XTAL Strategies

@XTALStrategies

Followers

54

Following

110

Media

23

Statuses

110

The Smarter Way to Navigate Private Market Illiquidity Risk - Benchmarks | Derivatives | Solutions

Milan | London

Joined August 2019

Thanks to @CAIAAssociation for hosting @mxsk1 our Founder's thoughts on the hot topic of private market liquidity. Is being patient a rational choice?

PE distributions at 50% of historical levels. IPO market shut. GP-led deals limited. Massimiliano Saccone of @XTALStrategies shares his thoughts on the "when & why" of selling PE interests in today's reality: https://t.co/g3A9Nb1ZgE

0

0

1

PE distributions at 50% of historical levels. IPO market shut. GP-led deals limited. Massimiliano Saccone of @XTALStrategies shares his thoughts on the "when & why" of selling PE interests in today's reality: https://t.co/g3A9Nb1ZgE

1

5

5

Il nostro CEO Massimiliano Saccone @mxsk1 inizia una interessante collaborazione con @Citywire_Italia ! Una rubrica per spiegare le complessità dei mercati privati! Buona lettura!

𝗡𝗲𝗹 𝗺𝗼𝘁𝗼𝗿𝗲 𝗱𝗲𝗹 #privateequity: una nuova rubrica curata da Massimiliano Saccone (@XTALStrategies) 🔎

0

0

0

Currently, no single performance standard captures the actual growth in wealth generated by a #PrivateEquity investment over time. To solve the puzzle @XTALStrategies launched the novel time-weighted metrics of #DARC (Duration-adjusted Return on Capital) https://t.co/M7qTZs3Yu8

0

0

0

Mind the DPI Gap. ⭐ If DPI (private equity’s Distributed over Paid-In ratio) is viewed as "the new IRR", it doesn't occur under the luckiest star... More here:

linkedin.com

⚠ Mind the DPI Gap. ⭐ If DPI (private equity’s Distributed over Paid-In ratio) is viewed as "the new IRR", it doesn't occur under the luckiest star, given IRR flaws. DPI and the need to generate...

0

1

2

Thanks for sharing the article and good catch to the authors! 📡 I was writing a quick post along the same lines yesterday (starting from certain private credit expectations). Here my thoughts: https://t.co/uTtKYDloSO 🔔 Bottom line, new private equity… https://t.co/6RwNTFoP9U

linkedin.com

Thanks for sharing the article and good catch to the authors! 📡 I was writing a quick post along the same lines yesterday (starting from certain private credit expectations). Here my thoughts:...

1

1

0

Definitely ! 💡 There is NO reason why illiquid / non fungible asset (like private market funds) should not have their risk easily managed with derivatives (like commodities, by the way). 🔔 Derivatives are about certainty of timely and quality deliver… https://t.co/5JN0mjp2Nk

linkedin.com

Definitely ! 💡 There is NO reason why illiquid / non fungible asset (like private market funds) should not have their risk easily managed with derivatives (like commodities, by the way). 🔔 Deriva...

0

1

1

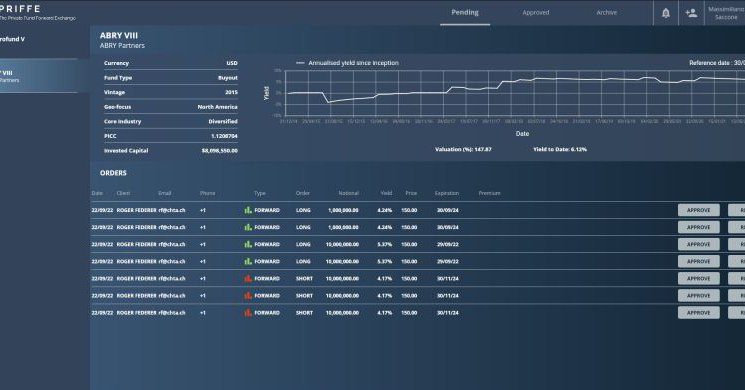

Very proud of the launch of PRIFFE. Illiquidity as well as market valuation risks are the problems that PRIFFE tackles. Liquidity unfortunately always dries up when it is most needed, making it harder to meet liabilities or to adjust allocations. PRI… https://t.co/1WbsAJKcf4

linkedin.com

Very proud of the launch of PRIFFE. Illiquidity as well as market valuation risks are the problems that PRIFFE tackles. Liquidity unfortunately always dries up when it is most needed, making it...

0

1

1

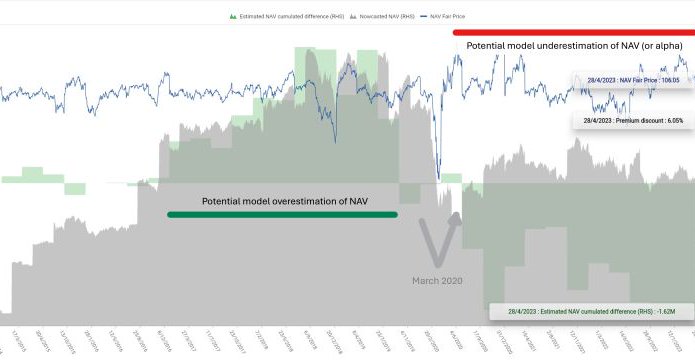

I can't say this is a a trend. Nevertheless, it is a framework to think about private equity valuation dynamics. NAVs' fair valuations can "happen to decouple" for various reasons from listed market movements. NAVs find it hard… https://t.co/gFMrVVrRx2

lnkd.in

This link will take you to a page that’s not on LinkedIn

0

1

1

Thanks to the participants to our Private Market Fund Derivatives webinar. We have strived to meet your expectations. That included serious efforts to maintain the #startup tradition of having a live software glitch "demoing" our platform #PRIFFE. We w… https://t.co/Yl0HCmzv6e

linkedin.com

Thanks to the participants to our Private Market Fund Derivatives webinar. We have strived to meet your expectations. That included serious efforts to maintain the #startup tradition of having a live...

0

1

1

Thanks @CFAAtlantic for sharing the thoughts and objectives on the topic that were kindly hosted by @Enterprising. Happy to engage in constructive dialogues with your members !! #privateequity #privatemarkets #NAV #valuation #riskmanagement

How can #investors price #NAV #valuations and efficiently transfer their eventual #risk? @mxsk1 digs in for @Enterprising

https://t.co/Q4W3LsLw4b

0

2

2

To hedge or not to hedge, that is the question. A bigger one in the #privatemarkets! Thanks for hosting my thoughts @Enterprising @CFAinstitute on the real question of efficiently managing allocations and forward looking returns in #privateequity. @XTALStrategies #PRIFFE

The debate about private market fund valuations and volatility has returned to center stage, Massimiliano Saccone, CFA, says. How can investors price NAV valuations and efficiently transfer their eventual risk? @mxsk1 via @Enterprising

https://t.co/8qMKYDBjFv

0

2

2

The debate about private market fund valuations and volatility has returned to center stage, Massimiliano Saccone, CFA, says. How can investors price NAV valuations and efficiently transfer their eventual risk? @mxsk1 via @Enterprising

https://t.co/8qMKYDBjFv

blogs.cfainstitute.org

How can investors price NAV valuations and efficiently transfer their eventual risk?

0

2

11

Great to see my thoughts on how to accurately measure #privateequity performance in the spotlight again. Thanks @CFAinstitute @Enterprising

#transparency #trust #investing #privatemarkets @XTALStrategies

The internal rate of return (IRR) has two major flaws, says Massimiliano Saccone, CFA: It doesn't tell when the average return starts to be earned or for how long. So what's the solution? @mxsk1

@XTALStrategies @Enterprising archives #privateequity

https://t.co/eUgTf3LlRk

0

2

2

Yep, you found us. THANK YOU. Getting ready to help investors, intermediaries and sponsors achieve more efficient private fund portfolio management!

Always good to welcome another #exchange to the parish. All the very best to The Private Fund Forward Exchange (PRIFFE). @XTALStrategies

#stockmarketnews #launching

0

0

2

@Enterprising @XTALStrategies The traditional approach of pooling cashflows distorts information more than the flawed averages (non-possible for money weighted metrics) it intended to fix

0

1

3

How can analysts keep accurate information from drowning in the private equity pool? Massimiliano Saccone, CFA, shares his perspective. @mxsk1

@XTALStrategies

https://t.co/oxnRzMhwfw

blogs.cfainstitute.org

What's most surprising about aggregated private market performance calculations? How deeply flawed they are.

1

1

3

Valuable insight from Vincent Gombault on the effect of mark-to-market on existing secondary portfolios via #SecondariesInvestor

#marketrisk #risktransfer #riskmanagement #valuation #privatemarkets #privateequity

lnkd.in

This link will take you to a page that’s not on LinkedIn

0

2

1

Thanks @preston_mcswain for drawing attention to the #DARC. Not simpler. But accurate, useful, unbiased, comparable. This is what @XTALStrategies has been aiming at. Performance #transparency creates trust advantages for the #privatemarkets industry.

Is there a better way? "We believe it would increase trust, putting both the industry and investors in a better position to form stronger, more lasting partnerships." A new approach to evaluating private investment returns from @mxsk1

https://t.co/AxWtAIAwo2

0

1

3