Ki Young Ju

@ki_young_ju

Followers

343,730

Following

1,964

Media

981

Statuses

2,521

Founder & CEO @cryptoquant_com | #Bitcoin On-chain Analysis

Seoul 🇰🇷 / NYC 🗽

Joined May 2011

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Xóchitl

• 504163 Tweets

Maynez

• 180575 Tweets

Wizkid

• 119555 Tweets

Suns

• 106772 Tweets

Real Life

• 93207 Tweets

DDAY SB19 JAPAN CONCERT

• 91225 Tweets

Davido

• 76140 Tweets

Anthony Edwards

• 74306 Tweets

Beal

• 54431 Tweets

#sbhawks

• 32751 Tweets

為替介入

• 31171 Tweets

Twitter調子

• 26464 Tweets

スレイヤー

• 19331 Tweets

Don Jazzy

• 17114 Tweets

#MondayMotivation

• 12581 Tweets

ホークス

• 11896 Tweets

グリフィン

• 11859 Tweets

#リクステ

• 10161 Tweets

Last Seen Profiles

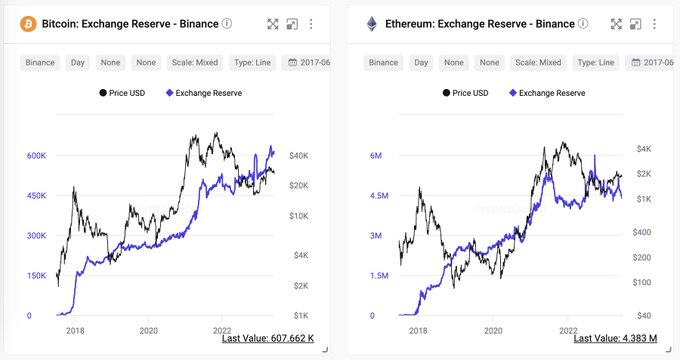

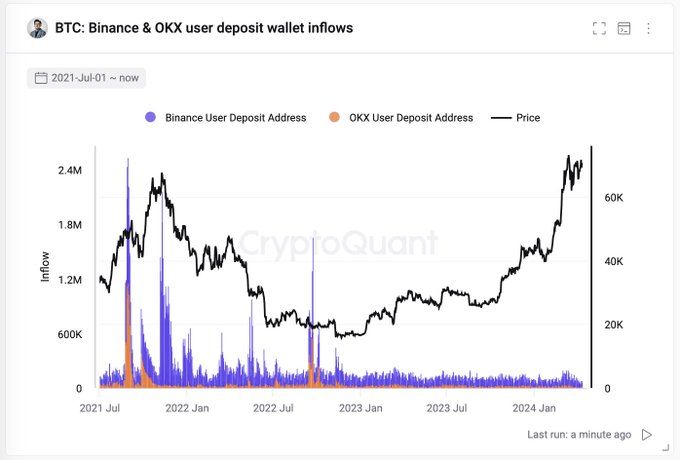

SEC sues

@Binance

, but no major withdrawals from Binance. User balances are increasing actually.

952

2K

10K

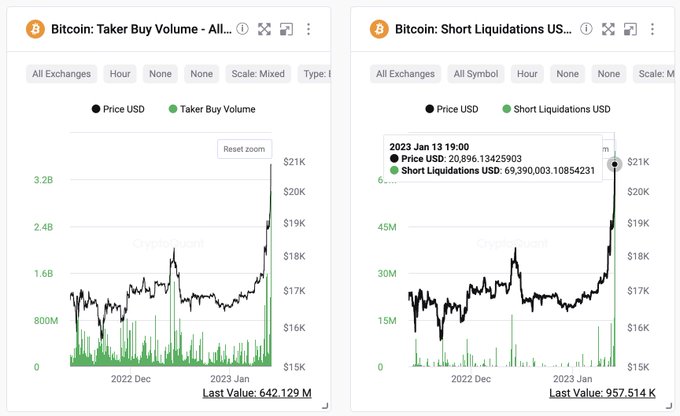

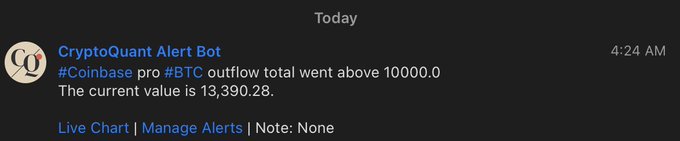

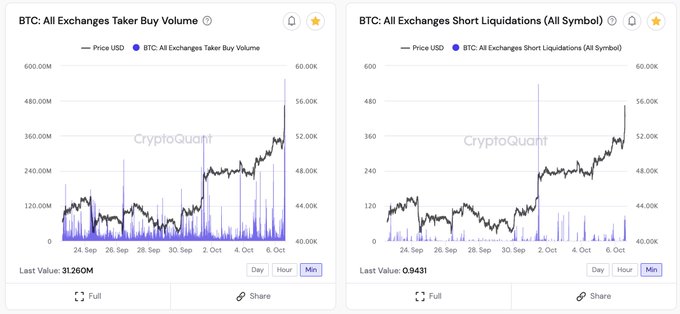

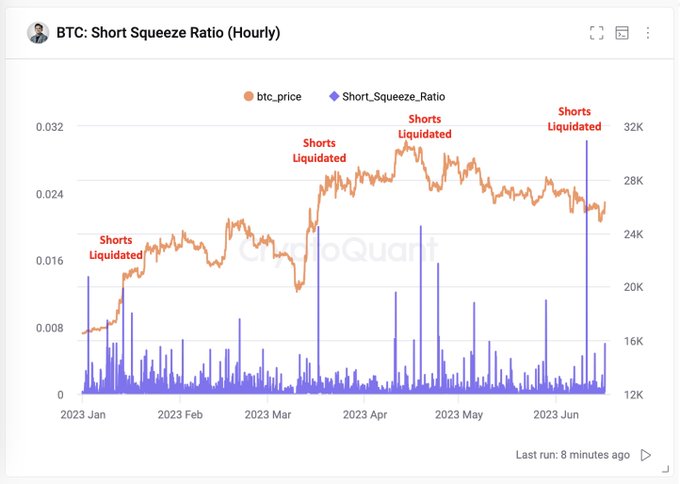

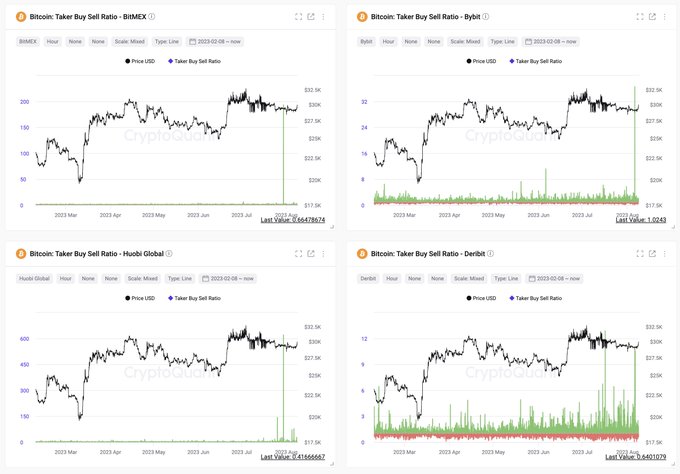

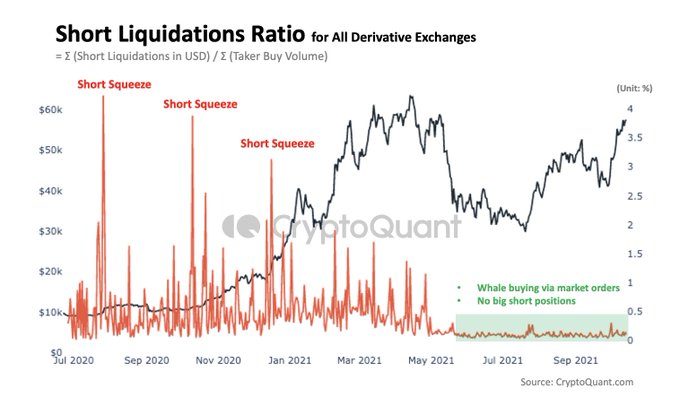

This is not a short squeeze, but someone(s) is just buying $BTC a lot.

I repeat.

This is not a short squeeze, but someone(s) is just buying $BTC a lot.

#Bitcoin

short squeeze hasn't happened.

Most perpetual swap buying volume came from pure $BTC purchases, not forced short liquidations.

More bullets for bulls.

169

202

1K

277

756

4K

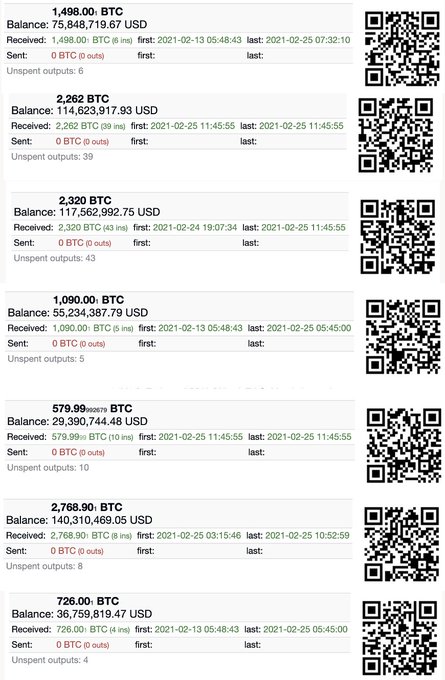

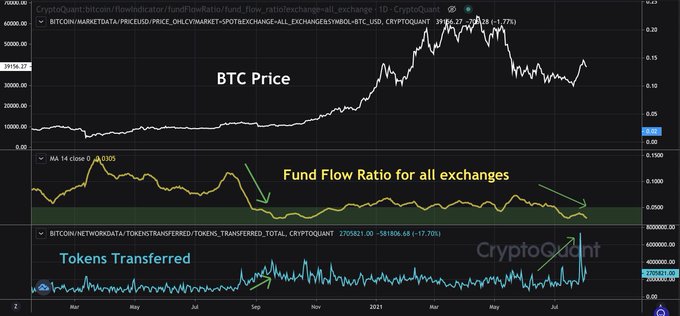

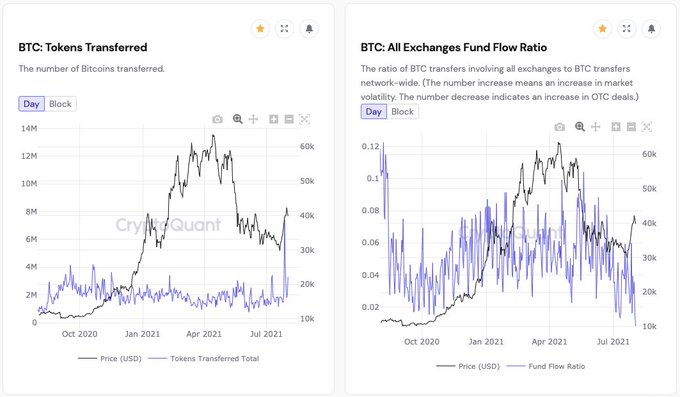

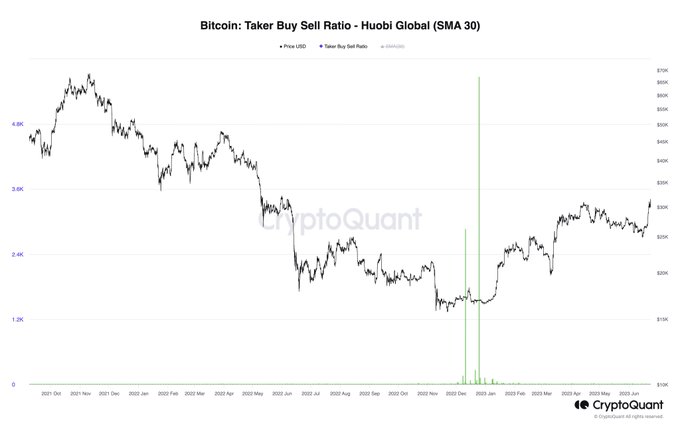

Someone is buying $BTC a lot.

99% of transactions are happening outside of the exchanges. Possibly OTC deals.

If big names announce their buying, bears could be in a trouble. I'm not sure about short-term price moving tho.

169

683

3K

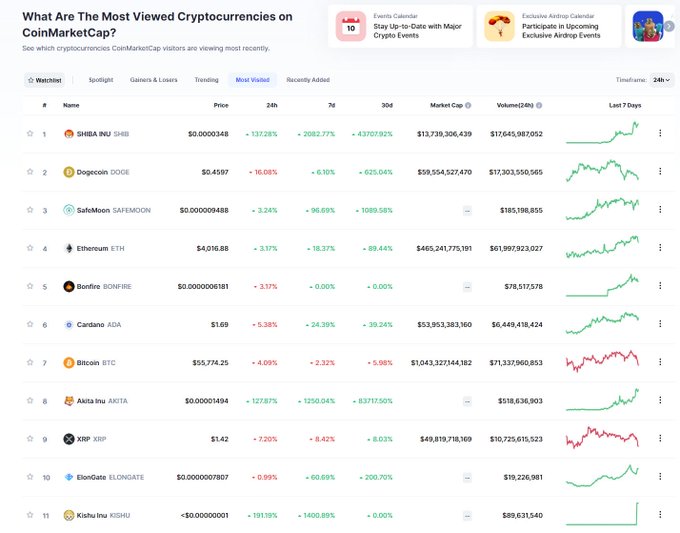

Meme coins harm the crypto industry.

It's frustrating to see billion-dollar-cap memecoins overshadow hardworking teams building legit products to advance this industry.

Easy money can't drive industry-wide progress, as shown by the 2018 ICO burst.

$SLERF, one of the tokens emerging from the Solana meme coin presale mania, chalked up multiple exchange listings, a $1.7 billion trading volume and thousands of unique holders in a few hours after going live – despite a major fumble. By

@shauryamalwa

305

553

2K

544

416

3K

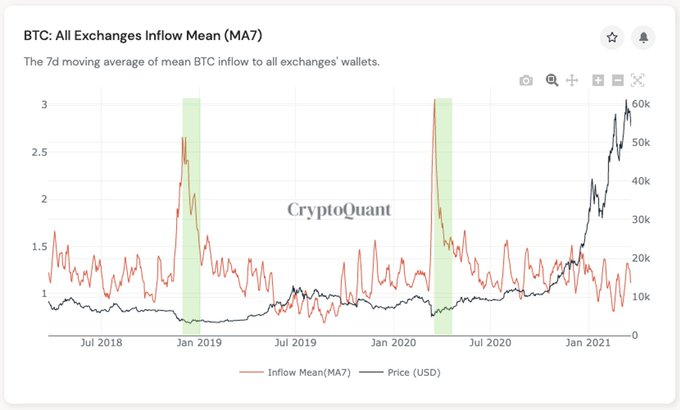

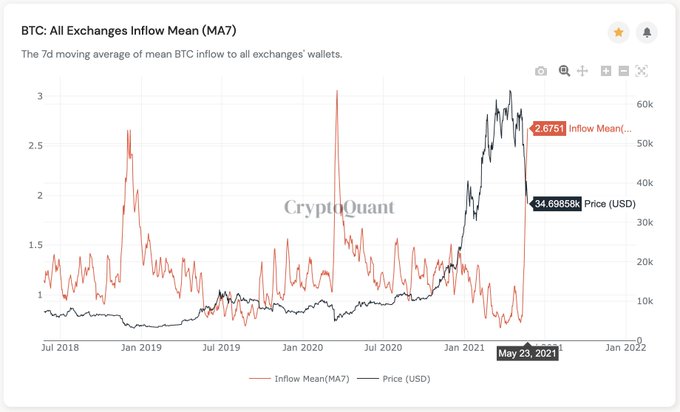

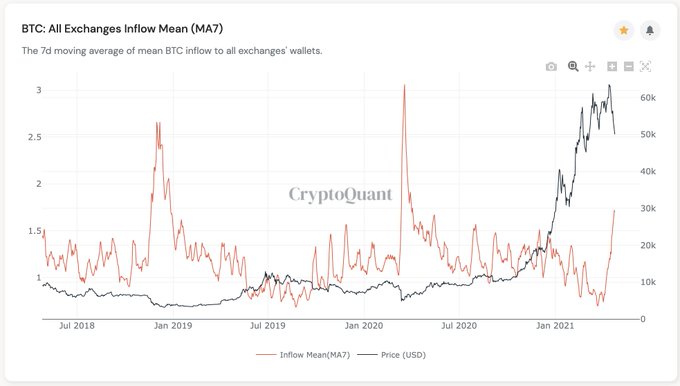

How to buy $BTC at the global bottoms:

1. $BTC drops hard over -30%

2. All Exchange Inflow Mean (MA7) spikes over 2.5 BTC

3. The indicator cools down

4. ALL-IN $BTC

5. Become a billionaire and give a tip to

@cryptoquant_com

Chart 👉

110

583

3K

The $BTC bottom is near.

How to buy $BTC at the global bottoms:

1. $BTC drops hard over -30%

2. All Exchange Inflow Mean (MA7) spikes over 2.5 BTC

3. The indicator cools down

4. ALL-IN $BTC

5. Become a billionaire and give a tip to

@cryptoquant_com

Chart 👉

110

583

3K

103

418

2K

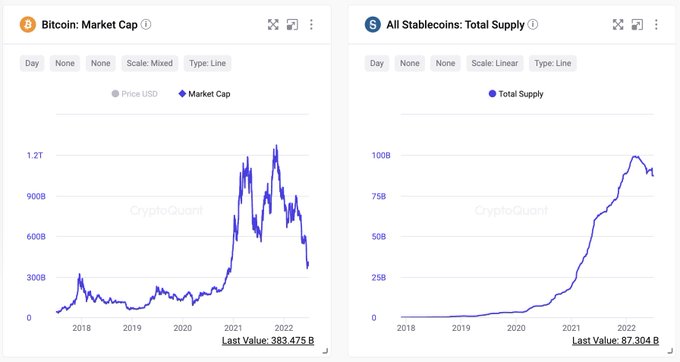

Everyone is talking about bearish things, but most of them haven't left the crypto market. They're just waiting for the bottom.

#Bitcoin

marketcap decreased by -70% from the top while stablecoin went down by just -11%.

231

404

2K

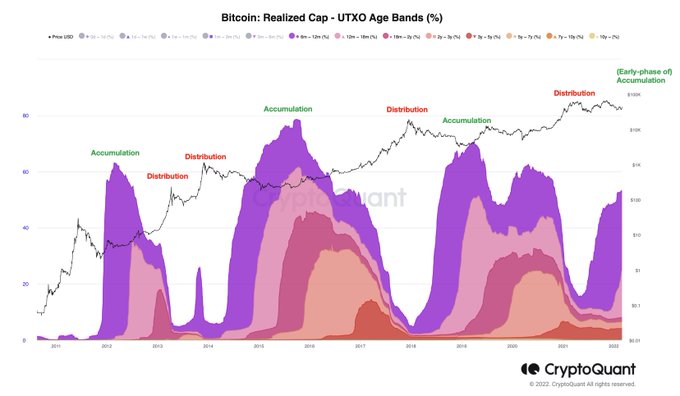

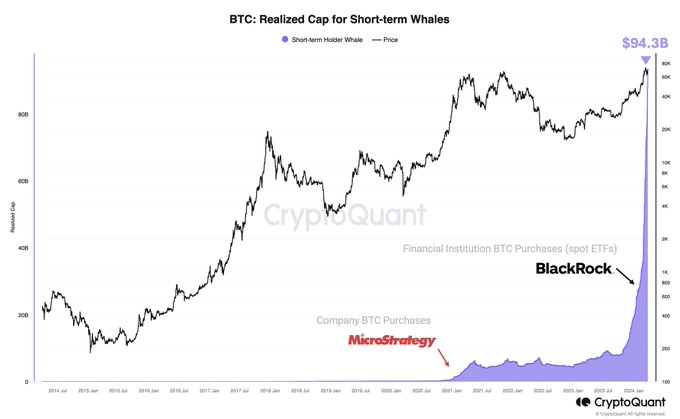

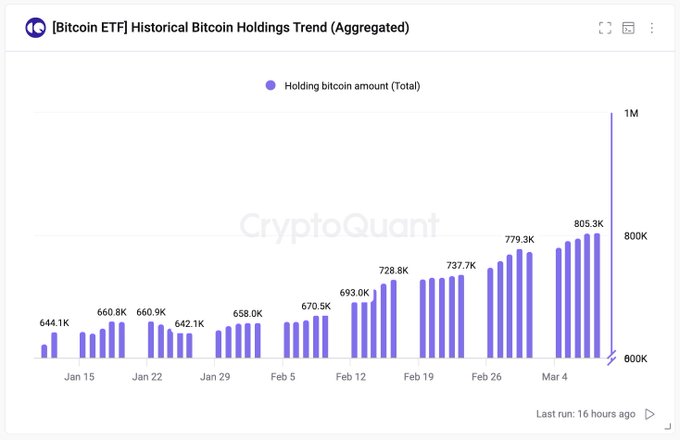

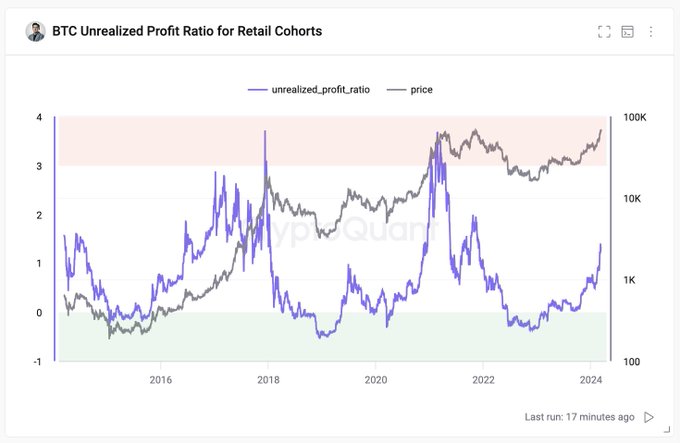

This cycle is different.

Institutional funds of $86B entered the

#Bitcoin

market in the past 6 months.

93

446

2K

🟨 Gold market cap

Before ETF in 2004: $1 Trillion

After ETF in 2021: $11 Trillion

If $10T demand came from an inflation hedge, not industrial use, this year is going to be interesting for

#Bitcoin

.

🪙 BTC market cap

Before ETF in 2021: $1 Trillion

85

532

2K

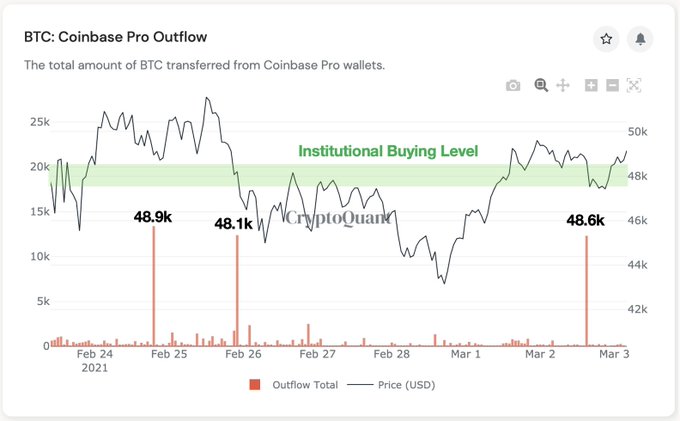

Another institutional buying at 48.6k

80

304

2K

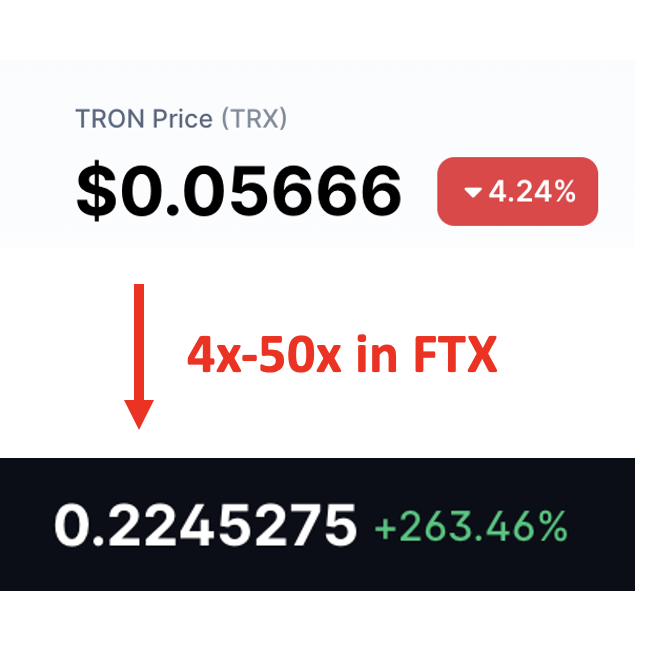

Isn't it illegal?

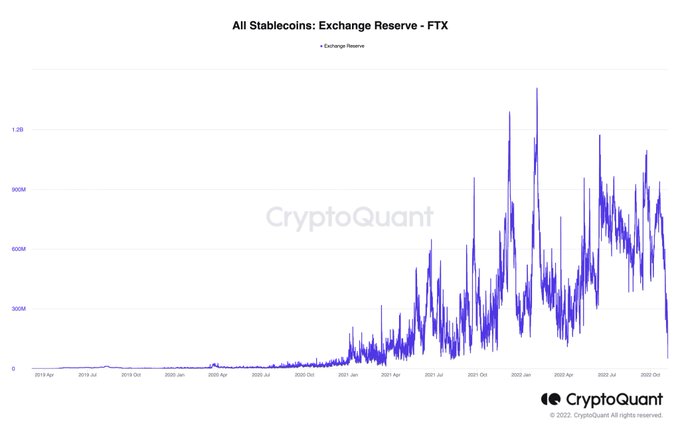

1/ FTX allows withdrawals only for TRX & TRC20.

2/ Users exchange assets to TRX to request withdrawals.

3/ TRX price goes up like 50x in FTX.

4/ Justin deposits TRX into FTX and sells them.

5/ FTX users sell TRX in other exchanges with a significant loss.

214

465

2K

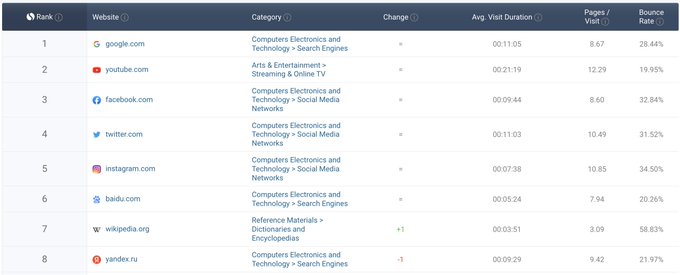

@elonmusk

Twitter just beat Instagram and took over 4th rank in global traffic.

The next target is Facebook.

149

298

2K

@cz_binance

@binance

Been tracking Binance's wallets for four years.

They have already been 99% transparent with a couple of cold/hot wallets, while other exchanges mix up clients' assets with third-party wallets like MMs.

Now they got 100% transparency. This is what the industry leader does.

0

127

2K

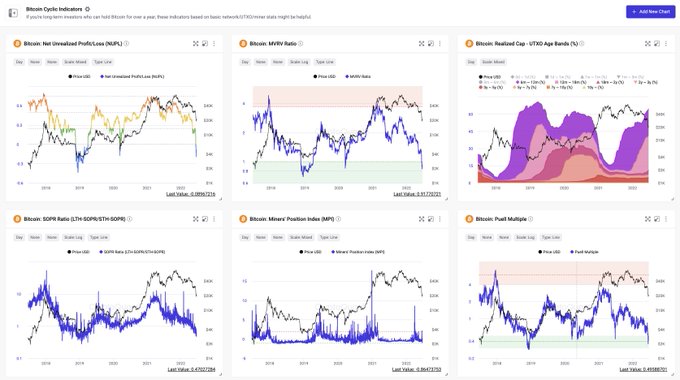

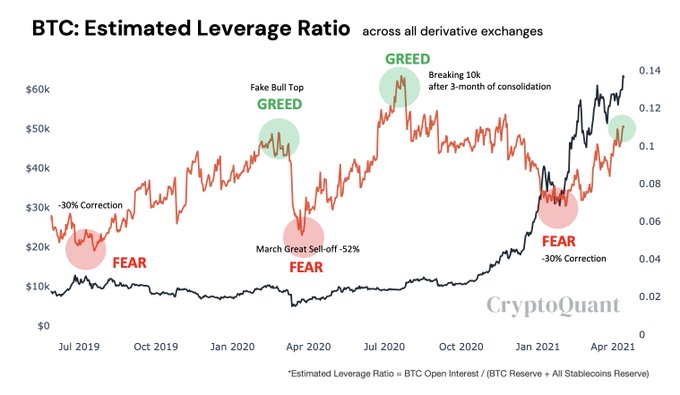

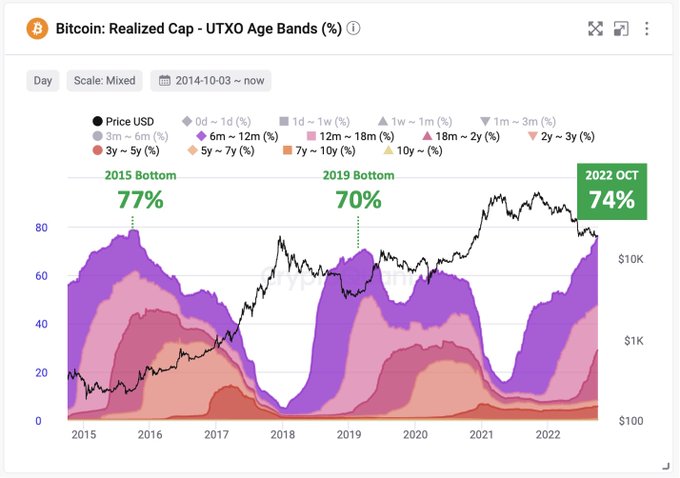

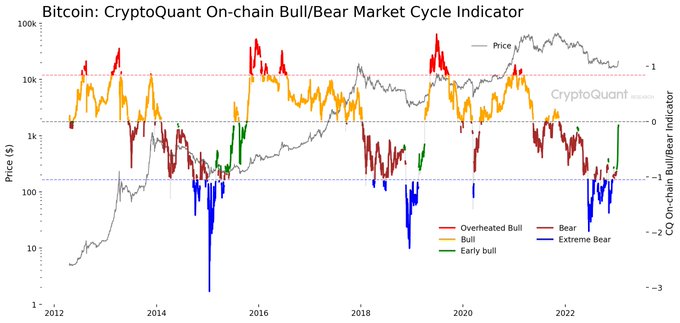

Most

#Bitcoin

cyclic indicators are saying the bottom.

Not sure how long it would take for consolidation in this range tho. Opening a big short position here sounds not a good idea unless you think that $BTC is going to zero.

Live Dashboard 👇

339

418

2K

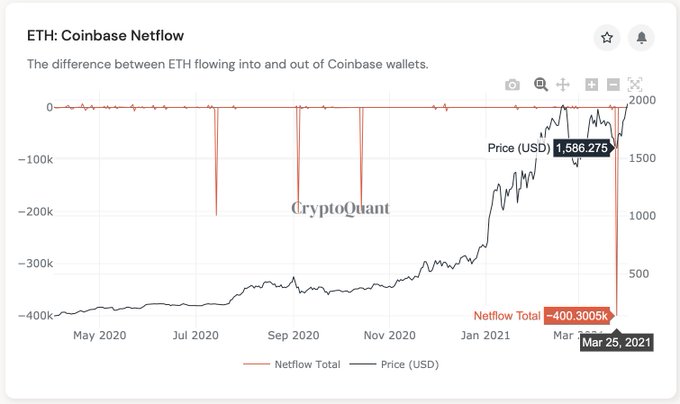

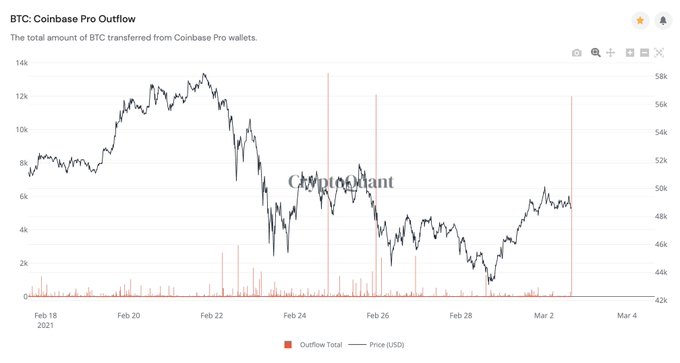

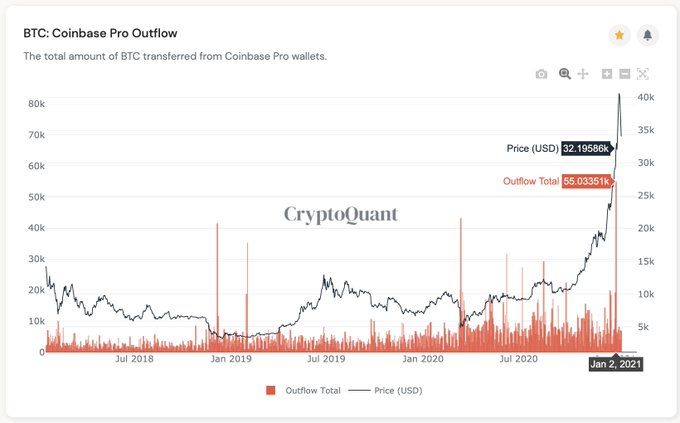

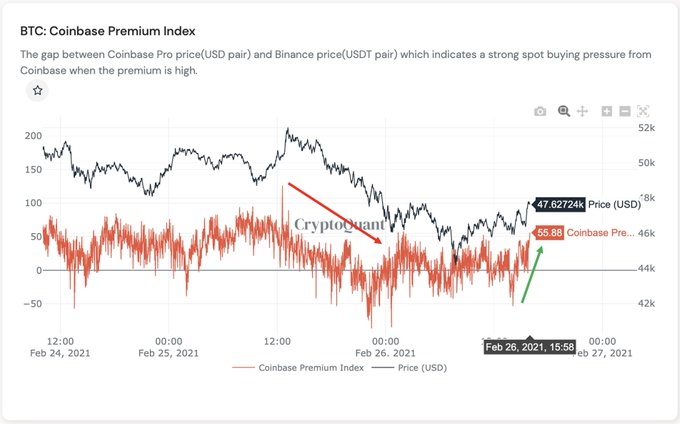

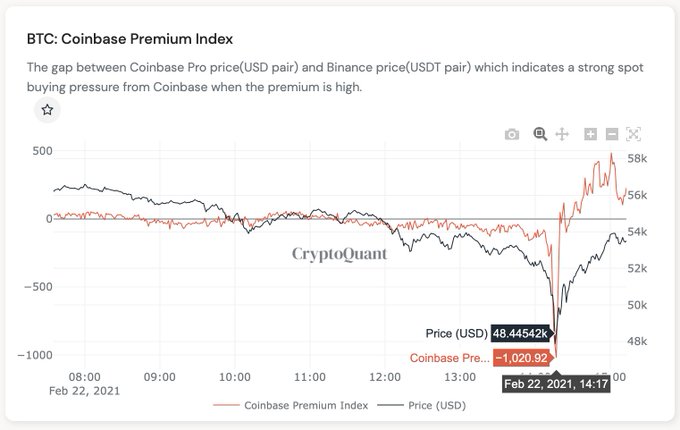

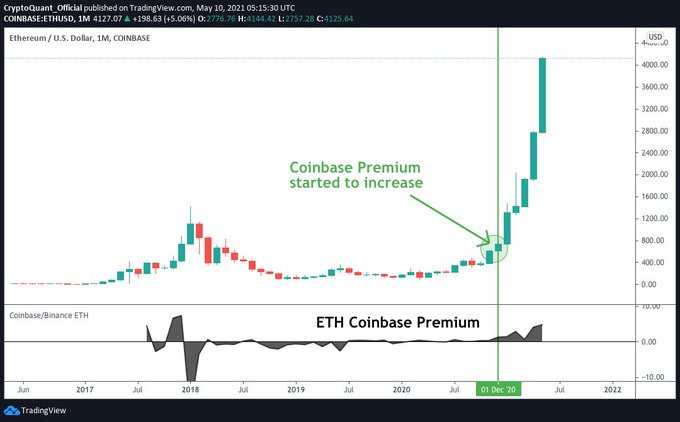

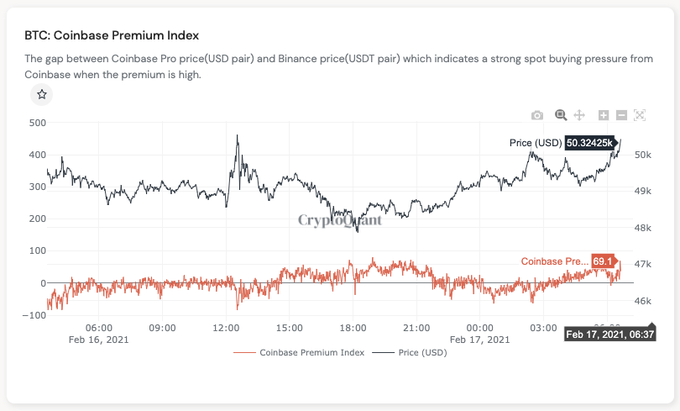

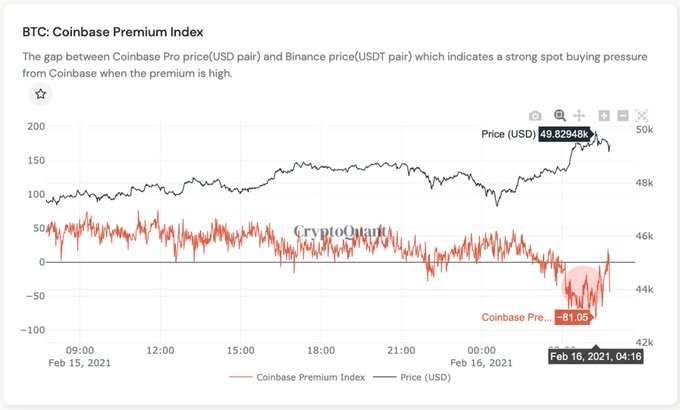

Coinbase premium turned to positive.

They're coming...

89

329

2K

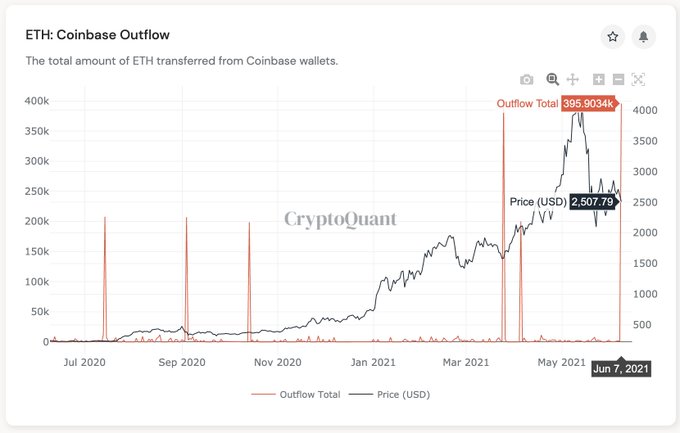

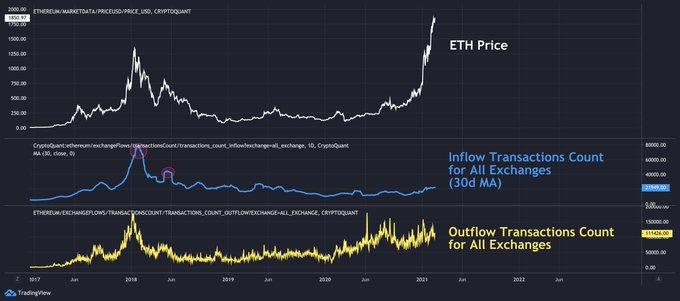

This is a pretty rare bullish signal. Might be OTC deals for institutional investors.

$ETH

80

337

2K

If you are not an insider, keep your eyes on data to see how front-runners behave:

1/ $1.6B-worth $BTC buying in 5 mins

2/ $186B-worth $BTC moved on the network (not from exchanges, highly likely OTC deals)

3/

#Bitcoin

futures premium on CME surges

Fit puzzle pieces together.

43

310

2K

This is another indicator I'm patiently waiting for cooling off to punt 10x long at $BTC bottom.

Chart 👉

How to buy $BTC at the global bottoms:

1. $BTC drops hard over -30%

2. All Exchange Inflow Mean (MA7) spikes over 2.5 BTC

3. The indicator cools down

4. ALL-IN $BTC

5. Become a billionaire and give a tip to

@cryptoquant_com

Chart 👉

110

583

3K

81

326

2K

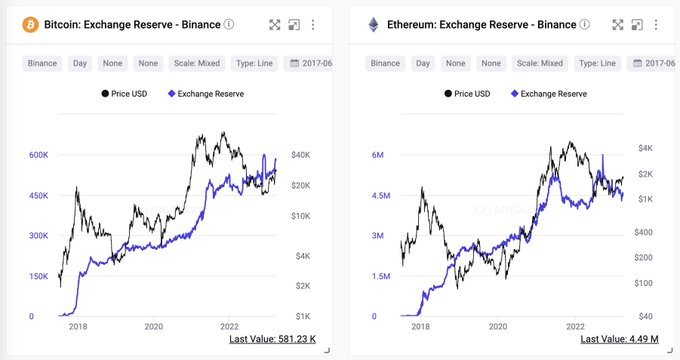

Binance:

Processing deposits and withdrawals for billions of dollars of crypto assets every day

WSJ:

Traders are pulling billions of dollars from

@binance

People:

Bank run on Binance

232

338

2K

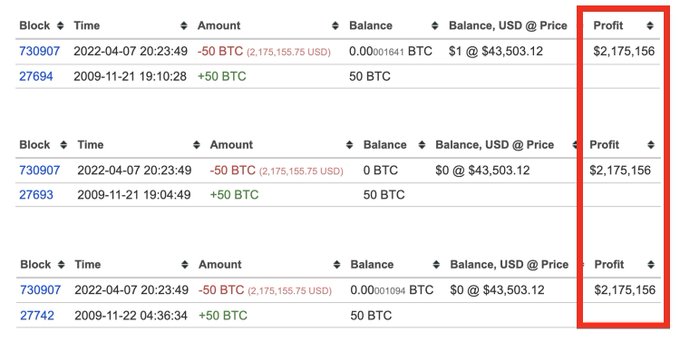

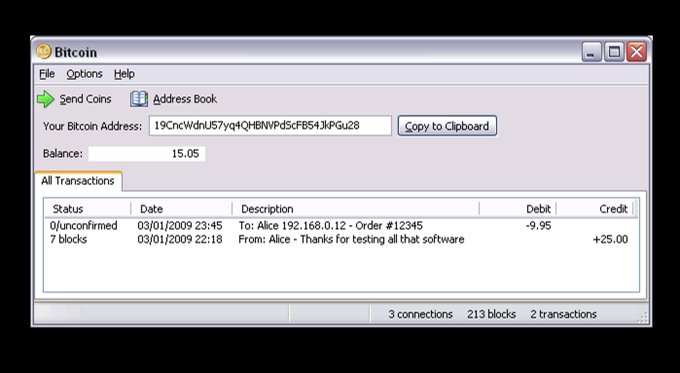

Fun Fact: This person mined 150

#Bitcoin

valued at $0.13, held for 13 years, then sold for $6.5 million, yielding a 5,019,590,600% profit.

115

231

2K

#Bitcoin

whales opened giga long positions at $29k.

122

347

2K

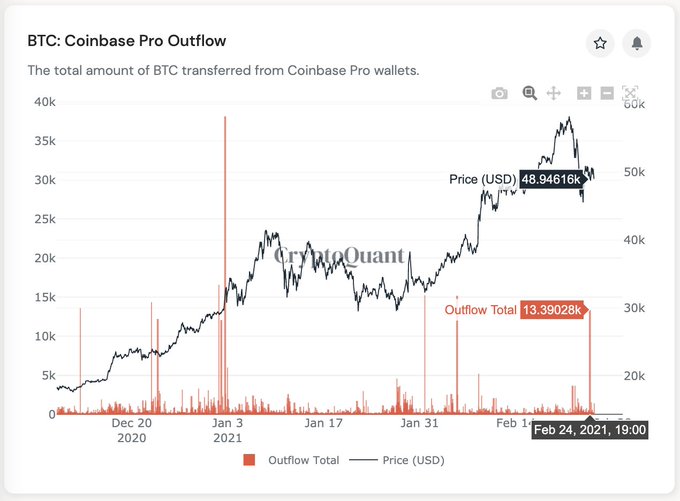

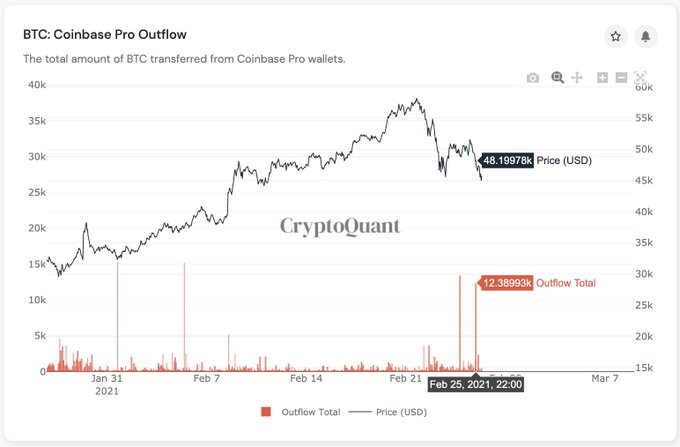

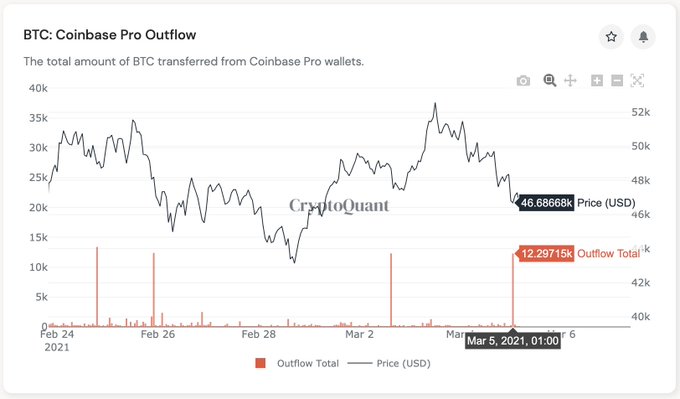

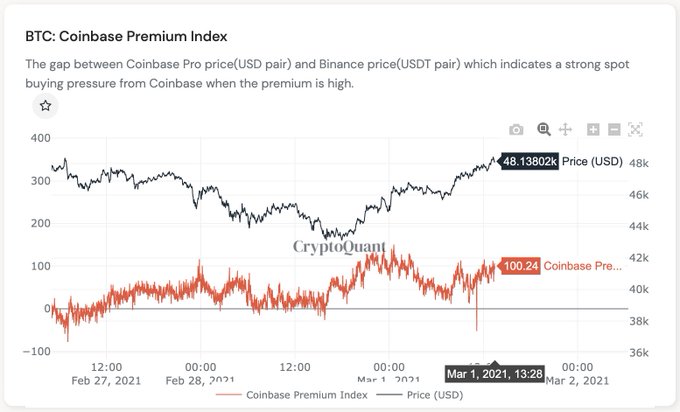

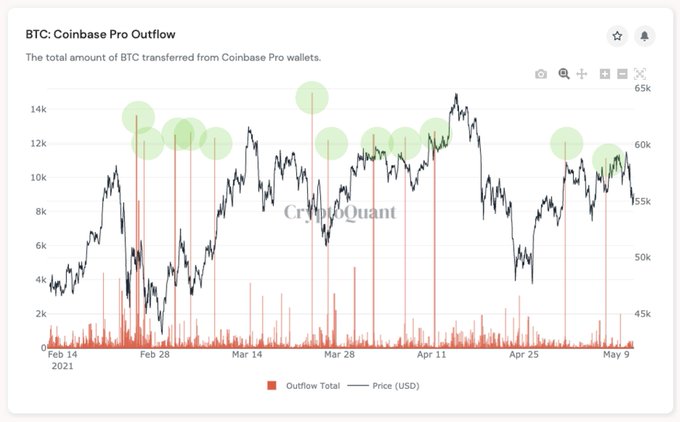

Another significant Coinbase outflows at 48k. US institutional investors are still buying $BTC.

I think the major reason for this drop is the jittering macro environment like the 10-year Treasury note, not whale deposits, miner selling, and lack of institutional demand.

78

316

2K

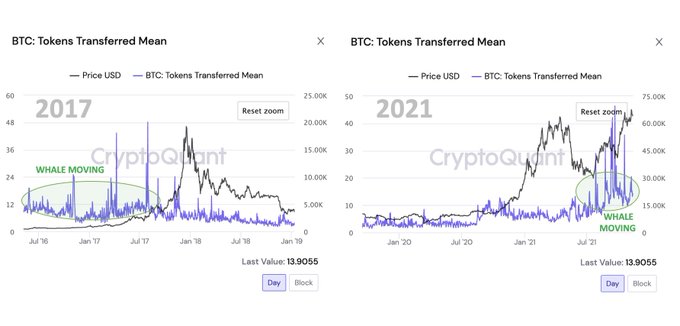

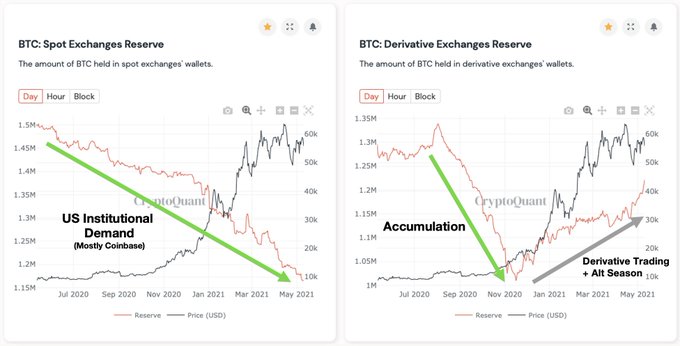

$BTC whales are moving to derivative exchanges from other exchanges, possibly to punt long positions.

Each time they moved, the price has been likely to go up in the long term.

Live Chart 👇

61

281

2K

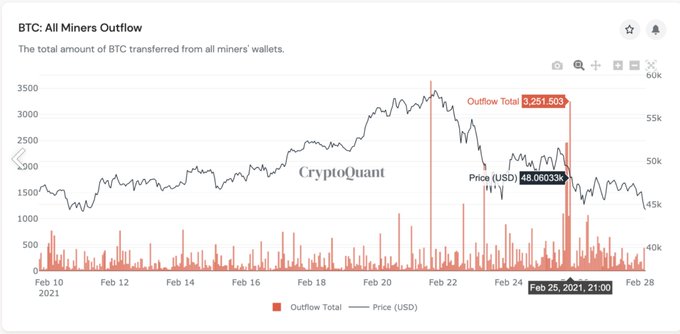

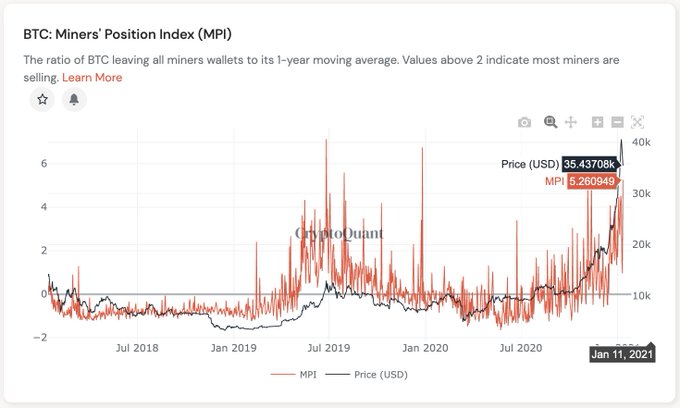

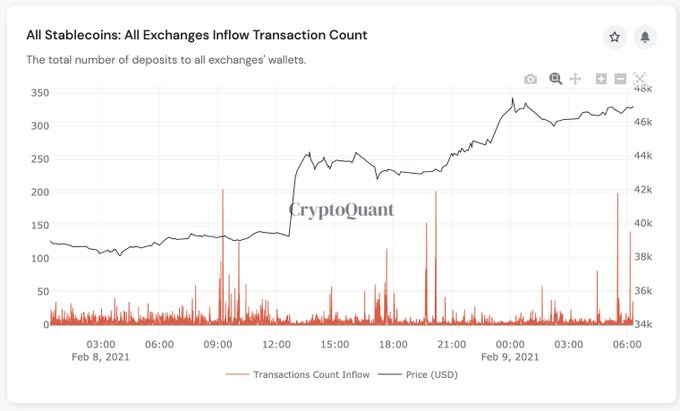

Nothing has been changed since yesterday.

Miners are selling, no significant

#stablecoin

inflows, no

#Coinbase

outflows, and 15k $BTC flowed into exchanges since yesterday.

We might have second dumping.

Chart 👉

99

240

1K

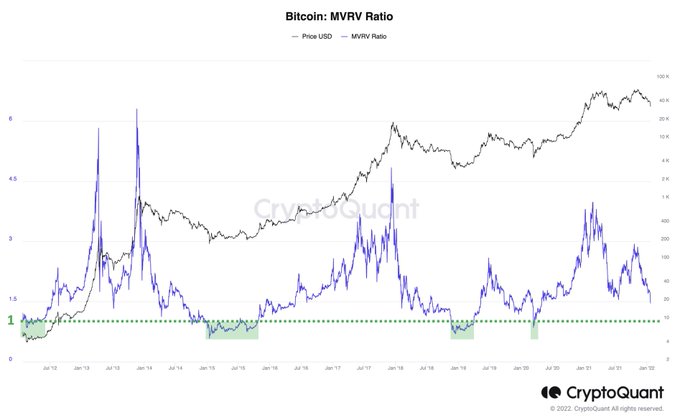

MVRV is currently 1.50, which indicates

#Bitcoin

wallets still have +50% unrealized profits.

If this is the end of the bull cycle, we should keep our eyes on this classic indicator to catch the cyclic bottom.

Historically, the cyclic bottom comes when MVRV reached below 1.

84

363

1K

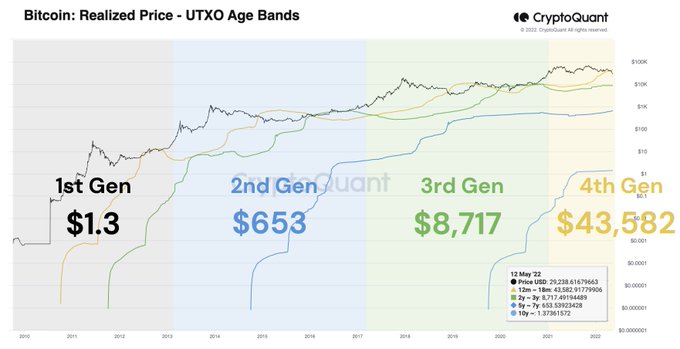

#Bitcoin

OG's Entry Price:

1st gen - $1.3

2nd gen - $653

3rd gen - $8,717

4th gen - $43,582

I'm the 3rd gen. Hang in there, 4th gen.

83

267

1K

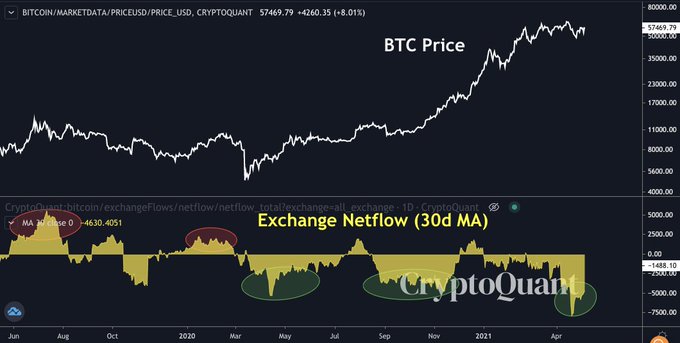

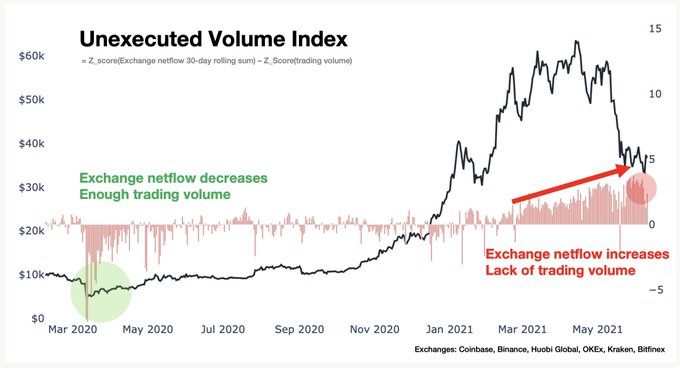

One thing that makes me worried about $BTC is exchange netflows.

There are many Bitcoins are flowing into exchanges lately but the trading volume is still relatively low.

$BTC needs more trading volume to digest increasing exchange inflows.

Data 👉

@cryptoquant_com

132

227

1K

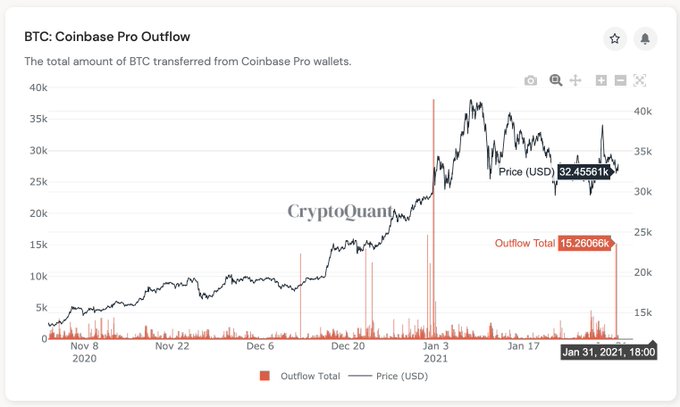

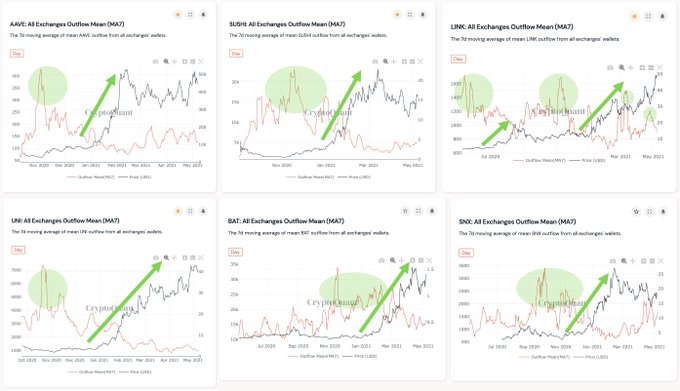

Whales are depositing $BTC to exchanges.

No doubt it'll hit $100k this year, but in the short-term, if we wouldn't see any significant buying pressure from

@CoinbasePro

, I think $BTC would be bearish.

Should keep eyes on Coinbase outflow and Coinbase Premium(will launch by tmr)

66

224

1K

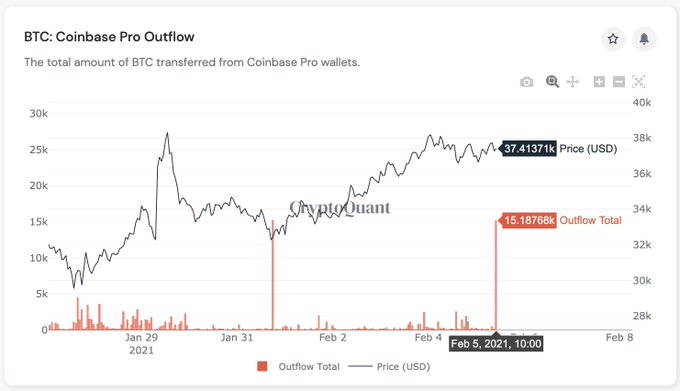

12k $BTC flowed out from Coinbase again.

Institutions are still accumulating $BTC in this range.

Chart 👉

63

265

1K

Still an insane $ETH Coinbase premium.

Selling $ETH now seems not a good idea in the long term. Follow US institutional investors, not against them.

Another evidence that US (institutional) investors are buying $ETH at

@Coinbase

.

$ETH Coinbase premium has been significantly increased since early 2021.

New money is flowing into the crypto market.

40

228

1K

52

283

1K

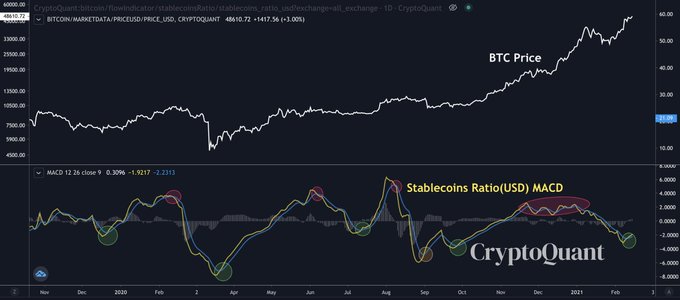

The next

#Bitcoin

parabolic bull run might begin when massive $USDC flows into exchanges.

For now, 94% of the USDC supply is outside exchanges, some of which are owned by TradFis like BlackRock, Fidelity, Goldman Sachs, etc.

They'll move when they get orders from their clients.

151

277

1K

I’m honored to be included in

@Cointelegraph

’s Top 100 notable people in blockchain, along with so many other amazing innovators!

Top 100 list -

I’m featured here -

#CTTop100

88

60

1K

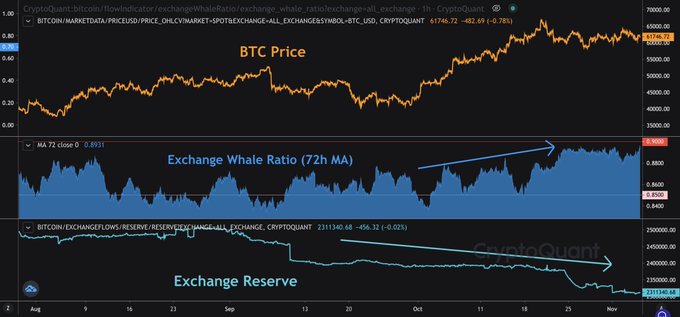

#Bitcoin

holds support above $60k in spite of whale dumping.

📉 Most $BTC exchange deposits are coming from whales. Top 10 TXs take almost 90% of the total volume in an hour.

📈 Exchange reserve is decreasing, leading to less supply on exchanges.

167

195

1K

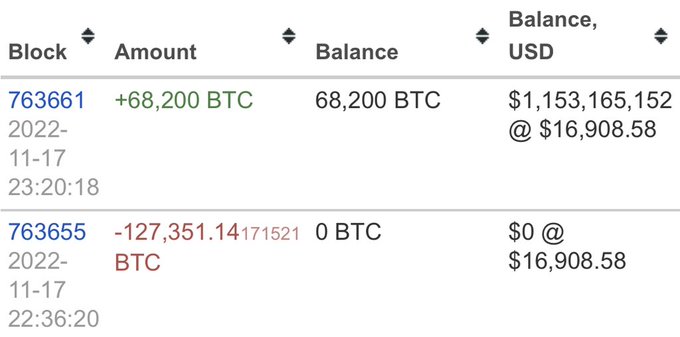

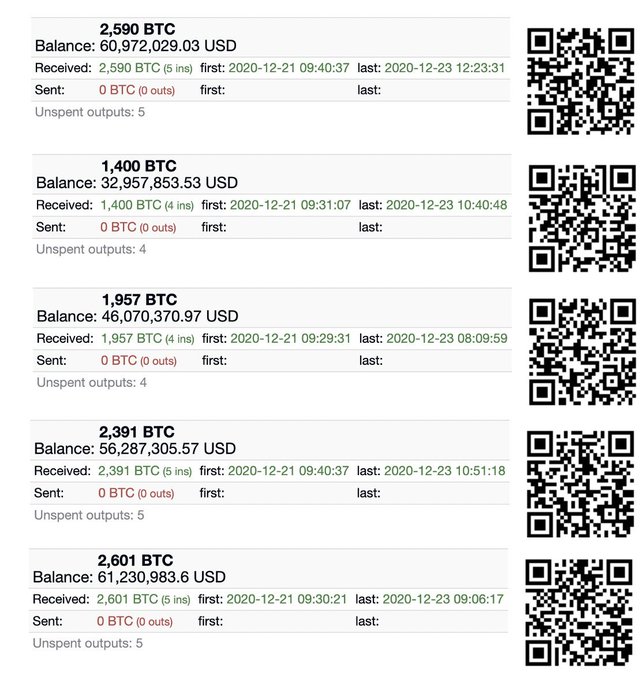

It seems most US institutions haven't sold any Bitcoin since their OTC deals.

For example, here are custody wallets from Coinbase outflows on Dec 23, 2020. No $BTC moved since then.

Remember, institutions like

@tesla

are with us.

52

229

1K

#Bitcoin

gives me the same vibe as 4 years ago.

2020-21:

$3K → $9K (Recovery)

$9K → $19K (Bull market to previous ATH)

$20K → $68K (The real bull market)

2023-24:

$15K → $45K (Recovery)

$45K → $68K (Bull market to previous ATH)

$68K → $___K (The real bull market)

100

242

1K

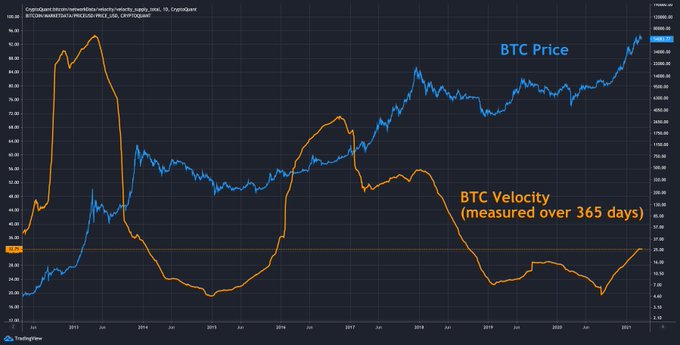

This bull-run isn't over yet. I'm ready to buy the dip.

$BTC velocity hit the year-high lately, but still, it keeps very low compared to previous bull-runs.

#store_of_value

Chart 👉

20

102

530

56

160

1K

#Bitcoin

Miners are extremely bullish now.

Hashrate to mining revenue ratio hit an all-time high, meaning they keep investing in infrastructure despite very small $BTC mining revenue.

Historically, miners were underwater in the short term but never failed in the long term.

132

269

1K

It seems Huobi users moved $ETH,

#stablecoins

, and DEX tokens to decentralized exchanges like Uniswap.

Outflow transactions spiked after Huobi announced the suspension of existing accounts in mainland China.

Ironically, regulation led to decentralization this time.

39

253

1K

Good news.

$BTC Coinbase Premium looks good after breaking 50k.

We can go higher now 🚀

Chart 👉

45

206

1K

Bears can't win this game until spot

#Bitcoin

ETF inflow stops.

Last week, spot ETFs saw netflows of +30K BTC. Known entities like exchanges and miners hold around 3M BTC, including 1.5M BTC by US entities.

At this rate, we'll see a sell-side liquidity crisis within 6 months.

74

306

1K

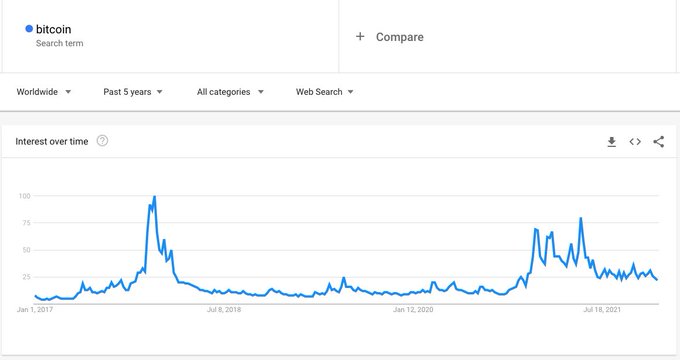

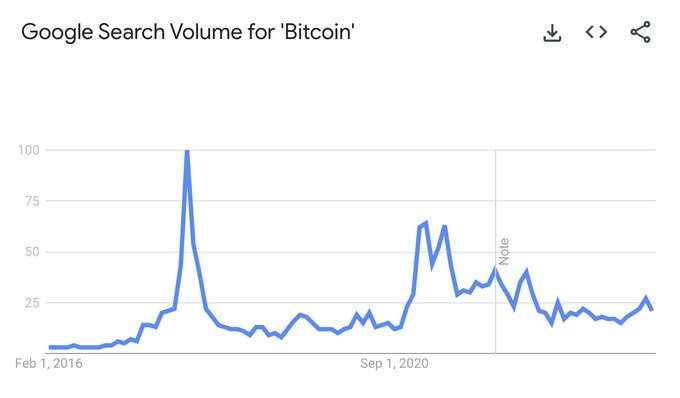

Google search volume for

#Bitcoin

just hit a year-low.

If you're still interested in crypto, you might have a belief in the future of the crypto market.

Historically, the remaining folks until retail interests bottomed out eventually have won this game.

125

212

1K

Another evidence that US (institutional) investors are buying $ETH at

@Coinbase

.

$ETH Coinbase premium has been significantly increased since early 2021.

New money is flowing into the crypto market.

40

228

1K

We may see a series of announcements of $BTC purchases from institutions like

@Facebook

soon.

Institutions have been accumulated $BTC in $48-60k range since February. Approx. 154k Bitcoins has flowed out from Coinbase into multiple cold wallets.

Chart👉

42

259

1K

#Bitcoin

short squeeze hasn't happened.

Most perpetual swap buying volume came from pure $BTC purchases, not forced short liquidations.

More bullets for bulls.

169

202

1K

Still bearish in the short term.

This whale dumping indicator hit a year-high since the March great sell-off last year. Whales keep depositing $BTC into exchanges.

If this is an orchestrated effort, it will go down again. If not, we may retest the bottom again at least.

105

228

1K