internQuant

@internQuant

Followers

249

Following

5K

Media

113

Statuses

564

quantitative & systematic research | portfolio management | trading systems | trader @ a small quant firm

Joined August 2024

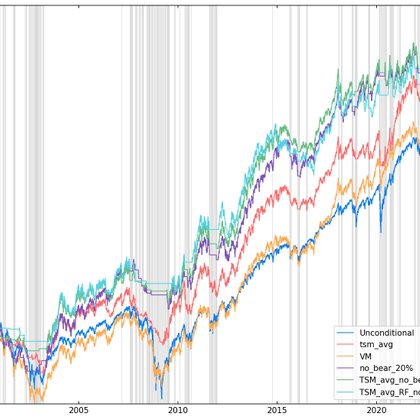

Replicating “Models, Regimes and Trend Following - Part 4” A White paper by. @JungleRockRes . Get your copy at Part 4 colab link:. Code available and ready to run (including data) on Google Colab for the complete series at:.

colab.research.google.com

Run, share, and edit Python notebooks

6

9

39

RT @internQuant: Replicating “Models, Regimes and Trend Following - Part 4” A White paper by. @JungleRockRes . Get your copy at https://t.c….

colab.research.google.com

Run, share, and edit Python notebooks

0

9

0

As always, I'd like to thank the whole @JungleRockRes team for these papers. I have learned so much doing this series I could not be thankful enough 🙏. Also, thanks to everyone that has tagged along and checked the series out. Feel free to reach out if you have any questions,.

2

3

16

RT @JungleRockRes: Would you allocate to the .Jungle Rock ETF at 69 bps?. It would be a multi strategy using trend following, asset allocat….

0

23

0

RT @JungleRockCap: Like this post and share . 2 giveaways to the research portal of .Jungle Rock, our sister company . Retail Tier.

0

36

0