Sightline Climate (CTVC)

@climatetech_vc

Followers

13K

Following

430

Media

83

Statuses

1K

A climate-first market intelligence platform powering the leading voice in climate tech

Joined June 2020

We're proud to unveil Sightline Climate, our new market intelligence platform for the new climate economy. Built on the foundation of the @climatetech_vc newsletter, our product provides data and frameworks to bring clarity to the climate transition. https://t.co/agRh0oBUyN

sightlineclimate.com

A market intelligence platform bringing clarity to the new climate economy.

5

15

77

Full circle moment chatting with @climatetech_vc about raising @planeteercap Fund I — from first close during the SVB collapse, through the sentiment full rotation rollercoaster, to what’s next at the intersection of climate and fintech. https://t.co/GA9add5LgW

ctvc.co

Q&As with Sophie Purdom, who just closed first-time Planeteer Fund I, and John Tough, who recently closed Energize Capital's mega-fund Ventures Fund III

7

5

56

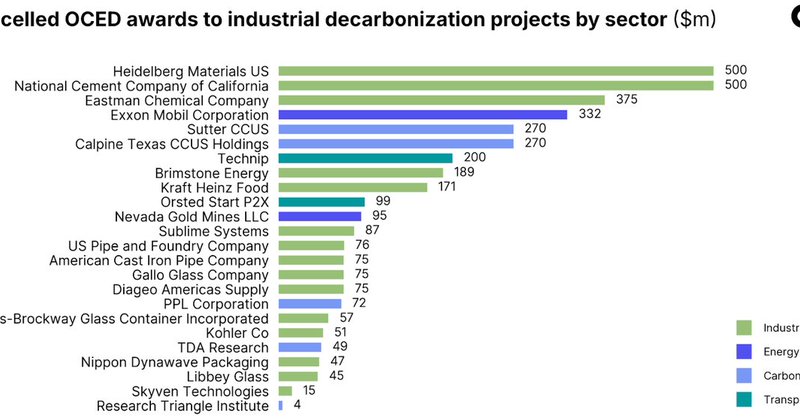

Our latest newsletter is out — with a deep dive into the industrial decarb projects that the DOE's OCED canceled funding for, the deals of the week, and more:

ctvc.co

Federal funds canceled for clean cement, steel, heat, CCS projects

0

0

1

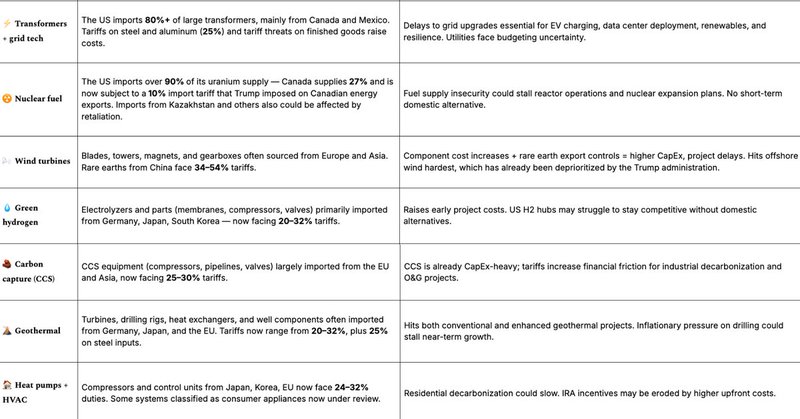

🌎 The tariff storm is hitting climate tech hard: 🔋 US tariffs on Chinese lithium-ion cells +64.5% ☀️ Tariffs 36-46% on SE Asia tariff imports 💽 Semiconductors: Exempt for now, but future ones possible. Plus deals, jobs, events & full story:

ctvc.co

The tariffs' toll, explained sector-by-sector

0

1

6

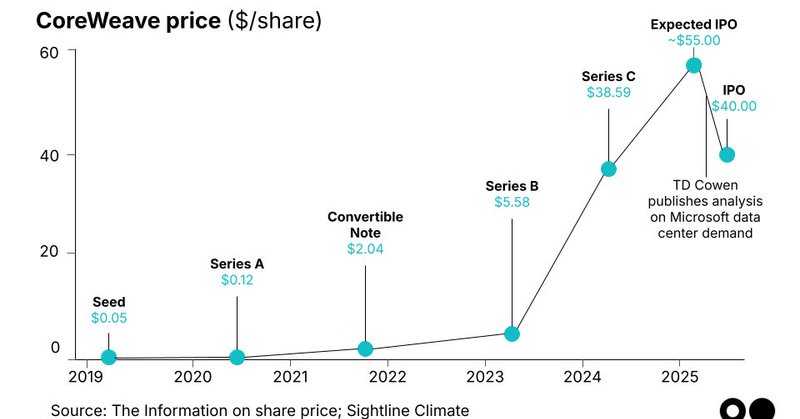

🚨 CoreWeave's IPO faltered — what's the fallout for climate tech? Our latest newsletter has a deep dive, jobs, events, & deals like: ⚡ $122m for fusion (for @MarvelFusion) ⚡ $50m for renewable energy & storage 🥩 $29m for lab grown meat Read here: https://t.co/O8NjyiAk5h

ctvc.co

The AI company’s debut shows where the chips are falling

0

0

1

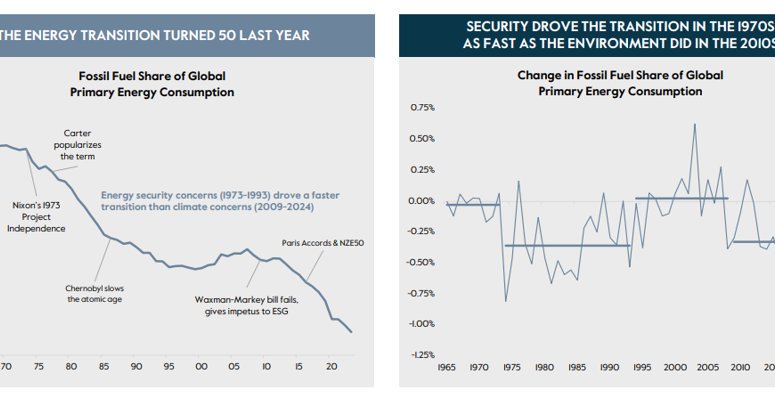

⚡ Climate’s out. Security’s in. Welcome to the New Joule Order. Our takes on the new @OneCarlyle report, plus climate tech deals, events, jobs, and more! https://t.co/NR3Paderlx

ctvc.co

A new Carlyle report maps the macroeconomics behind the shift from climate to security

0

1

0

In our recent member Q&A we discussed fusion investment trends with Guy Cohen, Senior Research Associate at @climatetech_vc. But how is fusion looking in relation to other sources of clean, firm power? Read our three key insights from the discussion here: https://t.co/NxOuiScPs6

0

3

5

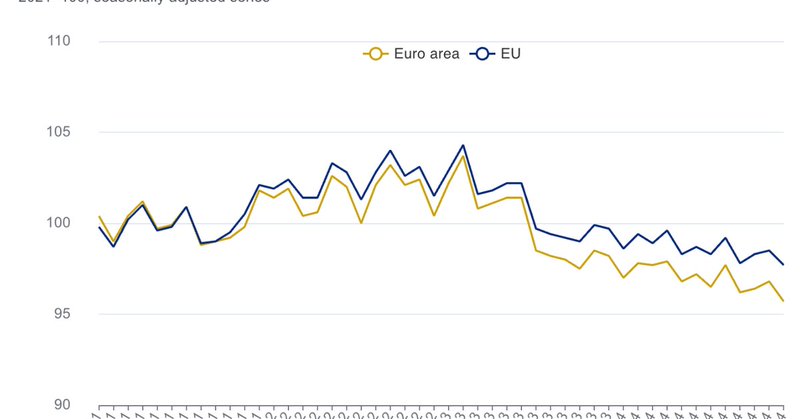

EU industrial output stalled-out in the race vs China & US. Maybe a revamped Clean Industrial Deal can jump-start productivity? @climatetech_vc tldr; 📝 cut reporting & carbon tax red tape 🏦 new €100b Decarbonization Bank ⚡ lower electricity prices https://t.co/gUzEAPghls

ctvc.co

Inside the EU’s €100bn plan to clean up industry

1

2

6

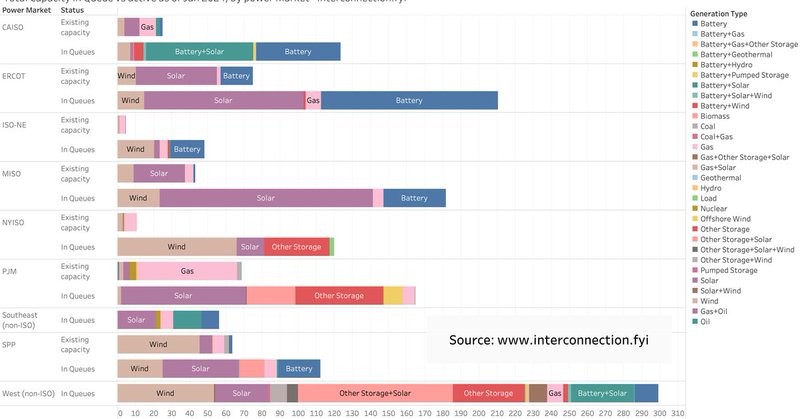

No transmission, no transition. We should put that on a shirt. Or start a cheerleading squad. In any case, capital goes where it can scale. IRA unlocked energy transition billions & FERC just locked it up again. More high-voltage drama @climatetech_vc

ctvc.co

Trump's new Executive Order puts FERC in the hot seat

3

2

14

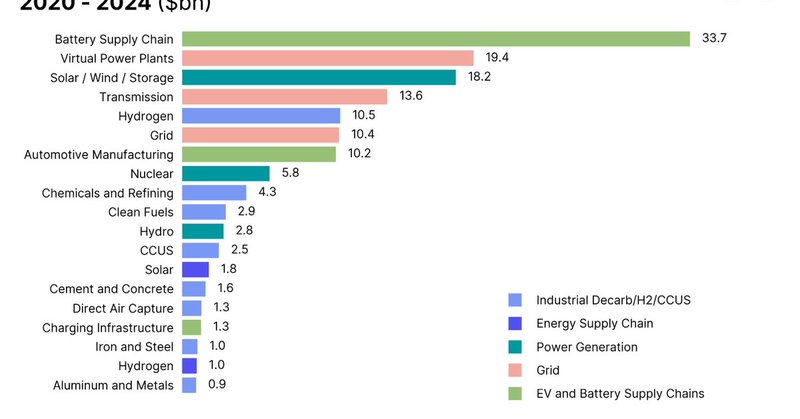

Trump’s federal funding freeze is a Schrödinger’s Term Sheet for climate: $145B in funding is both alive and dead until further notice. Red states may still get the green light on their $83B, but for now it's all eyes on DOE’s new fracking-friendly boss. https://t.co/OmI4A2ZdqS

ctvc.co

Inside the $145bn in federal loans and grants at stake

2

2

8

🚀 We’re excited to officially announce Sightline’s $5.5M Seed Round! 🚀 We’ve raised $5.5m in Seed funding to scale Sightline — our market intelligence platform powering strategic decision-making and capital allocation across the global transition economy. The round was co-led

2

1

17

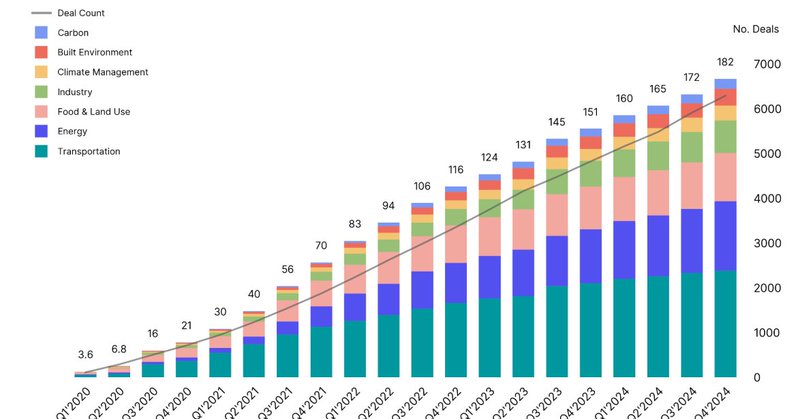

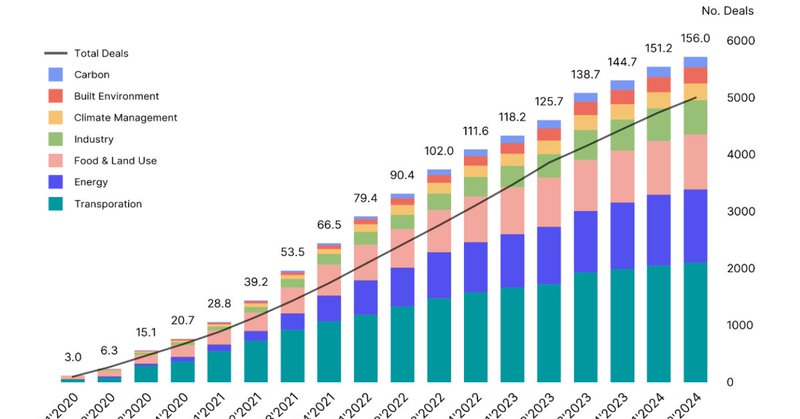

The balance of climate tech investment trends is shifting. For the first time since 2020, energy investments have overtaken investments in transportation, according to a report published today by @climatetech_vc: https://t.co/nnaKmoaLxU

latitudemedia.com

In the climate tech sector, energy investments overtook those in transportation.

0

2

4

Just dropped: @climatetech_vc's 4th (!) annual Climate Tech Investment Trends report. These are the charts that I’ll rely on throughout the year to predict where the venture market’s going and piece together what happened in 2024… aka the new normal. https://t.co/yFk0dPVwdp

ctvc.co

New year, new normal

2

5

23

It's here 🎉 our 2024 Climate Tech Investment report! New year, new normal for the sector. Check out all the data and insights here:

sightlineclimate.com

Gain a comprehensive overview of the latest trends in climate tech investment, including which sectors are getting the most funding, who's investing, and more. All backed up by Sightline’s underlying...

0

2

5

From the future of the IRA to impacts on key climate tech incentives and areas, BSP’s SVP James Prussing helps you understand and details what to expect from Trump 2.0 for climate tech in the latest @climatetech_vc newsletter:

ctvc.co

It's a setback for the sector, but not a full stop

0

1

2

We’re here to help you understand what Trump 2.0 means for climate tech. Read about the impacts, sector-by-sector, here:

ctvc.co

It's a setback for the sector, but not a full stop

0

0

7

It's live! ✨ NYCW x CTVC Events Tracker ✨ 📌 https://t.co/tkhQrNzRRc To help skip the hours of calendar coordination, we’ve built an open list of NYCW events tailored to climate tech founders, funders, and supporters. ~60 events listed already! Hope this helps 🚀

docs.google.com

5

9

41

It's nearly that most magical time of the year: New York Climate Week! Navigating NYCW can be overwhelming... 🙃 so @climatetech_vc & @planeteercap made a public events tracker to help Submit events today and keep 👀 tomorrow for the big schedule reveal!

docs.google.com

New York Climate Week can be overwhelming to navigate. CTVC manages this public-facing events tracker in the spirit of helping climate tech founders, funders, and supporters to find one another and...

2

8

52

The DOE is one of the largest climate tech investors in the world — and we spoke with decision-makers there about what goes into their investment decisions. Here's our guide for VCs to understand what gets publicly awarded, funded, and loaned, and from who:

0

0

3

If we’re being honest, we’ve all already felt this coming — but now the data is definitive. The H1’2024 climate tech funding market has fallen back to 2020 levels.

14

22

124

Today, we released our report on H1 2024 climate tech investment trends — it’s been another weak first half, but we’ve seen some strong plays. Check out our top charts, trends, and analyses of climate tech investment and deals of the past half-year here:

ctvc.co

Poor performance this half as investment falls to 2020 levels, but some strong plays.

0

0

7