Dennis C

@dennisc230

Followers

21,881

Following

104

Media

2,410

Statuses

14,749

Learning the ways of the monkey @tickermonkey Focused on growth stocks that have a new factor. Love to travel and anything outdoors. Sharing a few photos too.

Eastern Washington

Joined January 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

MIKHA OUR BEST PLAYER

• 204104 Tweets

安田記念

• 165665 Tweets

HERE WE GO

• 123143 Tweets

BUILD BD 3GETHER

• 96851 Tweets

ロマンチックウォリアー

• 81080 Tweets

GAME ON DONNY

• 80630 Tweets

#光る君へ

• 60479 Tweets

ナミュール

• 45591 Tweets

土砂降り

• 31715 Tweets

OFIFI LIVE ON IG

• 31575 Tweets

#鉄腕DASH

• 26250 Tweets

TMC WITH MC DAOU

• 22264 Tweets

ゲリラ豪雨

• 18962 Tweets

#さんにんにものもうす

• 18347 Tweets

桐生戦兎

• 16598 Tweets

宝塚記念

• 15662 Tweets

Last Seen Profiles

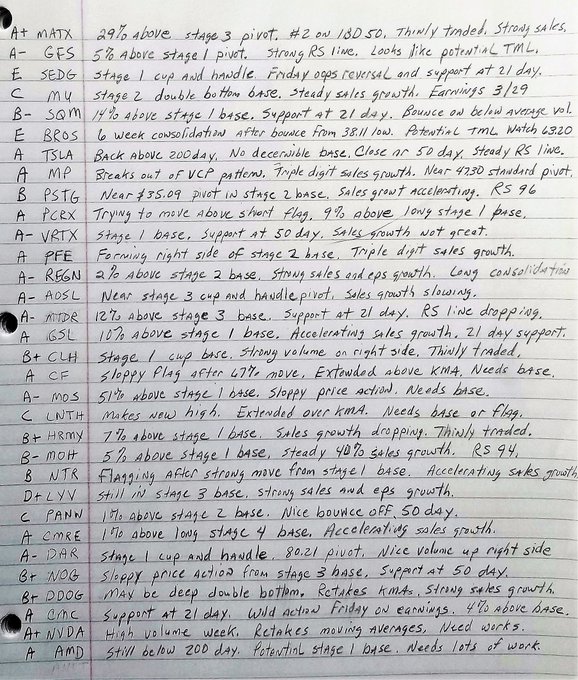

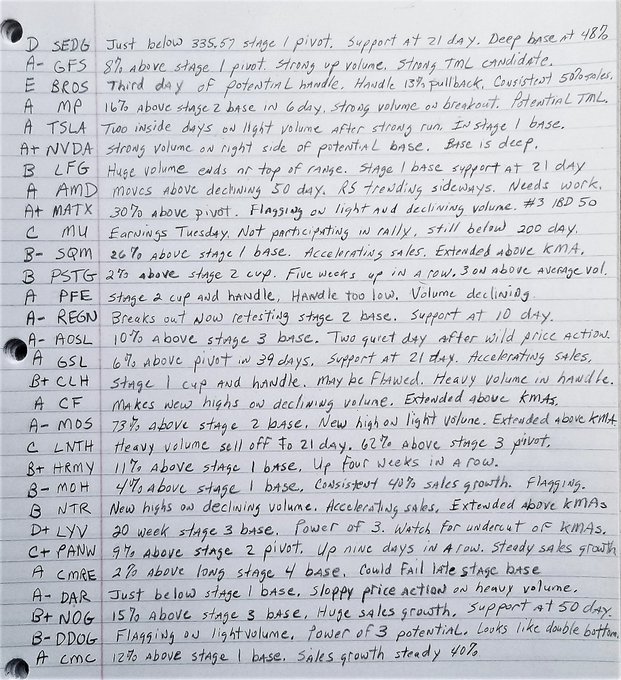

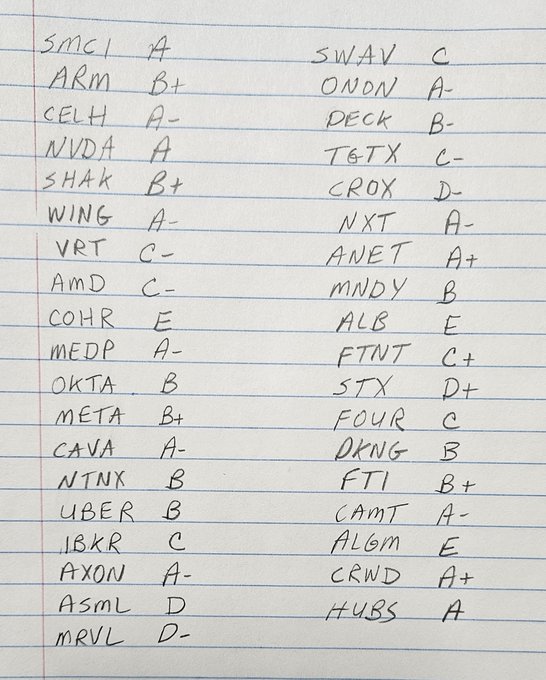

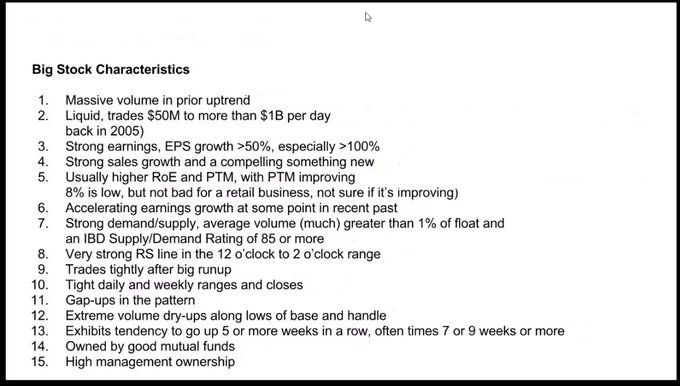

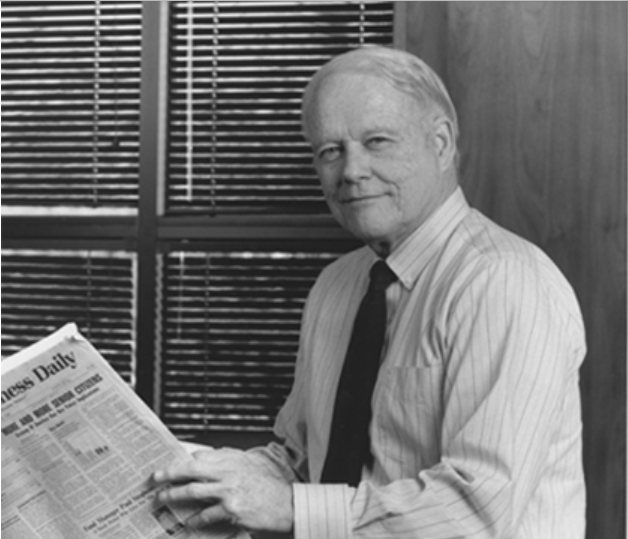

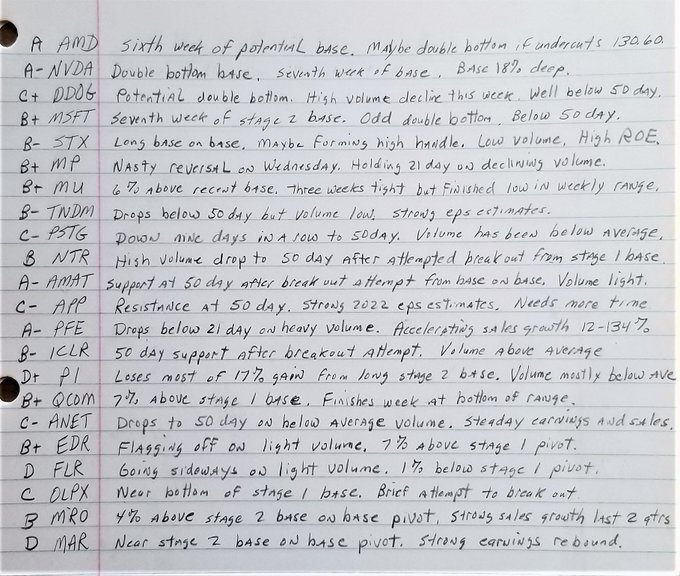

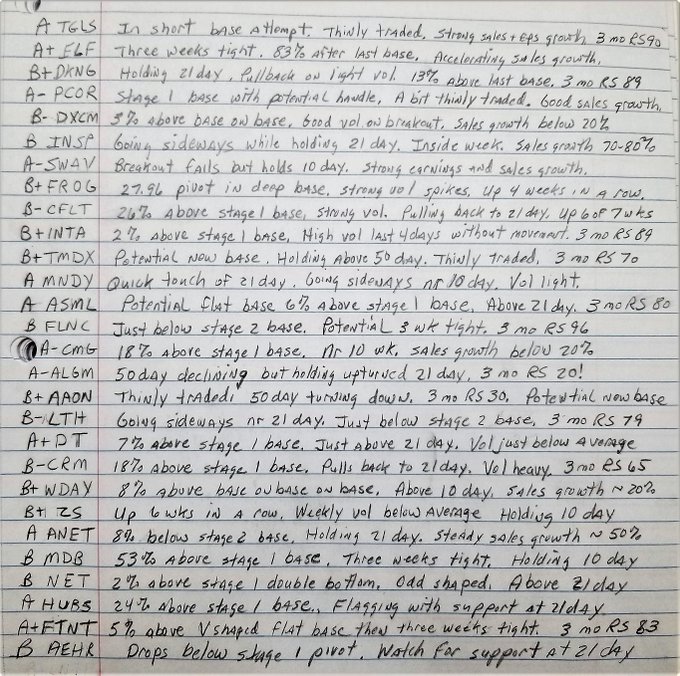

Happy Birthday to the 🐐 William O'Neil. I've personally learned so much from him.

@IBDinvestors

2

15

195