Tephra Digital LLC

@Tephra_Digital

Followers

2K

Following

1K

Media

135

Statuses

293

Website: https://t.co/8vpOGvpvzj LinkedIn: https://t.co/9VkJomRNBP Please see links above for disclaimers and disclosures.

Joined April 2025

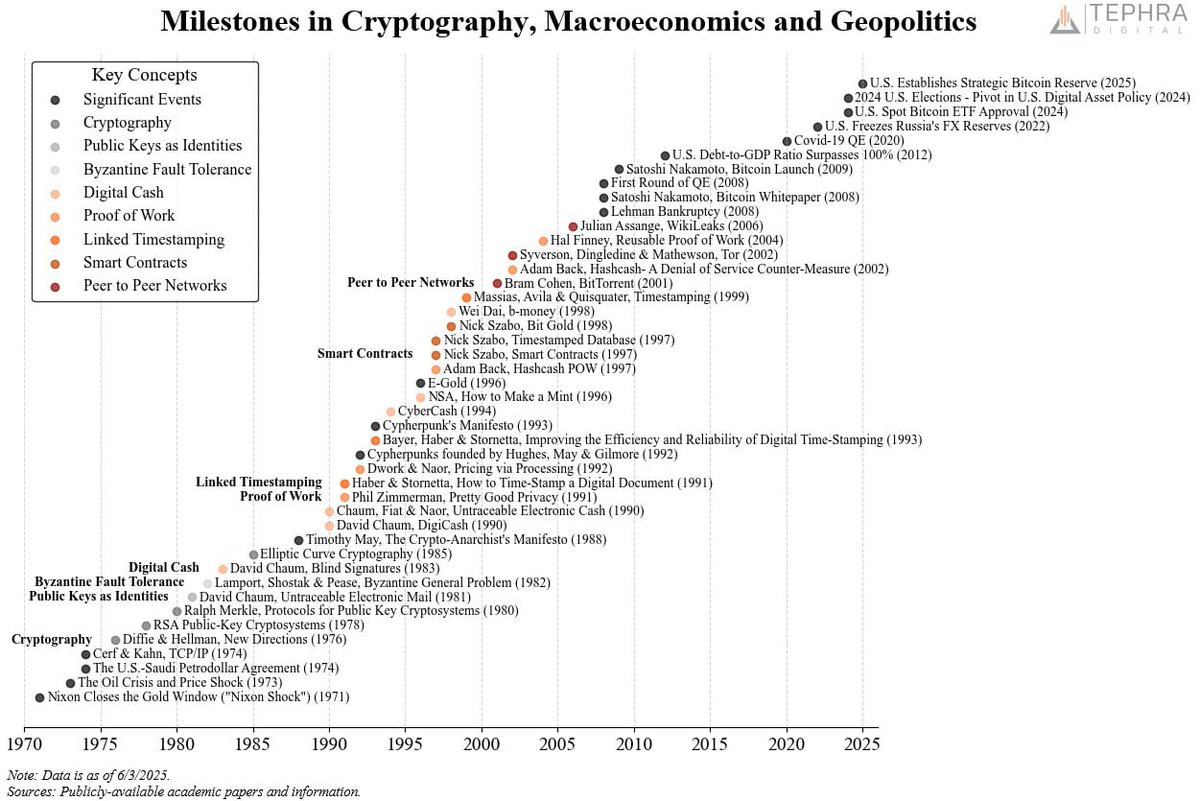

Bitcoin didn’t just appear. It was forged over five decades of cryptographic innovation, monetary upheaval, and geopolitical shifts. This is its origin story. Grateful to all who paved the way.

15

62

262

BTC/Gold ratio bottomed here the last two years. Gold led, now it’s Bitcoin’s turn. Catch-up mode into year-end. $167k-185k

1

4

8

Bitcoin → Stablecoins → U.S. Treasuries A powerful flywheel is taking shape: ⚡ Bitcoin → fuels stablecoin growth ⚡ Stablecoins → boost UST demand ⚡ Stablecoins → reinforce demand for Bitcoin as digital savings. We’re only at the beginning.

0

1

11

“The Stone Age did not end for lack of stone, and the oil age will end long before the world runs out of oil.” – Sheikh Yamani So too with money: fiat won’t vanish because central banks run out of paper. It will be replaced by something better. That’s Bitcoin. @balajis

0

0

7

What are the advantages of tokenized assets? We use tokenized gold as a simple case study. See the comparison table below. For any asset... Digital > Analog

0

2

10

If Bitcoin’s lagged M2 and gold correlations hold, the rest of the year could be very interesting. Charts below point to $167k–185k.

49

421

2K

Over the past year, ETH has traded like a high-beta small cap.

0

2

15

Crypto hasn’t fully scaled, yet it’s already orders of magnitude more efficient than banks. Crypto companies generate ~10x more revenue per employee. Protocols? Even higher. The efficiency gap is real and AI will only accelerate it.

0

3

16

As Howard Marks says, the best outcomes in investing come from being non-consensus and right. Let’s see how this positioning plays out in the years ahead. @zerohedge

1

1

9

The Rise of DeFi: More Software, Fewer Bankers. Could this be a $2 trillion opportunity? See below for a link to the full piece.👇 https://t.co/PnB32zzoof

0

0

8

Ethereum’s ownership base is shifting: smaller holders down, institutions up. The data is clear - institutional adoption is accelerating.

3

15

43

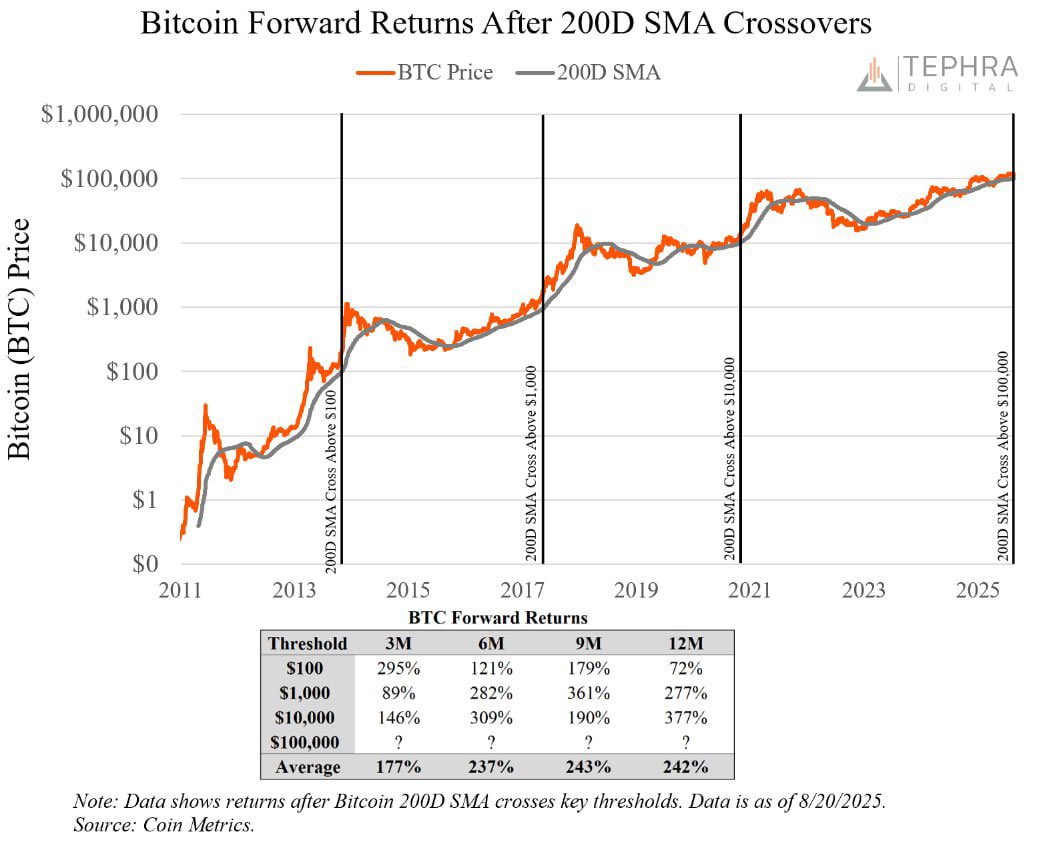

With Bitcoin’s 200-day moving average now above $100K, it joins prior milestones ($100, $1,000, $10,000) that marked significant inflection points in adoption and price history.

10

25

133

When institutions catch up to retail’s allocation, prices won’t be here. A 1% institutional allocation = $2.7 Trillion. All your models are broken.

0

2

13

Budget neutral is dead. Long live budget neutral. #Bitcoin

0

0

1

82% of FMS investors haven’t started to structurally allocate to crypto. Average allocation: 0.3% (3.2% for those invested) – BofA Global Fund Manager Survey. Three words for the 82% still on the sidelines: Career. Risk. Incoming.

0

0

4

Digital asset ETFs are surging - capturing 7% of global ETF inflows over the last month, more than double their 1-year average. With 72 more awaiting review and only 20 active today, this wave is just getting started.

0

0

8

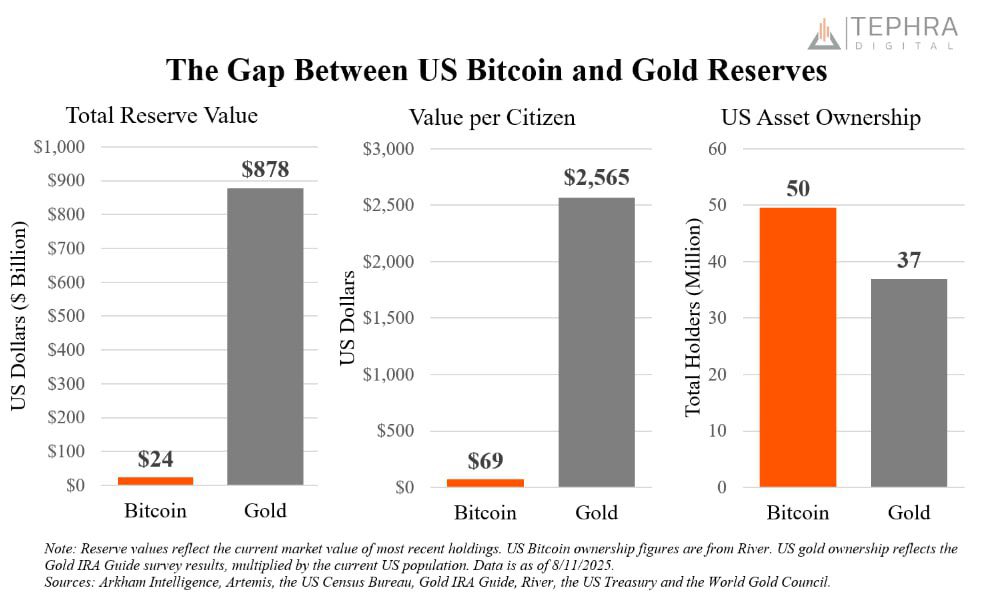

More Americans own Bitcoin than gold, yet our national reserves are a rounding error. $69 per citizen is ironic - let’s make it $4,200. American leadership in a digital age requires digital gold. @elonmusk @davidsacks47 @SenLummis

0

0

9

Ethereum activity is surging. The largest Layer 1 blockchain is hitting new highs in both transaction count and transfer volume, signaling rising usage and accelerating on-chain economic activity. Fundamentals are strengthening.

1

0

6

AI Fed Chair calls for 75–100bps in rate cuts today. Grok: “The current 4.25%–4.5% fed funds rate is restrictive. Inflation is moderating, growth is slowing. I’d cut to 3.75%–4.0%.” ChatGPT: “I’d go further. Based solely on macro data and inflation, the right rate is 3.50%.”

0

0

7