The Ken

@TheKenWeb

Followers

79K

Following

8K

Media

5K

Statuses

26K

Delivering sharp, original, insightful, analytical journalism about business and start-ups across India since 2016.

Bengaluru, India

Joined June 2016

RRP Semiconductor's stock rallied by 63,000% in 18 months despite negligible trading volumes, murky financials, and no tangible chip operations. The firm's largest shareholder is also the promoter of RRP Electronics—which is backed by the Maharashtra govt. and Sachin Tendulkar.

1

0

11

But its future hinges on litigation battles with American footwear retailer Crocs, writes Neha Mehrotra in this week's edition of 'Trade Tricks'. Link to the full piece here: https://t.co/XXImjc9hkP

the-ken.com

Bata Floatz is expected to touch Rs 800 crore in revenue by 2030; that is, if it survives

0

0

0

Bata Floatz is one of the few things buoying Bata India’s flailing boat: Over the last few years, Bata India’s gross margins have been stuck at 58%, its share price keeps inching downwards — meanwhile, Floatz has grown at a little over 30% year-on-year.

1

0

3

Make Pure Water from Air with WaterCube — Smart, Safe, and Sustainable for Your Family.

32

45

245

India now wants to build its own magnet ecosystem to decouple from China. The rub is that India’s EV ecosystem has no option but to rely on Chinese imports. For now, anyway. Read today's story by Keshav Pransukhka here: https://t.co/Rygx5H72R5

0

0

1

Almost all Indian electric vehicles run on PMSMs (permanent magnet synchronous motor), and 94% of their magnets come from China. Beijing imposed export restrictions on rare earths this year, and the curbs hit Indian automakers hard, including Bajaj, TVS Motor and Ather.

2

0

2

3. Last week’s 'Silent Sunday' collection with frames of the quiet beauty of natural landscapes, where the clouds steal the spotligh where the clouds steal the spotlight. Curated by Sakshi Modi. You can read the full free newsletter here: https://t.co/QuYxO7q14X

the-ken.com

Fault lines are appearing

0

0

1

Here’s everything we had for you in the First Principles Newsletter last week: 1. Rohin Dharmakumar shares his thoughts on homeostasis with curated excerpts and readings. 2. Tanim Mozumder, along with our readers, shared some splendid recommendations from our readers

1

0

2

Trapped in a small house, a bizarre visitor is knocking. But is he real, or a hallucination? Your survival depends on one choice: open the door, or take your pill.

0

2

17

But Tenneco Clean Air’s IPO last week bucked the trend, and proves that conservative pricing can still spark a strong listing, writes @Singh10Seema in this week's edition of 'Make India Competitive Again'. Read the full piece here: https://t.co/in8tpjLEJg

the-ken.com

Tenneco Clean Air proves that conservative pricing can still spark a strong listing

0

0

0

Long admired as financial wizards, private-equity firms today face an existential question: Is their model broken as the exits dry up? In India, this investor class is emerging as squeezers, extracting the utmost value from their portfolio companies before they go public.

1

2

4

The country saw payment fraud worth Rs 520 crore ($58 million) in the 2025 financial year, according to the Reserve Bank of India. But how much can “safety” sell and scale? Read the full story by @tam_arund here: https://t.co/bBhMzynIu8

0

0

0

Airtel Payments Bank has found a way to make a virtue out of necessity. In September, it launched a campaign to get people to open their “second” bank accounts with it: it wants users to use the payments bank, not because it’s any more convenient, but for safety.

1

0

3

Want to make your wife melt? Turn your family into a custom wooden bear puzzle, engraved with love! She'll proudly display it at home. Click the video to shop now 💖

153

712

10K

Seetharaman G sat down with Puneet Chhatwal to talk about the company’s turnaround and about embracing the unexpected. Read the full story here: https://t.co/RQRDhNAtpN

0

0

0

In the eight years before Chhatwal’s term as chief executive of Indian Hotels began, shares had risen merely by a third. Since then, though, the company’s market value has soared 7X to over Rs 1 lakh crore ($11.7 billion), making it the tenth most-valuable Tata company.

1

0

3

Listen to the full episode on your preferred platforms: Spotify: https://t.co/clfKemtyh0 Apple Podcasts: https://t.co/A7rb8fboT9 The Ken app: https://t.co/9zAorD0jKT

the-ken.com

Why is the world's smartest tech suddenly free in India?

0

0

1

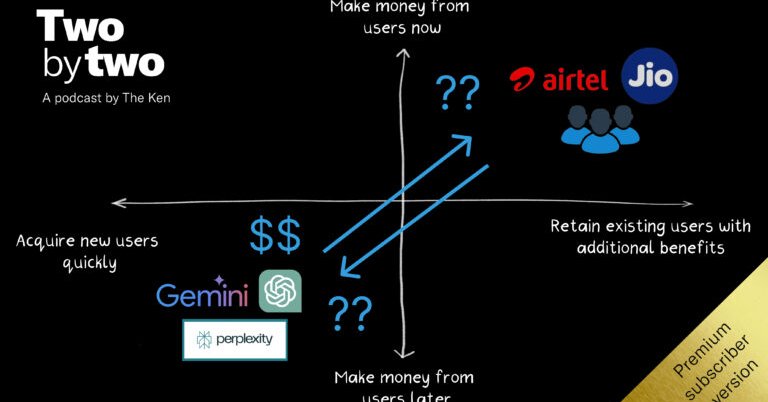

To decode the economics, they are joined by two industry experts: @VCShekhar and Prakash Deep Maheshwari. They also break down the actual structure of these deals, from minimum guarantees to the marketing halo the partnerships create.

1

0

0

This week, Two by Two debuts a new format: “Reverse engineering the playbook.” Why are companies like Perplexity, Google, and OpenAI racing to bundle their expensive premium subscriptions with Airtel, Jio, and Phonepe? Hosts Rohin and @peegeekay attempt to crack the math.

2

4

6

Right now, they are spread across five stages—from low-risk to radical. But mind you, very few of the AI use cases particularly blow your mind. Read this week's edition of 'Ka-Ching!' by @tam_arund here: https://t.co/UgusqdeWbc

the-ken.com

Razorpay, Cred, Phonepe, Zerodha, and other fintechs’ use of AI spans five stages—from low-risk to radical

0

0

0

The ChatGPTficiation of Indian fintech is here. All things considered, with the stock market and banking regulators, the choices that different fintechs, including Razorpay, Cred, Phonepe, Zerodha, and others, make are largely determined by their risk appetite.

1

0

6

And that gap between data and outrage is where the plot thickens, writes @anandg_kalyang in today's longform. Read the full story here: https://t.co/xX17DjP27t

the-ken.com

The biggest anchor investors among mutual-fund schemes—even in costly and losing IPOs—are delivering on what investors want most

0

0

1

The Ken parsed through IPO data from the last nearly five years and mutual-fund performance separately and found that several schemes that bet big on anchor investing had delivered on the metric that investors care most about: returns.

1

0

0

Dalal Street has a new villain—mutual funds that bet their retail investors’ money in overpriced initial public offerings (IPOs). Except the numbers nudge in the opposite direction.

1

0

1