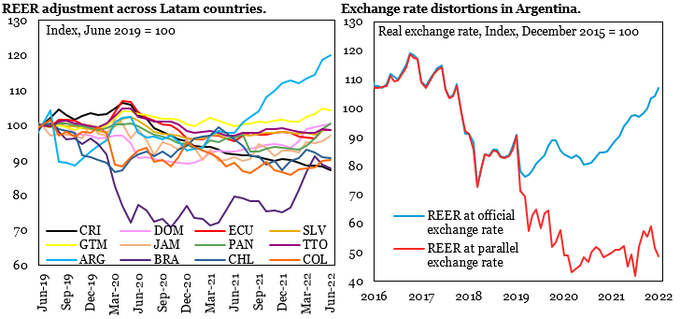

Argentina’s steady real exchange rate appreciation, measured by the official FX, has become such an outlier in the region. The main reasons are high inflation and self-inflicted policy wounds, including foreign exchange controls that only exacerbate distortions and imbalances...

Argentina's parallel exchange rate (white) is now 110% weaker than the official rate (orange). Back in 2018, we worried greatly about potential for contagion from Argentina to the rest of EM. Not anymore. Markets have retrenched and given up. With

@mcastellano44

&

@SergiLanauIIF

13

42

244

3

19

59

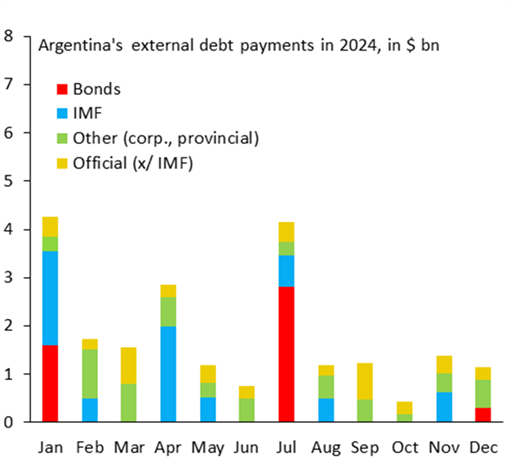

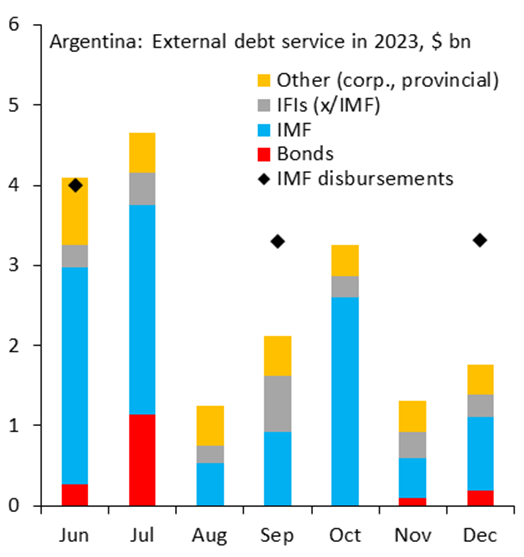

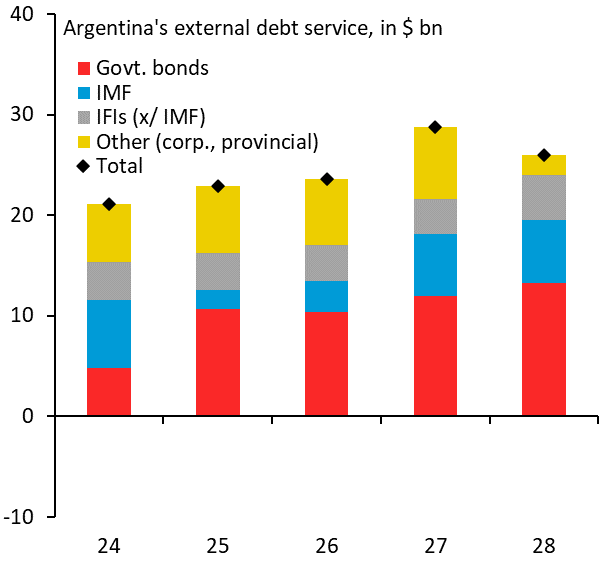

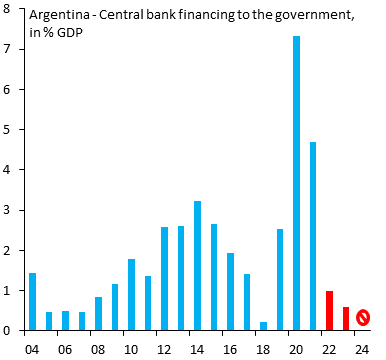

Moderate fiscal consolidation and ambitious rollback of monetary financing in 2022-23 would mean heavy debt issuance in a shallow local financial market, adding pressure on interest rates. Global debt is not an option, and further official funding will be tough to get.

2

11

50

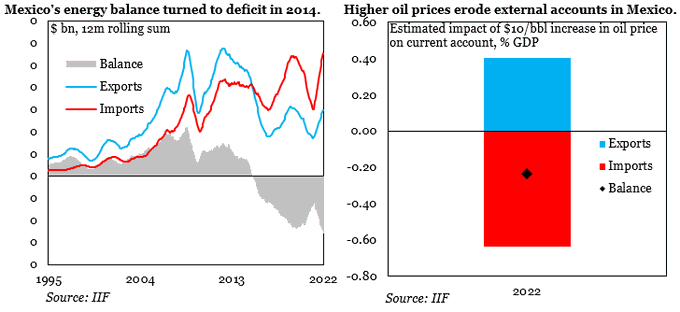

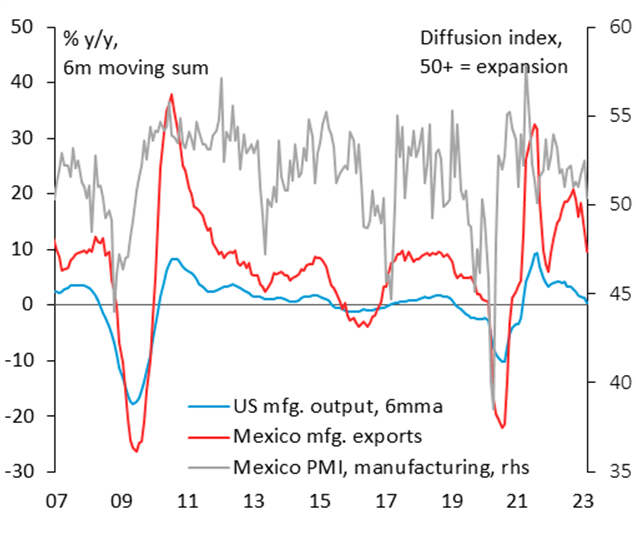

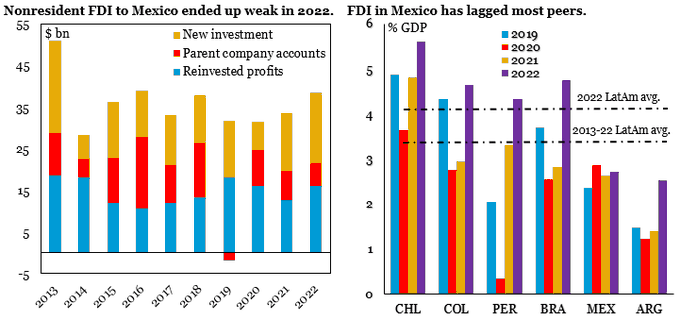

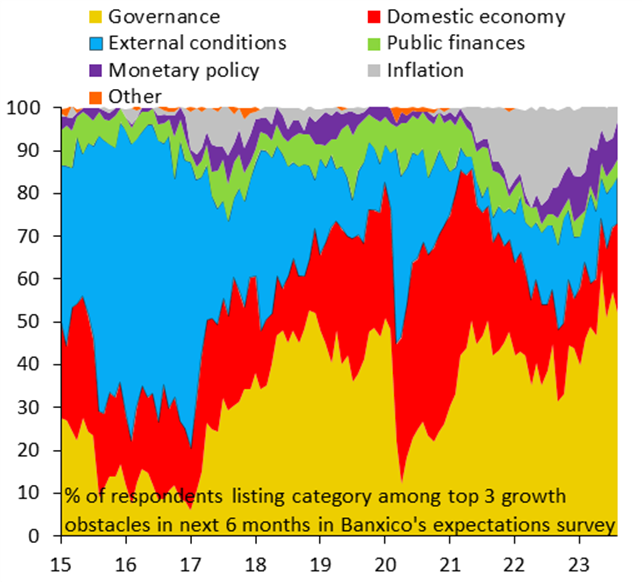

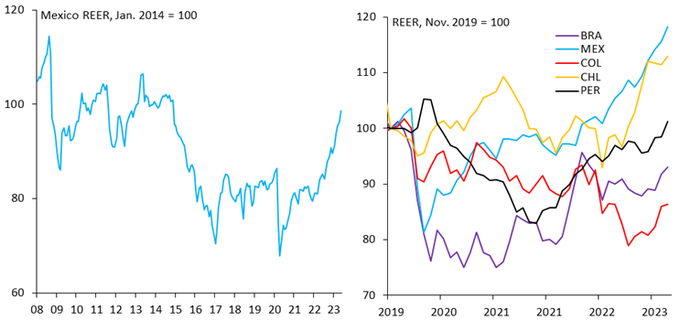

Things to cover in our Mexico investor trip this week

@IIF

:

1) Super MXN, for how long?

2) Is the core inflation decline sustainable?

3) Will activity keep surprising on the upside?

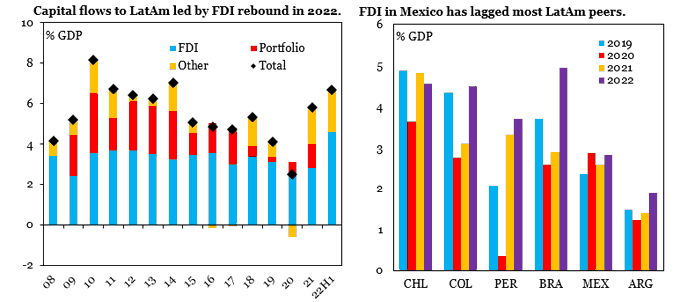

4) Is nearshoring already showing up in the data?

5) What policy changes should we expect in 2024?

4

12

52