Super฿ro

@SuperBitcoinBro

Followers

19K

Following

20K

Media

5K

Statuses

13K

Technical analysis should be made as simple as possible, but no simpler. --Albert Einstein, probably *not financial advice* 👇👇 free open-source indicators

Joined September 2015

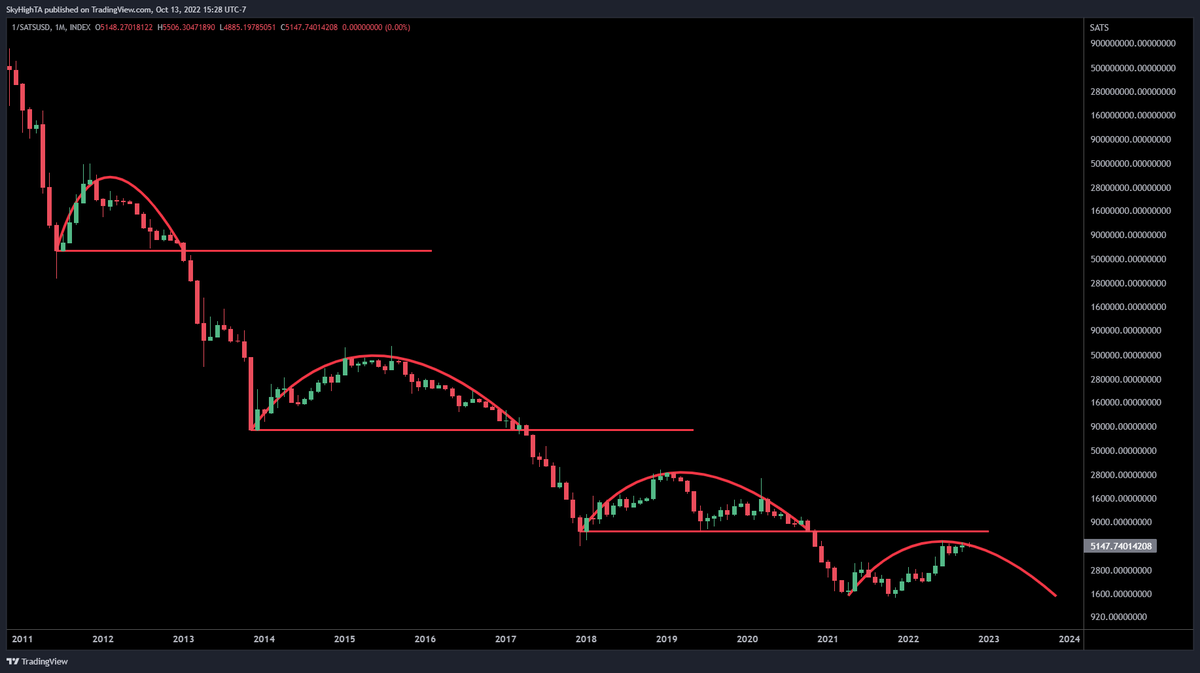

This is my long-term base case for $BTC USD is going to zero when priced in sats May or may not be more pain in store for hodlers but don't get too cute trying to play the dollar long

29

58

366

Been watching this setup since $43K, before there was even a right shoulder. It accurately forecast the ATH before the halving, the duration of the right shoulder, and the depth of this year's retest. Now I'm counting on it to forecast the top. https://t.co/Gs0bkGAQzk

$BTC monthly potential flight path 1. new ATH into the halving fueled by ETF 2. shakeout ETF buyers 3. inverse head and shoulders continuation > $250K

5

6

100

$BTC monthly Multi-year monthly patterns are accurate and reliable. $280K. Don't get chopped out.

48

129

842

true for more than just bitcoin and more than just a few cycles https://t.co/CU8xCBLc6L

@TomKazansky59 @SuperBitcoinBro Yes, historical S&P 500 data shows the Q3 low was in July for post-election years since 1989, except 2001 when September had the low due to 9/11.

2

2

29

In Q3 after an election year, $BTC has always bottomed in July, never September.

28

57

324

$BTC establishing base camp above the quarterly Bollinger Bands

29

122

689

Gold is on its 10th consecutive monthly higher low. The last time there was a streak of 8 or more monthly higher lows was 1971. With bitcoin as a superior form of money compared to gold, this rare demand for hard money may overwhelm the 4-year cycle.

5

15

137

$BTC daily looking for a breakout of this bullish falling wedge within a megaphone

69

284

1K

A textbook inverse H&S continuation is gold circa 2010. How would a similar move look on $BTC?

23

52

386

I for one am looking forward to the CRASH to $200K in August 2026 😎

7

3

87

My interpretation of the data in-hand is that significant upside remains before a sustained top. My base-case target remains unchanged at $280K and nothing has invalidated this. I continue to hodl 100% of my long-term BTC stack.

34

35

1K

Did $BTC already top? Is the top near? Let's review the charts. 1) Pi Cycle Top

138

444

3K