WalleDAO

@WalleDAO

Followers

161

Following

713

Media

72

Statuses

208

🏦 RWA × DeFi Researcher 📊 Ex-Big Tech (Alibaba→Coupang) | 10Y Data Science 💡 Institutional flows & on-chain alpha | DM for insights & collabs

Joined January 2025

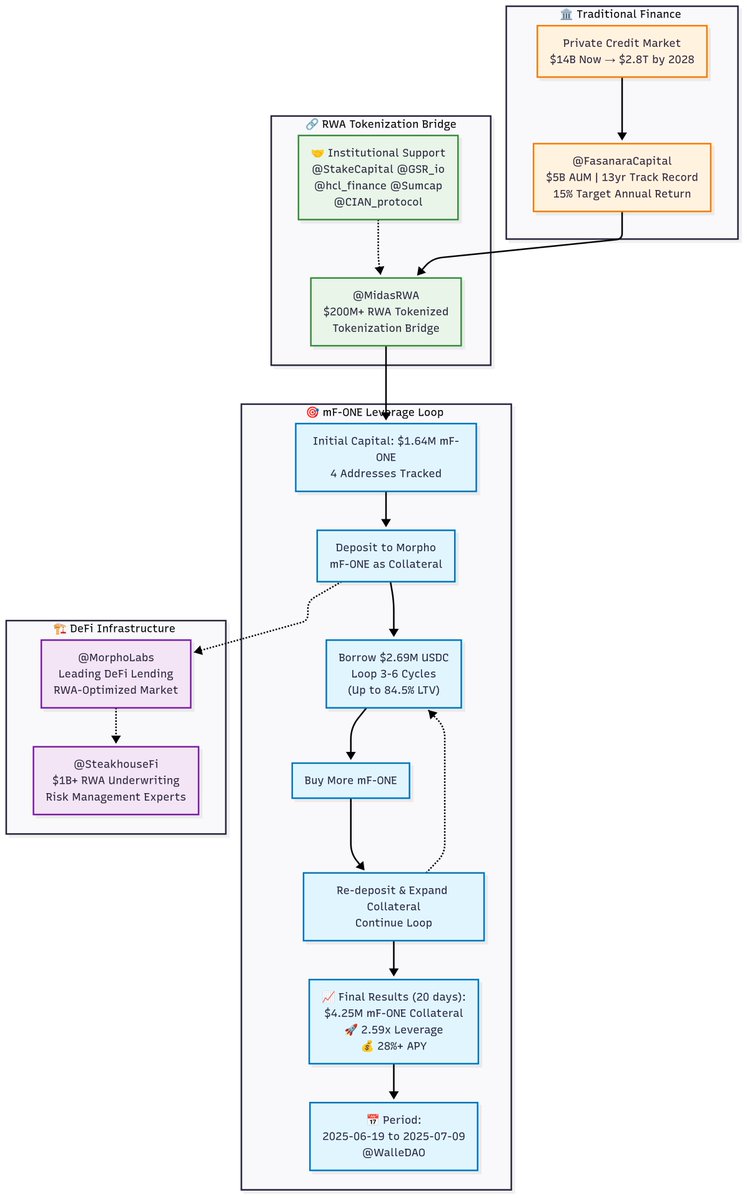

🔥 15%→28%+ APY: Private Credit On-Chain Leverage RWA Strategy . 4 addresses | 20 days | $1.64M→$4.25M mF-ONE collateral.2.59x leverage | @FasanaraCapital's $5B private credit AUM . @FasanaraCapital @MidasRWA @SteakhouseFi @MorphoLabs redefining on-chain finance 🚀. 🧵1/6

3

4

15

💡 Why Everyone Wins:. 🏢 Institutions: DeFi Liquidity Access.💹 DeFi Users: 15%+ Yields + Leverage.🕵️ Liquidators: 10%+ Discount Opportunities.🔗 Protocols: RWA Revenue Stream. @MorphoLabs Market👇. 🧵5/6.

1

0

2

🔑 28%+ APY Dream Team:. @FasanaraCapital: $5B AUM | 13yrs.@MidasRWA: $200M+ RWA Tokenized.@SteakhouseFi: $1B+ RWA Risk Experts.@MorphoLabs: DeFi Lending Pioneer. The mF-ONE is supported by leading institutions: @StakeCapital @GSR_io @hcl_finance @Sumcap @CIAN_protocol. 🧵4/6.

1

0

4

Leverage Loop: mF-ONE Collateral → Borrow USDC → Buy More mF-ONE → Repeat. 15%→28%+ APY Yield Math with 2.59x Leverage:. (15% × 2.59x) - (6.57% × 1.59x) = 38.85% - 10.45% = 28.4%. 15%: F-ONE fund target APY.6.57%: @MorphoLabs actual borrow APY. 🧵2/6.

1

0

3

RT @WalleDAO: 🚨 BREAKING: @BlackRock BUIDL Fund Surges to $2.83B. 💥 5.7x Growth in 1 Year ($500M → $2.83B) .🏆 World's Largest Tokenized Tre….

0

8

0

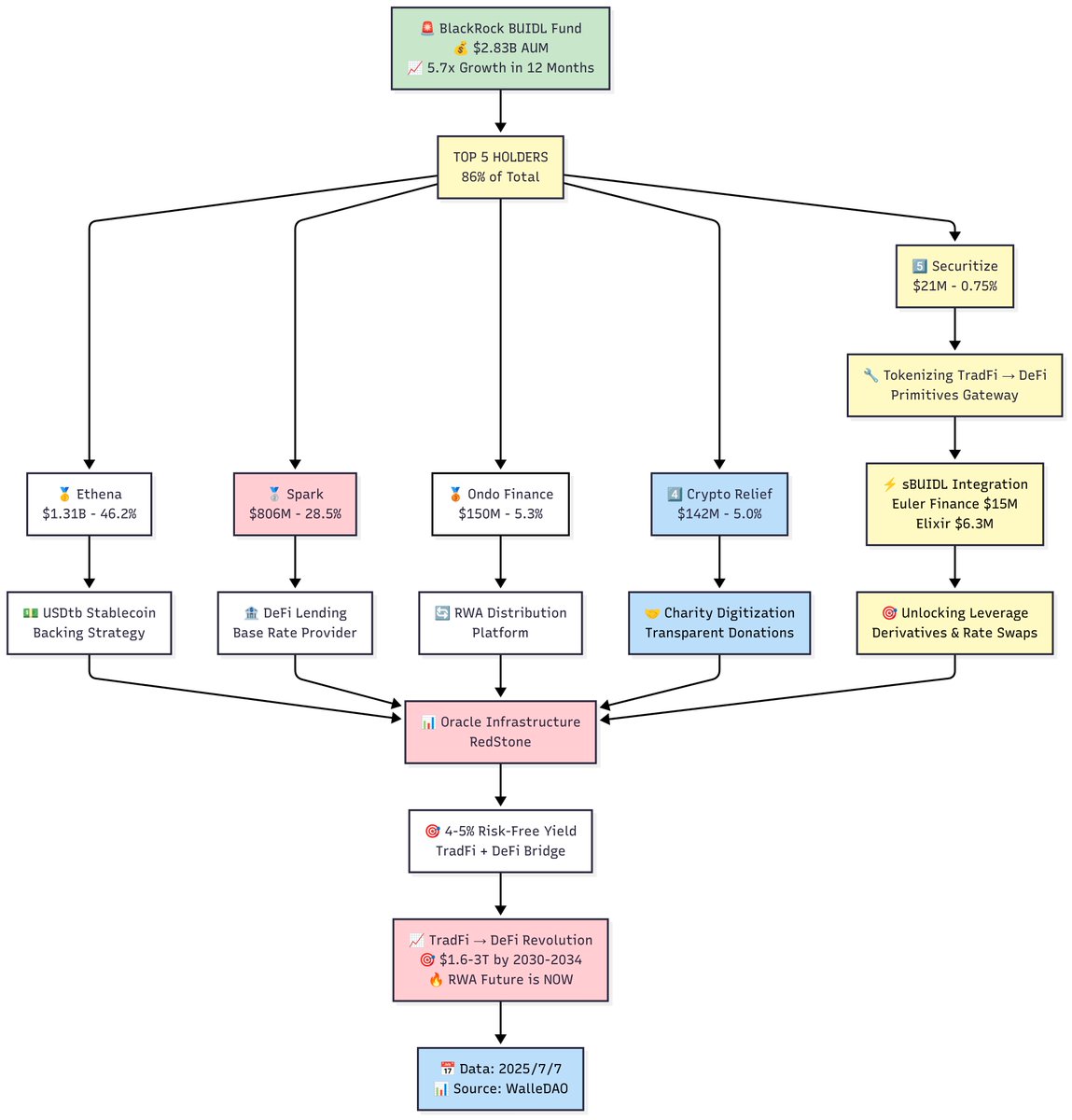

Future: RWA's Trillion-Dollar Horizon. BUIDL's $500M→$2.83B growth signals massive shift:.📈 Traditional asset managers racing to tokenize.🏗️ @Securitize & @redstone_defi setting standards.🎯 $1.6-3T projected market by 2030-2034. Src: 9/9 🧵.

0

0

3

Summary:. 1️⃣ Stablecoin issuers = biggest RWA buyers (@ethena_labs USDtb).2️⃣ Auto-allocation platforms rising (@sparkdotfi spread arbitrage).3️⃣ Tech wrapper platforms lowering barriers (@OndoFinance).4️⃣ Infrastructure driving standards (@Securitize + @redstone_defi). 8/9 🧵.

1

0

3

sBUIDL: DeFi's Native Asset Gateway. @eulerfinance ($15M) & @elixir ($6.3M) signal the shift:.🔧 @Securitize: Tokenizing TradFi → DeFi primitives.🎯 Unlocking leverage, derivatives, rate swaps.🚀 RWA revolution powered by sBUIDL composability. 7/9 🧵.

1

0

2

🔮 @redstone_defi: RWA Oracle Infrastructure. • Primary BUIDL price feed across 6 chains.• Specialized RWA pricing mechanisms.• Bridging TradFi valuations → DeFi protocols. The pricing brain behind RWA revolution!. 6/9 🧵.

1

0

2

@OndoFinance: BUIDL's biggest distributor!. $150M BUIDL position:.🎯 OUSG upgrade: BUIDL underlying, lower barriers + better UX.⚡ Tech wrapper: 24/7 instant invest/redeem + daily interest.🏦 Institutional bridge: Tokenized Treasury for TradFi. 5/9 🧵.

1

0

2

@sparkdotfi: Why hold $806M BUIDL?. 🔄 $3.6B AUM: BUIDL provides 4%+ risk-free yield base.⚙️ Fixed-rate SparkLend needs predictable Treasury backing.💰 Strategy: BUIDL yield floor → stable borrowing rates → attract borrowers. Smart DeFi banking! 💡. 4/9 🧵.

1

1

3

Why does @ethena_labs hold $1.31B BUIDL?. ✅ USDtb 90% backed by @BlackRock's BUIDL.✅ USDtb became 8th largest stablecoin in <6 months.✅ 4-5% yield during adverse rates.✅ Supports $2B+ @pendle_fi PT market. Innovation: TradFi + DeFi yield! 🚀. 3/9 🧵.

1

0

3

TOP 5 BUIDL holders:. 🥇 @ethena_labs: $1.31B (46.2%) - USDtb backing.🥈 @sparkdotfi: $806M (28.5%) - @SkyEcosystem allocation.🥉 @OndoFinance: $150M - RWA platform.4️⃣ @CryptoRelief_ : $142M - Charity digitization.5️⃣ @Securitize: $21M - RWA Tokenization tech. 2/9 🧵.

1

0

2

🚨 BREAKING: @BlackRock BUIDL Fund Surges to $2.83B. 💥 5.7x Growth in 1 Year ($500M → $2.83B) .🏆 World's Largest Tokenized Treasury Fund . Top Holders.🥇 @ethena_labs: $1.31B .🥈 @sparkdotfi: $806M .🥉 @OndoFinance: $150M . Powered by @Securitize @redstone_defi . 1/9 🧵

9

8

25

🌉 The Bigger Picture:. This isn't just a yield strategy—it's a milestone integration of RWA & DeFi infrastructure. We're witnessing the birth of truly institutional-grade on-chain finance. More ACRED Dashboard: (credit: @seouldatalabs). 🧵6/6.

3

0

9

📈 Market Context:. Private credit market: $14B → $2.8T by 2028 .@apolloglobal's $500B AUM backing + @Securitize's tokenization expertise creates the perfect foundation for institutional DeFi adoption. Traditional finance liquidity problems finally solved on-chain. 🧵5/6.

1

0

8