MarketLens

@marketlens_app

Followers

582

Following

145

Media

88

Statuses

235

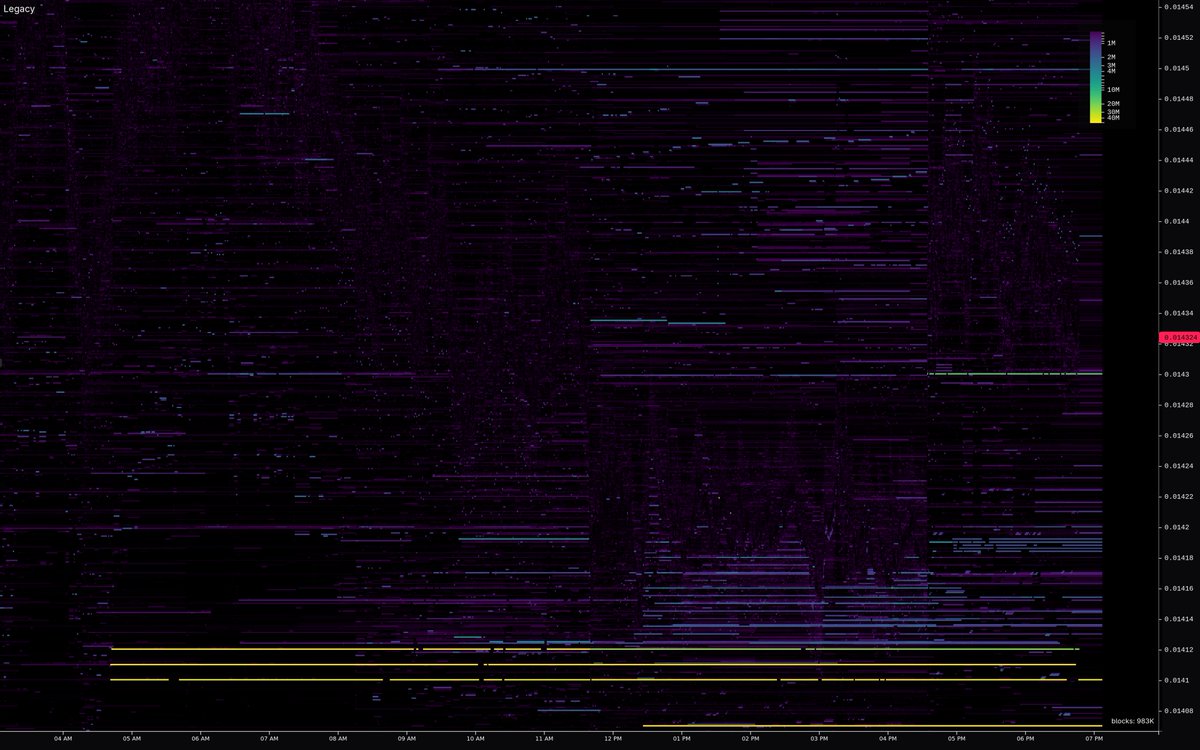

Advanced multi-market visualization. Aggregated order books with real-time executed trades. See clearly what others don't

Joined September 2024

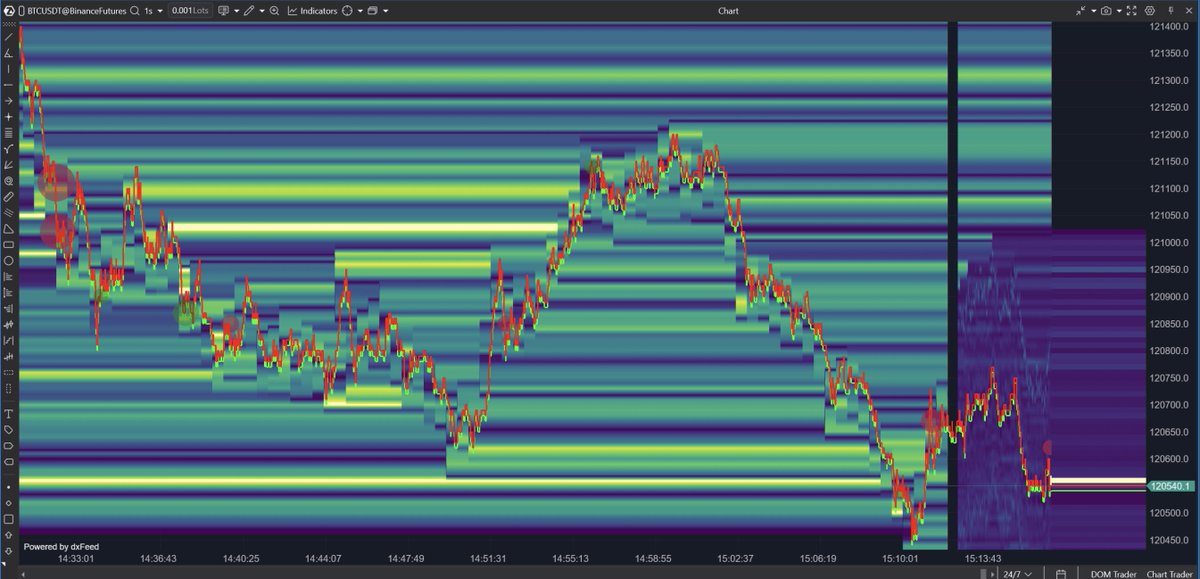

@Trader_XO > Bookmap style volume bubbles.we're curious what you like about them. bubbles are better visually measurable than heat maps, but still they clog the screen so much. Let us propose our analysis of the target analysis / trading platform

2

8

6

@tradinglite @coinglass_com @coinank_com @okotoki @MobChartCrypto @bookmap_pro @SierraChart @WintradingLive @AtasTrading - Windows app, less features than SierraChart, but feels modern as much as win app can be, crypto-friendly. Heatmap: provides on fly zooming in without a need to change timeframes, similiar to Bookmap, and has vertical smoothing as well. DOM trading is also there!

0

0

3

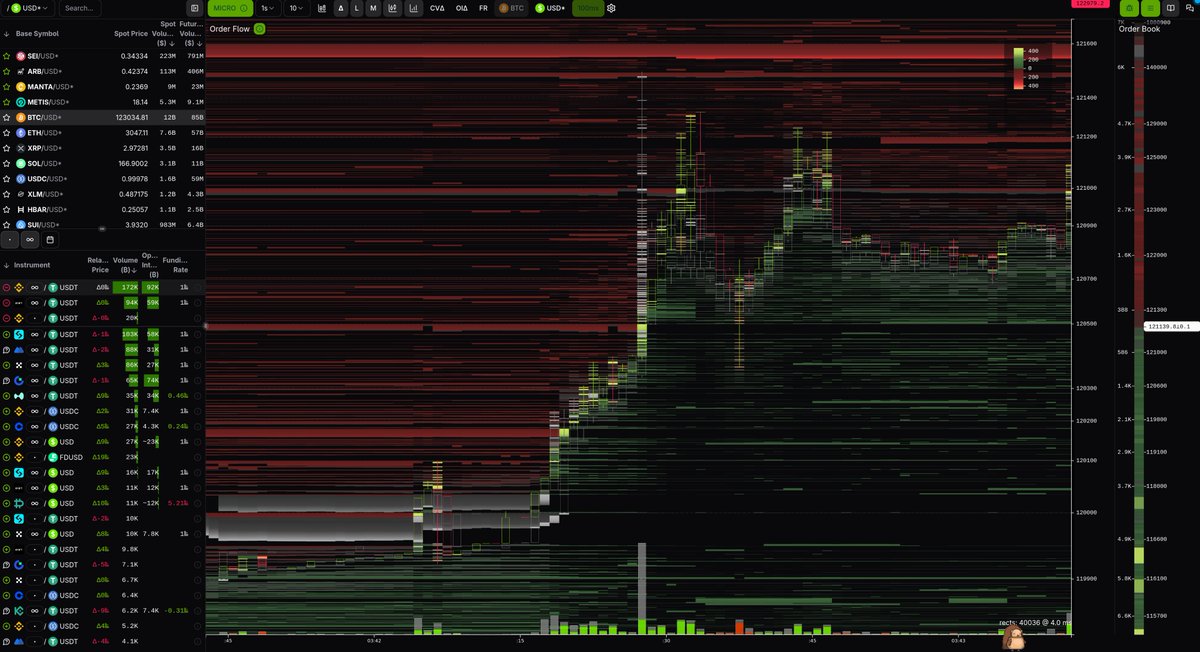

Asks are getting added a bit, but now it's just 2.6k to 130k and 4.5k to 150k (it was ~ 6k before). We wouldn't recommend shorting other than some quick reversal scalps, only if you know what you're doing and have suitable tools (e.g. a scalping terminal like @tigercom )

0

0

0

For comparison, Binance calculates premium index component for funding rates as time-to-funding weighted average value: Average Premium Index (P) = (1*Premium_Index_1 + 2*Premium_Index_2 + 3*Premium_Index_3 +···+ n*Premium_Index_n) / (1+2+3+···+n). @chameleon_jeff why HL uses.

0

0

0

Ok. Some useful content on this (already noticed by others).1/Hyperliquid PUMP don't rely on an external spot price index at this moment They call it Hyperps. "the funding rate is determined relative to a moving average of the hyperp mark price".

@Lord_Ashdrake right? @marketlens_app might be able to run some good analysis on pump-perp with all that data :p.

1

0

3