Taxation Updates (CA Mayur J Sondagar)

@TaxationUpdates

Followers

95K

Following

14K

Media

3K

Statuses

8K

CA | Tweets are personal | Retweet ≠ endorsement 🇮🇳🇮🇳🇮🇳

Mumbai

Joined July 2019

WhatsApp Community and Channel for Professional and Taxation Related Updates only. To join the community or channel kindly send you name, city and qualification at Currently .Members in Community 5138.Members in Channel 2057. Thanks.#TaxationUpdates.

4

9

23

RT @TaxationUpdates: Properly Sale Value : 60 Lakh.Sale Date 31/07/2024. Actual Purchase Cost : 50 Lakh.Indexed Purchase Cost : 58 Lakh. Wh….

0

7

0

Properly Sale Value : 60 Lakh.Sale Date 31/07/2024. Actual Purchase Cost : 50 Lakh.Indexed Purchase Cost : 58 Lakh. What will be his/her Total Income?.@IncomeTaxIndia @FinMinIndia.

7

7

23

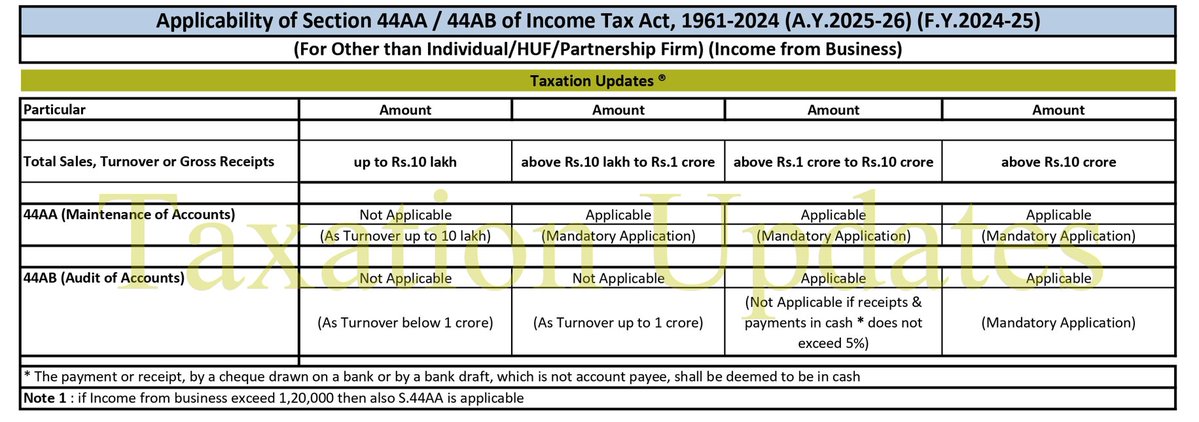

Guidance Note on Tax Audit under Section 44AB of the Income-tax Act, 1961 (Revised 2025) . Link Source @theicai

4

65

200

RT @TaxationUpdates: COMPUTATION OF TOTAL INCOME AND TAX PAYABLE BY INDIVIDUAL – STEP BY STEP PROCEDURE. This 🧵 will definitely be helpful….

0

45

0

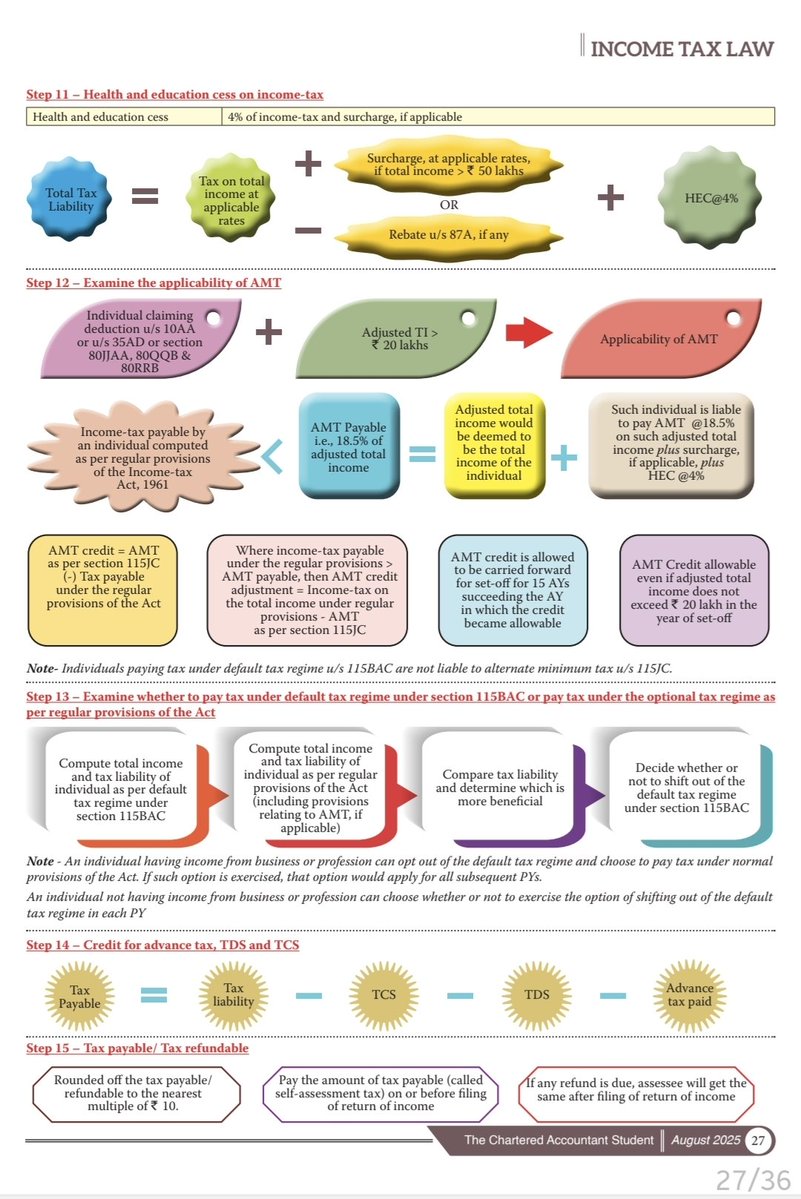

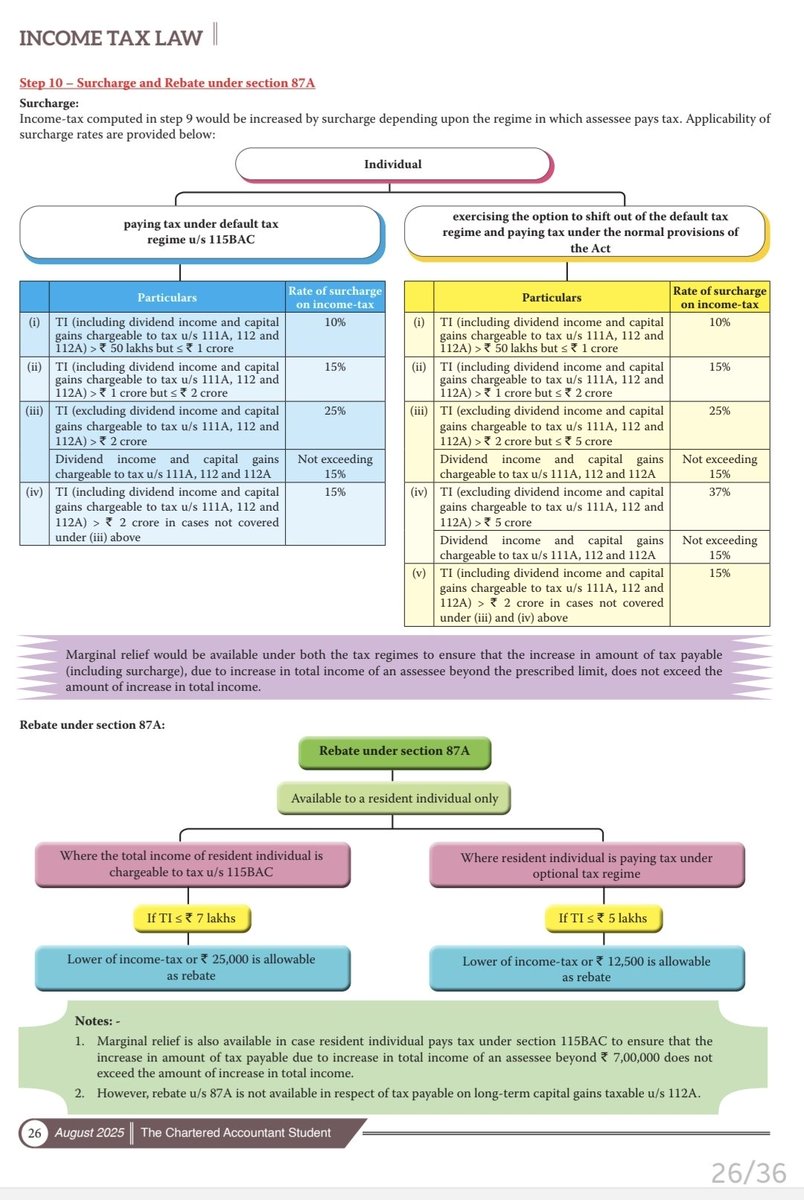

Step 11 – Health and education cess on income-tax. Step 12 – Examine the applicability of AMT. Step 13 – Selection of Regime. Step 14 – Credit for advance tax, TDS and TCS. Step 15 – Tax payable/ Tax refundable. Credit to @theicai .5/5

0

1

5

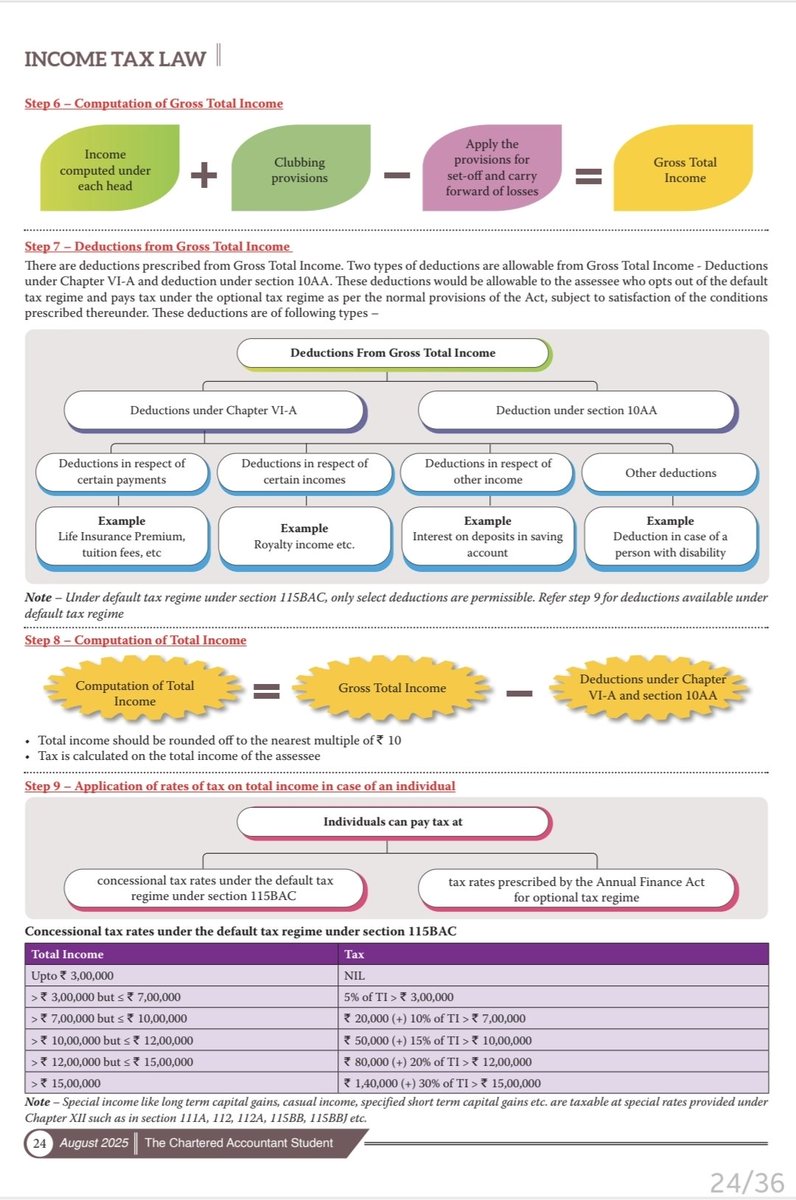

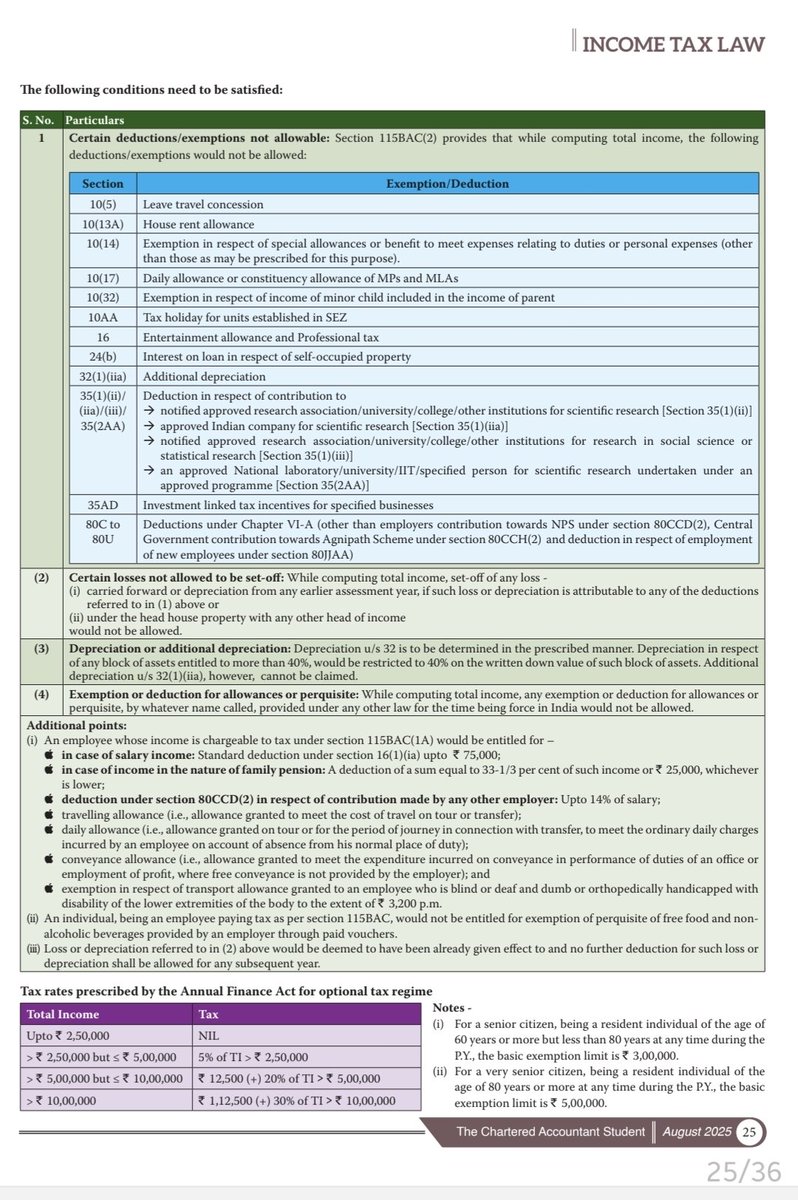

Step 6 – Computation of Gross Total Income. Step 7 – Deductions from Gross Total Income. Step 8 – Computation of Total Income. Step 9 – Application of rates of tax on total income in case of an individual. Credit to @theicai .3/5

1

1

3

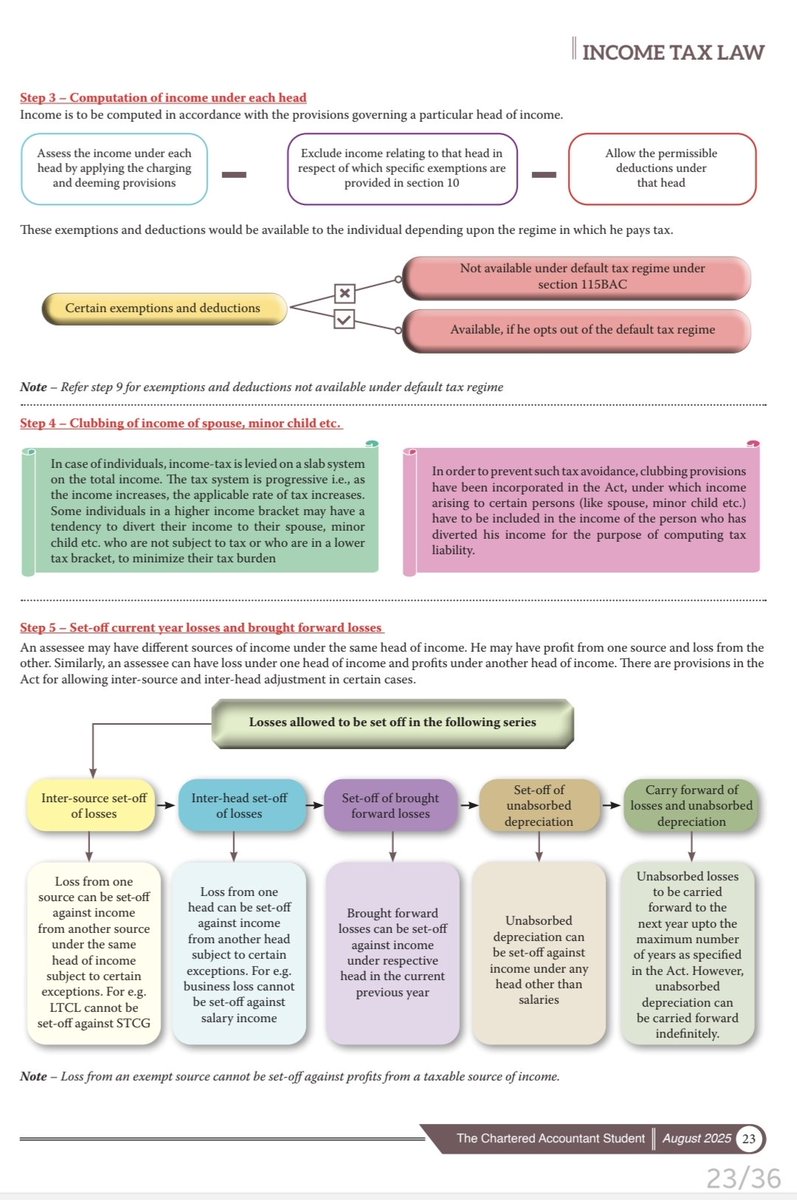

Step 3 – Computation of income under each head. Step 4 – Clubbing of income of spouse, minor child etc. Step 5 – Set-off current year losses and brought forward losses. Credit to @theicai .2/5

1

1

7

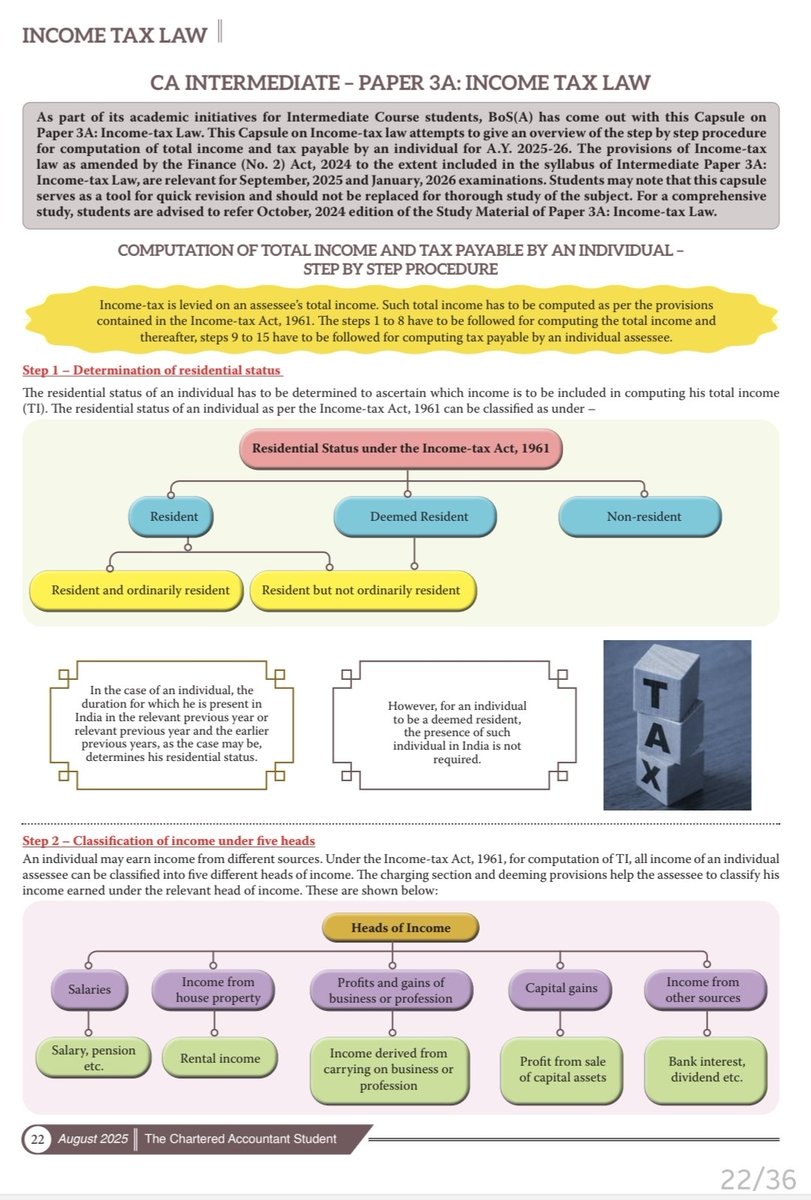

COMPUTATION OF TOTAL INCOME AND TAX PAYABLE BY INDIVIDUAL – STEP BY STEP PROCEDURE. This 🧵 will definitely be helpful during ITR Filing Session for AY 2025-26. Step 1 – Determination of residential status. Step 2 – Classification of income under five heads. Credit @theicai.1/5

1

45

173

RT @IncomeTaxIndia: Kind Attention Taxpayers!. The facility for filing Updated Returns for AY 2021-22 and AY 2022-23 for ITR-1 & ITR-2 is n….

0

141

0

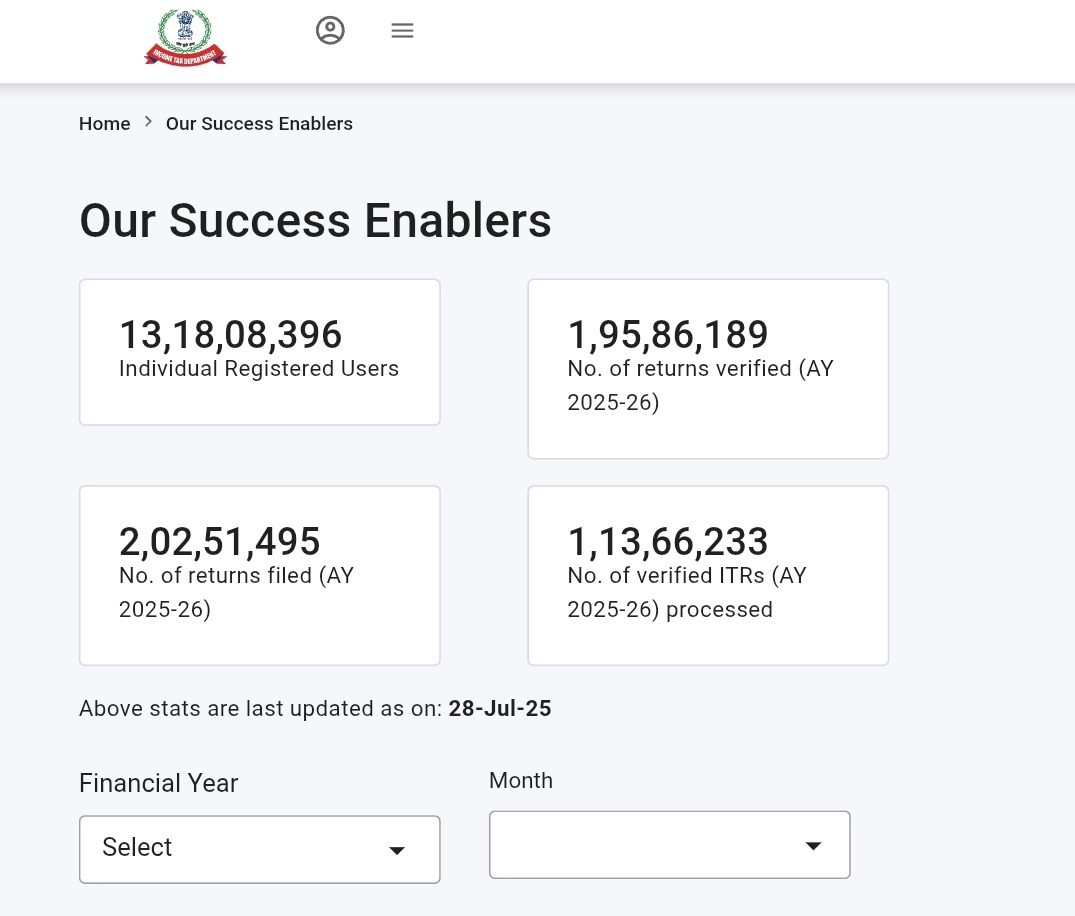

Date 28/07/2025. ITR Filing Count Crossed 2 crore. @IncomeTaxIndia @FinMinIndia

Date 07/07/2025. ITR 1 and ITR 4 Filing Count Crossed 1 crore. Thanks to @IncomeTaxIndia for processing ITR on same day and refund also got credited on same day or next day. All are Waiting for release of ITR 2 and ITR 3 . @IncomeTaxIndia kindly release other ITR forms now

7

2

30

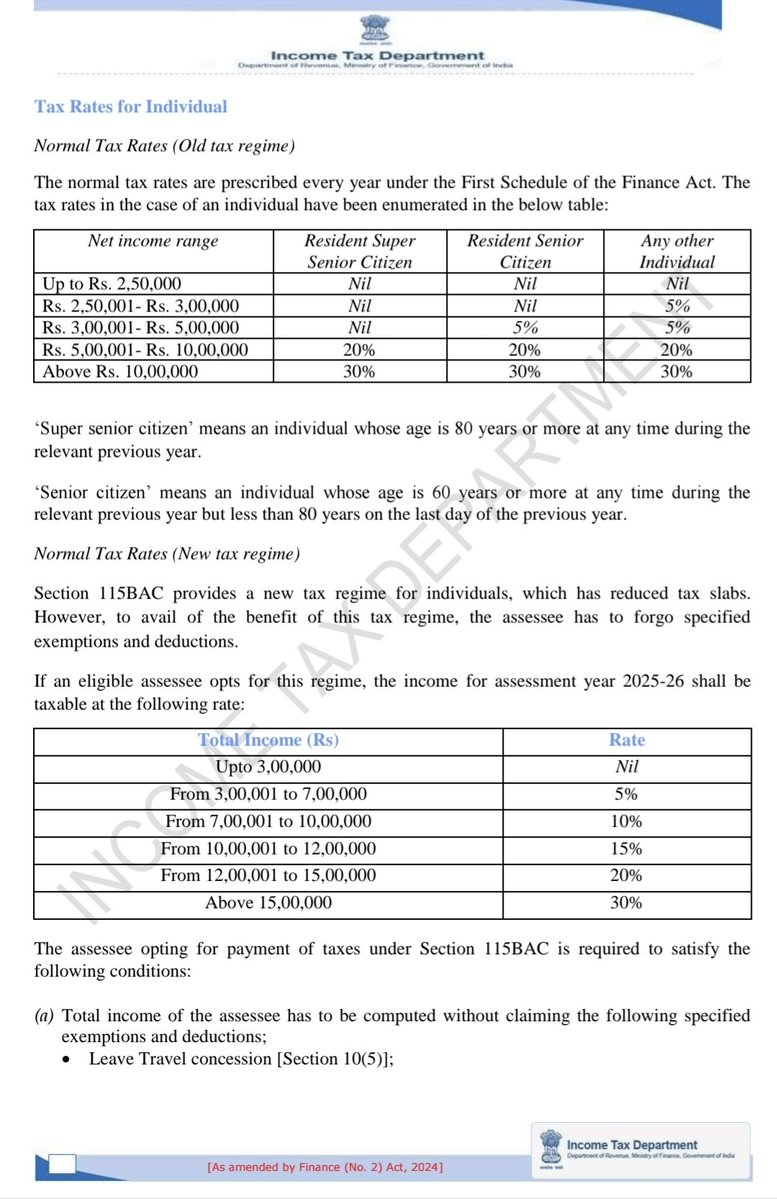

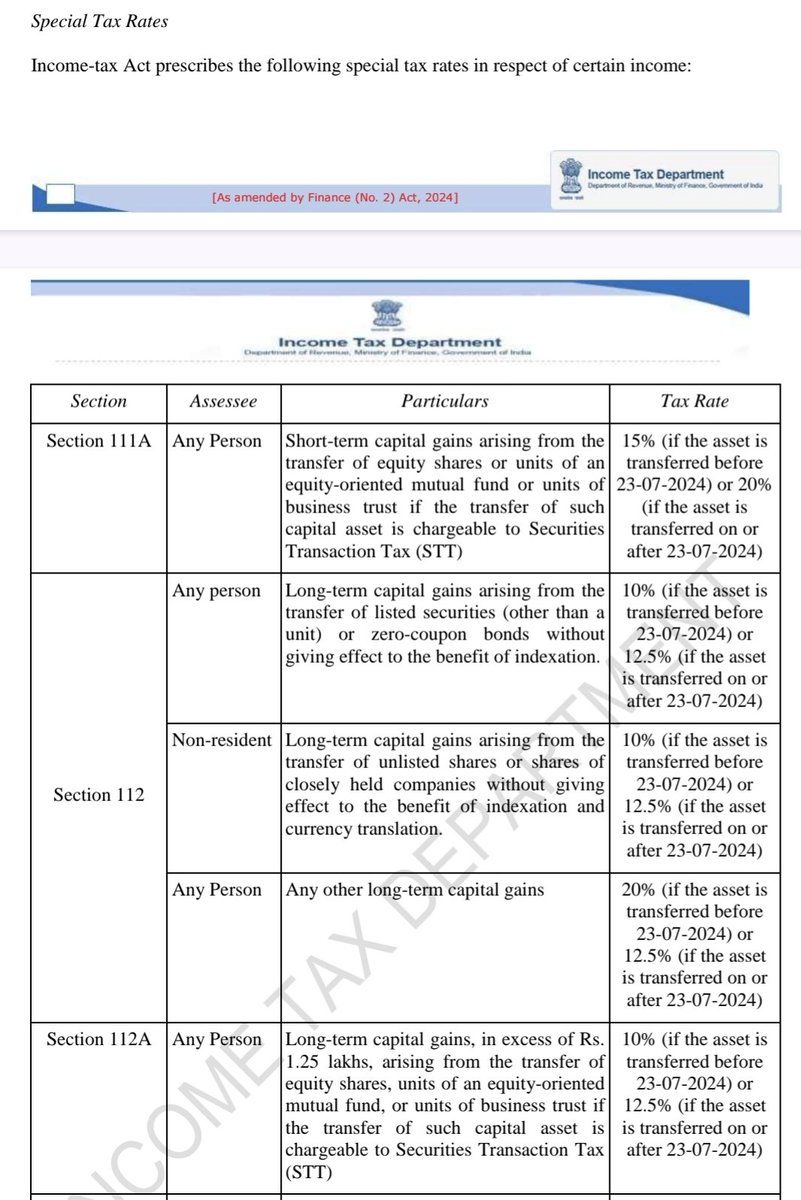

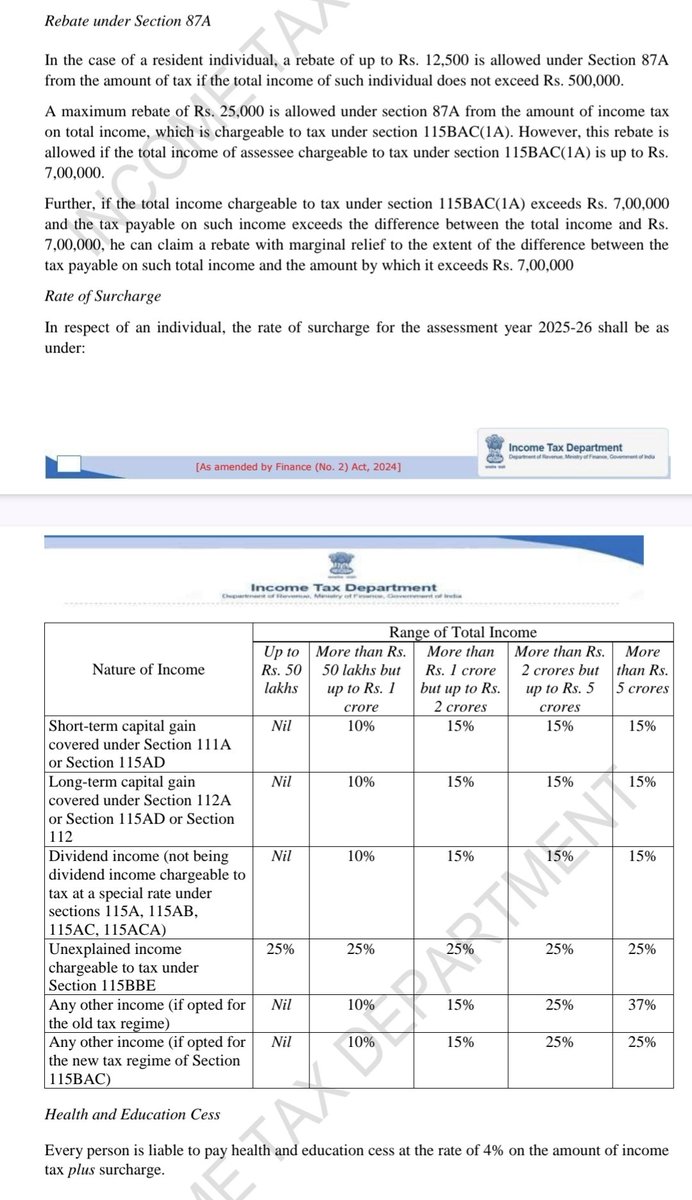

Normal Tax Rates for Individual. Special Tax Rates. Rebate under Section 87A. Rate of Surcharge & Health and Education Cess. Source @IncomeTaxIndia

4

62

224

RT @TaxationUpdates: Default Regime is New Regime for ITR Filing. Form 10IEA Filing Requirements . ITR 1 - No Requirements to File Form 10I….

0

65

0

RT @TaxationUpdates: Great efforts by @nirmal_ghorawat sir while preparing this Excel Based Financial Statement Preparation tools for Zerod….

0

72

0

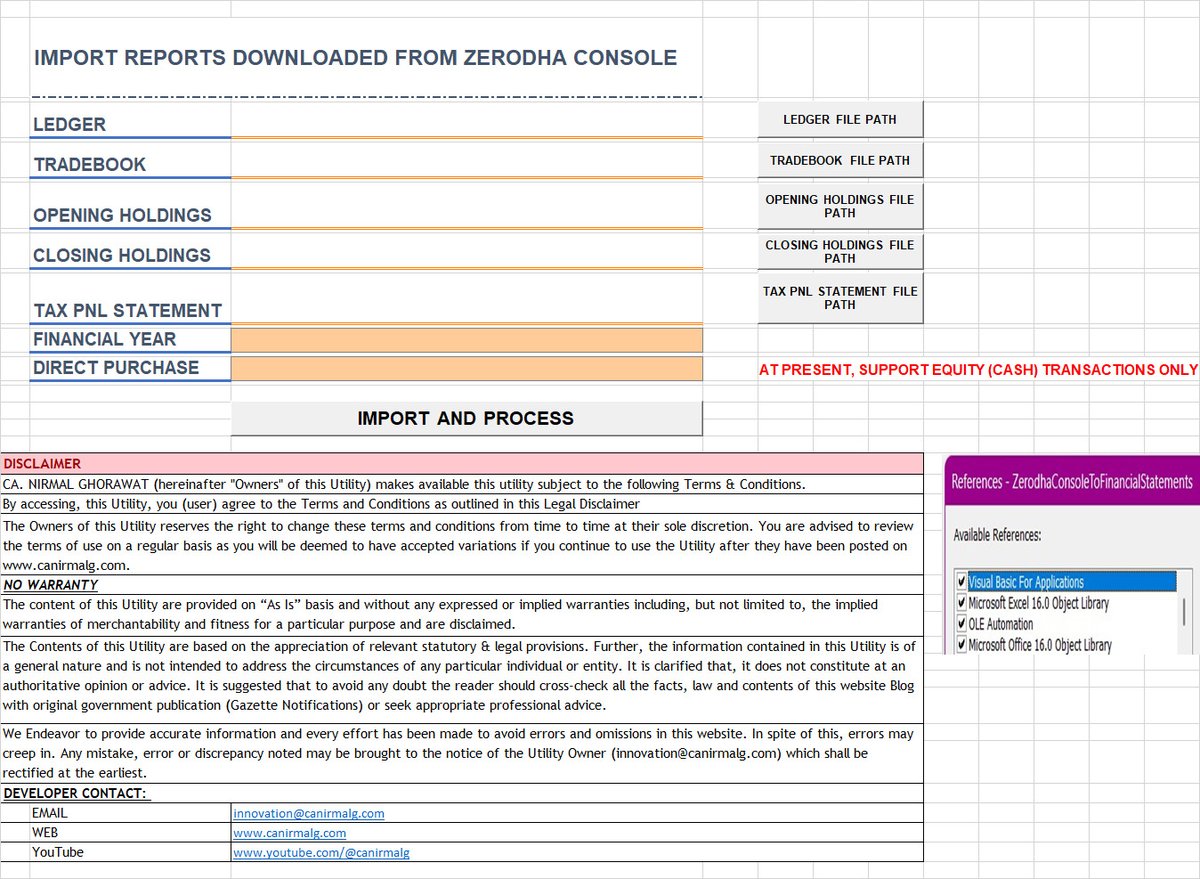

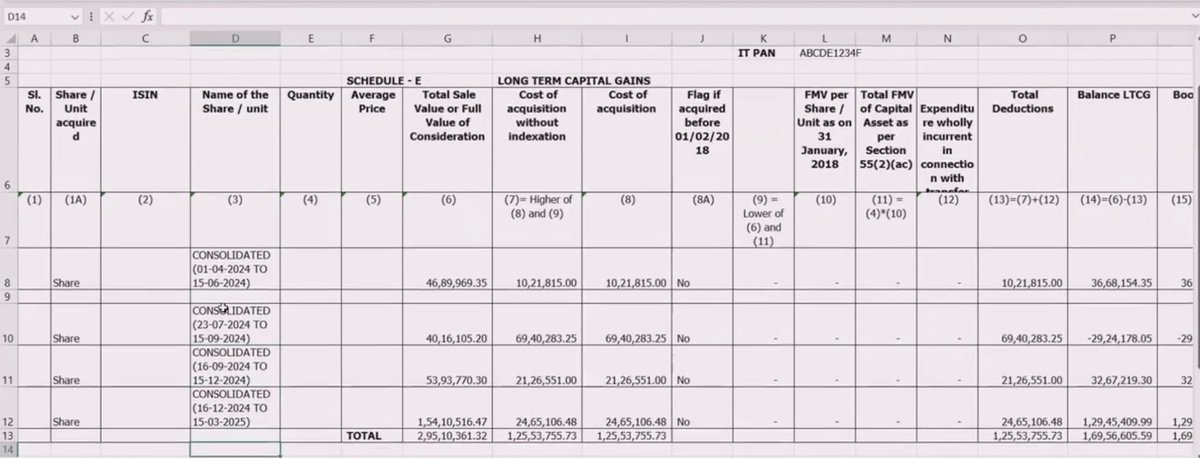

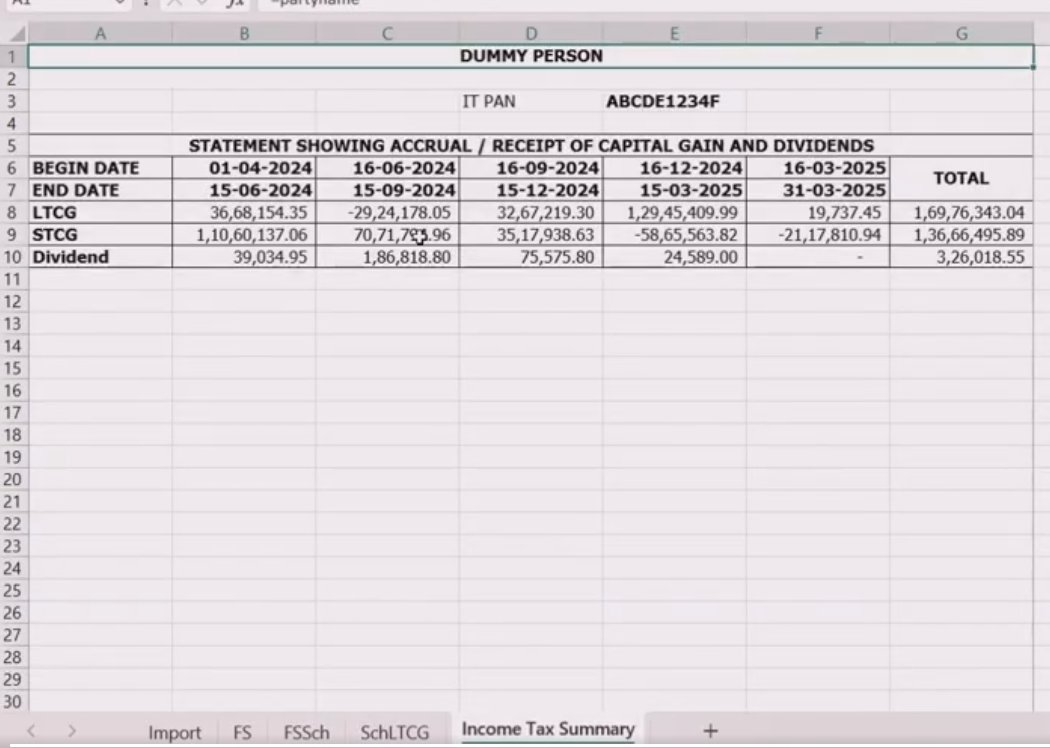

Great efforts by @nirmal_ghorawat sir while preparing this Excel Based Financial Statement Preparation tools for Zerodha Users. For @zerodhaonline users this excel is really helpful. In this excel you can import the files downloaded from zerodha and it will create Financial

4

72

290

RT @abhishekrajaram: I am sharing important judgments on the ITC mismatch between GSTR-2A and GSTR-3B. Please bookmark the tweet/post and….

0

63

0