Sahill Poddar

@llihas

Followers

1K

Following

8K

Media

18

Statuses

1K

Co-founder & CEO @ParafinHQ

San Francisco, CA

Joined August 2014

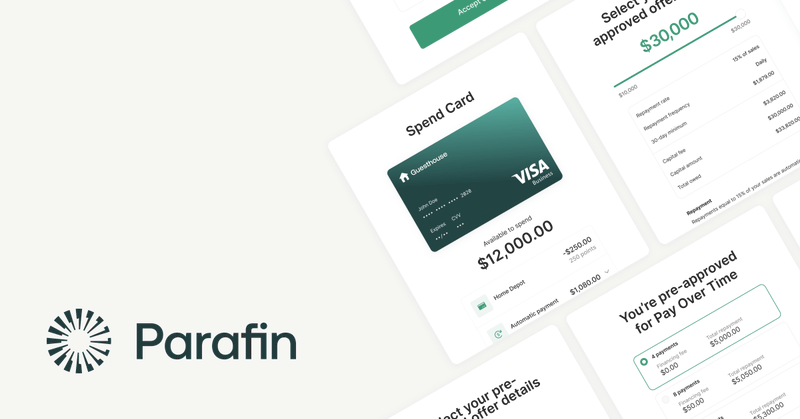

Very exciting times at @ParafinHQ as 1. we’ve surpassed a $100M revenue run rate 2. are live on 80+ platforms 3. have achieved this with a lean team of ~100 people We could not be more excited for what lies ahead of us as we scale multiple products. Come and join us in our

parafin.com

Help shape the future of embedded finance. Parafin offers competitive pay, benefits, and a mission-driven culture.

15

5

99

👀

IN NEWS: @GustoHQ unveils new cash flow tools at its live Showcase in San Francisco to help small businesses make payroll on time. “When I speak with small businesses, the hardest moments are when they cannot make payroll. It is not that they do not make enough money. It is all

1

0

5

It is @vladtenev vs Jamie Dimon and is crystal clear who is winning. One is relentlessly shipping product and other is shipping nonsensical fees.

$HOOD has NEVER traded at a higher market cap than $COIN ...until the last week I've long said that is easier for Robinhood to become Coinbase than viceversa and this may be the flippening as Robinhood goes tokenization and Coinbase goes stocks @vladtenev vs @brian_armstrong

2

0

15

There are two ways a small business can find itself -- via sales which payment processors solve for and via debt for which there is @ParafinHQ

I asked @llihas why most traditional banks don’t lend money to small businesses: “The biggest problem in small business credit in the US is it’s mostly consumer products masquerading as small business products. Banks and credit cards rely on personal credit scores and require

1

0

10

Great work, Mayor Lurie! Simplifying permits is a much needed change for SF based small businesses. With downtown driving 40% of city tax revenue, this hopefully sparks a recovery

Today, I signed an additional package of PermitSF into law. To allow our neighborhoods and downtown to thrive, the City needs to get out of the way of business owners by making the permitting process simple and transparent. Here is what this package does: ➡️ Eliminates the need

0

0

1

San Francisco staple @FiorellaItalian continues to scale their business by opening their Noe Valley location funded by @DoorDash capital powered by @ParafinHQ ♥️ 🇮🇹🍕 https://t.co/rXdVhshpxz

merchants.doordash.com

Learn how this San Francisco neighborhood staple used DoorDash Capital to expand their business, even in the city's unpredictable restaurant market.

0

2

5

Fun conversation with @shivassangwan from Physics to Fintech.

What if your fav barbershop or local restaurant was funded by your food delivery app? Not by it. But through it. Sahill Poddar built Parafin to give small businesses the credit banks wouldn't—using DoorDash, Amazon, etc. as the new underwriting system. @llihas

0

0

5

Team @cern back to 🧑🍳 with an unexpected observable at the LHC!

While searching for additional Higgs bosons, the @CMSExperiment may have instead uncovered evidence for the smallest composite particle yet observed in nature – a “quasi-bound” hadron commonly called toponium. https://t.co/7UqKxiWa17

0

0

2

Klarna succeeded where several others failed, making the European consumer use credit for e-commerce purchases.

A lot of uninformed dunking in my feed from the $DASH and $KLAR deal due to a lack of understanding of how BNPL/Pay-in-4 benchmarks against credit cards. For the consumer segments that do not get credit card rewards, Pay-in-4 is a superior product since there is no compounding

0

0

2

A lot of uninformed dunking in my feed from the $DASH and $KLAR deal due to a lack of understanding of how BNPL/Pay-in-4 benchmarks against credit cards. For the consumer segments that do not get credit card rewards, Pay-in-4 is a superior product since there is no compounding

0

0

7

The wild adjustment isn’t as bad: 1.The interest payment has a limited shelf life. 2. Omission of non-cash SBC is standard in adjusted EBITDA reporting across the board, not unique to X.

X raising $2B at $44B; includes 25% of xAI Launching X Money, digital wallet and p2p payments app later this year $1.2bn in adjusted EBITDA but it's wildly adjusted. Not surprising since when you buy a Tesla the price they show you subtracts "gas savings" 😂

0

0

2

Apple delaying AI? Not a big deal. •Their core biz (iPhone) is untouched. •They’ll tax whichever app wins. •True AI integration needs iPhone/iOS control. •Likely waiting for broader Neural Engine adoption. Apple plays the endgame, not the speed game.

Nailed it https://t.co/bmnMvFNOqG

1

0

6