Rafi

@_muhraf_

Followers

292

Following

7K

Media

447

Statuses

2K

Emerging Markets onchain data

Joined February 2025

Q2 2025: The State of Local Stablecoins (Non-USD) in Southeast Asia Thanks to @0xyuns who helped me shape this article! https://t.co/kWnovnIPPs

4

2

19

Non-USD stablecoin traffic is, in fact, very active

The conclusion that no one wants non-USD stablecoins is lazy. And it's wrong. It dismisses the need for significant participation from global economies. Using only current blockchain activity as evidence to support this conclusion is like staring at a single pixel and insisting

29

20

168

@Halko500k I think the logic here follows this line: traditional FX market depends mostly on liquidity of banks. Since global regulations disincentivize banks to hold non-USD inventory, non-USD corridors suffer from liquidity deficiency, resulting in high fees and large cross-rate spread,

1

1

1

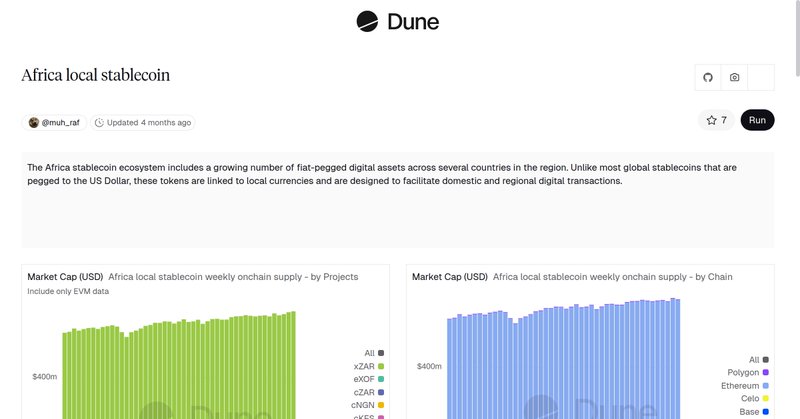

3/ The Latest on Celo: → Celo hit an ATH in stablecoin volume with $3.9B transferred for this month (source: @artemis) → Celo continues to lead Africa's local stablecoin landscape with over 90% market share (source @_muhraf_, @Dune) → @Valora team was acquired by Stripe,

Africa’s local stablecoin transaction landscape is still dominated by @Celo, holding 90% share on a weekly basis since October 2024.

1

1

5

The system design of Tempo is very thoughtful. Every TIP-20 token inherits the TIP-403 method (PolicyId), creating consistent policy enforcement. GG

0

0

0

Dev mode : on

Tempo’s testnet is live! Any company can now build on a payments-first chain designed for instant settlement, predictable fees, and a stablecoin-native experience. Tempo has been shaped with a wide group of partners validating real workloads including @AnthropicAI, @Coupang,

0

0

0

Great read on the state of Stablecoins in Southeast Asia. Non USD stablecoins are not a sideshow. They are becoming real settlement rails! 🔹 XSGD is the clear regional leader, boosted by Grab and Alibaba integrations 🔹 8 issuers across 8 plus EVM chains, yet SGD still drives

Q2 2025: The State of Local Stablecoins (Non-USD) in Southeast Asia Thanks to @0xyuns who helped me shape this article! https://t.co/kWnovnIPPs

2

1

15

found a pretty major data bug it turns out almost every major dashboard has been double-counting Polymarket volume (not related to wash trading) this is because Polymarket's onchain data contains redundant representations of each trade. receipts ⬇️⬇️

161

86

1K

@proofofjamal @0xMarcB @marcb_xyz @ViktorBunin 50%+ market share on local stablecoins volumes and transactions in latin america. Working on improving ramps with local stables +RTPs; non-usd forex and local stables structured yield products to keep winning in the region

0

1

4

More than half of stablecoin transactions in Latin America are consistently on Polygon You'll understand why at Money Rails in Buenos Aires next week. SIgn up in thread

NeoBanks are going to be targeting LATAM growth aggressively in 2026. Argentina inflation: Over 100% annually. Already over one in five adults own crypto. But over 50% of their crypto purchases are stablecoins. Not Bitcoin because they want dollar access. Plus Over 120 million

35

35

210

whats comes up must go down - whats goes down must comes up. "This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning " -Winston Churchill The market has always been like that. The longer your horizon, the better

0

0

0