Japan Elliott Wave Research Institute

@ewrij225en

Followers

7K

Following

1K

Media

4K

Statuses

7K

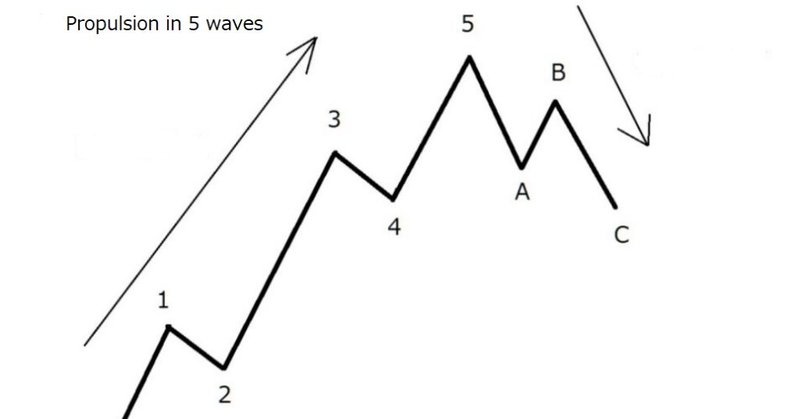

Trusted Elliott Wave insights for disciplined traders. This post is intended for those interested in Elliott Wave. Reach us: [email protected]

Japan tokyo

Joined February 2023

📈 The latest Weekly Report vol.377 is now available. This week’s edition opens with a comprehensive re-examination of Bitcoin’s entire wave structure going back to 2010. Has BTC already topped? We revisit all major inflection points from the early impulse waves to the present

1

1

5

A larger wave #USDJPY #Elliottwave

So, is the even larger wave count Figure 21? It would be a barrier triangle. #USDJPY #Elliottwave

1

1

11

So, is the even larger wave count Figure 21? It would be a barrier triangle. #USDJPY #Elliottwave

0

1

4

Updates to this pattern #Bitcoin #Elliottwave

1

3

9

Keep an eye on it. If it crosses the purple line, the upward trend will prevail. #USDJPY #Elliottwave

As of now. If the trend of a weaker yen continues, the correction may be complete around here. Given the shape of the small fluctuations, it seems somewhat likely that the trend will shift to a stronger yen. Well. Today appears to be finally a turning point. #USDJPY #Elliottwave

0

1

5

The SPX has now surpassed the end of the fourth wave of the assumed diagonal, making this pattern even more important to watch. #SPX $SPX #SP500 #Elliottwave

I've been trying to figure out how likely it is that the SPX diagonal is a flat C. For example, this count. I'm examining whether this count complies with the guidelines. #SPX $SPX #SP500 #Elliottwave

0

2

6

If the RSP (S&P 500 equal weight) continues to hit new highs, it will be three waves from the April low. This cannot be ignored. #RSP #SPX $SPX #SP500 #Elliottwave

0

0

1

The goal of becoming an Elliott Wave Master is not to be able to count, but to no longer be trapped by noise or subjectivity. #Elliottwave

0

0

8

As of now. If the trend of a weaker yen continues, the correction may be complete around here. Given the shape of the small fluctuations, it seems somewhat likely that the trend will shift to a stronger yen. Well. Today appears to be finally a turning point. #USDJPY #Elliottwave

0

1

12

0

0

4

One-month subscriptions are now on sale at the GUMROAD website. You can subscribe to the last two issues for one month. 10% OFF your first month — just use code: UVPMHYW at checkout. $SPX #SPX #SP500 #Elliottwave

https://t.co/Uvm1B7miEW..

japanelliott.gumroad.com

Unlock Deep Market Insights – 1-Month SubscriptionGain exclusive access to the Elliott Wave Weekly Report – a high-level analysis packed with about 30 pages of detailed wave counts, market correlat...

0

0

0

I've been trying to figure out how likely it is that the SPX diagonal is a flat C. For example, this count. I'm examining whether this count complies with the guidelines. #SPX $SPX #SP500 #Elliottwave

3

4

30

The USD/JPY has also moved along the assumed dashed line in Figure 49 so far. #USDJPY #Elliottwave

0

0

13

If you can't understand, there's nothing you can do about it. Because understanding requires ability in the first place. This gap cannot be filled with just a little effort or experience. Unfortunately, that's the reality. I'm not talking about Elliott Wave

0

0

4

The five waves of an expanding diagonal are limitless, so the only way to determine the target is to look at the preceding larger wave. I think (v) of Zigzag C is an expanding diagonal. #Bitcoin #Elliottwave

0

0

1

Most economic theory is based on armchair calculations, and it's impossible to know whether it will actually work as planned. This is because the real world involves many variables that aren't visible on paper. Behavioral economics can't compensate for that. There are countless

0

0

2