ZenomTrader

@ZenomTrader

Followers

4K

Following

8K

Media

614

Statuses

3K

Managing $4,900,000 in funded capital! 2-year track record! Edge Hunter!🚀 Sharing my growth journey! ⚠️Not financial advice! AI/Tech!

Joined January 2024

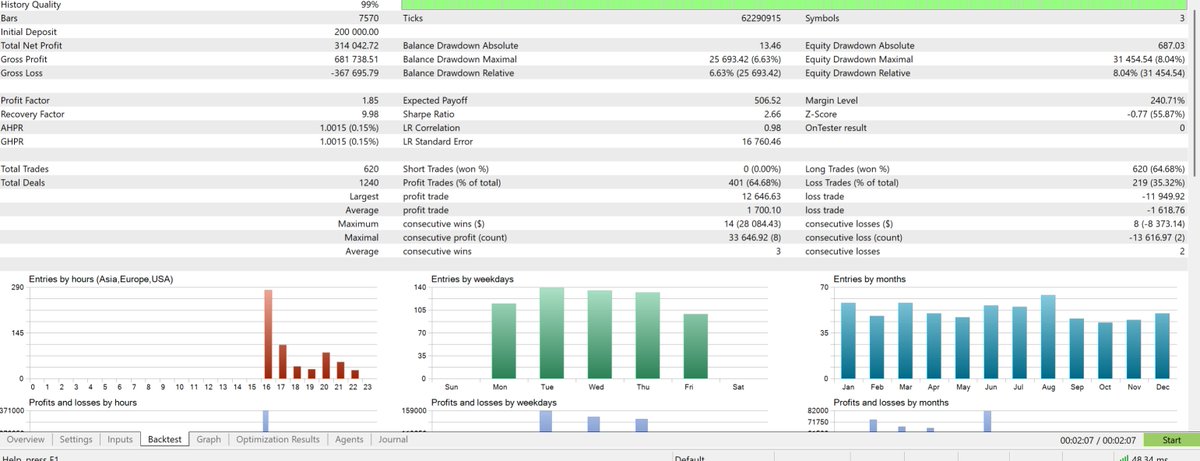

RT @Market_Emotions: Lots of people seem confused about the Game Master. How can you make lots of money on Prop Firms with a strategy that….

0

1

0