dknugo

@dknugo

Followers

588

Following

588

Media

32

Statuses

349

Smart Collateral / Smart Debt stable vaults on @0xfluid are printing 💰. sUSDe-USDT/USDC-USDT vault at 10x max leverage made 34% organic APR last 30 days (sUSDe yield + trading fees + supply APR - borrowing rate) . If you take into account 30x boost for Ethena S3 points on

3

10

30

4/ Dune dashboards:. - Fluid DEX: - Fluid liquidations: - Detailed stats:

dune.com

Dune is the all-in-one crypto data platform — query with SQL, stream data via APIs & DataShare, and publish interactive dashboards across 100+ blockchains.

0

0

2

Last 2 days only $247k ($81k + $166k) of collateral were liquidated in USDC-ETH/USDC-ETH vault on @0xfluid (Ethereum). This vault provides liquidity to Fluid ETH-USDC dex pair that facilitated 30% of all ETH-USDC trading volume on Ethereum yesterday with just $6M TVL 👀 🧵👇

2

6

32

RT @DeFi_Made_Here: Just realized that @0xfluid is also the second biggest DEX by fees generated on Ethereum. I know I sound crazy but with….

0

25

0

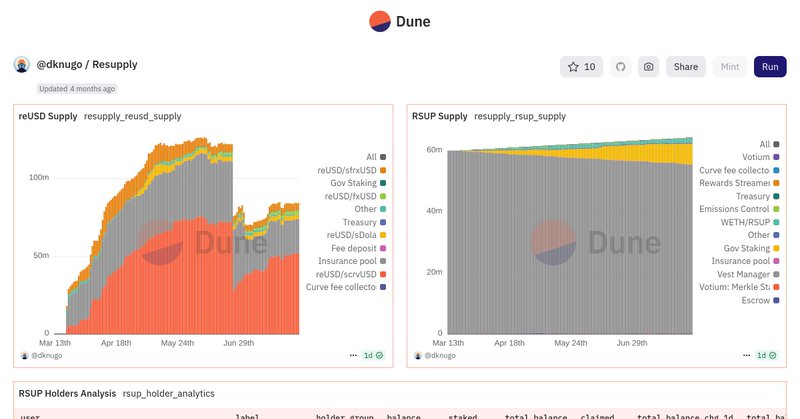

10/ Dune dashboard: In Part II of this thread we'll analyze "degen yields" with RSUP governance token.

dune.com

Dune is the all-in-one crypto data platform — query with SQL, stream data via APIs & DataShare, and publish interactive dashboards across 100+ blockchains.

0

0

0

8/ Another options is just to buy discounted reUSD on the market ( @CoWSwap limit orders are ok) and farm it. btw some juicy bribes are deposited on @VotiumProtocol -> more CRV rewards for LPs next epoch.

1

0

0

4/ Issues:.reUSD can be redeemed by anyone with 1% fee split 50/50 between the borrower and the protocol. Redemption model is communal -> your CDP can be redeemed fully / partially anytime:

docs.resupply.fi

1

0

0

Resupply ( @ResupplyFi ) is a new project launched by Convex and Yearn recently. It allows to mint and farm reUSD - stablecoin backed by yield-bearing lending pool tokens on Curve Lend and Fraxlend. You can earn up to 50% APR currently. Really? 🧵👇

2

2

12