Karishma Banga

@karishma_banga

Followers

685

Following

1K

Media

82

Statuses

880

Assistant Professor in Digital Economy @KingsCollegeLon via @IDS_UK @GlobalDevInst @odi_global @Cambridge_uni @GVAgrad

London, England

Joined November 2017

📯 Some exciting personal news to share. Today I started as a tenured Lecturer/Assistant Professor in Digital Economy at @KingsCollegeLon ! Looking forward to continuing my research and teaching on platform economics, BigTech regulations, AI and data-driven trade!

10

2

54

RT @PopuliBot: In our latest piece, @karishma_banga explores how digital trade governance can entrench asymmetries in global taxation, und….

0

1

0

RT @PopuliBot: Our latest piece features an interview with @karishma_banga as she delves into how digitalization has recalibrated the lands….

0

1

0

#Canada - latest to rescind the #Digital Services #Tax under pressure of a #trade deal with the #US!. I sat down with @BotPopuli to unpack how taxation rights, trade law & platform power are colliding in the digital economy. Who will write the new rules? .

botpopuli.net

As African economies accelerate their digital transitions, they face a critical paradox: while digital business models expand rapidly, the capacity to ta...

0

0

0

RT @JIEL_OUP: .@karishma_banga, Alexander Beyleveld and @Munumartinl analyze how #trade rules shape taxation of Africa's #digital economy,….

academic.oup.com

Abstract. The advent of digital and data-driven business models has heightened the risks of tax base erosion and evasion, adversely affecting revenue gener

0

3

0

🚨 New Paper Alert 🚨. "Trading away tax sovereignty?" 📊💻 at Check out the framework ⬇️ to explore how digital trade rules are undermining tax frameworks in the digital economy 🌍💡. #DigitalEconomy #TradeRules #Taxation #Africa

0

1

2

UK and India are considering BIG changes to #digitalservicestax to avoid #US #tariffs. Other countries might follow. 📯 Read our new paper in @JIEL_OUP to understand.the intersections between #traderules and #digitaltaxation instruments.@KingsCollegeLon

0

0

2

Decent work in a world of #digital #technologies, #AI, and shifting #geopolitics? Is it even possible? . In a new report, I explore the critical tensions between AI and decent work in developing countries, with a focus on the services sector (Chp 4).

1

0

1

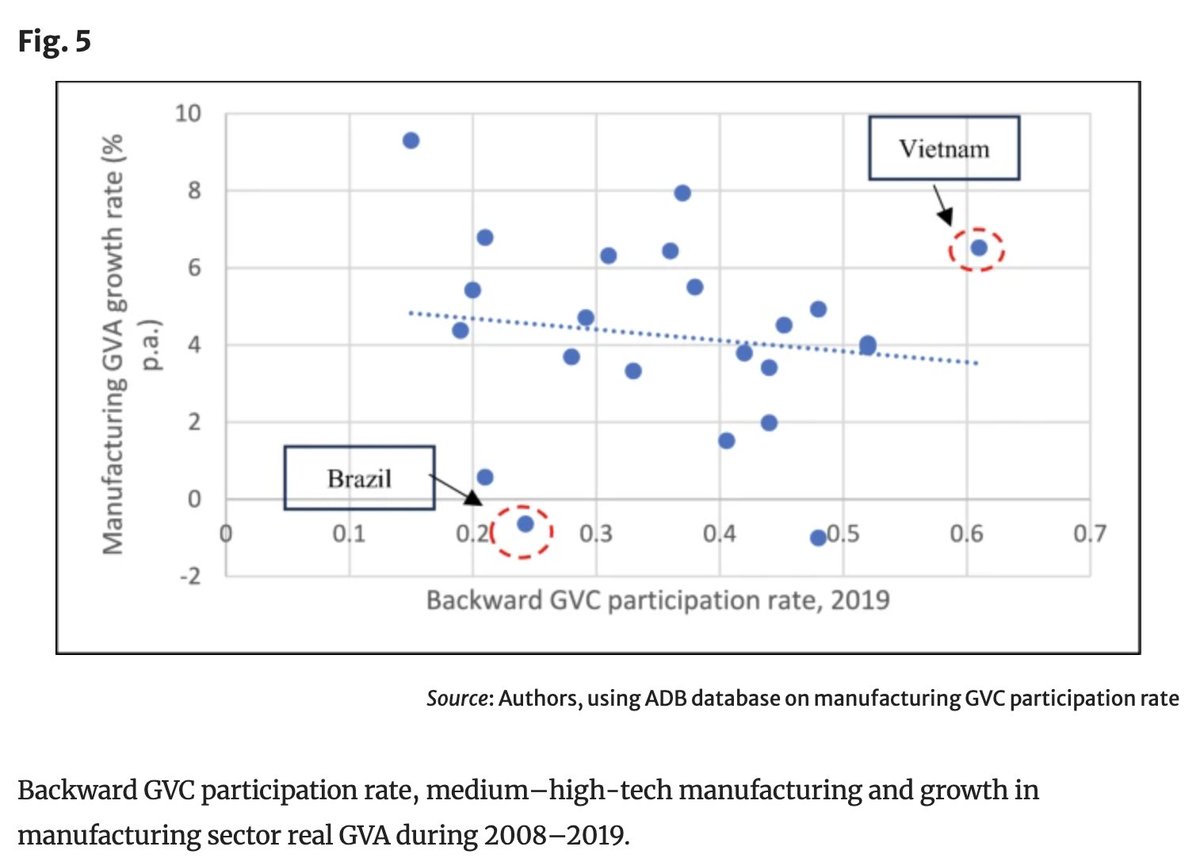

📢 Our new paper finds that once backward linkages reach the 11–20% range, they ⬇️ mfg growth in developing countries. Which countries benefit from a ‘strategic #decoupling’ from #GVCs?. Find out at . Open access thanks to @KingsCollegeLon

0

0

2

RT @Heccles94: We need @BBCNews, @SkyNews and @itvnews to stop calling violent, organised, extremist rioters 'protestors'. Stop legitimi….

0

4K

0

I had three incredible years @IDS_UK, working with a brilliant set of colleagues who profoundly shaped my thinking! . Also grateful to everyone who has helped me on this academic journey via @Cambridge_Uni @GlobalDevInst @ODI_Global.

0

0

1

RT @CharlesAutheman: 🇮🇩 @undip FEB summer course is starting next week. Several days left to register for this free course on business & su….

0

2

0

Thanks @WileyEconomics! As an early career researcher, it is always motivating to see when your work is picking up traction 😄🫡. Full paper available at

1

3

14

RT @IDS_UK: 📣 We’re delighted to announce that in partnership with @SussexUni we have been ranked first in the world for Development Studie….

0

21

0

RT @ICTDTax: 📃 Are trade rules undermining #taxation of the #digitaleconomy in Africa?. 🔎 Revisit this study by @karishma_banga and Alexand….

ictd.ac

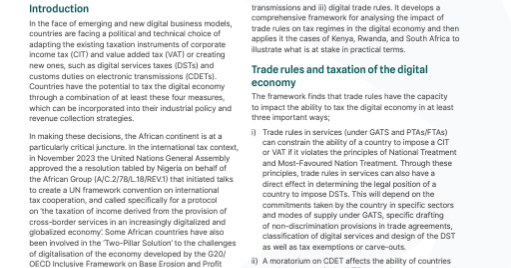

Countries have the potential to tax the digital economy through a combination of at least these four measures, which can be incorporated into their industrial policy and revenue collection strategies.

0

5

0

RT @ICTDTax: 📝This report by @TaxNotes quotes @karishma_banga on how the moratorium on custom duties for electronic transmissions, which w….

ictd.ac

ICTD Working Paper 181, entitled ‘Are Trade Rules Undermining Taxation of the Digital Economy in Africa?’, was cited in a report by Tax Notes on the recent renewal of the World Trade Organization’s...

0

2

0

RT @howserob: Serious recent research relevant to case for removing #WTO e-commerce customs duty moratorium. #WTOMC13AbuDhabi #MC13.

0

1

0

With the #WTOMC13AbuDhabi underway, a reminder ⬇️that trade-related negotiations at @wto have important #tax implications for developing countries. Our @ICTDTax @IDS_UK paper explores these impacts for the case of #Kenya, #Rwanda, and #SouthAfrica

ictd.ac

This paper puts forth a comprehensive framework for analysing the impact of trade rules on tax regimes in the digital economy, with a focus on Kenya, Rwanda, and South Africa.

0

0

1