Alvin Hsia

@alvinhsia

Followers

4K

Following

32K

Media

154

Statuses

2K

cofounder @ventuals_ @shadowxyz, eir @paradigm

nyc

Joined April 2011

A market, an oracle, and a dream. One area where crypto has unmistakable PMF is in the creation and trading of new markets. Over the last few years, tokens, bonding curves, and AMMs have been the core primitives for this — great for minting net‑new, onchain native assets, and

56

81

443

was shooting for ~50 testers, and ended up with a few thousand. was a busier weekend than expected 😅. ty to everyone who tested and provided feedback. received videos, docs, slides, and even a figma(!). still working through dms, so apologies if i haven't gotten back to you yet.

12

2

113

Ventuals matches the public's interest in transformative technology with real, tradable markets. our first markets are perps for pre-IPO companies; a multi-trillion dollar asset class that most people have been shut out of. let's Make Private Markets Public.

Ventuals makes private markets public. Testnet live now on @HyperliquidX

24

11

139

hip-3 might be closer than you think. hip3rliquid.

Mor precompiles! Some new HIP3-aware Read precompiles that flew under the radar:. AccountMarginSummary: Get the account value, margin usage, and aggregate position info for a user . Token Supply: Get details about a token’s max supply, total supply, circ supply, emissions etc.

4

0

62

RT @ventuals_: We’re making private markets public. Soon, anyone will be able to trade startups before they IPO, something once limited to….

0

268

0

like tokens, perps will be recognized as one of the most impactful innovations of crypto. we’ve seen what happened when the friction to create new tokens dropped to zero. what happens when the friction to create new perps trends to zero?. PERPIFY EVRYTHING.

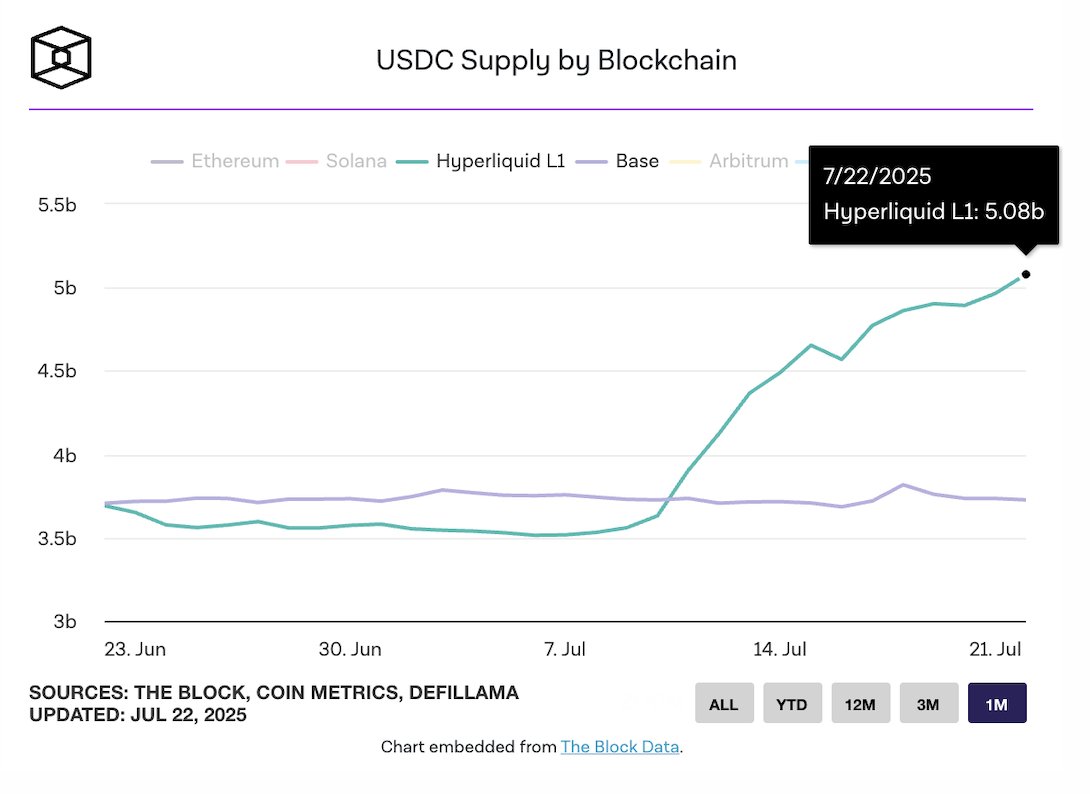

before tokenization: the perpification of everything. on why perps, not tokenized spot, is the real gateway to bringing RWAs onchain. and it’s already happening with @hyperunit (indexes), @ostiumlabs (equities + commodities), and @ventuals_ (pre-IPO stock) 🧵

6

0

15

IPO market structure is broken. compared to 1999:. - 35% fewer public companies today.- median age of tech cos at IPO: 4 years → 12 years.- median market cap of tech cos at IPO has gone from ~$500m to ~$2.4b. @ventuals_ is Making Private Markets Public again, on Hyperliquid.

5

4

47