Eldar

@eldarcap

Followers

2K

Following

1K

Media

164

Statuses

6K

Looking for asymmetric bet and undervalued crypto project in DeFi. Not financial advice.

Joined May 2021

Protocol to protocol uncollateralized credit line were already tried before in DeFi and didn’t end well. Remember @ibdotxyz ?. A credit line to @Alpha_HomoraV2 went bad after an exploit on Alpha. The drama that followed given the fault assignment issue was an epic TV show and a.

Wanted to share a message we received in our open DMs: "Hey team, I came across Astera and the whole ‘Facilitator’ idea caught my eye. But I'm curious though, what’s the main use case you’re most excited to push first with asUSD?". //. The main use case driving asUSD is actually.

0

0

1

Still the best comeback of DeFi so far. @InverseFinance is a good runner up but @eulerfinance is still ahead yet. And the best is likely to be ahead.

Euler v2 turns 1 today. No way we could've done it alone. Incredible things happen when you don't give up.

0

0

4

RT @gmcaseycraig: i’ll take the other side of this. nobody wants to trade options as they exist today. options ux mostly sucks and requires….

0

8

0

I thought Etherealize was supposed to be like a foundation to promote Ethereum and market it. Didn’t know they were gonna actually launch product. Apparently focused on the RWA game à la @grovedotfinance or @aave Horizon. Interesting.

🚨 Etherealize raises $40 million to expand Wall Street’s use of Ethereum . Here's how:.- Backed by Vitalik Buterin, Paradigm, Electric Capital, and the Ethereum Foundation.- Built by ex-Wall Street veterans & Ethereum researchers .- Focused on tokenizing mortgages, credit, and

0

0

0

Nice new pool there. Now just need a lending pool with the PT token on @MorphoLabs for leverage.

The top-performing USDC yield source on @base has landed on Spectra- powered by @ArcadiaFi. Trade yield evolution of Arcadia's USDC Lend product. PT → Fixed rate on USDC.YT → Leveraged exposure Arcadia's native rate.LP → Balanced exposure to native rate, PT + swap fees

0

0

1

Why go with a stablecoin design and not simply offer the $sUSDai component?. The core value proposition of @USDai_Official is a form of tokenized RWA, here GPUs financing. So why bother with a stablecoin at all if it isn't the core proposition and it doesn't seem to be the goal.

What’s the difference between USDai and sUSDai?. Both are core to the USDAI ecosystem, but they serve very different purposes.

1

0

2

The growth is strong with this one. It is still currently a point farming play at this point, but people seem to believe the GPU RWA collateral will have some value apparently.

The moment you've all been waiting for. On Sept 4 (12PM EST) deposit caps will be increased from $110M to $160M. The next cap increase will align with our @PlasmaFDN expansion for their mainnet launch.

0

0

3

Liberating the yield for AGI financing revolution believers.

Liberating the yield, on Arbitrum. With Pendle integrated, Euler is the only venue to natively loop @USDai_Official yield:. → $1M liquidity available.→ Lending rates at 18.91%.→ PT-USDai/USDC loop (87% max ROE)

0

0

6

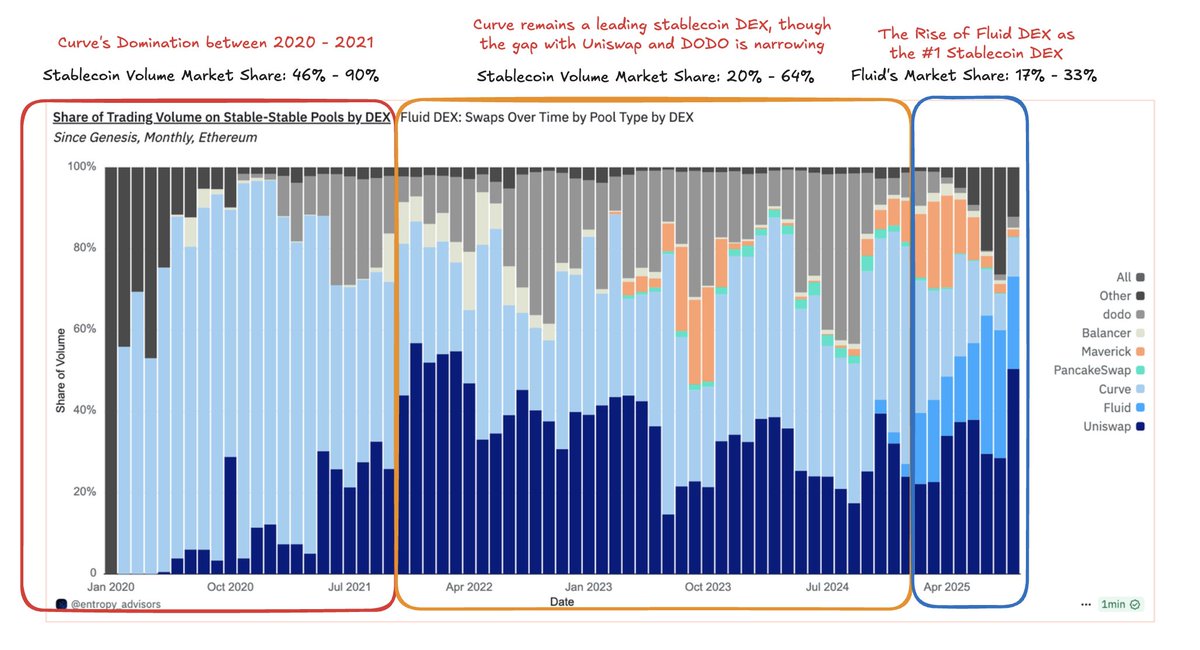

If this trend continue and is not due to unsustainable practices on the long term then things gonna get heated for @CurveFinance and $CRV. If it steadily looses its stablecoin swap crown in favor of hybrid lending-DEX like @0xfluid or @eulerfinance swap, then it s long term.

From Curve to Fluid, the shift in the primary liquidity hub for Stablecoins on Ethereum. Curve's Dominance from 2020 to 2024:.During the DeFi summer, Curve built the deepest stablecoin liquidity on mainnet with its 3pool. At its peak, 3pool had $6B in DAI/USDT/USDC liquidity,

0

0

6

The @LineaBuild ignition program is live. Some protocols I know should strive to get a partnership.

Welcome to Linea Ignition ⚡. Our liquidity-boosting incentive program is now open to the entire Linea community. Here’s what you need to know 🚀.

0

0

2

The large bulk of @pendle_fi TVL is @ethena_labs related. It facilitated ONE trade and it was sufficient to propel it in front of DeFi.

1

0

4

Would there be demand for @USDai_Official $sUSD.ai as collateral on @InverseFinance FiRM?. With proper risk parameters, oracle depending on liquidity, it could be achieved. Allow leverage for believer in the AGI financing revolution and more borrowing demand for $DOLA.

1

0

2

RT @euler_mab: Bunni appears to have been exploited on Unichain and Ethereum. Remove funds from Bunni ASAP if you have any on other network….

0

32

0

The @aave instance on @LineaBuild is closing in on $1B TVL. The @eulerfinance instance there is closing on a $100M TVL. The DeFi ecosystem is burgeoning there. Don't fade Linea.

4

2

70