Alberto Gallo

@macrocredit

Followers

23,955

Following

1,470

Media

1,966

Statuses

6,635

CIO, Andromeda Capital Management

London, England

Joined October 2013

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Bills

• 142117 Tweets

#WWERaw

• 109587 Tweets

Bengals

• 98344 Tweets

Washington

• 92360 Tweets

Commanders

• 82385 Tweets

sabrina

• 75035 Tweets

Jayden Daniels

• 69124 Tweets

連休明け

• 59408 Tweets

Terry

• 50333 Tweets

John Deere

• 49599 Tweets

Josh Allen

• 44656 Tweets

Jaguars

• 39121 Tweets

津波注意報

• 36779 Tweets

Jey Uso

• 35877 Tweets

呂布カルマ

• 32003 Tweets

うまい棒

• 28429 Tweets

ブロック機能

• 25746 Tweets

Jags

• 24528 Tweets

Dera Sacha Sauda

• 24057 Tweets

Trevor Lawrence

• 20769 Tweets

Bron

• 16727 Tweets

VOTA X KARIME

• 15987 Tweets

Joe Burrow

• 15043 Tweets

#RaiseHail

• 14864 Tweets

ラッパー

• 13685 Tweets

lorde

• 13100 Tweets

ブロック改悪

• 11694 Tweets

Last Seen Profiles

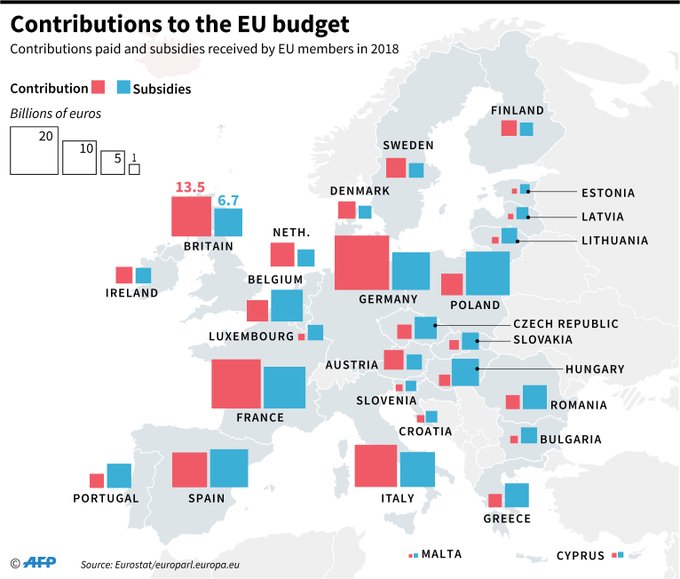

The UK is now de facto a periphery country: a government on the brink of collapse, constant sunshine and a good football team

#Brexit

24

155

381

Which countries have been net contributors vs receivers of EU funds?

Surprising for some, 🇮🇹 has been a net giver, while the balance for 🇪🇦 has been flat.

Grants under the

#EUco

#recoveryfund

are far from a gift - but can be seen as a few years of contributions given back.

21

143

307

#GreekCrisis

negotiations now a pure power play between German block, IMF/US & France/Italy

A country is being used as pawn in a chess game

31

451

209

The Netherlands, leader of the frugal four, ranks 4th globally as a tax avoidance centre, with EU countries losing over $10bn in taxes.

Today's

@FT

editorial points out - too kindly - PM Rutte's fragile attempt to take the high moral ground:

3

96

190

That moment when you realise

#Brexit

was only a way to shift power from the top-left to the bottom-right

10

216

178

"Married or divorced, but not something in between. We are not on Facebook with 'it's complicated' as a status."

Luxembourg PM on

#Brexit

6

173

172

"What's the limit?"

Many have asked this question, in relation to central bank balance sheets, as the ECB and Fed asset purchase programmes reach new highs.

Monopoly's Rule

#11

provides a useful, intuitive answer:

#QEinfinity

7

61

159

Fed: neutral stance

ECB: discussing new TLTRO

PBOC: new stimulus

Bye bye Quantitative Tightening

Welcome back to

#QEinfinity

15

86

159

GBP -14.5%

Inflation +2.4pp

Real wages growth rate -2.7pp

Investment -0.9% (Q4 '16)

Happy

#BrexitAnniversary

14

191

156

Theresa May

Knew about the

#MuslimBan

Knew about the

#Tridentmisfire

But kept quiet

Now she keeps quiet about the cost of Brexit

#ResignMay

4

103

128

#Brexit

box update

£/$ <1.3

FTSE250 -10%

4 funds suspended

0.5% bank capital spent

AAA rtg gone

Gilt 10y<0.75%

14

149

121

Balancing price stability vs financial stability in a post

#QEinfinity

world is a difficult act.

“There is no trade off between price stability and financial stability", said ECB President

@Lagarde

in March.

That is true, until something breaks.

1

6

117

Tax dumping/tax havens get defended in the name of economic liberalism. This argument keeps failing.

No-rules capitalism isn't capitalism.

It generates inequality, low productivity and eventually unhappiness. The old model is broken.

The EU exists to level the playing field.

14

17

86

Who's still against Greece? And who supports Greece in Europe

#GreekCrisis

http://t.co/CuAyALC36g

16

241

86

GRIN: Greece stays in €

GREXIT: Greece exits €

GRINCH: Greece in €, Schaeuble steals Christmas

(RT

@charlesforelle

)

11

99

86

10-year inflation expectations are higher following today's weak jobs report:

Covid/delta hits specific economic sectors (leisure and hospitality), the Fed reacts with a delay on tapering and lower for longer, and the result is more inflation down the line.

#QEinfinity

5

22

81

Since

#Brexit

£ at 31yr low

AAA rtg lost

Property buyers ask ~10% discnt

0.5% bank capital spent

FTSE250 -9.4%

Still tired of experts?

20

93

84

#Greece

reminds us again of democracy & human rights while countries in far better situation (US/UK) go adrift.

5

66

83

The 5-year German

#Grexit

"solution" requesting €50bn of Greek "valuable assets"

one word: enough

#Schaeublexit

http://t.co/pXYQCTG6zD

10

153

80

You now need €10 million to make an annual pension income of €60,000 pre tax and pre inflation, if you hold 30-year bunds

#QEinfinity

#FinancialRepression

13

31

81

For many years,

#Turkey

's government forced public & private banks to push credit to the economy, and sell Dollars to support the Lira.

Result: negative net FX reserves and a double-digit % GDP contingent liability on the sovereign.

Today, the first cracks are starting to show.

6

27

81

#Turkey

: Lira weakness comes back as policymaker continue to play with overnight markets without addressing fundamental problems: excess private leverage, fiscal deficit, unsustainable infrastructure investment, rising inflation vis a vis too low interest rates.

6

58

80

Surprise: even after 500bp hikes, interest rates are not restrictive yet, recent

@kansasCityFed

research says.

Why?

Inverted yield curves and insufficient quantitative tightening are part of the problem, as discussed in our latest

#SilverBullet

.

4

21

79

The

@economist

is usually top quality.

On Italy's reform, their analysis is superficial, as its readers point out.

23

41

71

After ten long years of stagnation,

#Italy

is growing.

Now, the country needs five key reforms to make it count.

- Justice system

- Education

- Bank consolidation

- SME financing

- Welfare and social mobility

On today's

@Corriere

@L_Economia

7

40

77

Things no longer exist:

Dinosaurs

Audio cassettes

Positive risk-free returns

Discussing today

@BloombergTV

with

@flacqua

5

15

75

#Brexit

reality check:

the rich who funded

@vote_leave

get corp tax cuts

the poor who voted leave get inflation, no EU funds and 'freedom'

12

96

73

The “thing that’s not priced in” is that both inflation and interest rates will be much higher, for much longer, than the markets are willing to price.

via

@totemmacro

@FT

6

23

76

What should investors do in a market where there's nothing left to buy?

Central bankers have skewed the odds against investors. Our job is to rebalance them in their favour: in our latest

#SilverBullet

we explain how we can find value in a

#QEinfinity

market.

7

16

73