Absolute Strategy Research

@asr_london

Followers

5K

Following

64

Media

583

Statuses

3K

Europe’s leading independent investment strategy and economics research provider. Including: Global equity strategy, Economics, Multi-asset, and Climate Macro.

London, England

Joined February 2011

We are delighted to announce that for the 10th year running, ASR has been recognized by Global investors as Europe’s leading Independent Research Provider in the Institutional Investor All Europe Research Awards.

1

0

4

ASR's Co-Founder, @IanRHarnett , shared his insights at the Family Office Investment Forums in MEL & SYD. His session, "Crowded Trades, Golden Opportunities and Risks on the Horizon," revealed that Melbourne investors are more cautious about inflation & bond yields than those in

0

0

2

Final call to join 200+ global investors participating in our #AssetAllocationSurvey and share your perspective on the financial markets outlook for the next 12 months. All respondents will be sent the raw results within 24hrs of the poll closing, plus our full analysis from

0

0

2

The ASR Quarterly Asset Allocation Survey is now in its ninth year, and the Q1 survey had >220 participants with over USD $8 trillion of assets under management. Find out more here:

absolute-strategy.com

ASR's Asset Allocation Survey is a quarterly survey of investors. We map their view of the financial world in terms of probabilities. Become a Participant too.

0

0

0

ASR's @CharlesMCara asks: "In the last survey, stronger earnings underpinned our panellists increased optimism. After a strong Q1 results season, will our panel have even more confidence that earnings will grow?"

1

0

1

Taking just 5-6mins to complete, you can #HaveYourSay in ASR's Asset Allocation Survey for Q2 2024 today by clicking

1

0

0

If you are not already a client and are interested in a free trial of our award-winning research, please see: #Economics #China #CreditGrowth #FinancialMarkets #PBOC #EmergingMarkets #GlobalEconomy #EconomicInsights #Research #Bloomberg #USChinaRelations.

absolute-strategy.com

Contact the ASR team to register for a trial, or speak to our sales team about your investment strategy and research needs.

0

0

0

Additionally, in March this year, Wolfe was invited to testify before the US-China Economic and Security Review Commission of the US Congress. His detailed testimony and a recording of the hearing can be accessed here:.

uscc.gov

March 1, 2024

1

0

0

For those interested in Wolfe's broader insights on China's economic impacts, he has previously authored a piece titled "The Global Spill-overs from China’s Reopening". Contact us if you're interested in reading more.

absolute-strategy.com

Contact the ASR team to register for a trial, or speak to our sales team about your investment strategy and research needs.

1

0

0

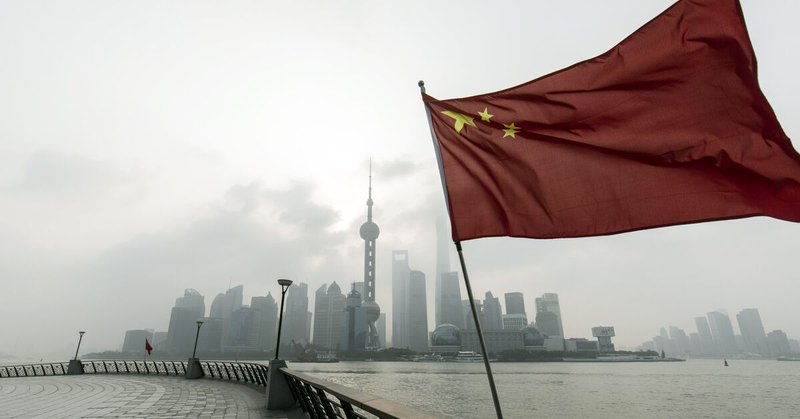

ASR's emerging market economist - @adamkwolfe was quoted in the latest @BloombergUK piece on China's credit engine. He noted that household savings, traditionally funnelled into property investments, are now entering the financial system.

bloomberg.com

China’s credit engine, which once powered industries and markets all over the world, is stuck in low gear – and set to stay there.

1

2

7

This survey is important as it provides an invaluable benchmark for investors as they reflect on their views for the rest of 2024 and into 2025. So please help us discover the consensus macro view by completing the survey later this week:

absolute-strategy.com

ASR's Asset Allocation Survey is a quarterly survey of investors. We map their view of the financial world in terms of probabilities. Become a Participant too.

0

0

0

ASR clients can read this report in full here: If you are not already a client and are interested in a free trial of our award-winning research, please see:

lnkd.in

This link will take you to a page that’s not on LinkedIn

0

0

0

Our latest #FunkyCorrelations by David Bowers is out | ‘Rules of Thumb for Busy Asset Allocators'

1

0

2

ASR Clients will have received this invitation via email: please check your email inbox for further details and the registration link. For all other institutional investors, please contact our Sales team:

lnkd.in

This link will take you to a page that’s not on LinkedIn

0

0

0