jc

@_justinjc_

Followers

3K

Following

56K

Media

3K

Statuses

5K

Trading, Markets $spx #bitcoin @chainlink

Joined March 2021

SPX Dealer Delta Hedging Map📍. -there’s a line of hedging support running from 6380 to 6370 & into 6365 eod. above spot,resistance from dealer hedging begins around 6400 and in earnest above 6405 into the close. -lotsa call oi in the aggregate market above spot with 6400 the

SPX Dealer Delta Hedging Map📍. -heavy selling to hedge book deltas commences above 6340. below current spot price & into eod there is support around the 6310 +\- strike. further below, around 6290 +\- there’s a dealer path of least resistance. 6300 & 6350 are the dominate strike

1

2

9

IBIT Change in Contract Price . calls lost value above & below spot from 70-61 and sporadically further itm/down the chain. from 66-71 puts gained value & remained flat pretty much everywhere else on the displayed chain. 0dte 8/8.Change Since Session Open.🔵Puts 🟡Calls. 🧮

IBIT Change in Contract Price . -calls gained value up to 68 strike. 69 & above calls lost value. itm calls gained value steadily down to 62 & beyond, flat-lining below 60. puts itm & otm lost value bigly between 70-60. further below only moderately lost value. above 71 no change

0

1

3

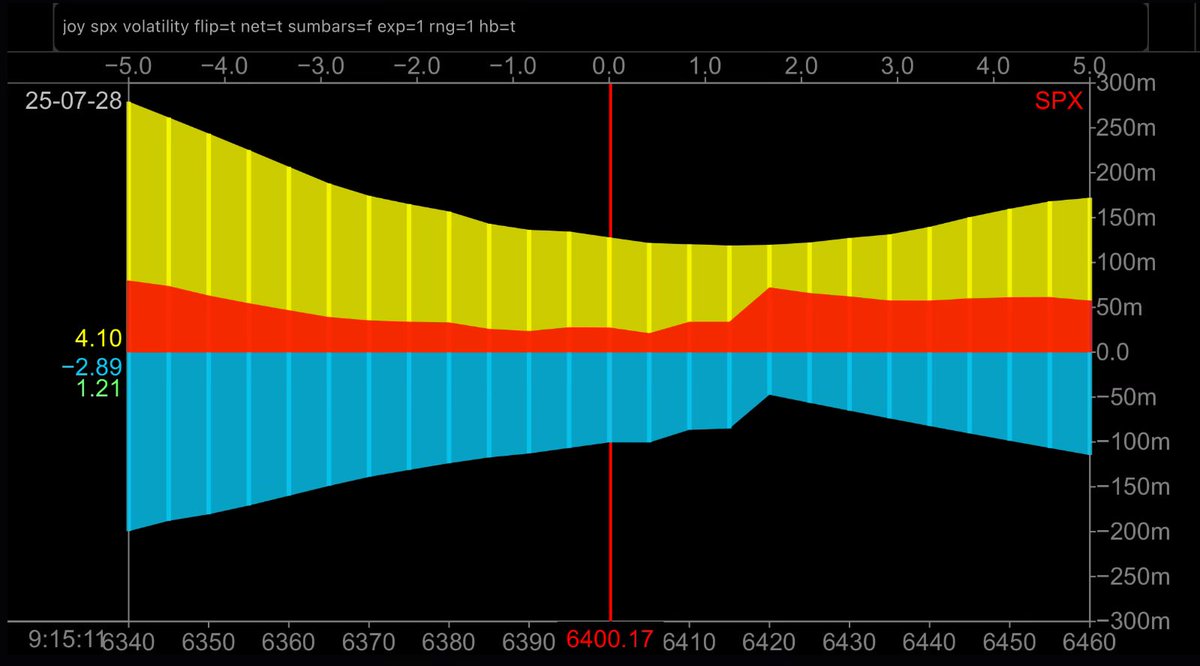

SPX Strike Implied Volatility. -call vol picks up above 6400 as put vol is favored directly above & below current spot price . 🟡calls 🔵puts 🔴(call-put). 🕳️ @ConvexValue .$spy $spx 🪦

SPX Strike Implied Volatility. -calls are favored and iv peaks above spot at 6420. iv changes with the animal spirits, these levels can shift throughout the session. 🟡 calls 🔵 puts.🔴 net. 🌂 @ConvexValue .$spy $spx ⏳

0

1

6

SPX 0dte Premiums. big money strikes:6370-90.puts edging out calls: 6345-40. puts flipped for display .🟡calls 🔵puts 🔴(call-put). 🧲 @ConvexValue .$spy $spx 🪛

SPX 0dte Premiums. big money strikes 6375-85. puts edging out calls 6370-6350 & calls pickup at 6300 & below . puts flipped for display .🟡calls 🔵puts 🔴(call-put). 🖼️ @ConvexValue .$spy $spx 🧬

0

2

4

RT @acllc2: UST 30yr Auction Results:.4.813%.2.1 bps tail.BtC 2.27.Indirects 59.5%. UBU5 trades down half a point (16/32nds) from 1pm mark.

0

7

0

SPX Flow ♾️. -volatility rips higher this morning as deltas melt away with spot price. Prop3 is positive & moved in divergence to deltas & spot for the first 90 min of session. been chopping sideways for an hour now but the positive direction and bulk total should be enough for

SPX Flow ♾️. -volatility dropped off the open as deltas were flat but began cranking up the prior hour. interestingly the Prop3 calc took a dump in the prior 15 min & is negative for the session. is this foretelling of a spot high of the day or .possible pullback looming? . 📦

0

2

6

SPX 0dte Volume . itm puts in charge up to 6360+ .with big otm downside strikes between 6340-00. otm call strikes towering at 6380-6420, peaking at 6400. cumulative session volume .puts flipped for display .🟡calls 🔵puts 🔴(call-put). 🪜 @ConvexValue .$spx $spy

1

1

5

RT @chainlink: We're excited to announce the launch of the Chainlink Reserve, a new upgrade centered on the creation of a strategic onchain….

0

1K

0

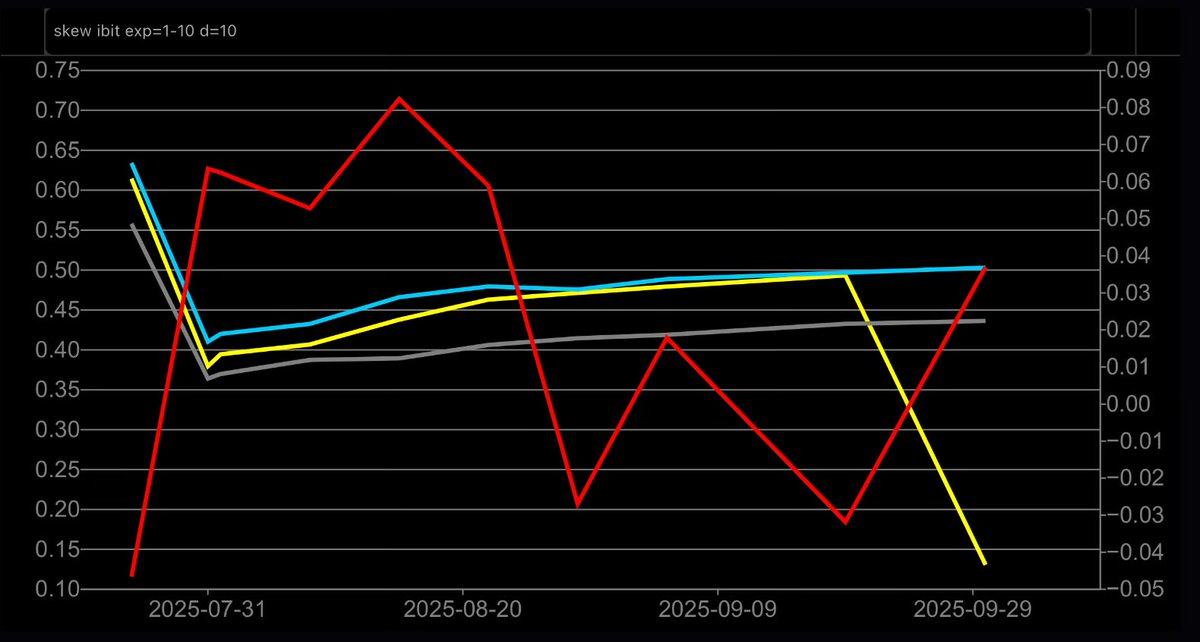

IBIT Skew. -35 delta calls are favored with a higher iv than both 35 delta puts & atm strike thru september. traders are gearing & leaning to the upside with the iv structure in contango post-opex 8/15. -skew continues to move further negative across the timeframe as call iv out

IBIT Skew. -10 delta vol drops into fed meeting & eom suggesting a limited implied range. thru august iv creeps slow and steadily higher with put iv richer than calls & both higher than atm. -skew tightens into september and after labor day. 9/19 september opex is the day after

0

1

5

IBIT Delta Notional . 8/8 & 8/15 expiry. this friday, calls in charge up to 68 and dominate below spot across the displayed chain. for 8/15 august opex, the put wall pushes up to 70. 66 strike dominates both expiry. calls > puts roughly 2:1 for both expiry . 🟡calls 🔵puts

IBIT Delta Notional . puts take charge at 66-68-70 with calls sticking out at 67, then taking over from 65 and below. 68 is the most balanced major strike for tomorrow. calls > puts 1.8:1. friday 8/1 expiry. 🏜️ @ConvexValue .$ibit $btc 🛖

0

1

3

SPX Dealer Delta Surface ☎️. -Market Makers add positive delta (buying) to hedge their book on spot moves down to 6280ish. further below and they begin adding negative delta (selling) and will assist downward price action. above spot they’ll be adding negative delta (selling)

SPX Dealer Delta Surface ☎️. -Market Makers add positive delta (buying) to hedge their book on spot moves down to 6285ish. further below and they begin adding negative delta (selling) and will assist downward price action. above spot they’ll be adding negative delta (selling)

0

1

8

SPX 0dte Premiums. big money strikes 6375-85. puts edging out calls 6370-6350 & calls pickup at 6300 & below . puts flipped for display .🟡calls 🔵puts 🔴(call-put). 🖼️ @ConvexValue .$spy $spx 🧬

SPX 0dte Premium . 6300-10-15 & 6230-20.big money strikes, thus far . puts flipped for display . 🟡calls 🔵puts 🔴(call-put). 🪠 @ConvexValue .$spy $spx 🧬

0

2

8

SPX Flow update . Prop3 chops sideways & still.negative as spot price ranges into the final hour. deltas continue to grind higher while volatility moves sideways. the big drop in Prop3 this morning foretold a waning upward move for spot price. 🪩 @ConvexValue

1

1

7

SPX Flow ♾️. -volatility dropped off the open as deltas were flat but began cranking up the prior hour. interestingly the Prop3 calc took a dump in the prior 15 min & is negative for the session. is this foretelling of a spot high of the day or .possible pullback looming? . 📦

SPX Flow ♾️. -volatility ran up off the open but been sideways for the prior 90min. deltas keep sliding down alongside the Prop3 calc. that’s deeply negative but flat in the 45min. 🎞️ @ConvexValue .$spx $spy 📟

1

2

10

SPX Dealer Delta Surface ☎️. -Market Makers add positive delta (buying) to hedge their book on spot moves down to 6285ish. further below and they begin adding negative delta (selling) and will assist downward price action. above spot they’ll be adding negative delta (selling)

SPX Dealer Delta Surface ☎️. -Market Makers add positive delta (buying) to hedge their book on spot moves down to 6290ish. further below and they begin adding negative delta (selling) and will assist downward price action. above spot they’ll be adding negative delta (selling)

0

3

7

IBIT Implied Move 📆. 8/8 expiry.70% likely range:.62.99-66.61.(btc 110,484-116,833). 9/19 expiry .70% likely range:.55.7-74.59.(btc 97,697-130,830). red number is the atm straddle 🔴. 🔶 @ConvexValue .$ibit $btc

IBIT Implied Move 📆. 8/1 expiry.70% likely range:.64.39-69.21.(btc 113,383-121,871). 8/15 expiry .70% likely range:.61.33-72.56.(btc 107,995-127,770). red number is the atm straddle 🔴. 🔶 @ConvexValue .$ibit $btc 🟧

0

1

5

SPX Delta Notional 0dte . -puts in charge across the displayed chain except 6190-6200-50-75. puts > calls 2:1. 🪣 @ConvexValue .$spx $spy 🧹

SPX Delta Notional 0dte . -index set to open up around 6340. towering spike of call delta 6350-65, further above and itm puts are in charge. below spot, itm calls are supportive with puts making a stand at 6295-90. 🧯 @ConvexValue .$spx $spy 💡

0

3

4

SPX 0dte Premium . 6300-10-15 & 6230-20.big money strikes, thus far . puts flipped for display . 🟡calls 🔵puts 🔴(call-put). 🪠 @ConvexValue .$spy $spx 🧬

IBIT Premiums prior 15 min 💸. big money:.65-68.5-69 call strikes.66-67, 70 put strikes . calls > puts 1.2:1. 8/1 expiry . 🟡calls 🔵puts . 🫘 @ConvexValue .$ibit $btc

0

3

5

IBIT Open Interest Change. 8/8, 8/15, 9/19 expiry . overnight change in open interest . 🔵puts 🟡calls . 🔭 @ConvexValue .$ibit $btc 💣

IBIT Open Interest Change. 65.5-66.5, 69 are call strikes added on while 64 & 60 put strikes added bigly. 64 strike calls taken off . 8/8 expiry . 🔵puts 🟡calls . 🎃 @ConvexValue .$ibit $btc 🍊

0

2

3