Matt Smith

@SmithMatthewC

Followers

1,717

Following

261

Media

476

Statuses

13,772

Husband to @arianakukors . Wahoo➡️Longhorn➡️CPA. Proponent of Tax Simplification/Automation. Loather of PTPs.

Manhattan Beach, CA

Joined August 2010

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#ElectionsResults

• 704284 Tweets

Modi

• 543762 Tweets

Hindus

• 203697 Tweets

उत्तर प्रदेश

• 129990 Tweets

Ayodhya

• 127305 Tweets

#すとぷり8周年

• 118883 Tweets

Ram Mandir

• 90739 Tweets

#लोकसभा_आमचुनाव_2024

• 84603 Tweets

Naidu

• 68617 Tweets

Yogi

• 64191 Tweets

Nitish Kumar

• 62614 Tweets

Erden Timur

• 62132 Tweets

नीतीश कुमार

• 50884 Tweets

राम मंदिर

• 50673 Tweets

Smriti Irani

• 49820 Tweets

バレーボール

• 32302 Tweets

Pradeep Gupta

• 23604 Tweets

楽天スーパーセール

• 11777 Tweets

ジュンブラ

• 11639 Tweets

#すとぷりxSimeji

• 10825 Tweets

#dursunözbekistifa

• 10785 Tweets

いちご検定

• 10118 Tweets

Last Seen Profiles

Can someone explain to me why the hell a small business tax preparer needs to be an expert in some of the most complex areas of international taxation to file a f-ing 1065 or 1120S because one partner might have a little over $600 of 1099-source foreign tax credit?

#TaxTwitter

13

7

142

To all those on

#TaxTwitter

posting that you're done and relaxing, did you cross check for wash sales across brokerage statements? Yeah, didn't think so. Get back to work.

10

3

87

Going to summarize my take on the K-2/K-3 filing requirements after an initial deep dive. Feel free to chime in

#TaxTwitter

For most 1065 and 1120S filings w/ non-foreign activities or owners, you would complete:

Item A - no

Item B - no

Item C - 2 - yes, 3 - yes, others - no

1/

4

1

88

PTPs should be eliminated as a structure. They’re a stupid, colossal waste of time and money and I loathe them.

Just needed to get that off my chest. Carry on.

#TaxTwitter

6

2

69

Can we please add a box on the W-9 to input an e-mail address and then a checkbox indicating we're opting into paperless 1099 issuance?

#TaxTwitter

@IRStaxpros

Enough of the stack of 1099s in the mail already. What a waste of paper and time.

4

0

55

Here's a quick PTET cheat sheet I put together ahead of the 3/15 deadline,

#TaxTwitter

. If anyone sees any discrepancies, input would be appreciated. 1/5

5

4

50

I'm sure the $125/250k cliff on student loan forgiveness will be fun for

#TaxTwitter

. We may well be looking at a situation where $1 in income on a client's return being the difference between $10/20k and $0.

6

4

45

Does anyone remember the good old days when there wasn’t something you had to research for every single client? Those were the best.

#TaxTwitter

4

0

50

Got off the phone with IRS TPS and the agent told me they are currently processing mail from June/July. Just FYI

#TaxTwitter

On a semi-related note, folks answering the phones at the IRS lately have all been super friendly and helpful. Has been quite pleasant calling in lately.

6

3

48

Cheers on making it through another tax season,

#TaxTwitter

. I appreciate you all more than my incessant ramblings may seem to indicate. Hope you all get a chance to rest and recharge.

2

1

46

So did anyone ever actually end up using that employee payroll tax deferral or did we all waste like 6-8 hours trying to figure it out and discussing it for no reason?

#TaxTwitter

12

1

46

@MarcGoldwein

Even absent a 0.2% payroll tax, imagine trying to sell voters that paid their loans off that they're getting nothing plus higher tuition costs for their kids.

2

0

42

Who else on

#TaxTwitter

is still stuck waiting on at least one K-1 in order to complete a partnership/S Corp due on Thursday?

10

1

44

My

#TaxTwitter

Tax Day hot take is that effectively no one should be using an “in by” date in the current environment. It’s impossible to gauge and is only likely to lead to massive amounts of stress and unforced errors.

12

1

44

As we head into filing season, one way the IRS could avoid a bunch of unnecessary mail to process (not that they aren't "current" on mail) would be to eliminate 7004s for at least forms 1065 and 1120S. Completely pointless filings.

@JanetYellen

@USTreasury

#SimplifyingTaxes

1/2

3

3

43

While the idea of simplified tax filings is routinely floated on both sides of the aisle (FreeFile, postcards, auto-filing, etc), little focus is ever paid to the many complications that a

#SimpleFile

return faces mechanically. Here are some of the key ones I see:

10

3

44

Dear

@MerrillLynch

, can you just go ahead and add up all the foreign dividends for me like

@MorganStanley

does? Just do it. It's fine. Now, Morgan if you could add in the wash sales to the net gain/loss like Merrill does that would be great. Ready, break!

5

1

44

S Corp 2% Owner Health Insurance shouldn't go on the W-2. It makes a mess of both S Corp and non-S Corp payrolls alike due to common misunderstandings. Should go on the K-1 or treat it like any other employee's health insurance.

@RepJudyChu

@RepJohnJoyce

#SimplifyingTaxes

3

0

43

Is there anything more unnecessarily complex than tax depreciation? Let's pick 2 or 3 depreciable lives (which are already blatantly arbitrary, let's be real), 1 method, and 1 convention and that's it for regular tax, AMT, and ACE.

@SenWarren

@BenSasse

#SimplifyingTaxes

7

1

44

So now that it is settled, PPP funded expenses are deductible, I think we can get back to other noble causes... For example, eliminating pass through treatment of PTPs. They are awful. Everyone hates them. I bet even their mothers hate them.

(Not letting this go)

#TaxTwitter

3

0

41

Does anyone else exhale a sigh of relief every time a client responds they haven't engaged in any crypto trading during 2020?

#TaxTwitter

4

1

39

#TaxTwitter

can we start a new cathartic hashtag called something like

#TaxRants

where we just do nothing but vent about tax-related stuff? Thoughts?

5

0

41

We need stable tax laws. Period. Just look at what was passed in Colorado this past week making their PTET retroactive to 2018! You can’t time budget, appropriately staff, right-size your client list, etc w/ the kind of erratic legislating we’ve seen since 2020. It has to stop.

#taxtwitter

long rant - this profession needs change. I truly don’t understand why I have to choose my family and mental health over staying in public accounting something I used to really enjoy and really thought I could do for my entire career.

35

11

236

3

3

39

If IRC 7216 penalties can *potentially* be brought against a tax preparer for blindly filing a well-intentioned extension, then why is the

@AICPA

not lobbying the IRS (or Congress) for form-free extensions to keep preparers out of a tight spot like that?

#TaxTwitter

3

2

39

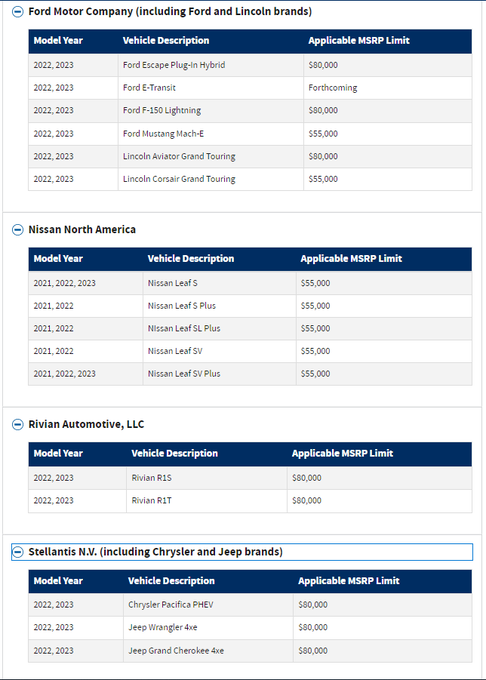

If anyone's paying attention, what the IRS is doing with the below form and 1040 - line 1, Schedule 1 - line 8, Form 7203, Schedules K-2/K-3, and so forth is using forms bloat to prevent common mistakes.

I look forward to every return being a minimum of 50 pages in 10 years.

#TaxTwitter

We have a BRAND NEW DRAFT form - Form 7206 "Self-Employed Health Insurance Deduction"

13

14

91

11

0

38

If there was one thing the IRS could do to make this filing season less of a total disaster for everyone it would be to simply grant a blanket reasonable cause waiver on all late filing and payment penalties through the extension deadlines if filed/paid by then.

#TaxTwitter

3

0

38

The IRS needs a site where you can enter the applicable Tax ID, upload correspondence or scanned/e-signed forms that otherwise would require mailing, and has tracking info so you can see received/processing/processed.

@USTreasury

@JanetYellen

#SimplifyingTaxes

5

1

37

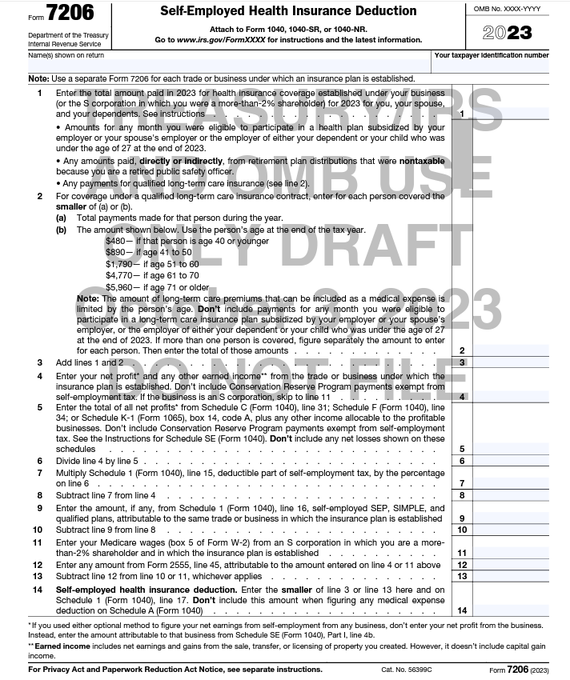

Close your eyes for a second

#TaxTwitter

and imagine a kind of utopia where the IRS instead repurposed all of the time it spent building out the K-2/K-3 that added prep time into enabling Wage and Income Transcripts to populate by April 2nd so as to subtract prep time.

5

3

36

#TaxTwitter

I have decided that in line with my earlier tweet, this new year I’m going to try to post something each day I would like to see changed within the tax world and then tag a related government account.

I will devote no less than 1/mo towards PTPs, which totally suck.

9

0

36

The logistics of 199A compliance is dumb and needs to be fixed. What (person) decided it was a great idea to have K-1s with potentially dozens of separately stated underlying 199A info to be picked out and reported separately? If you’re on here, reveal yourself.

#TaxTwitter

4

0

36

Staying on the topic of 1099s... if we’re going to exempt most S and C Corps from receiving 1099s, can we please also go ahead and exempt partnerships as well?

@RepRichardNeal

@RepKevinBrady

#SimplifyingTaxes

2

1

36

What would be an appropriate punishment for preparers who mask the partnership's EIN on an initial K-1 and make their colleagues waste time requesting it from them?

#TaxTwitter

7

0

35

Not possible without simplification of the code itself. Nice sound bite though I guess. Same thing with the postcard rhetoric on the other side of the aisle.

4

1

31

Are there any very knowledgeable International Tax experts on

#TaxTwitter

that might be able to help us all out in understanding which Parts of the K-2/K-3 a standard domestic partnership selling widgets from a single US location (in-store only) would need to actually complete?

4

3

31

So assuming K-2/K-3 is required for most 1065s and 1120s, what’s the percentage bump in page volume with each of those returns for 2021? It’s got to be something like 2/3/4x. That’s insanity. So much for “Paperwork Reduction.”

#TaxTwitter

5

1

31

Are the days of the “jack of all trades” or “general practitioner” category of tax professional coming to a close even on the smaller firm end of the spectrum? Or is it just me? And maybe that’s a good thing? 🤷🏻♂️

#TaxTwitter

12

0

31