Divya Gupta

@backtobasics_DG

Followers

389

Following

167

Media

34

Statuses

86

Not SEBI Registered | Swing Trader | Market Analysis |Stock Education |“Back to Basics – Fearless Trading”|

Joined March 2025

Hi everyone . "I know that many opportunities are open in the market but i am sharing only those in which i have invested.". So stay tuned for more analysis of the stocks. I am going to share my whole pf holdings analysis one by one 🙏😇.

1

0

17

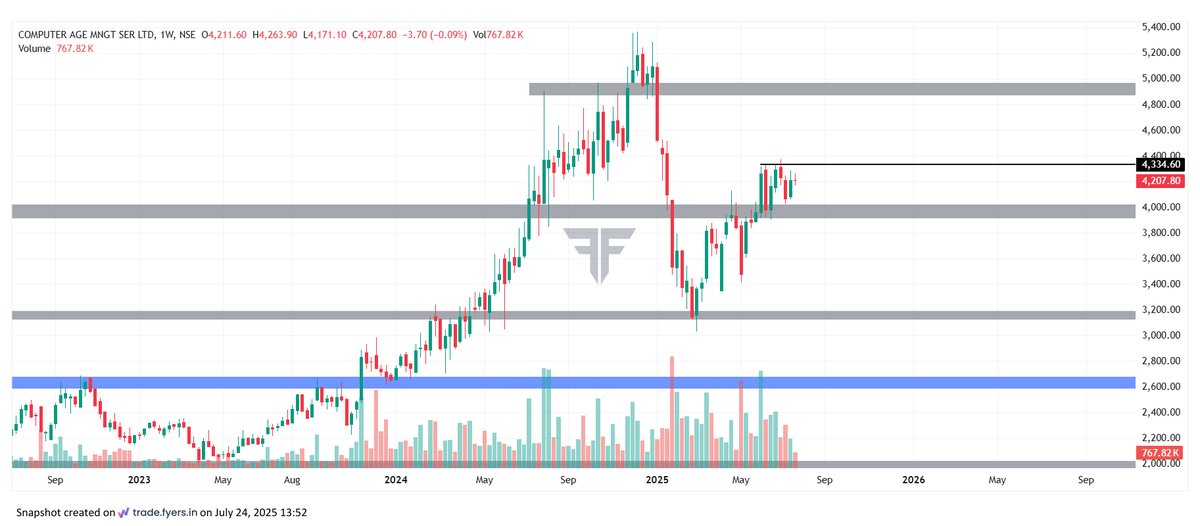

CAMS.Reminding the best opportunities. Just study the business model of cams and future of this business in india.Weekend the sahi istemal kijiye 🙏.V20 active ✅.Potential gains from CMP is around 48-50%. Disclaimer-For education purpose,not buy/sell recommendation,just study.

CAMS-Analysis.Strong base formed around ₹4000/-.Rising SIP inflows = steady AMC income.ROCE ~54.8%, ROE ~43.9%, almost debt‑free.Market dominance+high margins+robust growth=??.(can you complete above Equation, Do comments.).PS-Invested .Disclaimer-For education purposes only

1

0

14

CRISIL .1. Strategy: Support/Resistance and V20 active @TheVivekSinghal .2. ROCE- 35.6%, ROE-27.8%.3. Debt to equity- 0.11, Profit Prev. 12M₹-₹ 706 Cr.4. 13.21% Public Holding. FII's has increased their stake.V200 Stock with good fundamentals.Disclaimer- For education purposes

0

2

19

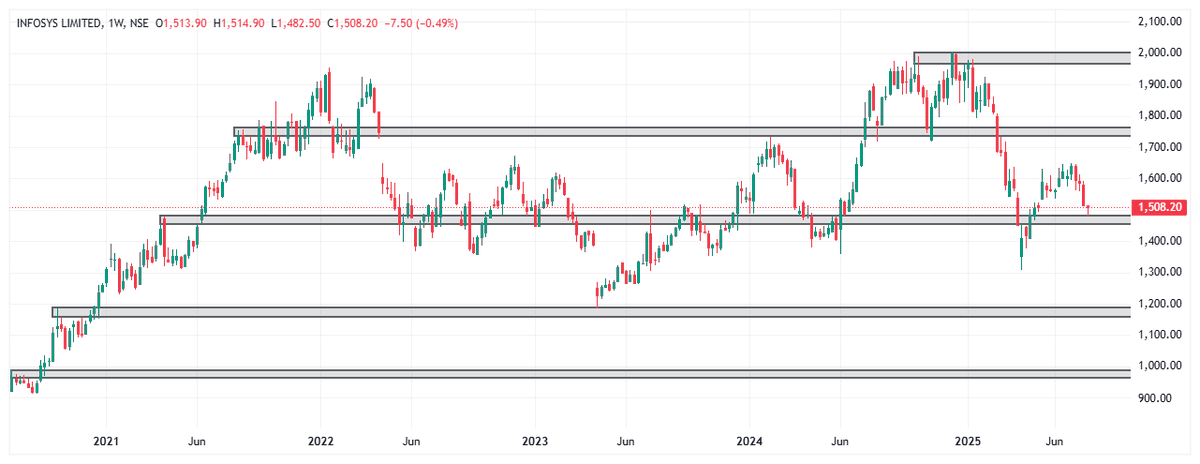

Infosys- Analysis.1. Strategy- S/R or Range Bound @TheVivekSinghal .2. ROCE-37.5 %, ROE-28.8 %. 3.Debt to equity-0.09, Profit Prev. 12M- 26,750 Cr. 4.Only 13.62% Public Holding. DII's has increased their stake. Other Imp. level~1200/-.PS. Invested.Disclaimer-For education purpose

0

2

17

Astral Analysis.1. Strategy- S/R and V20 @TheVivekSinghal .2. ROCE-20.3%, ROE-15.2%.3.Debt to equity-0.06, Profit Prev. 12M- 522 Cr. 4. Only 10.85% Public Holding. DII's & Govt have increased their stake. Other Imp. level is~1240/-.PS. Invested.Disclaimer-For education purposes

2

2

20

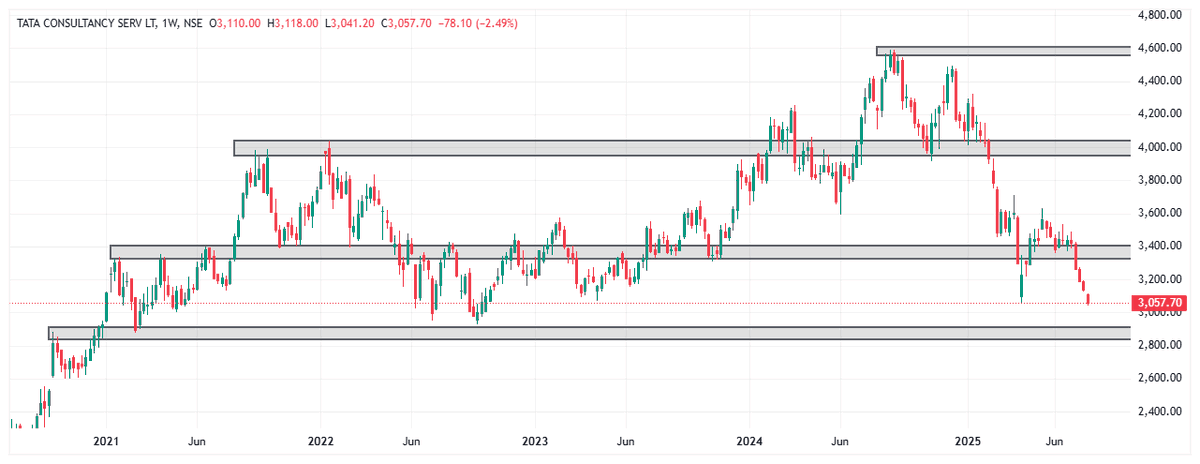

HCL TECH:CO ALSO LOOKS TO LAY OFF SOME EMPLOYEES:HINDUSTAN TIMES.Tata Consultancy Services(TCS)will reduce its global workforce by about 2%,during FY26:Money control reports. THESE NEWS CREATES PANIC AND TRIGGER THE BUY LEVELS:STAY ALERT (GTT PLACED).Disclaimer-Not buy/sell Reco.

Random Post~ ITBEES.No Explanation Needed .Try to understand The behavior of All IT companies. Good Opportunity may come As per Knox also. I am attaching a chart if IT Bees, Tell me are you able to see What I can see on the chart. @gargsahil840 shed some light. !!

0

3

12

SBI cards opened almost 6% down today . Is it an opportunity or we should wait for the entry/average ? . Important levels can be 815 and near 750. Keep in radar.

SBI CARDS- Analysis.Can this cross ₹1,100 again?.SBI Cards – India's Credit Powerhouse!.2nd largest issuer (18.9% share). Huge growth potential as card penetration <6%. "हम इस नाव में पहले से सवार हैं,.सवारी अपने सामान की खुद ज़िम्मेदार है।".Note:-Not buy/sell recommendation.

0

1

3

RT @TheVivekSinghal: Market rally is always like - 2 steps up, 1 step down. Currently, it is taking 1 step down. Nothing to worry.

0

90

0

Glaxo- Analysis.1. Strategy: S/R and CWH. 2. ROCE-63.2%, ROE-46.9%. 3.Debt to equity-0.01, Profit Prev. 12M₹-₹ 859Cr. 4. 12.41% Public Holding. FII's has increased their stake. Imp level~3450/- and 3050/-. PS. Not Invested. Disclaimer-For education purposes. @TheVivekSinghal

5

5

34

Havells- Analysis.1. Strategy:S/R and V20 in making. 2.ROCE-25.3%,ROE-18.8%. 3.Debt to equity-0.04,Profit Prev. 12M-1,470 Cr. 4.only 5.62% public Holding.DII's incr. stake. other imp. level~1500/-.PS.Invested and traded twice before. Disc.-not buy/sell reco. @TheVivekSinghal

2

4

39

MY GTT TRIGGERED . Disclaimer - For education purposes, not buy/sell recommendation. Please do your research.

Clean Science Same as New gen. 1. Valid V-20.2. ROCE-27.2 %, ROE-20.2 %.3. Profit Prev. 12M₹-264 Cr. 4. Debt Free Company. Many of us are applying RB But Confused Related To Financials improvement, in that case we can Avoid. I am Not SEBI Registered. DYOR

0

0

19

Random Post~ ITBEES.No Explanation Needed .Try to understand The behavior of All IT companies. Good Opportunity may come As per Knox also. I am attaching a chart if IT Bees, Tell me are you able to see What I can see on the chart. @gargsahil840 shed some light. !!

0

1

6

Dabur- Analysis.1. Valid SMA Active and S/R.2. ROCE-20.2%, ROE-16.8%. 3.Debt to equity-0.09, Profit Prev. 12M₹-1769 Cr. 4. only 5.69% Public Holding. FII's stake increased by almost 1%. other imp. level~500/-.PS-Invested .Disclaimer-For education purposes only. @TheVivekSinghal

0

4

23