CryptoData

@TheCryptoData

Followers

24K

Following

73K

Media

2K

Statuses

12K

Full-Time Trader | Former Capt USAF | @LairFNF | https://t.co/q0ksJPHgFf | Pinescript Coder | Developing AI Trading Indicators @CryptoScriptsAI

Best Multichain Bot 👉

Joined August 2014

Just created my own public Telegram channel where I'll be sharing constant updates on my thought process of the overall market, including technical analysis, altcoins, narrative rotations, and more 💎 https://t.co/icM4NBmSHM

t.me

https://x.com/TheCryptoData The Inner Circle is where I share my thought process on the overall market, including technical analysis, altcoins, and narrative rotations 💎 Nothing shared is financia...

58

37

244

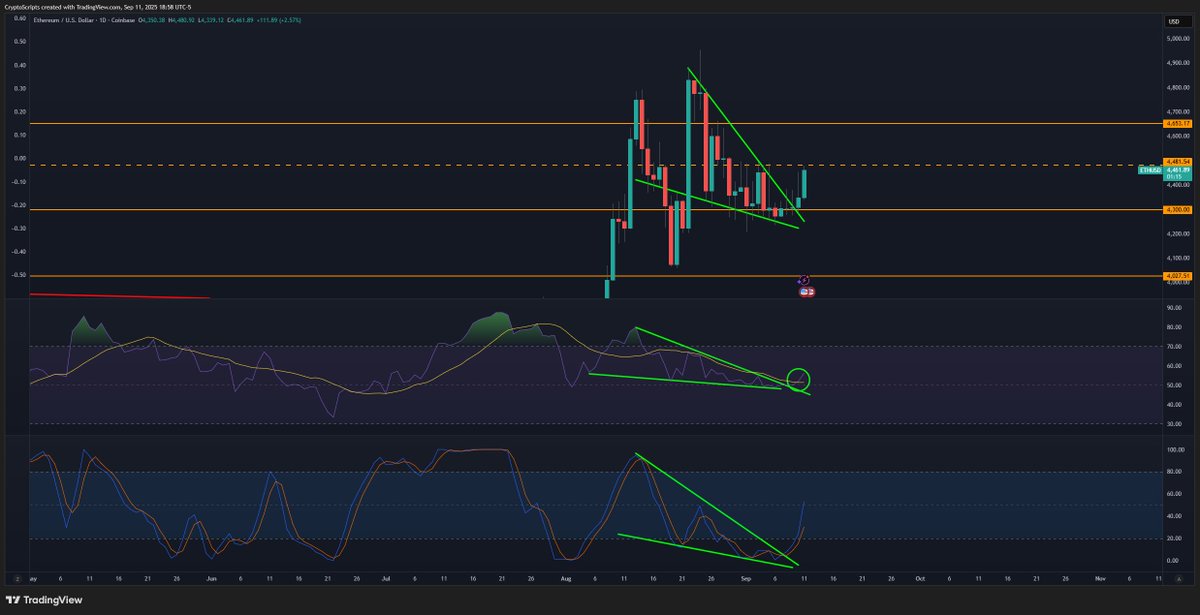

Our $BTC inverse H&S pattern is playing out perfectly, approaching the 115.6k resistance. The daily StochRSI is overbought so I'm expecting a pullback short-term. Our $ETH descending wedge also broke out with the RSI+StochRSI in confluence ✅ Now we wait for rate cuts 🤝

$BTC's inverse H&S is still intact. Large liq clusters are near 113.5k/110k. I imagine we'll visit the former before a potential pullback (due to the overbought StochRSI on the daily). $ETH broke out of its descending & looks better from a technicals perspective along with

9

6

61

Be grateful for every day that you have because you never know when it could all be taken away. Tell your family you love them, hangout with your friends, and give back to those less fortunate. You only have one life. Make the most of it.

11

12

152

$BTC's inverse H&S is still intact. Large liq clusters are near 113.5k/110k. I imagine we'll visit the former before a potential pullback (due to the overbought StochRSI on the daily). $ETH broke out of its descending & looks better from a technicals perspective along with

Inverse H&S is playing out nicely on $BTC. We closed the daily exactly at 112k which is very significant, as that's a major demand zone for flipping into bullish territory. There's currently liquidity clusters near 114k which is the first major resistance point. Keep in mind

6

4

53

Inverse H&S is playing out nicely on $BTC. We closed the daily exactly at 112k which is very significant, as that's a major demand zone for flipping into bullish territory. There's currently liquidity clusters near 114k which is the first major resistance point. Keep in mind

10

11

82

🚨BREAKING: Ledger CTO Charles Guillemet warns of a supply chain attack in the JavaScript ecosystem after an NPM account compromise. He advises users to carefully verify every transaction if using a hardware wallet, and to avoid on-chain transactions entirely if they don’t.

240

505

2K

What if laziness is a habit of thinking about the effort vs thinking about the outcome? Focus on the end goal instead of the effort it takes to get there, and watch your life change before your eyes.

15

12

117

The infamous Blood Moon (total lunar eclipse) is happening Sept 7-8th (later tonight/tomorrow). Here's some statistically significant dates based around this event: Bearish Examples 📉 May 16, 2022 – During a total lunar eclipse ("super blood moon"), we had the collapse of Terra

7

10

108

📊 Market Update 📊 Yesterday’s data showed initial jobless claims rose by 8,000 to 237,000 for the week ending August 30th, higher than expected and signaling cooling in the labor market, which helped push market odds for a 25 basis point Federal Reserve rate cut at the

4

7

73

Your parents are tired. You’re their last hope. Make it happen.

14

26

205

The PMI data for August came in below expectations, confirming manufacturing is contracting for the 6th consecutive month, reinforcing the need for a cut. Although the Nonfarm Payrolls report on Sept 5th is the one to watch, with a weak job report further solidifying the cut,

The next few weeks will be full of volatility: - Sept 1st WLFI launch @ 12pm UTC (14 min) - Sept 1st Labor Day (markets closed) - Sept 2nd ISM Manufacturing PMI - Sept 4th Initial Jobless Claims - Sept 5th Nonfarm Payrolls and Unemployment Rate - Sept 10th PPI - Sept 11th CPI -

5

11

58

The next few weeks will be full of volatility: - Sept 1st WLFI launch @ 12pm UTC (14 min) - Sept 1st Labor Day (markets closed) - Sept 2nd ISM Manufacturing PMI - Sept 4th Initial Jobless Claims - Sept 5th Nonfarm Payrolls and Unemployment Rate - Sept 10th PPI - Sept 11th CPI -

7

9

118

The market is about to heat up again and there's a few upcoming projects I'm watching. First was CAMP (which pulled a 6x on launch). Next was MMT (TGE in Sept). Third is @0G_labs, the largest AI L1 for storage, compute, and scale (TGE soon). 🧵 At its core, 0G is purpose-built

8

4

43

PCE data came in line with expectations yesterday, although consumer sentiment came in slightly below. We can still expect a 25bps rate cut in September, but this rules out a larger move given inflation remains above target. Regarding the overall market: ✅ BTC bounced nicely

10

8

79

Finally joined the Tesla club ⚡️ What’s better than being able to trade full-time? Being able to trade while your car drives you (supervised of course) 💻

41

7

175

Our CAMP call rose 6x after it launched. The next project I'm watching is @MMTFinance. They continue to scale as the central liquidity engine of the Move ecosystem, driving liquidity, trading activity, and user adoption at a rapid pace. Built to simplify access to DeFi, Momentum

We just added another 88K $MMT to the pool - Now worth over $713K in rewards 👀 Provide liquidity for BTC, USDC or SUI on @MMTFinance to get your share. 🗓️ Ends Sep 7 Start now: https://t.co/mbpHtt08lA

4

3

36

Earlier this month, I mentioned to keep an eye on @campnetworkxyz. They launched today and already pulled a 3-4x. Mainnet is now live with the largest repository of user-owned/AI-native IP . With Story- IP trading at $6bil, it's only a matter of time before $CAMP catches up 🏕️

With the AI narrative continuing to build, more projects are capitalizing, with @campnetworkxyz leading the way. They're a Layer-1 blockchain designed for autonomous IP. Think verifiable intellectual property, AI agents, and tools for creators to own, manage, and monetize their

4

2

45