Erika Giovanetti, CPFC

@erikaxgio

Followers

501

Following

3K

Media

256

Statuses

2K

Consumer Lending Analyst @usnews. I like data and charts. Ask me about mortgage rates. Formerly @FoxBusiness / @LendingTree

Richmond, VA

Joined December 2019

Tune in at 3pm EST for today's #CreditChat!

🏠 Ready to rent or buy a home but not sure where to start? Join us for this week’s #CreditChat: Preparing Financially to Rent an Apartment or Buy a Home We’re covering budgeting, credit, hidden costs & more!

0

2

4

Start 2025 off right! Join our #creditchat at 3 p.m. ET here on X about setting SMART financial goals, practical steps to kickstart your plan, & tools to stay on track.

experian.com

Our weekly #CreditChat started in 2012 to help our community learn about credit and important personal finance topics (e.g. saving money, paying down

1

4

6

@markasher32 gets the latest on mortgage rates from @erikaxgio of @usnews #loans #mortgages #mortgagerates #rates

0

1

3

There you have it, folks: 50 basis points. Looks like the #FOMC is acting aggressively in the face of a weakening economy – but I'm sure some people will claim that they opted for a half-point cut for political reasons, right?

54% of recent homebuyers believe the Fed is "politically motivated" to cut rates ahead of the November election, according to a new survey from @usnews But respondents believe other common misconceptions about our favorite scapegoat, the Federal Reserve👇 https://t.co/Zqr3YABZUz

1

0

2

54% of recent homebuyers believe the Fed is "politically motivated" to cut rates ahead of the November election, according to a new survey from @usnews But respondents believe other common misconceptions about our favorite scapegoat, the Federal Reserve👇 https://t.co/Zqr3YABZUz

money.usnews.com

Americans who took out a mortgage in the past year would like to have a word with Federal Reserve policymakers about high interest rates, or at least that's the vibe in a recent U.S. News survey.

2

1

2

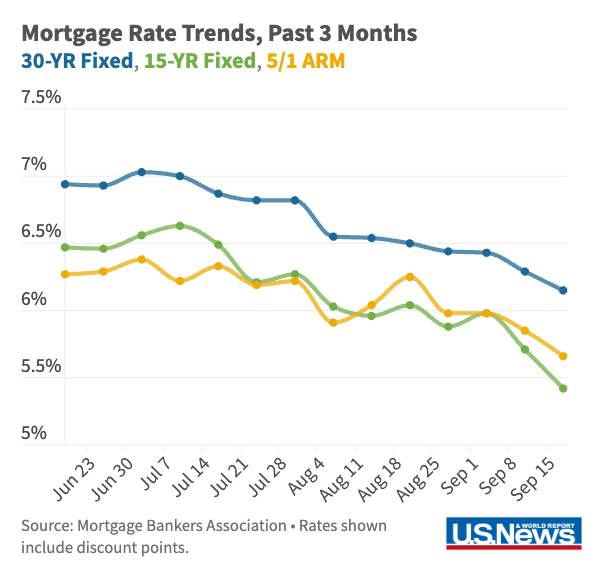

Mortgage rates are at their lowest levels in 2 years ahead of today's #FOMC meeting, per @MBAMortgage 30YR Fixed: 6.15% 15YR Fixed: 5.66% 5/1 ARM: 5.42% Even had to adjust the Y axis of our chart this morning!

0

0

2

Homebuyers aren't alone in their grievances Some economists, including Fed alumni – have also been questioning if the central bank has waited too long to cut rates. There was a really great @GoldmanSachs podcast on this topic ( https://t.co/SZe6HyEhhT)

1

0

1

If politicians had more control over the Fed, they could campaign on cutting interest rates to win over voters, regardless of whether it's an appropriate monetary policy Remember history: Nixon, Arthur Burns and inflation in the 1970s (via @marketplace)

marketplace.org

It was the lead-up to the 1972 presidential election. An era of “stagflation” was ahead. And President Richard Nixon had a plan.

1

0

0

There's a good reason why the Fed is independent. It has a dual mandate of price stability and maximum employment, but some of the tools that policymakers have to achieve this delicate balance – most notably, interest rate hikes – aren't always popular in the eyes of the consumer

1

0

1

Fed Chair Powell: "We never use our tools to support or oppose a political party, a politician or any political outcome." Also, Powell was appointed in 2018 by former President Donald Trump and reappointed in 2022 by President Joe Biden

1

0

1

@usnews 48% agree that the president should have more control over the Fed's policy decisions, 2X the amount who disagree (24%) 60% say the Fed kept rates high for too long, while only 19% say it didn't 52% believe that the central bank sets mortgage rates, which isn't true

1

0

1

54% of recent homebuyers believe the Fed is "politically motivated" to cut rates ahead of the November election, according to a new survey from @usnews But respondents believe other common misconceptions about our favorite scapegoat, the Federal Reserve👇 https://t.co/Zqr3YABZUz

money.usnews.com

Americans who took out a mortgage in the past year would like to have a word with Federal Reserve policymakers about high interest rates, or at least that's the vibe in a recent U.S. News survey.

2

1

2

Are you... 🏡Buying a house or car? 💰Paying off debt? 🌪️Shopping for a new insurance policy? Then your credit score needs to be in tip-top shape! Head over to @Experian at 3pm EST today for our weekly #CreditChat to learn how to get from good to great to *excellent* ✔️

Tune in to tomorrow’s #CreditChat about building a credit confidence ft. @CreditScoop, @BruceMcclary, @NextGenPF, @NavicorePR, @Theemoneyplug, @erikaxgio, @BeverlyHarzog, @Rod_Griffin, @Jennifer_wWhite, and @Teena_LaRo. https://t.co/KMrCXWXNza

0

1

4

📦 Thinking of relocating to a new city? Get expert advice from Erika Giovanetti on the latest episode of #CreditChatLive! Tune in for tips on renting vs. buying, mortgage rates, and much more. 🎧 https://t.co/YEVcw7nMCJ

#Relocation #HomeBuying #HousingMarket #CreditChat

2

6

12

The July jobs report wreaked havoc on stock portfolios, but there's an upside for prospective homebuyers: lower mortgage rates. https://t.co/P0xmdUsrQ2

money.usnews.com

The July jobs report wreaked havoc on stock portfolios, but there's an upside for prospective homebuyers: lower mortgage rates.

0

0

2

Erasing some of those gains by 12:45pm: 5.875% for purchase 6.125% for refi

0

0

1

@markasher32 talks with @erikaxgio of @usnews about the latest on mortgage rates. #rates #mortgages #mortgagerates #homeloans

0

1

2

If you recently bought a home and your mortgage rate is 7% or higher, it could be time to refi Current 30-year refi rates are at 6% at Wells Fargo, and I'm sure you could find lower by shopping around

0

0

1

WOW, as of 10:35 AM, those rates dropped: 5.75% for purchase 6% for refi

1

0

0