Yugesh

@Yugesh115

Followers

47

Following

207

Media

64

Statuses

123

ICAI | ICMAI Finalist | Investor | Trader| Option writer| Hedging. All suggestions are educational purpose.

Joined July 2019

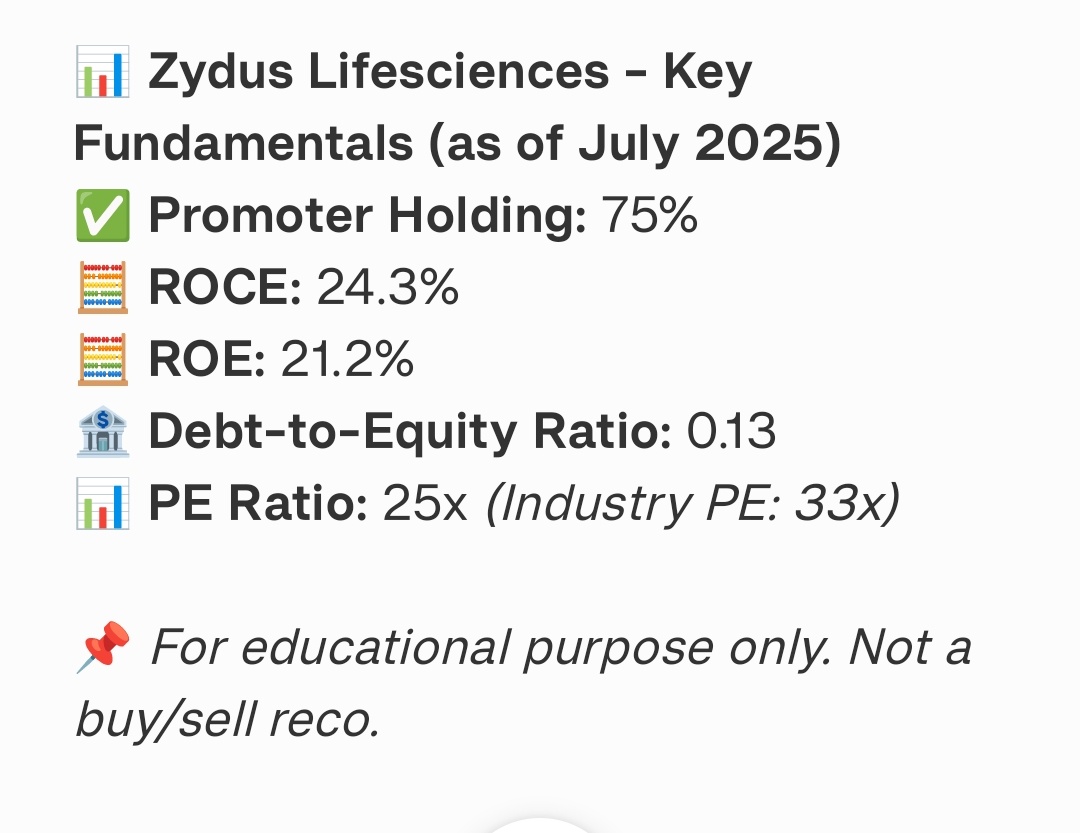

📈 Update: Zydus Lifesciences (₹958 → ₹1023) Recent high. ✅ ~6.8% move since my earlier post. #Zydus #PharmaStocks #StockMarket #Investing #shortterm #longterm Disclaimer: This is for educational purposes only, not a buy/sell recommendation.

📊 Zydus Lifesciences – Key Fundamentals (as of July 2025) #ZydusLifesciences #ZydusLife #StockMarketIndia #FundamentalAnalysis #CupAndHandle #TechnicalAnalysis #NSEStocks #IndianStockMarket #SwingTrading #BreakoutStocks #StockMarketEducation #InvestingTips #StocksToWatch

0

0

1

[6] ⚡Private Equity = Capital + Strategy + Discipline It’s how startups grow into giants before hitting the stock exchange.

0

0

4

[ 5] Exit via IPO Once the company is big & stable, PE firms sell their stake during an **IPO**. That’s when early investments pay off 💰. (Zomato IPO’d in 2021, giving exits to its PE investors)

1

0

3

[4] Value Creation PE firms focus on: * Better governance * Cost efficiency * Strong financial discipline This transforms startups into mature, IPO-ready businesses.

1

0

1

[ 3] *Growth Stage With PE backing, companies scale by: * Expanding operations * Entering new markets 🌍 * Acquiring competitors * Improving profitability (Zomato grew from a food discovery app → massive food delivery platform)

1

0

1

[ 2] Investment Stage PE firms invest in promising startups. They provide not just 💰 capital, but also: * Strategy guidance * Industry connections * Management expertise (Ex: **Zomato** received early PE backing from Sequoia Capital & Temasek)

1

0

1

Tweet 1 💼 Ever wondered how Private Equity (PE) firmsturn startups into billion-dollar companies that later list on the stock market? Here’s the journey from **Startup → IPO** (with a real example 👇) #PrivateEquity #IPO #Startups #Investing #Finance #zomato

#StockMarket

2

0

4

[4] ⚠️ P/E alone can mislead. It works best with other ratios (PEG, P/B, EV/EBITDA, Growth).

0

0

3

[3] 📌 How to Use P/E: Compare with industry peers Compare with company’s own historical P/E Use along with growth (PEG ratio)

1

0

3

[2] ✅ Interpreting P/E: Low P/E: Stock might be cheap, OR business has weak growth prospects High P/E: Stock may look expensive, OR investors expect strong growth So context matters.

1

0

1

[1] 📊 P/E Ratio Explained P/E = Price per Share ÷ Earnings per Share (EPS) 👉 It shows how much investors are willing to pay for ₹1 of earnings. Low P/E = undervalued? High P/E = overvalued? Not always! 👇 #StockMarket #Investing #ValueInvesting #FinanceTips #SmartInvestor

1

0

3

I applied for an IPO using my UPI ID, but shockingly my details (with my UPI ID) are showing up in someone else’s Demat account. Isn’t my UPI & Demat info supposed to be confidential? @kotaksecurities? @NSEIndia @BSEIndia @SEBI_India pls look into this. #IPO #UPI #StockMarket

1

0

5

✅ [ 7] These 5 ratios work best when used together, not alone. Starting tomorrow: detailed tweet on each ratio — with real-world examples. Follow along to sharpen your valuation skills

0

0

5

🔮 [6] 5️⃣ Earnings Growth 🔹 Future growth drives valuation 🔹 Strong growth + reasonable price = undervalued 📌 Upcoming tweet will explain how to use it

1

0

5

💰 [5] 4️⃣ EV/EBITDA (Enterprise Value ÷ Operating Earnings) 🔹 Includes debt — gives complete picture 🔹 Lower = relatively undervalued 📌 Detailed post on the way

1

0

0

🏦 [4] 3️⃣ P/B Ratio (Price ÷ Book Value) 🔹 <1 = undervalued (especially in banks/PSUs)

1

0

0

[3] 2️⃣ PEG Ratio (P/E ÷ Earnings Growth) 🔹 PEG < 1 = undervalued 🔹 PEG > 1.5 = overvalued ✅ Better than plain P/E

1

0

0

🧮 [2] 1️⃣ P/E Ratio (Price ÷ Earnings per Share) 🔹 Low = undervalued, High = overvalued ⚠️ Compare with peers & past averages 📌 Detailed explanation on the way!

1

0

0

🧵 [1] 📢 Want to find undervalued or overvalued stocks? Here are the 5 most important valuation ratios every investor should know 👇 (Detailed explanation of each ratio coming in next tweets) #StockMarket #Investing #FinanceTips #ValueInvesting #Fundamentals #SmartInvestor

1

0

8

6️⃣ – Final Note 📌 SEBI updates these rankings every 6 months (January & July). 📌 It's based on relative size (rank), not a fixed ₹ number. 📢 This thread is for educational purpose only. 💬 Like & Share if you found it useful! #FinanceIndia #InvestSmart

0

0

6