Tanyu (τ,τ)

@axionyu

Followers

667

Following

1K

Media

215

Statuses

783

Building the best dTAO trading platform at @BackpropFinance @TensorplexLabs. Believer in the future of decentralised AI with Bittensor

Joined September 2024

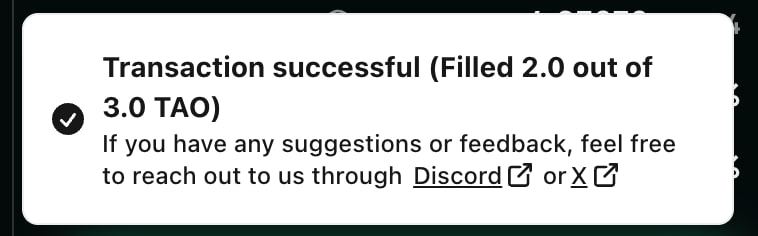

New features on Backprop Trading Terminal @BackpropFinance .- Anti MEV Mechanism (Set slippage extremely low to reduce the risk of Sandwich Attack) .- Allowing of Partial Fills (We will tell you in the notifications if it is fully or partially filled).- Faster transaction speed

2

1

13

There was a major Bittensor Chain Upgrade today, including native Uniswap V3, new 0.3% fees on all native staking and unstaking txns + anti MEV measures. We updated the Backprop UI to display the Bittensor Network Fee. Learn about the upgrade below ⬇️.

New Backprop UI Update: Now transparently displaying Bittensor network's standard fees: . Staking/Unstaking: 0.3% (standard network fee) . doesn't charge any additional fees on spot trades ✅

4

5

31

Interesting Bittensor Subnet updates for the past week:.@MetaHashSn73 Announces Decentralized OTC Marketplace for $alpha.@metanova_labs Adds 3B+ Molecules enabling silico synthesis for drug discovery.@ridges_ai Launches fully open source AI Software Engineer

3

6

33

Ever wondered what is the collected human feedback from Dojo (subnet 52) used for? . We are excited to release the DOJO-INTERFACE-CODER-7B Model that is trained on curated human feedback from Dojo Network. Supporting richer human-in-the-loop workflows and more modalities soon!!.

🚀 Tensorplex Dojo (Subnet 52) in action!. Meet DOJO-INTERFACE-CODER-7B:. Qwen2.5-Coder-7B-Instruct, fine-tuned with Dojo datasets to craft stunning front-end UIs!. ✨ Generates beautiful, interactive interfaces.✨ Trained on synthetic data with distributed human feedback.✨

0

1

12

RT @bittensorkr: 타오 생태계 대표 DEX @BackpropFinance, 드디어 한국어 지원 시작! 🇰🇷. 비트텐서 커뮤니티의 시선도 이제 한국을 향하고 있는 걸까요? 🤝.

0

1

0

Great to see more and more open sourced tooling solutions designed for Bittensor Network!.

0

0

0

Congrats to the Inference Labs team, also do check out the team's community good proposal (BIT0002: Proof of Weights) on how they aim to use ZK Proofs to fix weight copying issue on Bittensor Network (.

1/ Over the past year, we’ve been steadily building, and quietly backed by some of the strongest names in crypto and AI. Today, we’re sharing a milestone: over $6.3M raised to date across four rounds.

0

0

5