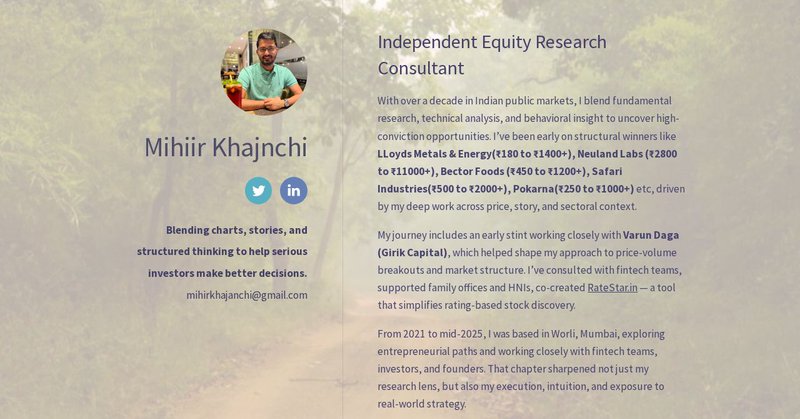

Mihiir Khajnchi

@m1hirk

Followers

3K

Following

3K

Media

283

Statuses

5K

I study markets. And sometimes, they study me back. Wildlife & stock charts - both unpredictable. DMs open for market conversations & research collabs

Joined January 2010

Put up a quiet little site: Not a blog. Not a pitch. Just a glimpse into what I do, how I think, and what I’m open to. If you’re in the markets, or building around them - have a look. Felt right to share on Guru Poornima.

mihir.xyz

Independent consultant with 10+ years in Indian equity markets. Combining business analysis, technicals, and behavioral insight to help funds, fintechs, and HNIs make conviction-led decisions.

3

2

16

Comes up with poor results on top of it… clearly not a great risk - riward bet amidst Tariff uncertainty… people forget the cyclical nature of the business in good times… #Pokarna.

A niche Quartz business I used to admire is going through a management shuffle. Usually, that sparks curiosity… but this one feels like switching jockeys on a very stubborn horse. Still, wishing its investors the very best ahead.

0

0

2

RT @SandeepMall: Every wonderful life we see online has experienced lot of blood, sweat and tears. It’s just that they keep pain private. O….

0

6

0