Mike C

@blogboy2

Followers

188K

Following

499

Media

7K

Statuses

114K

An extraordinarily humble blogger for Sugar Pine Realty

Sonora near Yosemite

Joined November 2008

Median age of first-time a homebuyer in 1955: ~30 Median income for 30-year-olds in 1955: ~$2,800 ($33,850 inflation adjusted) These homes cost ~2.6-2.8x the median income of a median first-time homebuyer in 1955 ——— Median age of first-time homebuyer today: ~40 Median income

311

1K

7K

MARKET MOVERS: Even though the U.S. real estate market has posed significant challenges for potential buyers, some parts of the country have seen increasing home values. Here are the top 10 metros where home prices have surged the most since 2019: 📍Knoxville, TN — +86%

117

114

318

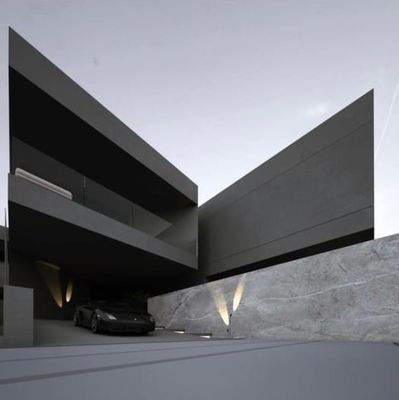

In the 1950s, an average working class man could buy this house, support motel guests and a stay-at-home mom.

865

2K

15K

The median age for home buyers has risen to an all-time high of 59, up from 47 in 2019, per BI.

154

383

3K

Warren Buffett's Berkshire Hathaway and Zillow say mortgage rates can't fall enough for Americans to afford a home, per FORTUNE

233

585

5K

Home sales are headed for their worst year since 1995, per Redfin

272

799

6K

Not even a 0% interest rate would make a typical home affordable in New York, Los Angeles, Miami, San Francisco, San Diego, or San Jose, per Zillow.

326

1K

9K

Reasons why people are backing out of home deals, per Redfin:

253

290

2K

73% of Americans think it’s a bad time to buy a house, per Fannie Mae.

240

303

4K

"As homeownership slips out of reach, more lower-income Americans are investing in stocks," per WSJ.

191

187

2K

Mortgage rates in the US have dropped to 6.17%, falling for the fourth straight week, per Reuters

100

168

2K

"About 56,000 U.S. purchase agreements were canceled in August, representing 15.1% of homes that went under contract. That’s the highest share for August deals falling through in records dating back to 2017," per FORTUNE

102

295

2K

"Would-be homebuyers are getting cold feet and backing out of deals at a record pace," per FORTUNE

130

275

3K

44% of US homeowners and renters are struggling to afford their regular rent or mortgage payments, per Redfin

342

1K

6K