Chainrisk

@chain_risk

Followers

8K

Following

7K

Media

443

Statuses

3K

Leading economic security solution for DeFi

Joined December 2022

Lending, But Safer 👀. With Chainrisk's risk monitoring dashboard for @SuperlendHQ, users can stay fully informed with risk metrics like:. → Market Utilization.→ Liquidation Events.→ Health Factor of All Wallets.→ Fluctuations in Borrow and Supply APRs

1

5

13

📢 New Market: LBTC on Superlend. @SuperlendHQ has listed LBTC on @etherlink market. Here’s what users should know:- . 🔸 Base Mode.→ Max LTV: 73%.→ Liquidation Threshold: 78%.→ Liquidation Penalty: 5%. ⚡ E-Mode (BTC correlated).→ Max LTV: 92%.→ Liquidation Threshold: 95%.

1

6

19

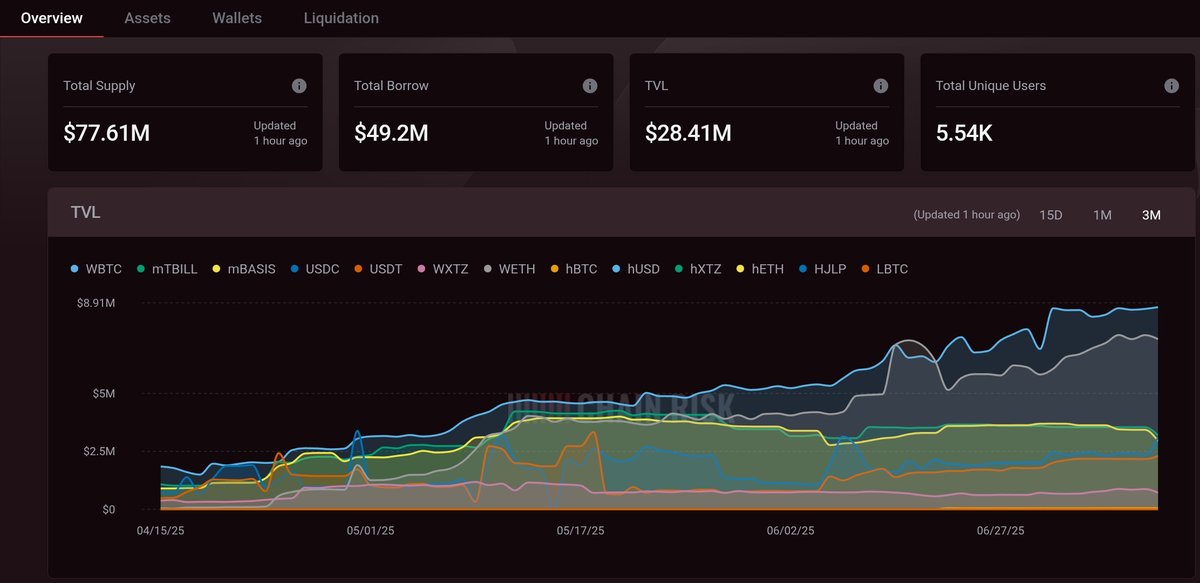

Gm guys! . Awesome news as @HanjiProtocol assets get listed as collateral on our partner protocol, @SuperlendHQ. Courtesy: Chainrisk Risk Dashboard for @SuperlendHQ (. Go and check out their @etherlink market, lend and borrow actively and take full

6

15

38

RT @swaylend: Partnership Announcement! ⚡️. We’re excited to partner with @chain_risk , a cutting-edge risk management provider that will s….

0

2

0

RT @PolynomialFi: You can’t scale perps without scaling risk systems. Polynomial now runs with @chain_risk, simulating risk in real time b….

0

6

0

RT @gauthamzzz: We're about to launch more markets, support more collateral, and scale faster at @PolynomialFi. Our new partnership with @….

0

3

0

RT @SuperlendHQ: Spoiler Alert: @HanjiProtocol LP Vaults are coming to Superlend Markets . Asset listing is underway, following a comprehen….

0

15

0

(7/11). Rates ≠ Risk Tradeoffs. Setting @SuperlendHQ's lending/borrow rates wasn’t a gamble. We used risk-calibrated algorithms to ensure:. - Competitive APY/APR.- No protocol exposure spikes. Result? Liquidation till date has been on a lower side. Liquidation Buffers:

1

0

7