Max Pog

@maxpogu

Followers

894

Following

597

Media

66

Statuses

168

Capital Networking Virtual Conf Apr 24-25, 2025: register for free – in bio

Portugal

Joined September 2009

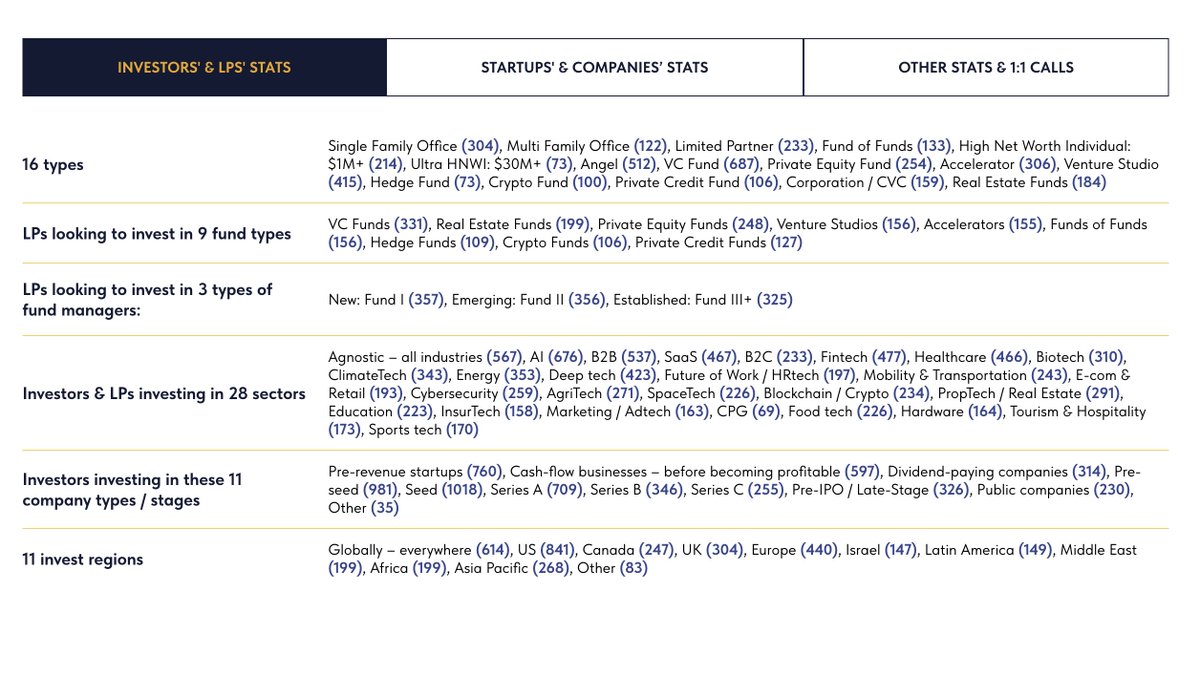

Join for free: a virtual conf with 1000+ LPs, Family Offices, Funds of Funds, & GPs of VC, PE, RE, & Hedge Funds – Nov 26 on Zoom. $100M+ & $1B+ Single FOs, LPs, FoFs & other investment firms have confirmed their participation. Like & reply "+" to get the invite in DM (we're at

81

223

378