Kim

@kimtalkscrypto

Followers

2K

Following

7K

Media

412

Statuses

4K

I simplify macro analysis so you can trade the crypto markets ✦ learn for free: https://t.co/xzSMTSKOTm ✦ @ZCTraders

Joined August 2022

Trump just reshaped the world economy. There's a lot of noise. Not a lot of clarity. Here’s a high-signal breakdown of:. – What tariffs actually are.– Who benefits and who bleeds.– How this plays out for crypto and markets. Let’s get into it.👇.

8

16

100

RT @KoroushAK: Altseason Money Flow:. ETH> Major Caps > Mid and Micro Caps> Crash. This is outdated. The money flow cycle has completely c….

0

535

0

Bitcoin has been notably less volatile than usual. A sign that institutional flows are starting to dominate retail-driven price action. It’s not the same parabolic retail frenzy we saw in 2021. It’s calmer, more sustained, and likely reflects structured accumulation.

The current Bitcoin surge isn’t random. It’s being fueled by President Trump’s secret war against the globalists’ banks. His administration is creating a new financial system. A $250K target price is not bullish enough. I’ve spent over 400 hours in the past two months

0

1

18

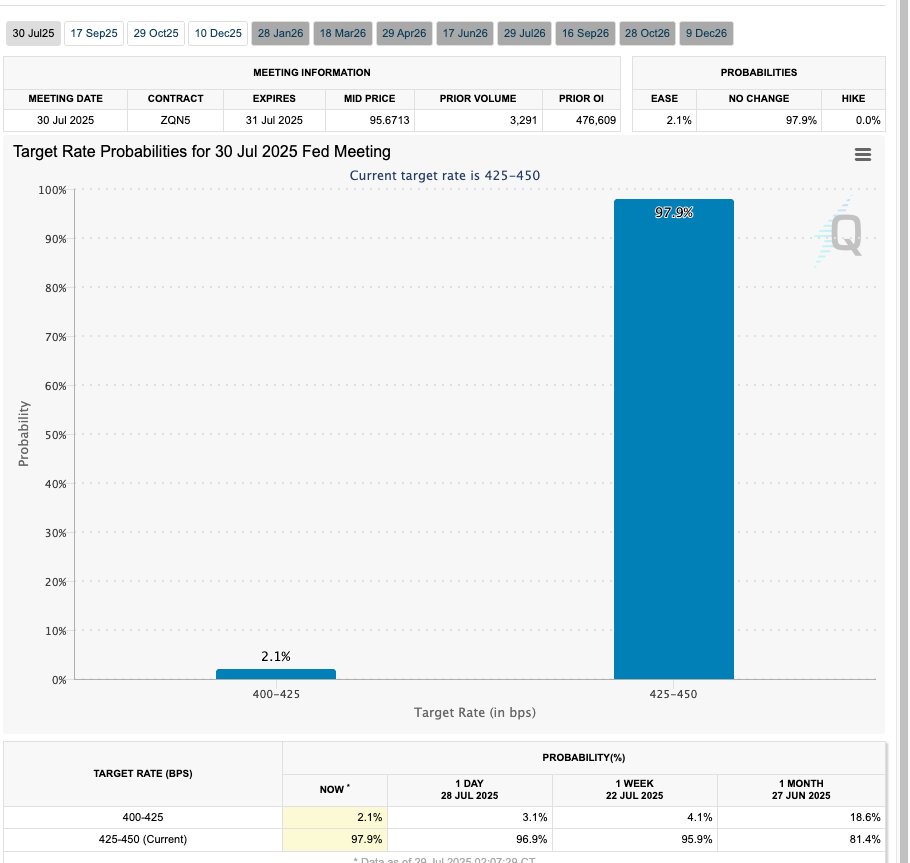

RT @KoroushAK: FOMC today. Unless you know you can trade these high volatility days well, observe and paper trade.

0

3

0

RT @crypto_birb: For an average risk-averse trader, it is best to stay on the sidelines. Here’s why:. 1. Short-term Impact .Don't expect a….

0

7

0