YourNest VC

@YourNestVC

Followers

3K

Following

802

Media

153

Statuses

1K

YourNest Venture Capital is a pre-Series A fund investing in 25-30 startups across the technology and technology-enabled spectrum.

Gurgaon

Joined March 2011

IDTA also proud to announce a second wave of members—Activate AI @ChirataeVC @InfoEdgeVC @Kalaari @QualcommVenture @SingularityAMC @YourNestVC together adding ₹7,500 crore (~$850M) in new commitments to India deep tech.

1

1

1

@ChirataeVC @InfoEdgeVC @Kalaari @QualcommVenture @SingularityAMC @YourNestVC @ESTIC2025 @PMOIndia @narendramodi @CelestaCapital Grateful to the conveners and partners of this week's events. @IndiaDST @PrinSciAdvGoI, and many more. Funds, technology companies, and like-minded organizations interested in working with IDTA, reach out 👉

idtalliance.org

An industry‑led consortium of leading Indian and Global Investors who have come together to accelerate deep‑tech entrepreneurship in India and align with national innovation priorities

0

1

1

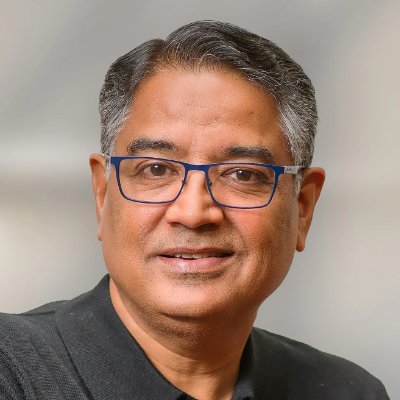

Sunil K Goyal on Conscious Capitalism and Building Global Market Leaders Read the full Interview: https://t.co/ShWMH4YSRu

0

1

2

In this edition of #TheContext by the Indian Venture and Alternate Capital Association (@IndianVCA), @skg69, Managing Director, @YourNestVC, explains why continuation vehicles (CVs) are emerging as a game-changer for India’s maturing venture ecosystem. With traditional exits like

1

1

3

The Indian Venture and Alternate Capital Association (@IndianVCA) Secondaries Conference 2025 in Mumbai brought together global and domestic leaders for in-depth exchanges on liquidity solutions, continuation funds, and the evolving role of secondaries in India’s private markets.

0

2

2

@skg69, Managing Director and Fund Manager, @YourNestVC: “Any property change to the activity vehicles that will bring some change, that will bring some relaxation on some of the GPs can opt for a longer resolution period. But the only aspect out there is that, there will be many

1

1

1

Panel Discussion: Continuation Funds: Unlocking Liquidity and delivering value takes centre stage at #IVCASecondaries2025 The panellists include: 📍Jason Sambanju, Co-Founder and Partner, Foundation Private Equity 📍CHENG Chee Mun, Managing Director, 57 Stars LLC 📍William Lo,

2

1

1

As India’s secondaries market gains momentum, IVCA Secondaries Conference 2025 will offer a vital platform for dialogue and collaboration among limited partners, general partners, family offices, and policymakers. @IndianVCA is pleased to have @YourNestVC as a partner at the

1

1

1

Indian Venture and Alternate Capital Association (@IndianVCA) is pleased to host IVCA Secondaries Conference 2025, in partnership with @MorganLewisLaw, @PwC, Foundation Private Equity, Madison India Capital, TPG NewQuest, @YourNestVC, and @BlumeVentures. The conference is a

1

1

2

India’s private capital ecosystem is maturing, and secondary transactions are becoming a vital tool for liquidity and fund restructuring. To spotlight this growing segment, the Indian Venture and Alternate Capital Association (@IndianVCA) is gearing up to host the IVCA

business-standard.com

Mumbai (Maharashtra) [India], August 19: The Indian Venture and Alternate Capital Association (IVCA), India's apex industry body for alternative assets, is set to host the IVCA Secondaries Conference...

0

1

1

Indian Venture and Alternate Capital Association (@IndianVCA) is pleased to welcome Sunil Goyal, Managing Director and Fund Manager, @YourNestVC, to IVCA Secondaries Conference 2025. 📍 Mumbai 📅 21st August 2025 🕤 09:30 AM Organised by IVCA, the summit will convene leading

0

1

2

Here's a list of funds backing pre-seed founders for India: - @AntlerIndia by @AntlerGlobal - @vaibhavbetter (BetterCapital) - Atom by @Accel - Surge by @peakxvpartners - Sonic by @ChirataeVC - Early stage deeptech program by @YourNestVC - DeVC(couldn't find Twitter

For any pre-seed founders exploring accelerators, this is my shortlist: • @HF0Residency (SF) • @southpkcommons (SF/NYC/Bangalore) • @Seqoia Arcm(US/EU) • @pearvc PearX (SF) • @AIgrant (global) • @Neo (SF) • @conviction Embed (SF) • @ycombinator (SF) • @FirstRound

1

1

8

“Deeptech today could be mainstream tomorrow,” says Sunil Goyal, MD & Fund Manager, @YourNestVC . At Startup Mahakumbh 2.0, Piyush Goyal’s remarks stirred debate on India’s readiness for deeptech, but stats tell a promising story. With over 3,600 deeptech startups and 100+

0

1

2

We are honored to have Sunil K Goyal, Managing Director & Fund Manager at YourNest Venture Capital, as one of our esteemed speakers at the Venture Intelligence Conclave 2025, proudly presented by Ascent Capital.

0

2

3

The day wrapped with a session on “Opportunities in Defence and SpaceTech,” moderated by Yachna Luthra (@IndianVCA), featuring @ashish__taneja (@growXventures), Cdr. Navneet Kaushik (@JamwantVentures), @Girishivani (@YourNestVC), Raj Sethia (@MKavachh), and Vinod Shankar

3

4

4

Indore’s Perkant Tech Secures ₹6.6 Crore In Seed Funding To Expand AI Health Diagnostics. https://t.co/6fjjkoi4wo

0

1

3

Investment secured by CCAMP startup @DozeeHealth from Catalytic Capital for Climate & Health, an impact-first vehicle by @Temasek Trust. Dozee, supported through the CCAMP C-TIP programme, is a pioneer in contactless patient vital monitoring and early warning systems for

0

3

5

🔹 Commander Navneet Kaushik (Retd.), Founder and Managing Partner, Jamwant Ventures 🔹 Girish Shivani, Executive Director and Fund Manager, @YourNestVC 🔹 Raj Sethia, Founder and Managing Partner, MountTech Growth Fund – Kavachh 🔹 Vinod Shankar, Founding Partner, @JavaCapital

1

1

1