Winter Soldier ❄️🙋🏻♂️

@WinterSoldierxz

Followers

23K

Following

6K

Media

454

Statuses

4K

🦾 On-chain researcher with a S̶o̶v̶i̶e̶t̶ Wakanda metal arm Golden Degen’s bodyguard

Joined October 2022

Today @Circle has launched its cross-chain transfer protocol (CCTP). This will set new standards in pricing power and bridging monopoly for $USDC, which could be a 𝙙𝙤𝙤𝙢𝙨𝙙𝙖𝙮 for cross-chain bridges 🤯. A quick 🧵 on how CCTP works & its implications

105

319

2K

It's official: @synthetix_io has flipped @GMX_IO. Over the past two weeks, Synthetix recorded a trading volume of $2.1B surpassing GMX's $1.7B. Notably, Synthetix's volume was $300M just yesterday, 5 times higher than GMX's $60M. A thread on why👇🧵

49

111

556

1/ @CurveFinance secretly shipped TriCrypto-Token pool on @ethereum mainnet yesterday. This move is set to take Curve's composability & capital efficiency to the next level. How will this impact the Curve ecosystem and your $CRV & $CVX bags?. A short 🧵👇

28

104

429

1/ @fraxfinance’s staked $ETH performance has been nothing short of spectacular in the past 30 days. ~500% TVL growth. 9.3% APR (vs 3% on @LidoFinance). All this during one of the worst months in crypto history. Here’s how they did it. #FraxFinance #LiquidStaking #Ethereum.

17

87

434

An epic battle is brewing in DeFi. This saga, known as "The Liquidity Wars," tells the tale of intrepid innovators vying for supremacy in the realm of perpetual swaps. An in-depth review of the house pool designs in @GMX_IO @GainsNetwork_io and @synthetix_io 🧵

19

128

305

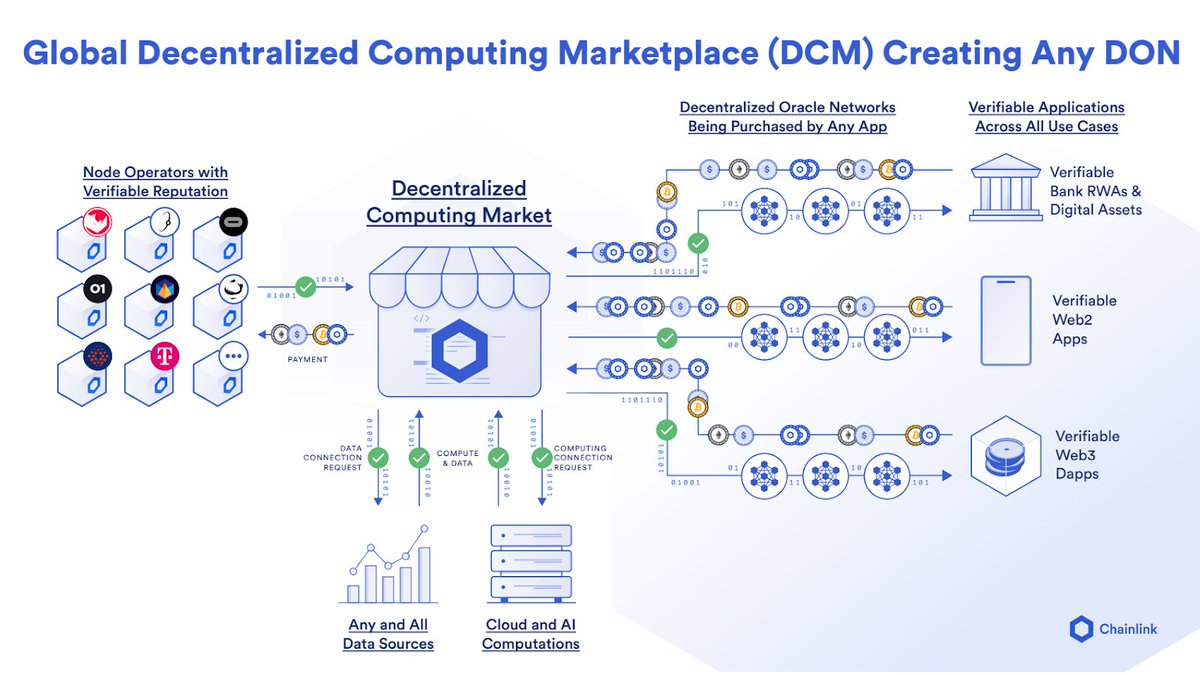

⚡️: 5 First Impressions from my Chainlink Rabbit Hole. 1. @chainlink is NOT an "oracle". • An ecosystem of thousands of decentralized computing networks. • Enables the creation of validator sets that handle a single specific offchain computation in a trustless and verifiable

31

71

299

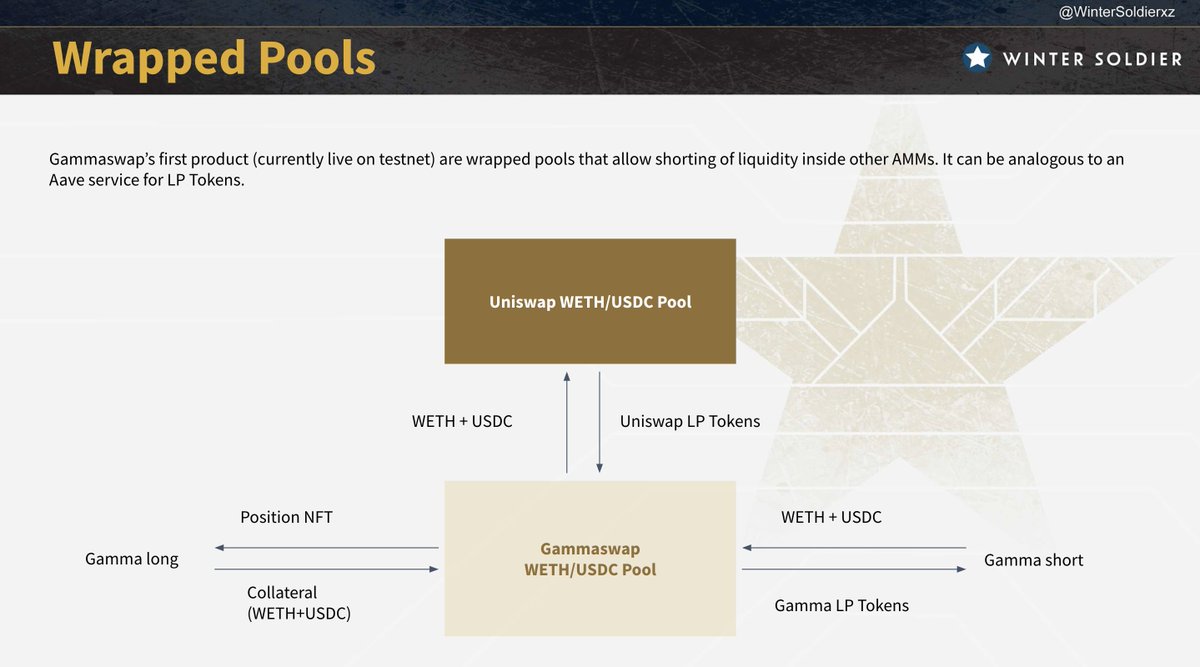

The innovation in @GammaSwapLabs will revolutionize LPing - one of the oldest #DeFi primitives. To help you understand what’s coming, I've created a 19pg research report you can get FOR FREE. All you have to do is:. 1. Follow me.2. Like + RT.3. Comment “Gamma”

198

227

248

Timeswap marks the dawn of a new era for onchain money markets. A multichain three variable AMM model free from liquidations & oracles, currently offering an unprecedented 40%+ APR for $USDC - $ARB. A thread on @TimeswapLabs loans & how I use them to lev. trade $ARB

13

54

237

The launch of @Synthetix_io V3 will revolutionize the perp trading landscape. Unlimited asset classes and multiple collateral options. Discover this game-changing upgrade to this DeFi OG in under 5 mins🧵

11

65

233

I spent 5 hrs on a 55-pg paper by Prof. Appel @UVA & Prof. Grennan @SantaClaraUniv on Decentralized Governance & Digital Asset Prices. Found valuable insights on robust DAO governance, with ve-tokenomics giants @CurveFinance & @ConvexFinance as highly relevant examples🧵💡

23

62

232

Much has been said about the 3X gas efficiency enhancement in @CurveFinance V2 TriCrypto-Token Pool. Yet few looked into the specifics. I spent 10 hours disentangling the complexities of TriCrypto from both mathematical and technical perspectives for ELI5. A gigathread 🧵

20

61

238

The next Curve war will be fought with $CNC. In a remarkable feat, @ConicFinance peaked at $64M TVL in 2 weeks of launch. How will it fuel the $crvUSD narrative and liquidity wars on @CurveFinance & @ConvexFinance?. Let’s dive in 🧵

7

60

240

1/ The more I research @fraxfinance, the more impressed I am of their DeFi product stack. Each vertical is embedded with innovation & meticulous strategic planning. I cover these in my full 36 page report on Frax published for FREE below ⬇️.

13

60

231

1/.EigenLayer will democratize ETH’s security for all onchain applications. Oracle & bridge exploits will become a thing of the past. With @eigenlayer, $ETH will secure their operations and users. Learn about this new frontier in protocol security in under 5 min🧵

21

62

234

Are options complex? I've got your back. I spent 60 hrs researching imo the best options protocol built on @Uniswap V3 and V4 - @Panoptic_xyz. And I distilled everything into a FREE 36-page research report for you ⬇️.◦ Options 101.◦ Market landscape.◦ Protocol mechanism

26

57

217

#LSDfi: A New Era of Stablecoins?. A 🧵 Exploring the Latest Developments and Complexities of LSD-backed Stablecoins: The Good and the Bad. (1/17)

26

51

194

Out of all DeFi innovation, nothing excites me more than @InfPools. Let me show you how to achieve unlimited leverage on ALL assets. Liquidation free. 🧵

20

47

198

Is @LiquityProtocol v2 Solving the Stablecoin Trilemma through Delta Neutrality?. This 🧵 will cover the key concepts of v2 which enables a decentralized reserve-backed, delta-neutral hedged stablecoin. TLDR: .• Abandon CDP and adopt reserve backing mechanism with 1:1 minting

26

38

183

1/ @GMX_IO's innovative design has allowed it to flourish into its own ecosystem through $GLP yield & ready-made delta-neutral strategies w/ @UmamiFinance @GMDprotocol @rage_trade. To help you learn how, I've published a FREE 59 page research report🧵👇

16

48

159

My comprehensive 39pg research report on @0xC_Lever & @0xconcentrator is finally ready!. Here's a teaser on @aladdindao for y'all🤝. If this tweet gets 100 likes I'll share the full report👀

9

21

164

.@allianceDAO's accelerator program is the best in crypto. Home to the likes of @synthetix_io, @dydx, @pendle_fi & @injective_. I researched their most recent cohort to look for hidden gems. The following three caught my eye 👀.

6

23

136

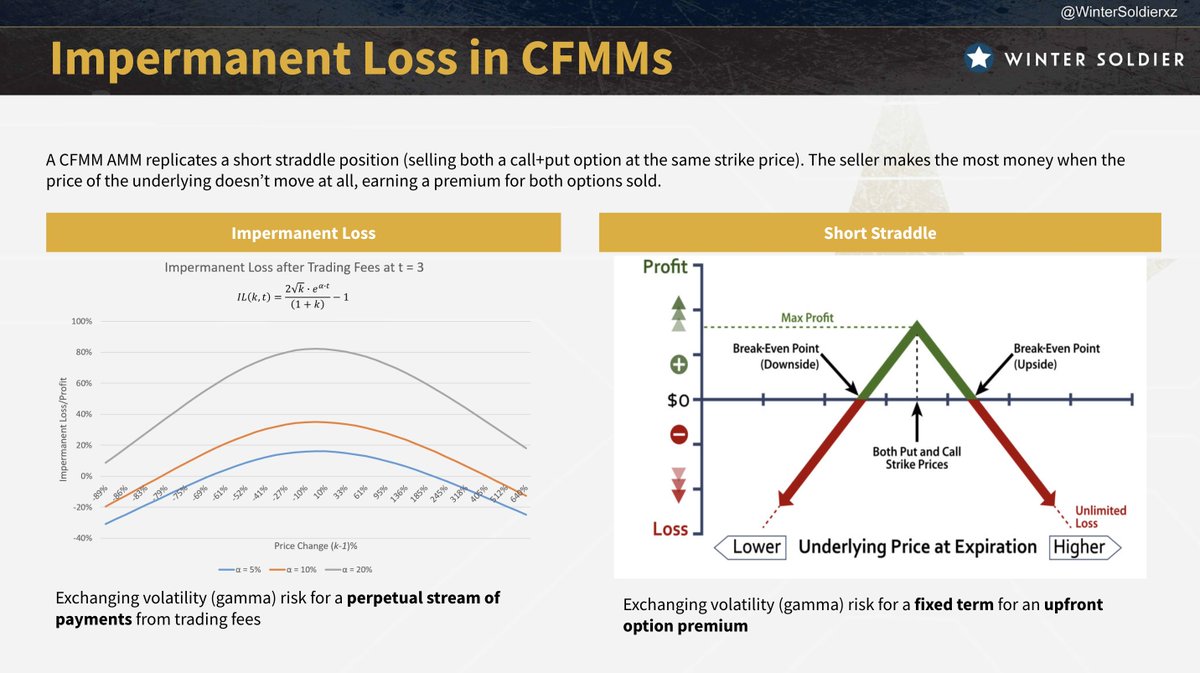

1/ For crypto LPs, impermanent loss is unavoidable due to volatility (gamma) of assets. But what if there was a way to long/short gamma? A way to earn extra yield and make impermanent gains?. Enter @Gammaswaplabs - the next primitive that will change DeFi forever. An ELI5 🧵

15

40

153

1/ @avalancheavax’s incumbent stableswap, @platypusdefi, is due for a MASSIVE upgrade in the next few weeks. To help you understand it, I’ve condensed hours of research into a simple thread and research report that you can get for FREE. Read this ELI5 thread to get ahead 👇

26

47

140

1/ The chads over at @DigitsDAO made 213 $ETH in 2 days back in Nov ‘22 betting on the $MIM & $USDT depegs. How, you ask? @Y2KFinance. Read this 🧵 to learn how you can hedge / speculate on pegged assets using this blood splattered, smiley faced protocol.

15

40

144

In just a week, @WombatExchange achieved 50M+ TVL on @Arbitrum. This low MCap gem stands out as the only stableswap distributing real yield revenue in stablecoins, solidifying its status as a bribing powerhouse. A 🧵 on how to turn a 10K initial capital into ~30K USD with $WOM

12

26

141

1/ As promised, here’s my brand new 22pg research deck for @gammaswaplabs. I’ve distilled hours of research into an institutional grade report that you can download FOR FREE. Volatility trading will undoubtedly be the next DeFi primitive. Read this deck to get ahead!

6

74

139

Around 60% of $crvUSD circulation is in @ConicFinance’s crvUSD Omnipool with an APR of 18%. Are we witnessing the perfect alchemy for optimizing $crvUSD usage and fuelling @CurveFinance’s liquidity layer?. A short thread🧵

7

33

140

1/ @DeFi_Cheetah is one of my most respected DeFi analysts. But in the spirit of fruitful discussion, I respectfully disagree with some points in his analysis of @CurveFinance V2 vs @Uniswap V3. A rebuttal🧵.

14

37

130

Which LSD-backed stablecoins @PrismaFi @raft_fi @LybraFinanceLSD @gravitaprotocol to choose?. I have compiled a 25 pg report comparing their product design, tokenomics, liquidation & peg mechanism. Complete LST stablecoin landscape covered in metrics. Best part. it's free ⬇️

22

36

128

1/ @GainsNetwork_io $GNS is now LIVE on @arbitrum & looking to continue their ATH numbers. In the past 2 months, #gTrade has seen.~$3Bn total trade vol.~$2M to $GNS holders. To help you learn the #GNS design that made this possible, I'm sharing my FREE 24-page research report🧵👇

4

33

129

If you’re a @CurveFinance LP on Convex, let me introduce you to @0xConcentrator & @0xC_Lever. Together, they form one of the strongest flywheels in DeFi. Learn how you can SUPERCHARGE your yield ⚡️

11

34

124

. @0xC_Lever & @0xConcentrator built a powerful auto-compounding liquidation-free leverage farm product that amplifies $CVX gains in a few simple clicks. To help you capitalize, I’ve distilled hours of research into an institutional grade report that you can download FOR FREE👇

13

34

121

1/ If you missed @GMX_IO, don’t miss @GainsNetwork_io. The biggest perpetual #DEX on #Polygon has been on a roll, achieving >$22bn in total trade vol. & $15m in trading fees accrued. With their recent expansion plans, they're not showing any signs of slowing down. A deep-dive🧵.

4

30

115

1/ @Y2KFinance offers an unprecedented DeFi structured product to underwrite/hedge against pegged assets, coupled with an all-or-nothing payout system that handsomely rewards degens and hedgooors alike. Go from zero to hero on @Y2KFinance with my 34 pg research report

10

23

115

There has not been any innovation for stableswaps since @CurveFinance until @WombatExchange. The stableswap had one of the most successful @arbitrum launches, amassing $20M+ TVL in >30mins. A 🐂 🧵 on WOM's innovation & future catalysts

10

33

107

As DeFi beckons institutions, @Binance decisively enters @CurveFinance's $CRV Wars & @WombatExchange's $WOM Wars, wielding $wBETH liquidity & incentives. A thread on how Binance is shaping the currents of liquidity wars🧵

13

28

102

.@Uniswap V4 presents two core innovations in the infrastructure for AMMs: Hook & Singleton. Are we witnessing the culmination of Uni forks?. Or is this just a transformative infrastructural upgrade?. A thread on Uni V4 from a technical perspective 🧵

11

24

103

Through @EigenLayer, oracles, bridges, even non-EVM modules, gain access to ETH’s trust network, enhancing security & innovation at an unprecedented scale. To help you understand this new narrative, I’ve distilled hours of research into a FREE institutional grade report 👇👇👇

7

32

97

If tokens = equity financing, the next frontier for protocols is debt financing. i.e. Issuing loans, instead of selling tokens. @tazz_finance stands out to me as the spearhead with its innovative perpetual debt primitive. A 🧵 on Tazz + the future of onchain debt finance.

18

15

90

1/ Loads of #FUD going around about @FTX_Official being insolvent. I’m not going to talk about that. Instead I want to get into the history of #Binance & #FTX, and how #CZ is playing chess with public opinion. A conspiracy 🧵.

4

20

84

LP management on @Uniswap V3 is complex. Some even say it's V3's fatal flaw. @MavProtocol's Dynamic Distribution AMM mitigates this shortcoming with an automated directional LP strategy, enhancing the accessibility & user friendliness in concentrated liquidity. A thread🧵

15

22

84

Can you automate arbitrage, LP farming, gauge voting, rewards compounding, and liquidation-free leverage into one scalable product?. If this sounds too good to be true, it’s not. Learn how to 100x your Convex yield with $abcCVX by @0xC_Lever & @0xConcentrator

9

26

85

1/ Uniswap vs Curve Part 2: Why @Uniswap fares better as DeFi infra than @CurveFinance. TLDR:.Curve is more innovative but Uniswap fares better as DeFi infra bc it.(1) Is sustainable & new entrant friendly.(2) Aligns incentives for stakeholders to create a more vibrant ecosystem.

9

22

89

The convergence of LSD & stablecoins goes beyond leveraging $ETH. Here's what everyone can benefit from:.• The bribe market of blue-chip LSD.• A capital-efficient flywheel.• Community-driven governance. A thread on why @PrismaFi will reign as the LSD primitive🧵

6

17

85

Why I think @Farcaster_xyz > @LensProtocol. 1. Decentralization is overrated. A decentralized social network has many requirements that are difficult to meet in a single system while guaranteeing a good UX. Users must be able to create, own, and transfer accounts in a.

8

12

73

Some claimed that DeFi would never break free from mass adoption. @CurveFinance proves them wrong!. 2 days ago, the Bank for International Settlements stated they were considering using Curve V2 HFMM to deploy wholesale CBDC and cited Curve Founder @newmichwills' paper in 2021.

3

12

81

Folks, Blur Lend has arrived. The @paradigm shift to the NFTfi space, built by @blur_io in conjunction with one of the inventors of Uniswap V3 - @danrobinson. It is poised to become the @Aaveaave of NFT lending, a product truly usable by borrowers and lenders. A thread 🧵

6

18

72

1/ Been seeing a few threads about the Optimism > Arbitrum flippening. User & capital inflow metrics are strong for @optimismFND, but @Arbitrum has more native protocol diversity and innovation imho. Here are five #Arbitrum native protocols you must keep your eye on

7

11

77

Among all structured products, @Panoptic_xyz stands out as a beacon of perpetual options: prudently crafted, permissionless and oracle-free. Its protocol design embodies unparalleled catalyst supercharging @Uniswap ecosystem. A 🧵 on how Panoptic pioneers composable options

10

18

81

1/ In less than 3 mos., @WombatExchange firmly sits at #3 in the list of DEXes on #BNBChain, with an ATH TVL of US$220m. A $10m swap only incurs $4.7k slippage vs $2.5m on #Pancakeswap. How is this possible?. 🧵A thread on how Wombat is re-engineering the stableswap experience.

14

19

66

5/ The obvious implication is that @Circle will likely monopolize the USDC bridging market. Cross-chain apps that are currently integrated with other bridges may soon hop over (Radiant, Sushi) due to cheaper transactions.

1

3

74

Past few weeks of trading on multiple L2s/L3s made one thing clear:. Multichain capital efficiency is crucial for the bull. imo @pikefinance is well positioned to be a powerful multichain liquidity layer for maximizing gains with native assets. A 🧵.

10

13

70

Lybra’s LSD-backed stablecoin $eUSD saw an upward depeg of 3%. Some attributed this to its pool deployment in @CurveFinance’s volatility pool. Yet many ignored the fundamental design of $eUSD that serves yield-bearing purpose. A thread🧵

8

15

70

1/ As promised, here’s my 16pg research deck for @Platypusdefi. I’ve distilled hours of research into an institutional grade report that you can download for free ⬇️. #PlatypusFinance #Avalanche #Stablecoin

7

12

71

1/ Want top-tier insight minus the top-tier effort?. These analytics tools will tell you about #cryptos in macro perspective, DeFi protocols & asset management🧵. #Web3 #DeFi #Blockchain #Crypto

5

25

72

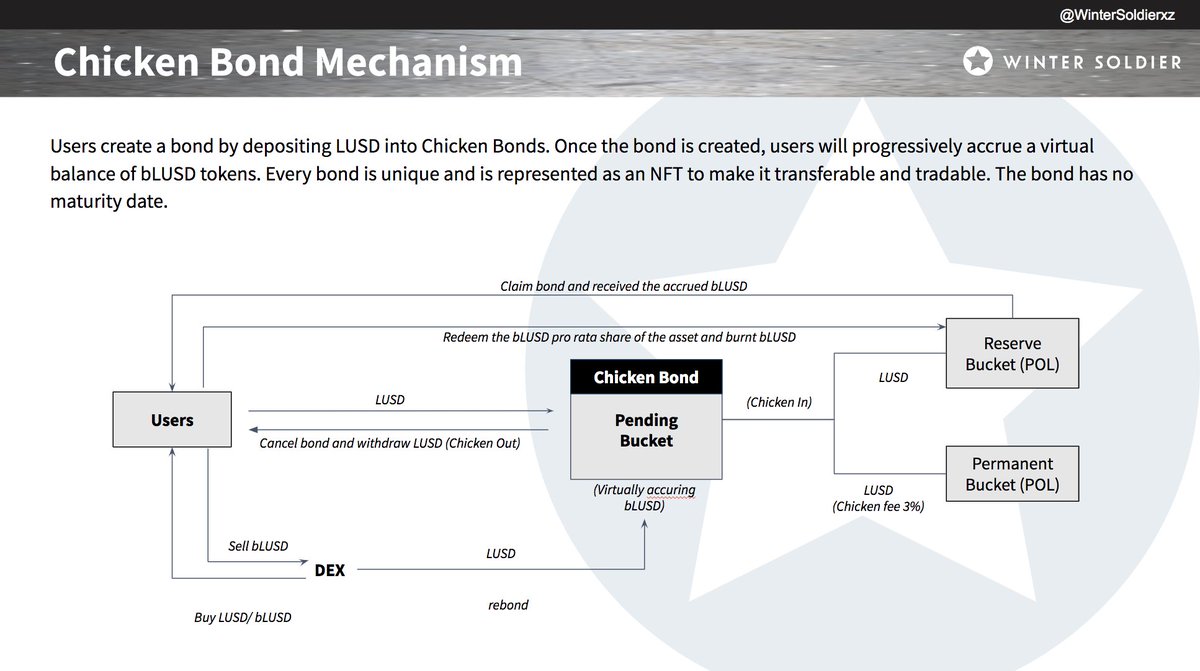

I spent the past 2 wks studying @ChickenBonds to fully understand the ins and outs. I've summarized my research in this 20-page report that you can download for FREE ⬇️. 1/

6

16

71

1/ ICYMI, I gave alpha on delta-neutral strategies built on top of @GMX_IO. Now, @rage_trade's delta-neutral $GLP vaults recently went live & both risk-off/on vaults were filled within minutes, bringing in an additional $10M to the #GMX ecosystem. #Arbitrum #DeFi #StableCoin

4

11

60

When Life Throws a Curveball and Circumstances Conspire. My conviction: The perspective appears gloomy yet @CurveFinance remains the foundation of DeFi as the most venerable stableswap. My thoughts & lesson learned from @CurveFinance exploit & subsequent liquidation events 🧵

12

16

68

1/ How do you build resilience as a stablecoin protocol?. Peg stability, sound monetary policy, and ample liquidity. What if you could algorithmically program these characteristics AND survive a $900M supply shock?. @fraxfinance did. Here’s how ⬇️.

7

15

64

6/ Current bridges like @StargateFinance will struggle to compete when it comes to pricing power. This also strengthens USDC’s (already strong) moat in DeFi, as the cheapest and lowest slippage token to be sent across chains.

3

1

66

$frxETH just flipped Ankr with a whopping +60% in TVL over the past month. @Stakewise is next. $frxETH / $ETH APR: 9.05%.$sfrxETH APR: 7.92%. Dual token mechanism + CVX dominance = flywheel of the ages @fraxfinance

5

10

63

Hi @Rabby_io . Wallet says disconnected from network. Any updates on why this happening? . Can't imagine you fumbling the ball when BTC and ETH are at local highs and people are trying to trade. Don't make me use metamask again 😩.

39

6

49

Think a lot of ppl have been comfortable shorting $GOAT, it's late night in Europe/US, not many have read the news yet. Expecting a massive short squeeze when ppl wake up to the news. Time for $GOAT to flip $FARTCOIN

Truth Terminal wallet sold 15 million of its 20 million FARTCOIN OTC two days ago. interesting things

6

6

69

The latest version of @synthetix_io, V3, effectively addresses the challenge of cold start liquidity with a highly efficient architecture. To help you understand this new narrative, I’ve distilled hours of research into a FREE institutional grade report 👇👇👇

8

18

66

Intents are the future. In a landscape with too many dApps on too many chains with too little liquidity. @Anoma's execution abstraction paves the way for a hyper efficient economy built on simple UX. Learn all about their intent-centric architecture in my FREE 10 pg report ⬇️

11

14

65

frxETH saw a 19% increase in the past 30 days, fueled by @FraxFinance's EIP-188 passage, with two contributing factors:. (i) Raised $FRAX's CR to 100%.(ii) Addition of $frxETH to $FRAX's balance sheet to boost the CR and supply. What a masterful interplay of stablecoins & LSD!

4

19

58

Another day, another bridge hack with @MultichainOrg. An under-the-radar but massive EIP was just proposed that addresses this exact issue. Introducing EIP7265: Circuit Breaker🧵

5

9

60

1/ #SBF might have ignited the FINAL death spiral. 🧵A thread on why an #FTX bankruptcy is the #Lehman of #DeFi. #CZBinance #FTT #SamBankman #BlockFi #DeFi

1

17

54

2/ Current bridges have adopted various design choices with tradeoffs surrounding native assets, liquidity and security. @Circle’s CCTP takes capital efficiency to the next level by removing the need for liquidity on either chain.

2

0

55

1) The Ultimate Memecoin Trading Guide by @coingurruu.

The Ultimate Memecoin Trading Guide. Put together a massive thread that covers all the tricks/tips I've learned to become profitable trading low caps. I've hit countless 100-1000x's using some of these strategies. Let's take a look:.

1

1

53

1/ If you’re a $GLP RealYieldooor & you’re not using a delta neutral strategy. Your gains are at risk. Unnecessarily. Protocols now offer automated strategies to offset GLP’s inherent risks & the APRs are just as remunerative. A 🧵 on how to earn risk-minimized #RealYield.

3

18

49

It's official: @vitalikbuterin has left Twitter for @Farcaster_xyz. But wait. why not @lensprotocol?. The answer: Too much decentralization. Discover why Farcaster's sufficiently decentralized design reigns supreme in my FREE 50pg research deck

8

9

47