First Close Partners

@close_first

Followers

2K

Following

5K

Media

99

Statuses

2K

First Close Partners strives to make VC more inclusive. We back venture funds owned by underrepresented managers (“URMs”), esp to help them to a “first close.”

NYC & SF Bay

Joined December 2020

😳 thanks @ychernova & to our partners: @thebetsyz @tgr @reginabenjamin @joshk @EdGrapeNutZimm @pjparson @bibicheri @tyahma @MorganCheatham @batmelon (more coming).

First Close Partners backs diverse VCs. The group already invested in two dozen funds & plans to back 60 this year. "We’ve seen instances of our money being dramatically multiplied by other LPs" @EdGrapeNutZimm @close_first .

5

12

61

RT @rquintini: I am thrilled to announce Renegade II, a $128M fund to invest in 20 category-defining startups! I’m honored to work alongsid….

renegadepartners.com

In 2020, when nearly every plane in the world was grounded, we gave the very first Renegade term sheet to a nascent aerospace startup. Since then, Air Space Intelligence (ASI) has signed customers...

0

4

0

RT @Open_LP: 1/ 🧵New @PitchBook data reveals that the journey from a first to a sophomore fund has never been more daunting. Historically (….

0

30

0

RT @EdGrapeNutZimm: Check out @LowensteinLLP's @VentureCrushFG Africa Global on 3 April in NYC (also by zoom) How Does Africa Create More #….

0

4

0

RT @AcrewCapital: Congratulations to @close_first on receiving the #DEI Impact Award from @nvca and @VCForward. Our Co-Founding Partner @t….

0

4

0

RT @VentureCrush: Please join our @VentureCrush 3/21 @ 5-8PM ET (Live) 5:30-7PM ET (Zoom).Venture Capital (Deals and Current Market), AI, &….

0

4

0

RT @close_first: @VCForward We so appreciate this recognition🙏 & your support🔦.We also appreciate the extraordinary underrepresented VC man….

0

3

0

RT @VCForward: Thrilled to announce @close_first as the 2024 #DEI Impact Award winner! 🎉Their industry leadership and support of our progra….

0

5

0

RT @EdGrapeNutZimm: So I need some help with questions for @JethaAfsane.(#AltaSemperCapital).@MarlonCNichols (of @MaCVentureCap @CornellMBA….

0

3

0

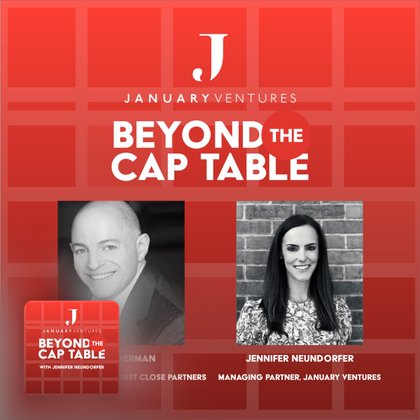

RT @jkk: 🎤 Listen on Apple Podcasts:

podcasts.apple.com

Podcast Episode · Beyond the Cap Table · 01/23/2024 · 37m

0

3

0

RT @jkk: Thank you Ed for such a powerful and personal discussion. Thank you also for your support of @January_VC and other emerging manage….

0

3

0

RT @jkk: Ed is a convener, a mentor, an advocate, and a champion for diversity. Listen in to hear: . 🔓How he broke into venture. 💵What he….

0

4

0

RT @jkk: I’m honored to welcome @EdGrapeNutZimm to Beyond the Cap Table! Ed is a longtime venture lawyer at @LowensteinLLP, he's a prolific….

0

5

0

RT @VentureCrush: Please join @VentureCrush on Wed, 1/24 @ 1:30-6PM ET (NYC) OR 2-3:30PM ET (Zoom).W/ @hanstung (@GGVCapital) @JethaAfsane….

0

4

0

RT @Beezer232: For those of you that can't get enough of all things venture - huge shout out to @EdGrapeNutZimm's deep dive 🧵 into @close_f….

0

4

0

RT @EdGrapeNutZimm: @MoniqueWoodard Great questions @MoniqueWoodard. Our @close_first 750 VC fund data set had funds w/ a 1% fee that we se….

0

2

0

RT @MoniqueWoodard: I wonder if there were other factors consistent across funds who charged lower than average fees that led you to not co….

0

3

0

RT @EdGrapeNutZimm: If you'd like our🧵on VC manager DPI based on funds in carry in our pre-@close_first portfolio, see👇. Also, we'll post a….

0

1

0

RT @EdGrapeNutZimm: Our analysis in this thread did NOT review fees stepping down over time, though we do regularly see management fees dec….

0

1

0