Nick

@Skrip4ik

Followers

112

Following

296

Media

14

Statuses

49

Crypto &Web 3 Investor. NFT Collector. ⚙️

Barbados

Joined November 2017

RT @TFSCChain: We're excited to launch the TFSC Ecosystem Pass (NFT) – Complete tasks and claim your free NFT once the Alpha network goes l….

0

4K

0

RT @pulsr_ai: GM🌞. Excited to welcome @CRAYsecurity, founder of @KindredHeartsIO, who will be taking over our feed today to spread some ext….

0

13

0

RT @Lamina1official: Attention Metaverse Builders: The Lamina1 Testnet is now LIVE. Join the @Lamina1official Discord for access: https://t….

0

18K

0

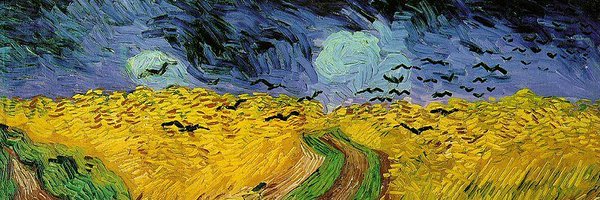

RT @portal_finance: The future isn't just bright - it's immutable. 🔭 DYOR : .💜 Design by: @Skrip4ik .

0

39

0