Steven Kelly

@StevenKelly49

Followers

10K

Following

19K

Media

963

Statuses

4K

Advisor to the Chairman, @GuggenheimPtnrs. Former director at the Yale Program on Financial Stability. Still an academic at parties.

Joined March 2019

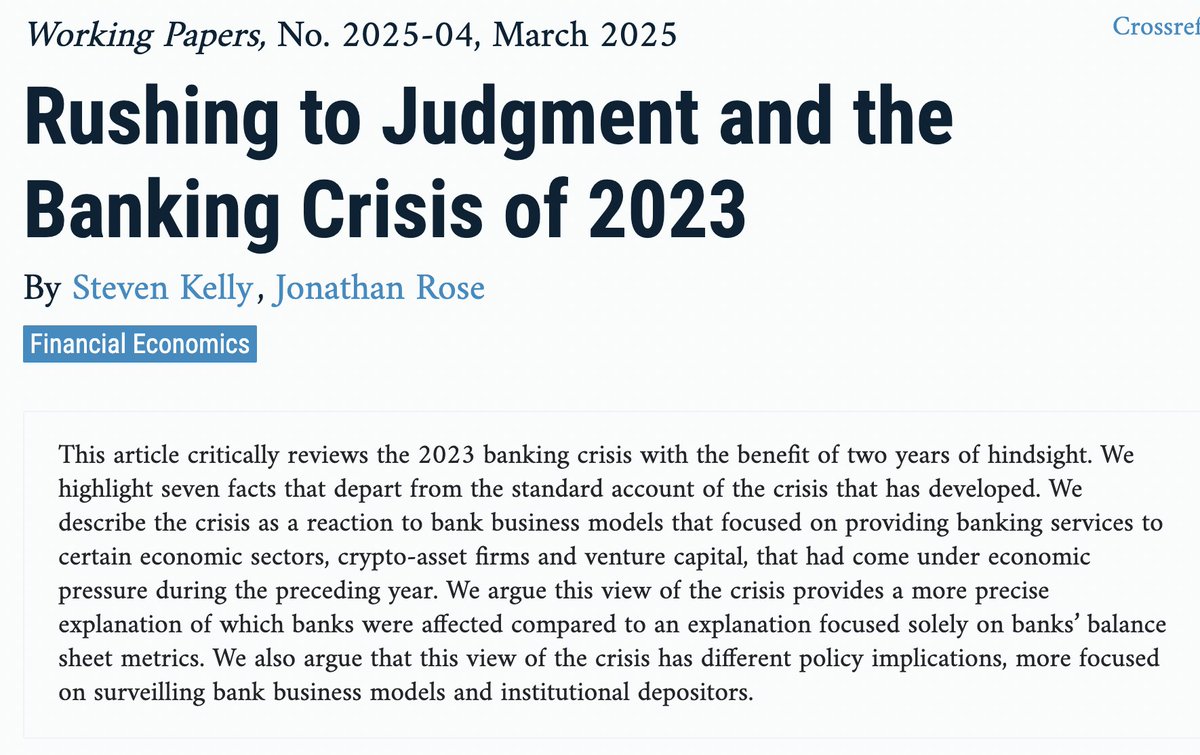

New paper: "Rushing to Judgement and the Banking Crisis of 2023" At the two-year anniversary of the crisis, @thejonrose and I present 7 facts that are overlooked in the standard account of the crisis: https://t.co/hRNEOsmzFd

5

22

108

🚨🚨 Calling all financial stability professionals! The application for next year's Master's in Systemic Risk program is now LIVE: https://t.co/ESdrzIPf3c Please share with your networks! You can reach out with questions to somsysrisk@yale.edu

som.yale.edu

All candidates for admission to the systemic risk program must first be nominated by a qualified institution.

1

1

1

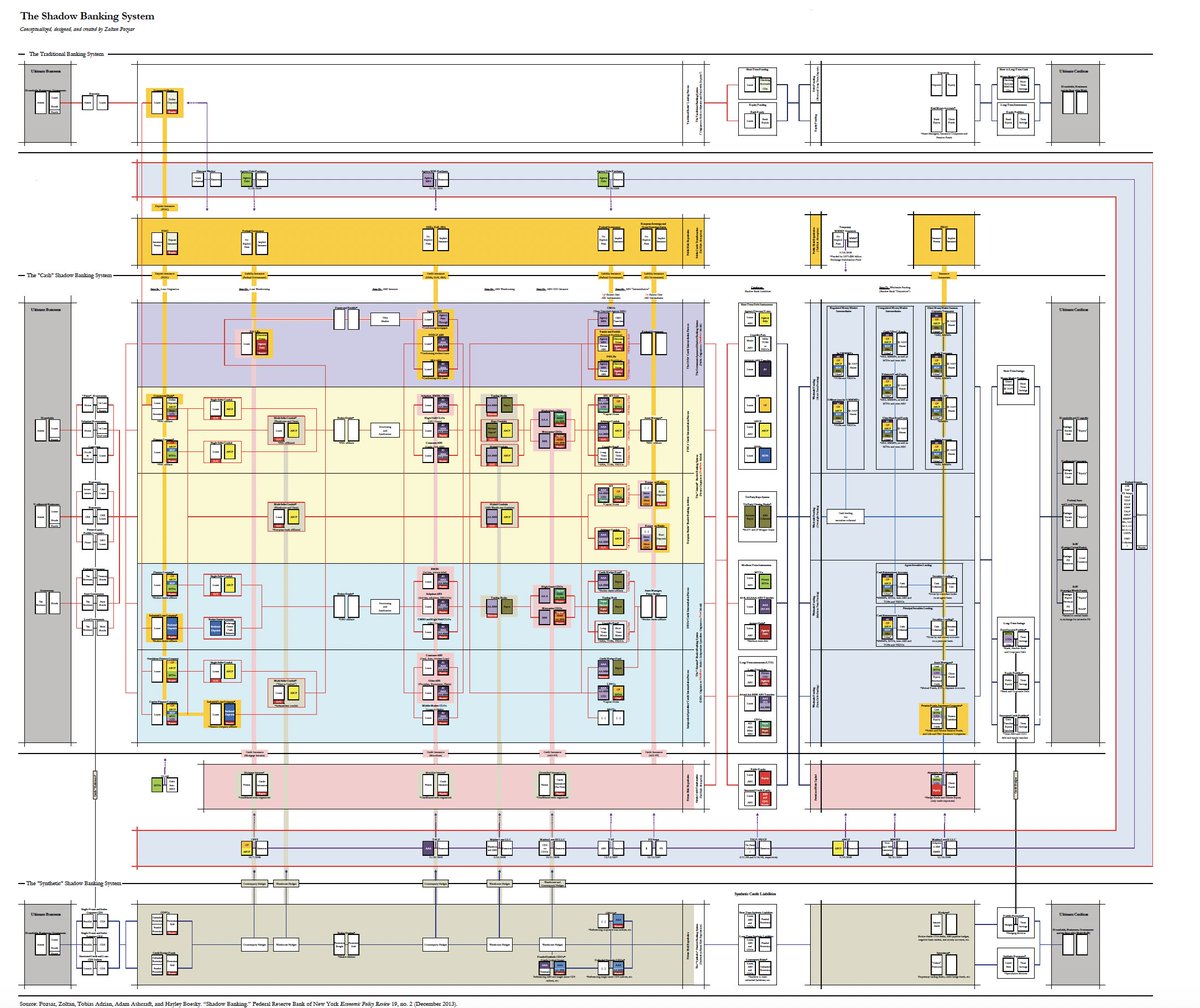

But the human brain cannot comprehend

The complexity of the human brain and its functions in a neat infographic map [zoomable version: https://t.co/4KyqZPcgRB]

1

4

67

Really nice IMF article from Darrell Duffie, Odunayo Olowookere, and Andreas Veneris discussing how tokenized payments can incorporate AML/KYC compliance by design: https://t.co/id3dStJ6BZ

imf.org

Fighting financial crime doesn’t have to come at the cost of privacy

1

0

6

2/ AT1 bail-ins or skipped calls can cause stigma for the bank’s funding and/or suggest something is wrong with the *bank*. Bail-in of a *portfolio* by SRT funding, in contrast, makes a bank seem a genius risk manager and is not a statement on the value of the wider franchise.

0

0

3

“In practice, opting not to call an AT1 bond can damage the good reputation that a bank needs to maintain in order to access affordable borrowing.” This potentially leaves SRTs as a dominant form of going-concern bail-in relative to AT1s. (1/2) https://t.co/xXCSaHdWkY

bloomberg.com

Additional Tier 1 bonds, known as AT1s, have been outperforming most other financial assets on the planet, producing bigger returns than some of most risk-tolerant hedge funds. The beefy yields on...

2

0

9

“However, a number of traditional lenders still have hangovers from recent losses in the industry.” Wineries and Whiskey Makers Tap Private Credit for Financing https://t.co/LqpYBjmngL

bloomberg.com

Wineries, booze distributors and distilleries are turning to private credit for financing, especially as tariffs and a decline in drinking habits bring more risk to the alcohol industry.

1

0

3

Seriously what is with those subscription apps that tell you when you’re paying for unnecessary subscription apps? Doesn’t that violate the laws of robotics

1

0

2

UBS: "Private debt had about $450 billion loaned to the technology sector as of early 2025, up $100 billion from 12 months earlier." https://t.co/OZOUCeRZMG

bloomberg.com

Private credit lenders, and their deep pockets, are rapidly becoming an important source of capital for artificial intelligence development. That’s raising concerns at UBS Global Research.

1

0

6

"Regarding banks, a couple of participants commented that, though regulatory capital levels remained strong, some banks continued to be vulnerable to a rise in longer-term yields and the associated unrealized losses on bank assets."

We have posted the minutes from the #FOMC meeting held July 29-30, 2025:

0

0

3

Schroders noting PE selling to PE is historically normal: “The most significant disruption [of growing use of continuation vehicles] is not in the concept of holding companies for longer under private equity ownership, but rather in who retains ownership” https://t.co/WslmyEoP6x

bloomberg.com

Continued ownership structures favored by private equity firms in a challenging exit environment could make it harder for larger sponsors to pursue new deals as they ultimately transform the indust...

0

0

7

(1/x) An excellent interview with the Bank of England’s Nat Benjamin. H/T @StevenKelly49 "People talk a lot about how banks have a lesser role. They don’t have a lesser role at all. They’re still extremely involved, but just in a very different way…” https://t.co/TCEXgAqa8W

centralbanking.com

The UK central bank’s executive director for financial stability strategy and risk speaks about leverage in the gilt repo market, minimum haircuts and central

1

1

4

The Great Bank Retranche: "All in all, this analysis shows that the growth of the private credit industry has offered banks a new, profitable form of indirect lending, positioning the two lenders more as partners than competitors."

📢 New research: Banks and Private Credit: Competitors or Partners? Private credit may compete with banks for business loans, but banks can also lend to private credit funds themselves—with higher risk-adjusted returns on average. 🔗: https://t.co/oVZrkDWciT

#EconTwitter

0

1

8