Wealthfront

@Wealthfront

Followers

38K

Following

3K

Media

2K

Statuses

13K

Save and invest for what’s next. 💸 https://t.co/KnnzJL9PpN

Palo Alto, CA

Joined May 2008

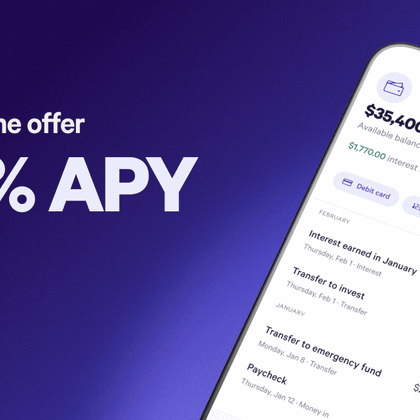

Updated Cash Account APY Boosts for New & Current Clients We’re offering 2 ways to upgrade your Cash Account Annual Percentage Yield (APY) boost. For a limited time only. 🧵⬇️ ------------------ Disclosures: The Cash Account, which is not a deposit account, is offered by

2

1

2

.@Nasdaq Global Indexes & @Wealthfront join @JillMalandrino on Nasdaq #TradeTalks to discuss the merits of direct indexing versus ETF investing.

1

2

2

Nasdaq-100 Direct allows clients to hold individual stocks in the Nasdaq-100 Index®, but it may not hold all the stocks in the index. As a result, its performance may deviate from that of the Nasdaq-100 Index® due to tracking error, market conditions, and the limitations of

1

0

1

Check out this conversation with our VP of Product, David Myszewski, who was just featured on @Nasdaq's Talk Your Ticker segment. He and Jillian DelSignore cover our newest direct indexing offering, Nasdaq-100 Direct, and how it’s designed to help everyday investors save on

nasdaq.com

David Myszewski, VP of Product from Wealthfront joins Nasdaq's Jillian DelSignore to discuss Wealthfront Nasdaq-100 Direct, which allows for direct ownership of individual stocks that make up the...

3

1

3

Reminder: Our webinar is this Thursday, December 4 at 1:00 PM ET. Find out how direct indexing may help increase your after tax returns – we hope to see you there!

event.on24.com

Thursday, December 04, 2025 at 1:00 PM Eastern Standard Time.

Want to learn about how you could save on taxes? Don’t miss our webinar where Wealthfront’s VP of Product, David Myszewski, and VP of Investment Research, Alex MIchalka join @Nasdaq to dive into direct indexing—a strategy designed to do just that. 🏓 Save the date: Thursday,

0

1

4

We’re thrilled to be featured by @Forbes as one of the best brokers for direct indexing and saving on capital gains taxes. Read more here: https://t.co/8BqPPwxL4K —------- Disclosures: Tax-Loss Harvesting benefits from direct indexing depend on your tax and investment profile.

0

1

5

All mortgage products are offered by Wealthfront Home Lending, LLC NMLS 2358115 Home loan availability will be subject to credit approval and applicable state and federal licensing requirements. Rates vary based on credit profile, loan terms and market conditions. Not all

0

1

2

Thank you to @jeffkauflin at @forbes for covering today’s launch of our newest product expansion, Wealthfront Home Lending. We’re excited to bring our software-driven approach to mortgages and offer clients low, transparent rates without charging hidden fees or requiring points.

forbes.com

The Silicon Valley robo-advisor, which has 1.3 million customers, is expanding into home lending as it also tries to go public.

1

1

6

Say hello to Wealthfront Home Lending – A new, streamlined approach for clients to buy a home or refinance a mortgage with transparent, low rates, and no hidden fees or sales calls. We’re excited to continue to help our clients grow their wealth by helping them earn more on

0

1

15

Tax-Loss Harvesting benefits from direct indexing depend on your overall tax and investment profile. New securities may perform better or worse than those sold, and tracking errors could cause slight divergence from benchmarks. Unintended tax effects may occur. Wealthfront does

0

0

0

Want to learn about how you could save on taxes? Don’t miss our webinar where Wealthfront’s VP of Product, David Myszewski, and VP of Investment Research, Alex MIchalka join @Nasdaq to dive into direct indexing—a strategy designed to do just that. 🏓 Save the date: Thursday,

event.on24.com

Thursday, December 04, 2025 at 1:00 PM Eastern Standard Time.

1

1

2

Why has the market been so volatile? Well, it’s a bunch of things. AI debt, the Supreme Court, and Santa Claus all have something to do with the recent stock roller coaster. Read why in Vested Interest, our finance and economics news series:

wealthfront.com

There isn’t one single issue driving the stock market roller coaster. The economy, rather, is basically fighting with itself about whether it's good or not.

1

2

4

Check out the full article: https://t.co/3GmlZ6sAmg -- The information contained in this communication is provided for general informational purposes only, and should not be construed as investment, tax, or home lending advice. Links to other sites are provided for convenience

marketwatch.com

Mortgage rates have fallen for the 4th straight week

0

0

0

Consider other costs: While getting a lower rate on your mortgage is the main benefit of refinancing, it often involves a few other factors including the closing costs associated with taking out a new loan. These can include appraisal fees, title searches, deed-recording fees and

1

0

0

Calculate your break-even point: Assuming you’re refinancing with the goal of lowering your interest rate and thus your monthly payment, the question you need to answer is: how long will it take for my savings from a lower interest rate to exceed my closing costs?

1

0

0

Mortgage rates declined for four consecutive weeks throughout October. Does that mean now is the right time to refinance? Wealthfront’s Director of Home Lending, Michael Young, shared two important things to keep in mind with Alisa Wolfson for @Marketwatch ⬇️

1

1

1

Since the Federal Reserve cut interest rates last week, the rate on the Cash Account will be lowered to 3.50% APY provided by program banks. At this adjusted rate, your Cash Account still earns you nearly 9x the national average. For a limited time, new clients can join with a

1

1

2

Heads up that we’ll be performing planned maintenance on Saturday, Nov 1 from 10:30pm PT until Sunday, Nov 2 12:30am PT. During this time, account logins and services will be unavailable. If you have any questions in regards to your account, please feel free to email us at

0

0

0

The Nasdaq-100 Index® tends to be more volatile compared to broader indices. When it comes to direct indexing, this can be a hidden opportunity for tax savings. Direct indexing–aka holding many stocks of an index, instead of a single index ETF–allows for strategies like tax-loss

0

1

3

We're excited to announce that Francesco D'Acunto has joined Wealthfront’s Investment Advisory Board. Francesco is the A. James Clark Chair in Global Real Estate and a Professor of Finance at @Georgetown . His research focuses on consumers' beliefs and economic decisions,

wealthfront.com

Learn more about where inflation stands today, surprising effects, and historical context in this Q&A with Georgetown professor Francesco D’Acunto.

0

0

1

New clients: earn 4.40% APY As a new client, you can boost your Annual Percentage Yield (APY) from 3.75% to 4.40% APY for 3 months (up to a $150K balance) when you open and fund a Cash Account. Get started at https://t.co/tlo0Qj4ksn -------------------------- Disclosures: The

wealthfront.com

New clients earn 4.15% APY for 3 months when you open a Cash Account. After that, you’ll earn the base 3.50% APY. No fees, no strings, and surprisingly few asterisks.

0

0

0