Choice Mutual

@choice_mutual

Followers

31

Following

0

Media

5

Statuses

314

We are a nationwide final expense insurance agency. We compare the rates from all the top insurance companies to get you the best value.

675 W Moana Ln #101, Reno, NV

Joined August 2016

Today, we launched a revamped version of our funeral cost calculator. It's far more robust and allows you to estimate the cost of your funeral in the future.

choicemutual.com

Use our free funeral cost calculator to estimate the cost of your final expenses. It will also estimate the future costs based on inflation.

0

0

0

Seniors over 85 can obtain life and burial insurance. However, the options are limited, and only a few insurance providers will issue a new policy to people who are 86 or older.

choicemutual.com

You can get life insurance for seniors over 85. Learn which companies are available, the cost and how to apply.

0

0

0

Life insurance for children is very similar to adult life insurance coverage, but there are differences. Depending on your goals, buying a policy for a child may or may not be a good idea.

choicemutual.com

Learn how children's life insurance works, the pros and cons, requirements, see sample costs, the best companies & if it's a good investment.

0

0

0

Grandparents buying life insurance for grandchildren is a great way to give them a head start on their financial future. You can lock in extremely low prices, guarantee their future insurability, and help them build equity for college tuition or other major life events.

0

0

0

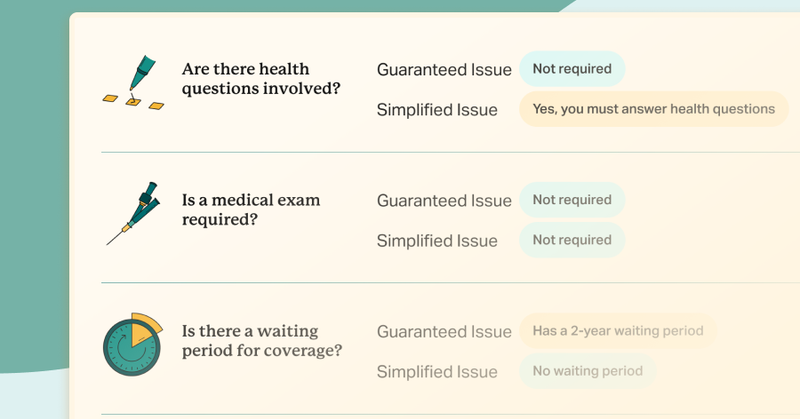

Guaranteed life insurance is a policy that will not deny you due to pre-existing medical conditions. In other words, your approval is guaranteed.

choicemutual.com

Guaranteed issue life insurance requires no health questions and no medical exam. You cannot be denied due to pre-existing conditions.

0

0

0

Funeral expenses are not tax-deductible for individuals, but they can be claimed on estate tax returns. This exception allows the IRS to calculate a decedent’s gross estate value and federal taxes owed.

choicemutual.com

Funeral expenses generally aren’t tax-deductible, but there are exceptions. Read on to find out what unique situations one can claim them.

0

0

0

We surveyed 6,000 Americans regarding their eco-friendly and alternative burial preferences compared to traditional options. We found that in 2024, 19% of respondents would choose a ‘Green Burial’ over a traditional one.

choicemutual.com

For 2024, we surveyed 6,000 Americans regarding their eco-friendly and alternative burial preferences compared to traditional options.

0

0

0

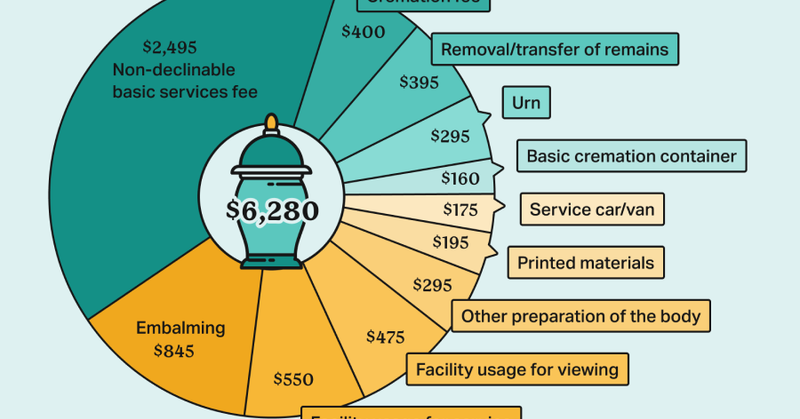

The National Funeral Directors Association reported that in 2023, the average cremation costs $6,280, which includes a viewing and funeral service. However, if you opt for a direct cremation, the average cost drops to roughly $1,924.

choicemutual.com

The average cremation costs $6,280, which includes a service and viewing. However, direct cremation typically only costs $2,000.

0

0

0

As of 2023, the National Funeral Directors Association (NFDA) reported that the average funeral costs $9,995, including a burial service, viewing, and vault. The average cost of cremation is $6,280, which includes a funeral service and viewing.

choicemutual.com

The average funeral costs $9,995 for burial and $6,280 for cremation. See a detailed breakdown of funeral expenses for all 50 US states.

0

0

0

Use our free funeral cost calculator to estimate your final expenses.

choicemutual.com

Use our free funeral cost calculator to estimate the cost of your final expenses. It will also estimate the future costs based on inflation.

0

0

0

Mutual of Omaha burial insurance is generally the lowest-cost option compared to other providers. Plus, there is no waiting period, and you can buy up to $50,000 in coverage if you work with an agent.

choicemutual.com

Learn how Mutual of Omaha burial insurance works, see the cost, pros and cons, how to qualify, and how they compare to other companies.

0

0

0

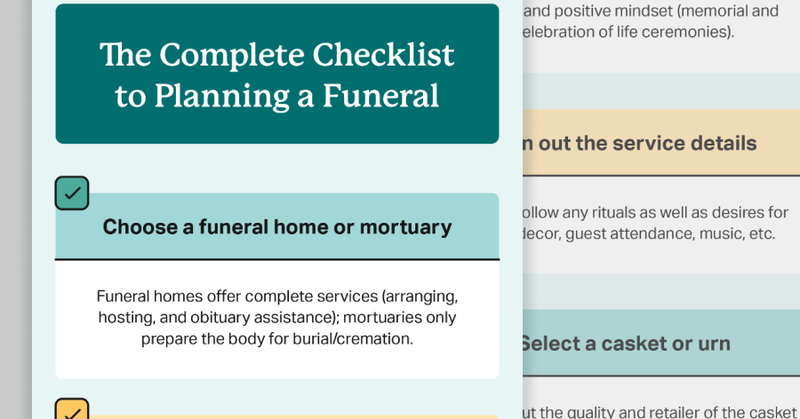

While death may not be your favorite topic to think about, what happens to your estate after you die is important to consider. Estate planning is the process of designating who makes decisions on your behalf, who receives your assets, and much more.

choicemutual.com

Planning your own funeral can help relieve loved ones of the expenses. Learn how to estimate funeral costs, service types, and more.

0

0

0

Only five life insurance companies will issue a new policy to an 86-year-old senior. Premiums at 86 typically range from $120-$320 monthly, depending on factors such as your health and gender.

choicemutual.com

Getting life insurance for 86-year-olds is possible. Learn your options, see prices, available companies, and how to apply.

0

0

0

87-year-old seniors are eligible for life insurance from a handful of providers, but the options are limited. Typically, it will cost $135-$310 per month, depending on factors such as gender and how much coverage you buy.

choicemutual.com

87-year-olds can get final expense life insurance. Learn what options you have at this age, the cost, the best companies, and how to apply.

0

0

0

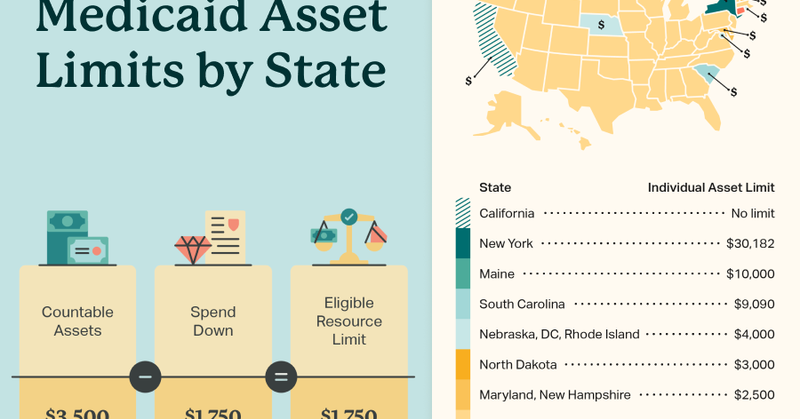

Each state determines how it manages its Medicaid program, including eligibility guidelines and coverage. Income limits typically float around $1,616 for an individual or 133% of the federal poverty limit (FPL).

choicemutual.com

Medicaid eligibility varies by state. Explore income limits, eligibility groups, and state-specific benefits before applying.

0

0

0

Only whole life burial insurance has no age limit and will last forever no matter how long you live. Term policies, on the other hand, typically have an age limit of 80 or 90, which is when the coverage terminates.

choicemutual.com

Learn which types of final expense insurance policies have no age limit, which ones do, and the best companies to consider.

0

0

0

Medicaid asset limits are common for seniors and disabled people applying for medical coverage. An individual can typically have $2,000 in countable assets, while couples can have up to $3,000.

choicemutual.com

Explore current Medicaid asset limits by state and learn about countable vs. exempt assets and how resource limits apply to eligibility.

0

0

0

Funerals are highly customizable to accommodate personal values, faith, and rituals. Families can opt for a formal funeral service, simple direct burial, or niche service like a green burial.

choicemutual.com

A collection of articles related to various end of life issues such as planning your own funeral, creating a will, or coping with the loss of a loved one.

0

0

0

While New York has significantly fewer final expense insurance companies than all other states, there are still plenty of plans available. Expect to pay roughly $55-$110 per month for a $10,000 policy.

choicemutual.com

Find affordable funeral insurance in New York from these top companies. See sample rates, policy details, and how much a funeral costs in NY.

0

0

0

The state of Kentucky has many top-rated burial insurance companies that offer affordable plans to seniors and young adults. The premiums tend to range from $50-$100 per month but can vary based on factors like the coverage amount and your age.

choicemutual.com

Find the best burial insurance companies in Kentucky. Also, see sample quotes, how burial policies work, and how much a funeral costs in KY.

0

0

0