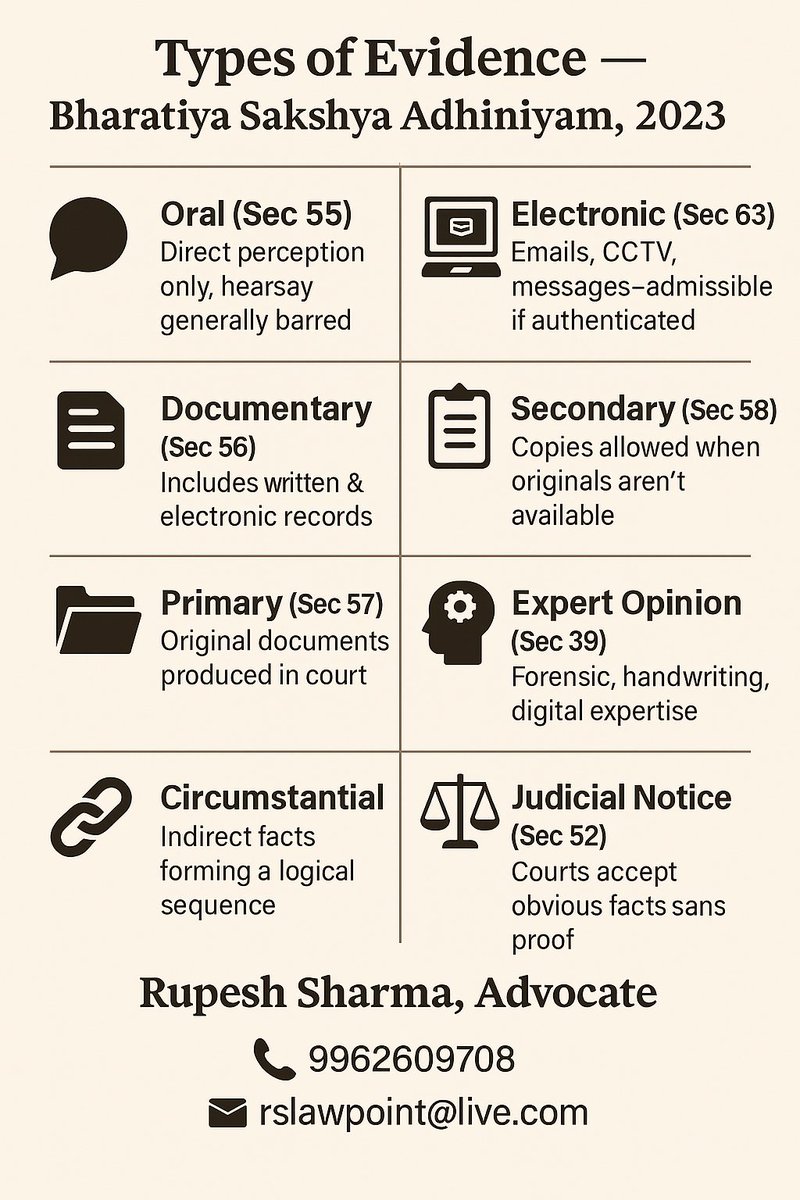

Adv. Rupesh Sharma

@i_rupeshsharma

Followers

1K

Following

1K

Media

469

Statuses

3K

Advocate | Tax, IPR & Legal Updates | Proud Indian & Hindu | Lord Krishna Devotee | Knowledge Sharing | Photography | Tech & Fitness Enthusiast | Food & Travel

Chennai, India

Joined February 2017

RT @i_rupeshsharma: 📘 Rule 33 of CGST Rules – GST on Reimbursements Explained. One of the most debated GST topics:. 👉 Are reimbursements su….

0

7

0

Wishing all the Chartered Accountants and Doctors a Very Happy CA and Doctors respectively 💐 . Keep Shining 🌟 . #DoctorsDay.#DoctorsDay2025.#CADay #CADay2025.

0

0

5